Robotaxi, inconvenient to go anywhere

![]() 07/01 2025

07/01 2025

![]() 765

765

Original content by New Energy Outlook (ID: xinnengyuanqianzhan)

Full text: 3767 words, reading time: 14 minutes

The Robotaxi track is buzzing once again.

Musk's nearly decade-long preparation for Robotaxi officially launched pilot operations in Austin, Texas, USA.

However, the technical performance and deployment quantity of Tesla's Robotaxi during the trial operation did not meet Musk's previous promotional effects, and it was even reported by relevant departments due to numerous issues within just two days of operation.

Just two days before Tesla announced the official launch of Robotaxi, the domestic Robotaxi platform Luobo Kuaipao was accelerating its layout in the Southeast Asian market and announced that it would launch its driverless travel services in Singapore and Malaysia as early as this year to expand its global footprint;

A day after Tesla's announcement, a technology company named "Shanghai Zaofu Intelligence" was registered. Tianyancha information shows that the company has a registered capital of nearly 1.3 billion, backed by giants such as Hello Inc. and Ant Group.

Figure/Basic Information of Shanghai Zaofu Intelligence

Source/Screenshot from New Energy Outlook on the Internet

The scramble for layout and phased progress by new and old players have brought about another "Year One" for Robotaxi.

However, in sharp contrast to the active layouts of enterprises, consumer acceptance of Robotaxi is not high. High R&D and operational investments also make this seemingly bustling track far from achieving true profitability.

1. Robotaxi sweeping the globe, with frequent emergence of strong players

Tesla has finally officially launched its Robotaxi service. However, it is not the previously exposed unmanned taxi that undertakes this task, but rather 10 Model Y vehicles modified into Robotaxis.

Figure/Robotaxi modified from Model Y

Source/Screenshot from New Energy Outlook on the Internet

Moreover, contrary to Musk's previously promoted superior FSD technology, Tesla can be said to have equipped Robotaxi with comprehensive safety measures: an offline safety officer in the co-pilot seat and an online remote monitoring system.

It is reported that the service is tested within a small area south of Austin, USA, and is limited to invited users, with a fixed fare of $4.2 per trip, operating from 6 AM to midnight.

Figure/Musk announces Robotaxi fare

Source/Screenshot from New Energy Outlook on the Internet

Musk stated that the service will be expanded to markets outside Austin by the end of the year, with plans to deploy hundreds of thousands of autonomous vehicles by the end of next year. At the same time, the first fully autonomous Tesla vehicle "drove from the production line to the owner's home" on June 28, fully controlled by Tesla's latest FSD (Full Self-Driving) software.

In fact, in recent years, Robotaxi has already been a situation of many players competing, with major domestic and foreign players entering the market one after another. Domestically, in addition to Baidu, which cuts in from software technology, there are also Pony.ai's PonyPilot+, AutoX, WeRide, and other enterprises. Furthermore, automakers such as XPeng Motors and travel platforms like Ruqi Travel and Didi Chuxing have also successively deployed.

Competition among foreign players is equally fierce, with major players being Waymo, Amazon-owned Zoox, and the aforementioned Tesla.

In order to stay at the forefront of the industry, players are rushing to open cities. Among domestic players, Luobo Kuaipao has provided official services in over 15 Chinese cities, including Beijing, Shanghai, Guangzhou, Wuhan, Shenzhen, Chongqing, Yangquan, etc.; it has also launched overseas pilot operations in Hong Kong and the United Arab Emirates.

Figure/Luobo Kuaipao

Source/Screenshot from New Energy Outlook on the Internet

Baidu founder Li Yanhong once stated that Luobo Kuaipao will enter the "year of important expansion" in 2025, planning to accelerate the large-scale landing of its business through cooperation with mobile service operators, taxi companies, and third-party fleet operators.

WeRide and Pony.ai are also stepping up their efforts in urban coverage. The former is operating in Guangzhou, Shenzhen, Beijing, Nanjing, and Sharjah (UAE), while also obtaining testing permits in France and Singapore; the latter is mainly concentrated in Guangzhou, Beijing, Shanghai, Foshan, etc. It also has testing projects in California (Fremont, Irvine) and New Jersey, USA.

Official data shows that in March 2025, Pony.ai and ComfortDelGro, which globally owns over 29,000 taxi operating networks, announced the joint operation of autonomous driving travel in Guangzhou. Pony.ai CFO Wang Haojun emphasized that the company will focus on efficient investment and optimized output, dedicating more resources to accelerate the company's business landing strategy.

Figure/Pony.ai's cooperation with ComfortDelGro

Source/Screenshot from New Energy Outlook on the Internet

WeRide announced in May this year that it would expand its strategic cooperation with Uber, planning to add 15 new international cities over the next five years to deploy autonomous Robotaxi services, including international markets in Europe, the Middle East, and other regions.

Figure/WeRide expands cooperation with Uber

Source/Screenshot from New Energy Outlook on the Internet

Among foreign players, Waymo currently provides over 250,000 paid driverless rides per week in Los Angeles, San Francisco, Phoenix, and Austin, with a cumulative number of over 10 million rides. On June 18, local time, Waymo announced that it had applied for a permit from the New York City Department of Transportation to allow it to be driven by "trained professionals" in Manhattan for mapping and testing.

Figure/Waymo

Source/Screenshot from New Energy Outlook on the Internet

The competition among big players has also driven rapid industry development. A Goldman Sachs report points out that the global Robotaxi market is expected to experience explosive growth, with a market size potentially reaching $40 billion to $45.7 billion by 2030, with a compound annual growth rate exceeding 60%.

An internal analysis by Luobo Kuaipao personnel revealed that among the many players, the technical routes adopted are not the same. Tesla adopts a pure vision strategy, relying entirely on cameras and AI, and abandoning LiDAR. The modified Model Y is equipped with four millimeter-wave radars to compensate for the cameras' deficiencies in harsh weather.

"The multi-sensor strategy of Luobo Kuaipao and Waymo uses a comprehensive set of sensors, including LiDAR, millimeter-wave radars, cameras, combined with highly detailed pre-mapped high-precision maps. This multimodal approach provides excellent accuracy, redundancy, and reliability, especially in complex urban environments and challenging weather conditions."

2. Autonomous driving everywhere is equally unreliable?

Despite the differences among players and their respective technical advantages, the issues exposed by Robotaxi exhibit similar trends, which warrants emphasis.

Taking Tesla's Robotaxi as an example, it experienced frequent problems shortly after its launch. According to multiple media reports, within two days of providing trial rides to invited customers in the south Austin area, the service was exposed to multiple dangerous driving behaviors such as speeding through residential areas, forcibly changing lanes without signaling, and closely approaching other vehicles. It is currently under federal investigation by the National Highway Traffic Safety Administration (NHTSA) of the United States.

Figure/Robotaxi under NHTSA investigation

Source/Screenshot from New Energy Outlook on the Internet

Waymo also once misjudged the depth of water during a heavy rainstorm and braked abruptly, causing a rear-end collision, with the insurance company and the automaker arguing for half a year before resolving the claim; a Zoox driverless taxi collided with a passenger vehicle approaching and stopping in front of it from a perpendicular lane on a Las Vegas street, prompting Zoox to initiate a software recall of all its vehicles.

While foreign Robotaxi issues continue, the domestic situation is not much different. In June 2024, after the sixth-generation driverless vehicle of Luobo Kuaipao was put into use in Wuhan, it also encountered a series of complaints from citizens. On the Wuhan City Message Board, complaints about "Luobo Kuaipao autonomous driving" vehicles mainly focused on issues such as occupying lanes during peak commuting hours, slow speeds, and sudden stops. Many Wuhan netizens even joked that "Luobo Kuaipao" was "silly (dumb) radish."

Figure/Complaints about Luobo Kuaipao in Wuhan

Source/Screenshot from New Energy Outlook on the Internet

Among the numerous complaints and controversies, "unreliable technology" and "unfriendly experience" have become the two core grievances. Many netizens even expressed that "since intelligent assisted driving for private cars is so popular, automakers might as well first serve private car owners before extending to driverless taxis. It is really unnecessary to try to take away the jobs of ride-hailing drivers when private car technology is not yet mature."

However, any technology in its development process has both advantages and disadvantages. Despite consumers complaining about Robotaxi, its advantages are also obvious. Taking Luobo Kuaipao as an example, it still attracts some young people due to its high cost-effectiveness.

A consumer who lives in Wuhan and has taken Luobo Kuaipao stated that after comparing the orders of Luobo Kuaipao and Didi, they found that although Luobo Kuaipao took much longer for the same distance, the payment fee was very low, almost half that of Didi, "So in non-emergency situations, Luobo Kuaipao is still very appealing."

Consumer recognition has also driven the phased development of Luobo Kuaipao's business. According to Baidu, as of March 2025, Luobo Kuaipao had provided over 10 million travel services, and by May, this number had increased to 11 million. In the first quarter of 2025, Luobo Kuaipao provided over 1.4 million travel services globally, a year-on-year increase of 75%, with over 170 million kilometers driven safely.

Figure/As of May 2025, Luobo Kuaipao has provided 11 million global travel services

Source/Screenshot from New Energy Outlook on the Internet

However, while actively disclosing the number of orders, Baidu seems to avoid discussing profitability issues.

In 2024, Baidu predicted that with the gradual deployment of a thousand sixth-generation driverless vehicles, Luobo Kuaipao would achieve a break-even point in Wuhan by the end of 2024 and enter a full profit period in 2025, becoming the world's first autonomous driving travel service platform to achieve commercial profitability.

In 2024, Wang Yunpeng, Vice President of Baidu Group and President of Intelligent Driving Business Group, mentioned in an internal letter on the 7th anniversary of Baidu Apollo that the next mission of Luobo Kuaipao is to accelerate the turnaround of gross margin and establish a viable business model.

"This is an extremely challenging goal. After 100 million kilometers of testing and operational mileage, the next goal is 100 million yuan in revenue and 100 million yuan in profit."

However, it is not yet known whether its profitability is as optimistic as expected.

3. How far is it for Robotaxi to achieve free travel?

For enterprises, the timing of profitability remains unknown. For consumers, it is still unclear when they can hail a Robotaxi just like an ordinary ride-hailing vehicle.

"The immaturity of laws and regulations prevents Robotaxi from achieving free operations (detached from geofencing), and consumers or ordinary users cannot experience true point-to-point travel like hailing a ride-hailing vehicle. Therefore, governments and enterprises need to work together to promote the soundness and improvement of Robotaxi industry standards and laws and regulations," said Zhou Xiongfei, a senior figure in the smart travel industry.

Figure/Robotaxi geofencing

Source/Screenshot from New Energy Outlook on the Internet

Zhou Xiongfei further stated that currently, from an industry perspective, governments of various countries are relatively cautious about Robotaxi, so it will be necessary to wait for the maturity and improvement of laws and regulations in the future, thereby making large-scale commercialization of Robotaxi possible.

Apart from the need to improve relevant laws and regulations, the high cost of Robotaxi has also become one of the obstacles to its large-scale implementation.

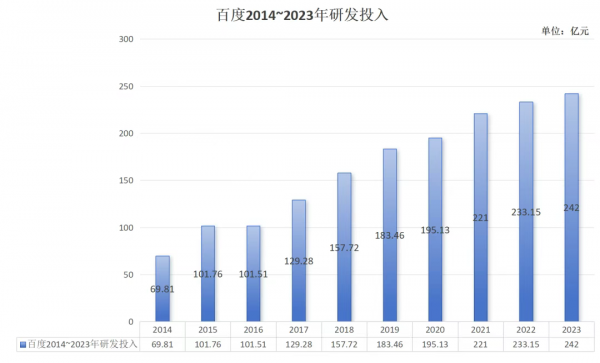

Data shows that from 2014 to 2023, Baidu's investment in the field of autonomous driving amounted to 150 billion yuan. By 2024, despite the overall decline in R&D investment, it was still as high as 22.1 billion yuan. It should be noted that the decline was not due to less R&D investment, but rather a reduction in personnel-related expenses.

Figure/Baidu has invested up to 150 billion yuan in autonomous driving over 10 years

Source/Screenshot from New Energy View on the Internet

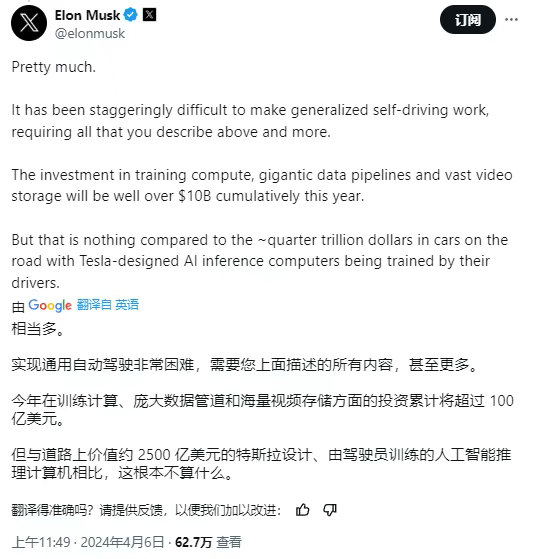

Previously, Musk revealed that Tesla's cumulative investment in autonomous driving will exceed 10 billion US dollars by 2024. This figure is more than four times the total investment Tesla has made in autonomous driving over the past seven years.

Figure/Musk's tweet on cumulative investment in autonomous driving exceeding 10 billion US dollars

Source/Screenshot from New Energy View on the Internet

Meanwhile, whether consumers will truly accept it is also crucial for the actual deployment of driverless taxis.

Judging from the perspective of intelligent assisted driving in private cars, from hyping up to abruptly hitting the "brakes," consumers have not yet truly accepted it. They are confused by flashy gimmicks and promotions, to the extent that consumers who were originally interested have become cautious, and those who were originally observing have directly "shut out" intelligent assisted driving.

Similarly, when Didi can already fully meet consumers' travel needs, where lies the advantage of driverless taxis? And how long can the cost-effectiveness pursued by consumers be maintained after truly educating users? After all, Didi also captured consumers with its low prices in the early stages.

Xu Lijuan, director of the Market Research Institute at Beijing Jiaotong University, analyzed that as a typical application scenario of artificial intelligence empowering the automotive industry, autonomous driving involves the development of related industries such as chips, operating systems, the Internet of Things, urban infrastructure, testing, and certification, and is an important track for the integration of the digital economy and the real economy.

"Moreover, emerging industries represented by autonomous driving and intelligent connected vehicles are also resonating with the industrial upgrading of more cities, including Wuhan, bringing new opportunities to urban development. In the future, with the gradual improvement of laws, regulations, and related policies, autonomous driving, as a new type of productive force, will also allow the entire society to share the fruits of technological development, bringing autonomous driving truly into thousands of households."

From this perspective, driverless taxis are indeed the carrier of future technology, but there is still a distance from "relax and set off immediately".