MiniMax or IPO in Hong Kong this Year: The Mid-Game Battle of the 'Big Model Six Dragons'

![]() 06/27 2025

06/27 2025

![]() 688

688

As news of Himalaya's sale, Hupu's acquisition by Xunlei, and 58.com's layoffs of 10,000 employees spread, the dilemma of the 'middle layer collapse' in China's internet industry has also beset prominent big model startups.

Recently, multiple media outlets revealed that AI unicorn Xiyu Technology (MiniMax) is considering an initial public offering in Hong Kong, to which the company responded with 'no comment.' Furthermore, according to Zimu Bang, five of the 'Big Model Six Dragons' (MiniMax, Zhipu AI, Baichuan Intelligence, ZeroOne, Dark Side of the Moon, Step Star) are already preparing for their IPOs.

Behind this news lies a growing exodus of executives from the 'Six Dragons,' amidst the intensifying roar of AI infrastructure investments from Alibaba and Tencent.

From mobile internet to generative AI, history is repeating itself: companies that reap early technology dividends but fail to build sustainable moats will eventually be overshadowed by giants and become mere stepping stones. How can MiniMax and others evade the 'middle trap'?

Technology Shifts and Talent Exodus: The Decline of the Big Model Six Dragons

With each technological revolution, the pace of progress and intensity of commercial competition evolve rapidly, and the challenges faced by big model startups have surfaced much sooner than those encountered by internet startups.

In the race for model scale and performance metrics, the cost of training a single model can easily exceed millions or even tens of millions of dollars, consuming vast amounts of capital. However, the industry environment has significantly deteriorated, with global AI financing shrinking in 2024 and investors' willingness to continue backing startups markedly weakening. According to Tianyancha APP, since 2025, only Zhipu among the 'Big Model Six Dragons' has secured new financing and initiated the IPO process.

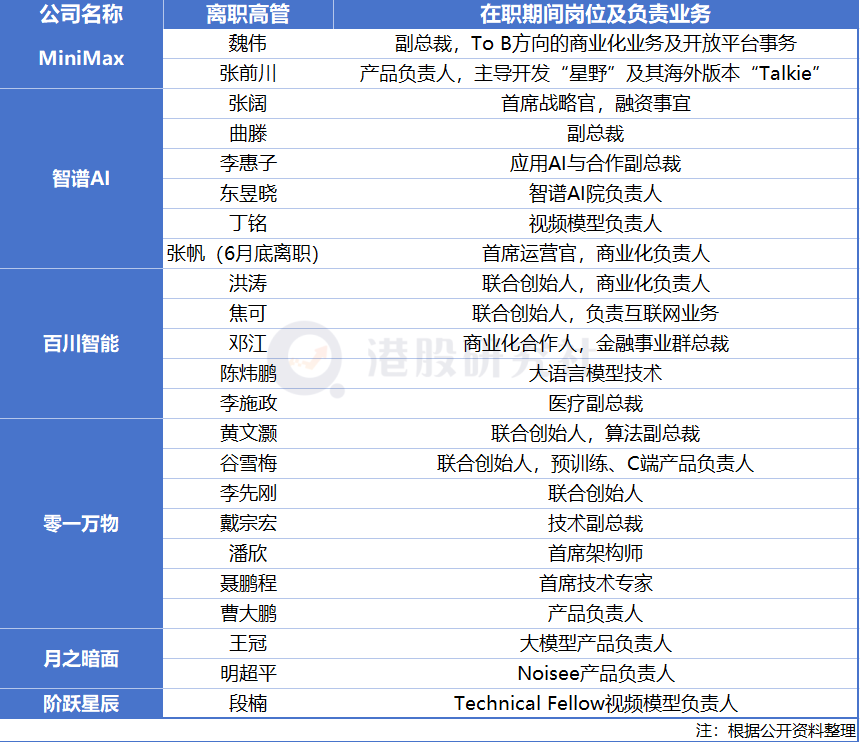

With tight capital chains, big model startups must grapple with high-frequency talent loss. Since 2024, at least 23 executives have left or are on the verge of leaving the 'Six Dragons,' with ZeroOne witnessing a mass exodus of seven core technical personnel.

Tight financing and talent exodus are mere symptoms of a deteriorating entrepreneurial environment. The deeper dilemma lies in the general misdirection of big model startups and the unfavorable prospects for their commercialization.

Technologically, the Six Dragons missed the open-source window and were outpaced by DeepSeek's 'open-source + cost-effectiveness' approach.

While startups enjoy the flexibility of being 'small and nimble,' they are also more susceptible to market fluctuations. Many big model startups failed to adopt an open-source strategy in a timely manner, missing the opportunity to build an ecosystem. This year, the rapid rise of DeepSeek and the announcement of internet giants like Baidu joining the open-source ranks have put big model startups on the defensive, with their market space continually being squeezed. Among the 'Big Model Six Dragons,' MiniMax released its first open-source model in January, but the company's founder, Yan Junjie, said in a media interview, 'There are many lessons to be learned from a first startup. If I could choose again, I would have open-sourced it from day one.'

Meanwhile, at the commercial level, tech giants are swiftly capturing a significant market share from startups with their vast ecological advantages.

Taking Kimi, a product under Dark Side of the Moon that once garnered significant attention, as an example, in terms of product performance, QuestMobile data shows that as of March 2025, if mobile assistant functions are included, Kimi ranks ninth in relevant user scale lists. Excluding mobile assistants, DeepSeek, Doubao from Bytedance, and Tencent's Yuebao occupy the top three spots with monthly active users of 194 million, 116 million, and 41.64 million, respectively, while Kimi ranks fourth with 18.2 million monthly active users. This signifies a substantial order of magnitude gap between Kimi and DeepSeek/Doubao.

One step behind leads to further delays. As foundational capabilities improve, the competitive landscape is being reshaped, and big model startups have lost the initiative.

Relying on their strengths in customers, data, and capital, tech giants excel in AI investment, development, and commercialization, tending towards a 'winner-takes-all' scenario.

Taking Alibaba as an example, it emphasizes that 'all businesses will be AI-driven in the next three to five years,' an aspiration unattainable for startups. As a globally leading open-source big model vendor, Alibaba's Tongyi model has been deeply integrated into core businesses such as Taobao (optimized recommendations), healthcare, and Quark.

Simultaneously, giants can complete a full-stack layout from chips, infrastructure to applications through investments, enhancing certainty. Alibaba Cloud plans to invest over 380 billion yuan in AI infrastructure (including self-developed chips, liquid-cooled data centers, etc.) over three years and meet data and computing power needs through hybrid cloud solutions.

This indicates that the foundational model competition is nearing its conclusion, and big models are entering a new competitive dimension of applications and ecosystems. It is evident that the 'Six Dragons' and other big model startups cannot keep pace in the realm of foundational models and urgently need to find a sustainable self-financing path amidst funding shortages, talent loss, and the looming presence of giants.

To B or To C?

All companies that ultimately fail to generate revenue have fundamental flaws.

The path to building general large models has been blocked by giants, making commercialization a crucial issue for startups to remain competitive. The 'Six Dragons' are compelled to accelerate their shift towards specific scenarios and applications, leading to significant divergence in their strategic paths.

One path is to delve deeply into the To B sector, realize the data flywheel, and thereby outmaneuver giants.

For instance, ZeroOne has abandoned the general large model route benchmarked against OpenAI and fully shifted to 'small but beautiful' industry landings; Baichuan Intelligence has entered a silent period for foundational model research and development, betting on the medical AI track; additionally, MiniMax empowers over 2,000 enterprise customers through its open API platform, with WPS Office AI integrating its document generation capabilities as a notable example, achieving revenue through pay-per-use and custom agreements.

However, the To B track is not without challenges. Throughout the development history of domestic SaaS (Software as a Service), from big data, cloud computing to computer vision, there are pervasive structural dilemmas: excessive customization demands coexist with homogeneous products, low-price competition erodes profit margins, and coupled with capital's demand for short-term returns, a vicious cycle ensues.

More critically, enterprise customers have a weak digital foundation and consistently low willingness to pay, making the To B market a high-difficulty arena for startups.

Therefore, another path is bound to receive equal attention and is considered by some big model startups as a choice for commercial breakthrough. That is to focus on multi-modal C-end products.

Taking MiniMax as an example, the company's application Conch AI is a representative C-end product that has validated the feasibility of profiting through in-app purchases, membership subscriptions, etc. For the C-end market, Wei Wei, the former head of MiniMax's open platform, previously stated in a media interview that C-end users may be willing to pay for large models to answer their questions through inexpensive or free means.

It is noteworthy that as open-source foundational models like DeepSeek rise, if MiniMax flexibly adopts them, similar to Tencent's Yuebao connecting to DeepSeek, it is anticipated to reduce research and development costs and instead enhance application layer profitability.

However, just as the B-end market has inherent issues, the C-end market also presents corresponding challenges.

Creating high-value, high-investment AI products, such as AI videos, faces difficulties in sustaining long-term consumption for startups due to high R&D investment and low user willingness to pay. Conversely, developing low-threshold, low-investment products, such as AI virtual socializing and AI costume changes, falls into a technological generational gap crisis. When foundational model capabilities leap forward, the differentiated advantages of vertical applications may vanish overnight. More cruelly, the rapid iteration and pixel-level imitation of tech giants are compressing the lifespan of C-end innovative products to the limit.

How to maintain a unique competitive edge amidst giants? In this regard, we believe that whether it is B-end or C-end, only by establishing a closed-loop data flywheel can a sustainable moat be forged.

The Key to Building a Closed-Loop Data Flywheel

The Year of AI Agents: Large Companies Pave the Way, Small Companies Build Cars?

In the AI application race, differentiated products are the sole key to activating the data flywheel.

When product functions converge, such as in general chatbots, user behavior data becomes highly repetitive, and this low-value data cannot catalyze qualitative changes in model iteration. Conversely, MiniMax's Hoshino AI, which specializes in 'secondary dimensional emotional companionship,' has amassed vertical scenario dialogue data that is expected to form a corpus irreplaceable by giants.

The essence of the data flywheel is that 'the more vertical the scenario, the scarcer the data.' Facing the overwhelming power of giants, the 'Six Dragons' must break the deadlock through vertical deep cultivation and model innovation.

The cardinal rule is to focus on segmented scenarios. Just as MiniMax's Hoshino AI companion and overseas chat application Talkie have established a comparative advantage in the pan-entertainment and content creation fields, this has also positioned MiniMax as one of the few startups in the industry that can clearly articulate a commercialization and monetization path.

Only in this manner can big model startups seize the upcoming wave of AI Agent adoption. IDC predicts that AI Agents will see large-scale deployment in 2025, and CICC further asserts that they may reshape the entire internet ecosystem by usurping mobile phone interactions. This presents startups with deep accumulations in specific fields a historic opportunity to redefine software rules and establish new user experiences.

The crux of building Agent products based on vertical scenarios is to construct a symbiotic ecosystem. Startups should leverage the computing power infrastructure of giants and concentrate on application layer innovation and experience optimization. While foundational model vendors will inevitably develop general Agents, in-depth cultivation in specific scenarios still holds irreplaceable value, which is also a pragmatic choice for startups to coexist with tech giants in the future.

This is also a form of strategic retreat to advance. It is foreseeable that when Agents focusing on specific populations or scenarios accumulate a sufficiently large and unique knowledge base, and the company can achieve rapid iteration, vertical leaders are expected to obtain tickets to redefine the rules of general Agents.

In summary, the era of AI entrepreneurship has only just commenced. For big model startups, the paramount priority now is to survive, find a differentiated niche, establish a user switching cost moat, and construct a data flywheel.

With leading players like MiniMax choosing to enter the capital market at this juncture, coinciding with a pivotal moment where global investment institutions are reassessing the value of AI assets, completing IPO financing amid industry enthusiasm can not only procure ammunition to continuously refine products but also secure a favorable position in fierce competition.

In the future, from the perspective of industrial evolution laws, the AI application market may exhibit a 'dual-track parallel' pattern. Tech giants continue to invest tens of billions of dollars to enhance AI infrastructure, akin to laying intelligent highways, while startups rely on these foundational capabilities to create application scenarios with professional barriers in vertical fields, akin to running distinctive smart cars on these highways.

To become 'car manufacturing giants,' the Six Dragons must demonstrate to investors before the IPO window closes that they have established data closed-loop capabilities in their chosen tracks and completed commercial closed-loop validation to truly secure tickets to the future.

Source: Hong Kong Stocks Research Society