Tesla Slashes FSD Price as Final Launch Window Nears

![]() 06/27 2025

06/27 2025

![]() 540

540

The automotive industry has embarked on its fiercest competition since its inception.

In 2025, Musk faces a new scenario not seen in years. Historically, stock prices would surge upon the release of a new car or technology, followed by a dip and eventual rebound. However, Tesla's stock price began to decline three days before the latest release and struggled to recover.

The reasons are manifold: firstly, a Model 3 equipped with FSD got stuck on a train track, resulting in a minor collision. Secondly, doubts lingered about the autonomous driving launch, exacerbated by a ten-day delay of the autonomous driving car with unspecified reasons, leading some to speculate technical issues. Thirdly, news of the Austin factory shutting down for a week, ostensibly for maintenance but coinciding with the autonomous taxi launch, sparked concerns. Lastly, the Israel-Iran conflict brought about capital anxiety.

Tesla's stock price plummeted to levels last seen three years ago, amidst a scenario of "those who understand, understand." Now, its counterattack sentiment is palpable. The global automotive industry values the large-scale rollout of autonomous vehicles, as Musk's success could redefine the automotive development model.

Tesla's Technological Battle: Autonomous Driving vs. FSD

Musk is currently experiencing a mix of joy and sorrow. The joy stems from the commercial testing of projects, but the sorrow comes from the challenges of a new path with uncertain victory against Chinese competitors.

Surprisingly, technical difficulty has become a minor issue with the implementation of commercial projects.

On June 22, 2025, Musk's first batch of autonomous driving models finally arrived. Pre-release incidents were abundant, including rejected trademark registrations for Cybercab and Robotaxi due to similar technologies from rival companies. Fortunately, Tesla FSD's trademark registration holds promise.

As Tesla's pre-launch heated up, local tests revealed issues. A Model Y with FSD failed to comply with regulations, such as stopping for school buses and crashing all dummies in simulated scenarios. Tesla had preemptively noted in the product manual that it could not fully handle all school bus scenarios.

Essentially, there's a significant difference between a Model Y with optional FSD and an autonomous taxi Model Y using FSD.

Musk intensified his logic during the pre-launch warm-up. On June 16, he released a video stating that road systems worldwide are designed for intelligence, neural networks, and eyes, not laser emissions. This wasn't Musk's first LiDAR mockery, but he emphasized Tesla's pure vision advantage. Additionally, he retweeted news of Tesla leading Chinese pure electric vehicle sales from January to May.

This fits communication rules, but Musk's past statements, like claiming Mars is part of the US and Tesla is the world's safest car, raise questions.

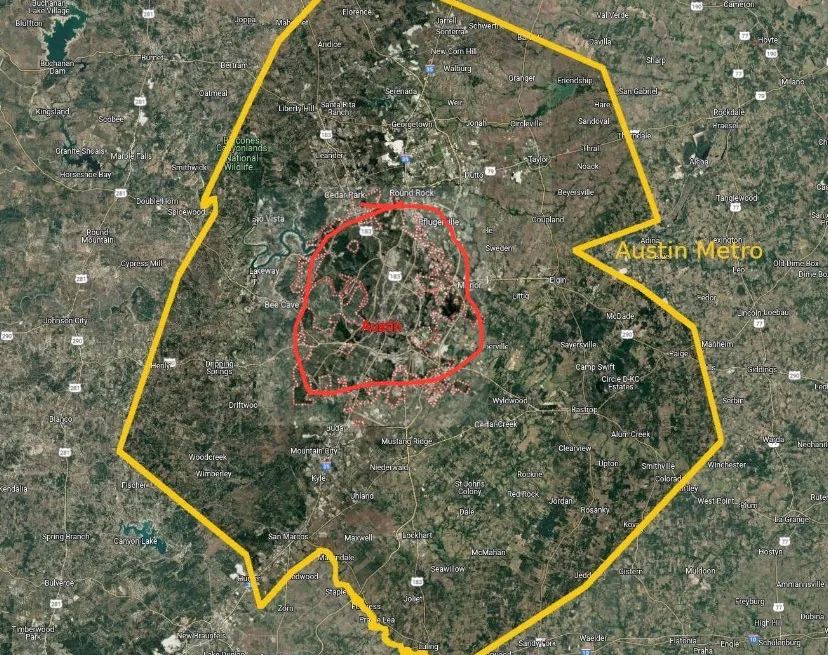

Technologically, Tesla's logic remains unchanged: massive data injection, human eye pattern observation, and human brain pattern intelligent driving. With sufficient computing power, autonomous driving can be achieved. The market concludes that Tesla has no direct US competitors and can gradually expand from California to other states or overseas.

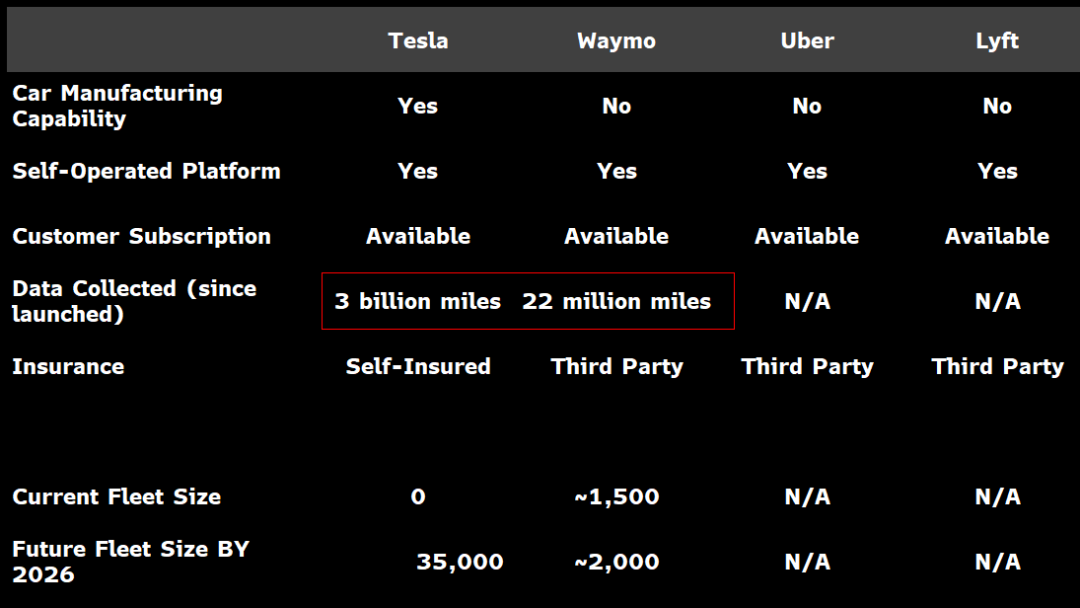

Tesla's autonomous driving excels in usable range, manufacturing cost, and accident rate. Waymo, once world-leading, is outmatched by Tesla in operating area and specific experience. Tech enthusiasts and media have compared Waymo and FSD on Model Y, with FSD winning in driving scenarios.

On June 16, Musk retweeted Waymo vs. FSD technology competition news. The critical data point: Tesla's accident rate per million miles is 0.15, Waymo's is 1.16, and the US average is 3.90. Tesla's current safety factor is 26 times the US average.

In manufacturing costs, Tesla is closer to mass production than Waymo. Technical details and credibility are also verified. FSD on Model Y has received praise in China and the US, concluding it outperforms Waymo in driving. For instance, FSD arrives earlier than Waymo on the same road segment and moves like an experienced driver in left and right turn scenarios.

Even before June 22, photos emerged of people sleeping in the passenger seat with the driver's seat unmanned. While many question and oppose it, a high proportion is interested. Continuously breaking doubts and attracting new users will facilitate autonomous driving's breakthrough, a pivotal moment in automotive history.

FSD Price Reduction, Ushering in the Final Window Period

It's undeniable that Tesla is currently the world's leader.

However, how long this advantage will last and whether it can solve Musk's existing dilemmas remain uncertain.

Technically, Tesla's autonomous taxi has a vague positioning, neither traditional L3 nor L4. While no one drives or supervises the car, it's remotely supervised by humans, similar to Baidu's unmanned driving and chauffeur functions. As more vehicles are deployed, Tesla needs to increase remote supervisors.

Musk's solution, scheduled for the second half of 2025, involves AI5 chips. Claims about the chip's maximum computing power vary, from above 2000 TOPS to over 7000 TOPS, over ten times that of AI4. Logically sound, but the final conclusion depends on the actual product, as Tesla's history is rife with delays.

Moreover, technology needs practical application for commercialization. Tesla faces significant challenges. In the US, FSD promotion has faced multiple NTHSA investigations, and unsupervised FSD will be even more cumbersome.

Except for a few countries like Norway, which recently approved Tesla's two-year test, the universal approach is supervised L3 autonomous driving, upgrading to L4 after sufficient performance.

Even with current advanced technology, resolving Tesla's underlying logic conflicts may take a long time.

Chinese automakers, Tesla's global rivals, opt for L3 autonomous driving first. About ten Chinese companies have announced plans, with several aiming for L3 by 2025:

1. GAC Group will mass-produce and market China's first L3 autonomous driving passenger car in Q4 2025.

2. Zeekr 9X's L3 autonomous driving technology architecture is expected to have mass production vehicle delivery capabilities by the end of 2025.

3. Xiaopeng announced that in H2 2025, it will offer the L3 experience.

4. IM Motors also announced L3.

5. Huawei's Kunlun Intelligent Driving will soon enter the market with the Zenith S800.

Currently, technical discussions are secondary. The priority is dispelling myths and changing perceptions. Tesla's current autonomous taxi has no advantages here.

Tesla's model involves small-scale pilot operations, gradually expanding later. For instance, current small batches are only available to internal invitees. Compared to Chinese companies' L3 models, even a few thousand Zenith S800 owners can significantly accelerate Chinese users' acceptance of autonomous driving.

In China, the L3 autonomous driving business model can be operational within six months to a year. For Tesla, expanding to over ten US states within a year is a significant challenge.

The clichéd question arises: how much core competitiveness will Tesla have next? Recent spy shots suggest Tesla won't counterattack based on the automotive business model. The latest models hint at a lower price range.

Another cliché: when will Tesla's 64,000 yuan FSD come to China, and will it be discounted? However, the crucial question is, with Chinese enterprises rolling out L3 autonomous driving within half a year, how many will still consider Tesla?

Conclusion

Tesla has internal solutions, like reducing FSD prices. The marginal cost of software capabilities in later stages is nearly zero. Thus, with scale, FSD can quickly become a killer feature.

For instance, the current 64,000 yuan price is per vehicle but could be equivalent if sold to three vehicles at 20,000 yuan each or six vehicles at 10,000 yuan each.

Ultimately, it depends on Tesla's attack pace in the Chinese market. It has many options: reduce FSD prices and enter the market after L3 autonomous driving is universally recognized within a year; or change prices within 2025 to boost global performance data.

This year's market conditions differ from those Musk has previously faced.