Robotics: The Next Frontier After New Energy? China's Manufacturing Strength Paves the Way for Industry Disruption and Accelerated Fundraising

![]() 06/29 2025

06/29 2025

![]() 610

610

Given China's status as the world's second-largest economy, deeply rooted with its 'manufacturing genes,' the robotics sector, poised to reshape the labor market, stands on par with the new energy industry, which successfully transformed the energy landscape. The prospects for future growth are immense.

Despite being on the cusp of large-scale commercialization, the growth momentum has intensified. Morgan Stanley predicts that by 2024, China will capture roughly 40% of the global robotics market share, experiencing a compound annual growth rate of 23% over the next four years, from $47 billion to $108 billion, further cementing its dominance in the global robotics field.

Moreover, investment and financing within the industry are heating up. Statistics reveal that in the first half of 2025, the robotics industry collectively attracted over RMB 50 billion in funding. Leading companies secured record-high financing, with top-tier institutions like Huawei Haobo, Sequoia China, and Hillhouse Capital, as well as national teams such as Zhangjiang Fund and Pudong Venture Capital, entering the market.

Take Infi-Tech, a two-year-old company, as an example. After recently completing a RMB 1.1 billion financing led by "CATL," it set a new benchmark for the largest single financing in domestic embodied large-model robots and topped the financing list in the embodied AI field with a cumulative funding of RMB 2.4 billion.

Furthermore, supported by a series of policies, over ten robotics supply chain companies have disclosed plans to go public in Hong Kong this year, encompassing mature enterprises like Estun Automation and Sanhua Intelligent Controls, alongside startups like XianGong AI and Wo'an Robotics.

Recently, according to the Hong Kong Stock Exchange, Standard Robotics, led by Xiaomi, Bohua Capital, and Liangxi Investment, is racing towards the Hong Kong Stock Exchange and may become the "first stock of industrial embodied AI."

During this critical period of 0-1 breakthrough in the robotics industry, no player wishes to miss out on the opportunity to secure an IPO, which can solidify their first-mover advantage.

Through detailed analysis, it becomes evident that these players with positive investor sentiment mostly possess the ability to "tell a compelling story": Companies like Horizon Robotics-W and Crossbow Technology, listed on the Hong Kong Stock Exchange for less than a year, have seen their share prices nearly double in 2025; Sanhua Intelligent Controls has also enjoyed three consecutive gains since its listing in Hong Kong.

So, what are the capital 'stories' of Standard Robotics and Infi-Tech in this environment? What is the logical underpinning?

Standard Robotics: The Hidden Beneficiary of Industrial Embodied AI Behind Xiaomi and BYD's 'Explosive Orders'

The backdrop of Standard Robotics' narrative lies in the vast industrial scenarios of China's resource hinterland.

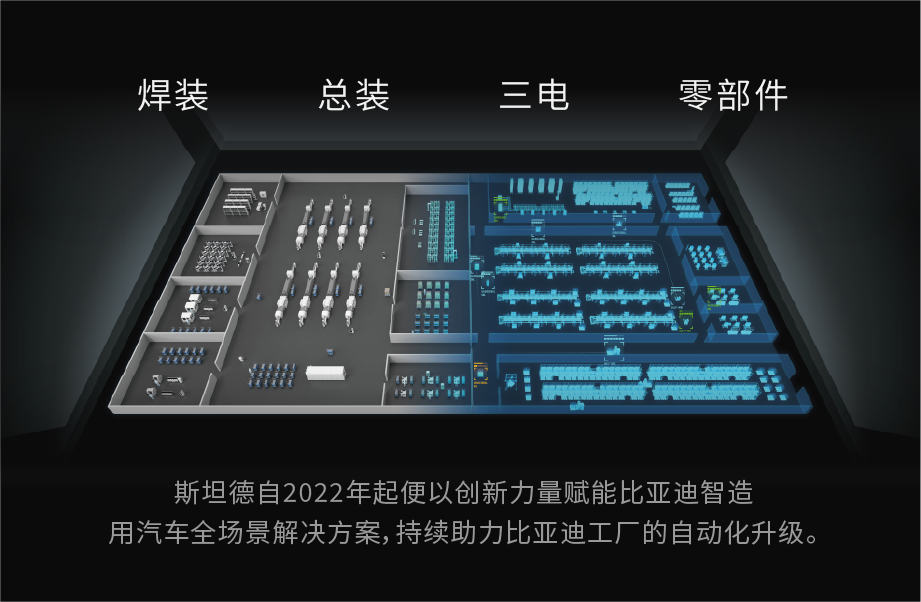

To date, Standard Robotics offers tailored one-stop robot solutions, encompassing a core robotics technology platform, a multifunctional industrial intelligent robot product line, and an all-in-one intelligent collaboration system known as RoboVerse. The company has amassed full-stack technical capabilities and scenario-based innovation capabilities.

From an industrial perspective, embodied AI has emerged as the core of the upgrade in the new generation of robotics. However, due to limitations in some core components and operating systems, mobile robots, the focus of Standard Robotics, have a natural advantage in entering the embodied AI field. Products empowered by embodied AI can adapt to various new scenarios and achieve rapid deployment with stronger generalization capabilities.

General industrial scenarios also represent the primary commercial landing grounds for high-cost robots, suggesting that players deploying mobile robots may be the first to reap commercial dividends during the commercialization of embodied AI.

According to data from China Insights Consultancy, driven by the flexible production needs of the 3C, automotive, and semiconductor industries; on the supply side, the cost advantages of robots using AMR technology to replace traditional AGVs, alongside policy support, the global market size for industrial intelligent mobile robots is expected to grow at an average annual rate of 39.8%, from RMB 15.3 billion in 2024 to RMB 81.4 billion in 2029. Among them, the industrial embodied AI robot segment is growing faster, with a CAGR of 61.1% from 2024 to 2029, exhibiting explosive growth.

As China's first company to realize the 'world model' and 'swarm intelligence' of industrial robot systems, its technical layout spans three dimensions: hardware, algorithms, and system integration.

On the hardware front, in May this year, Standard Robotics launched its first humanoid robot, DARWIN, integrating 23 degrees of freedom and a precision super-joint design, equipped with an innovative omnidirectional chassis, significantly enhancing flexibility and task execution capabilities in complex scenarios. To a certain extent, Standard Robotics is also a pioneer in providing industrial embodied AI robot solutions.

This is also the key confidence behind Standard Robotics' anticipated status as the "first stock of industrial embodied AI" in its Hong Kong listing.

Regarding algorithm advantages, its self-developed SLAM (Simultaneous Localization and Mapping) technology, Visual Language Action (VLA) model, and globally leading scheduling system support the simulation and scheduling of over 2,000 robots in a single scenario (the industry average is only 500).

As one of the first companies in China to independently develop a proprietary operating system suitable for industrial intelligent robots, and one of the few in the industry to achieve independent research and development of full-stack technology, Standard Robotics' technical prowess has long been recognized by Xiaomi Automobile.

It is reported that as early as 2021, when news of Xiaomi and Huawei's cross-border ventures into the automotive industry emerged, Standard Robotics began attempting to introduce laser-guided AMRs into the new energy vehicle sector. During the launch of Xiaomi's SU7, Standard Robotics successfully delivered over 200 fully laser-guided AMRs, providing a powerful tool for Xiaomi's automotive factory with ultra-high mobile variability on the production line. This is also the first new energy vehicle assembly line in China to comprehensively apply laser SLAM AMRs.

To date, its All-in-One intelligent collaboration system, RoboVerse, enables multi-robot collaboration and data closed-loop, with a key customer retention rate of over 60%, covering more than 400 enterprises such as Xiaomi Automobile, Foxconn, OPPO, and BYD.

More excitingly, just yesterday, Xiaomi's YU7 surpassed 200,000 pre-orders within just 3 minutes of its launch and soared to 289,000 within an hour. Currently, Xiaomi's automotive factory's total production capacity obviously cannot cover the orders for Xiaomi's YU7 and SU7, which means that as Xiaomi Automobile gradually becomes a new generation of major automakers, Standard Robotics will likely benefit significantly from capacity expansion.

In addition to business synergies, the equity relationship between Standard Robotics and Xiaomi is also very close.

The prospectus reveals that since its inception, Standard Robotics has completed multiple rounds of financing, with the final round before the IPO led by Xiaomi Smart Manufacturing, Bohua Investment, and Liangxi Investment. Other investors include Guoke Jiahe, Source Code Capital, Lightspeed China Partners, Hopu Capital, Qiji Venture Capital, and YaoHong Venture Capital, with a post-investment valuation of RMB 2.1 billion.

From 0 to 100 Stores in One Year: Infi-Tech's Commercialization Runs at 'Double Speed Mode'

If Standard Robotics is honing the 'blade' of embodied AI, then Infi-Tech is the 'blade wielder.'

Public information shows that Infi-Tech, founded in 2023 by Wang He, an assistant professor and doctoral supervisor at the Advanced Computing Research Center of Peking University's School of Computer Science, specializes in the research and development of humanoid robot hardware and large embodied AI models.

Although only established for two years, this startup, which brings together strategic and industrial investors such as CATL, Meituan Strategic Investment, BAIC Industrial Investment, and iFLYTEK Fund, as well as renowned venture capital funds like Matrix Partners China and IDG Capital, currently exhibits a trend of creating a business closed loop across capital, technology research and development, and the market.

As Wang He stated, "When we discuss embodied AI this year, an important goal is to promote its industrialization, so that embodied AI can truly advance towards industrialization and create new productive forces."

Smart retail, industry, and healthcare are becoming the preferred sectors for Infi-Tech to propel industrialization.

On the technology research and development front, in January this year, Infi-Tech took the lead in launching GraspVLA, the world's first end-to-end embodied large model pre-trained on billions of synthetic action data. Recently, it also released GroceryVLA, the world's first end-to-end model for retail commercialization, which addresses two key challenges in complex retail environments, achieving full-coverage intelligent grasping and high-efficiency scenario adaptation.

On the application front, Galbot, the first-generation embodied large model robot launched by Infi-Tech in June last year, has been deployed in unmanned stores for 24-hour operation since March this year. As the world's first humanoid robot smart retail solution, Galbot can manage the entire process of inventory, restocking, and more for 5,000 products, 6,000 shelves, and over 10,000 boxes of goods, with single-store deployment time compressed to one day.

Currently, nearly ten stores in Beijing have already been deployed and are operating normally, and the plan to land 100 stores nationwide within the year is progressing steadily.

In terms of industry collaboration, Infi-Tech has also made a crucial move. A week ago, it announced the establishment of a joint venture, "Bosilver Innovation," with Boshi Capital, a subsidiary of the Bosch Group, focusing on complex assembly and core manufacturing scenarios to accelerate the large-scale implementation of embodied AI in the industrial field. This cooperation aligns with the global wave of intelligent transformation in manufacturing, marking a significant leap for its embodied AI technology from laboratory validation to industrial application.

Conclusion

Drawing historical parallels from the new energy industry's reshaping of the global energy landscape, China's robotics industry is pulling back the curtain on the eve of industrialization explosion, fueled by the triple potential energy of 'manufacturing genes + technological breakthroughs + capital resonance.'

Capital has already cast its vote of confidence with tangible investments - giants are rushing to invest, financing records are being shattered, and there is a surge of IPOs in Hong Kong stocks. A fierce battle for resources surrounding the 'future of robotics' has already commenced.

From Standard Robotics empowering industrial flexible production with 'world model + swarm intelligence' to Infi-Tech exploring new retail and manufacturing scenarios with embodied large models, technological pioneers are pulling out all the stops to seize the commanding heights in the crucial leap from 0 to 1.

Source: Hong Kong Stock Research Society