Stock prices on a "roller coaster", what's wrong with NVIDIA?

![]() 10/21 2024

10/21 2024

![]() 601

601

Author | Lushi Ming

Editor | Dafeng

2024 is destined to be an extraordinary year for NVIDIA. Since the beginning of the year, NVIDIA's share price has risen by nearly 180%. Behind the surge in share prices lies the global capital's optimistic expectations for the long-term demand in the AI field and NVIDIA's leading position in the AI chip market. However, surges are often accompanied by crashes. The higher the market's expectations, the more intense the disappointment. After hitting an all-time high in June and briefly becoming the world's most valuable company, NVIDIA's share price has fluctuated repeatedly. One reason is market concerns about potential delays in NVIDIA's new product launches, but the more significant factor is the U.S. export restrictions on NVIDIA.

Meanwhile, even though NVIDIA has a commanding lead in the market, it is not without challengers. Over the years, AMD has made inroads into Intel's market share in the CPU space and now aims to gain a foothold in the AI GPU market. NVIDIA urgently needs to provide investors with a definitive answer about its future direction.

Stock Prices on a "Roller Coaster"

After a 9.5% plunge in NVIDIA's share price on September 3, wiping out $279 billion (approx. RMB 1.98 trillion) in market value, the company suffered another significant drop recently. On October 15, NVIDIA's share price plummeted nearly 6.8% during intraday trading, erasing $158.71 billion (approx. RMB 1.13 trillion) in market value overnight. News of ASML, the global lithography giant, releasing its financial results early and forecasting lower-than-expected sales and orders for 2025 due to continued weakness in certain segments of the semiconductor market contributed to the decline. ASML's share price fell over 16%, marking its biggest one-day drop since 1998. The sharp decline shook the entire tech market and triggered a collective sell-off in U.S. chip stocks.

As a key player in the chip industry, NVIDIA, despite being at the forefront of the booming AI sector, was inevitably impacted. Furthermore, recent foreign media reports indicate that the U.S. has discussed imposing limits on export licenses for AI chips from companies like NVIDIA and AMD to certain countries. These restrictions, focused on Gulf nations with growing demand for AI data centers, could affect their AI capabilities. The upstream industry is facing significant headwinds, and the market environment is becoming increasingly challenging, making NVIDIA's recent share price crash unsurprising. However, unexpectedly, just a day later, on October 16, NVIDIA's share price rebounded by 3.13%.

Source: Xueqiu

In financial markets, short-term fluctuations are random, unpredictable, uncontrollable, and lack patterns, but long-term trends follow discernible patterns that can be dispersed and managed.

In the AI era, as AI technology continues to evolve, demand for NVIDIA chips is increasing. Even with short-term share price drops, the long-term upward trend seems unstoppable. Billionaire investor and founder of the Duquesne Family Office, Stanley Druckenmiller, recently stated in an interview, "In my investment career, I've made many mistakes, one of which was selling all my NVIDIA shares at around $800-950. NVIDIA is a fantastic company, and if its share price falls, we'll get back in. But now, I'm licking my wounds from that terrible sale." However, this does not mean NVIDIA can rest easy.

The Relentless Pursuit of AMD

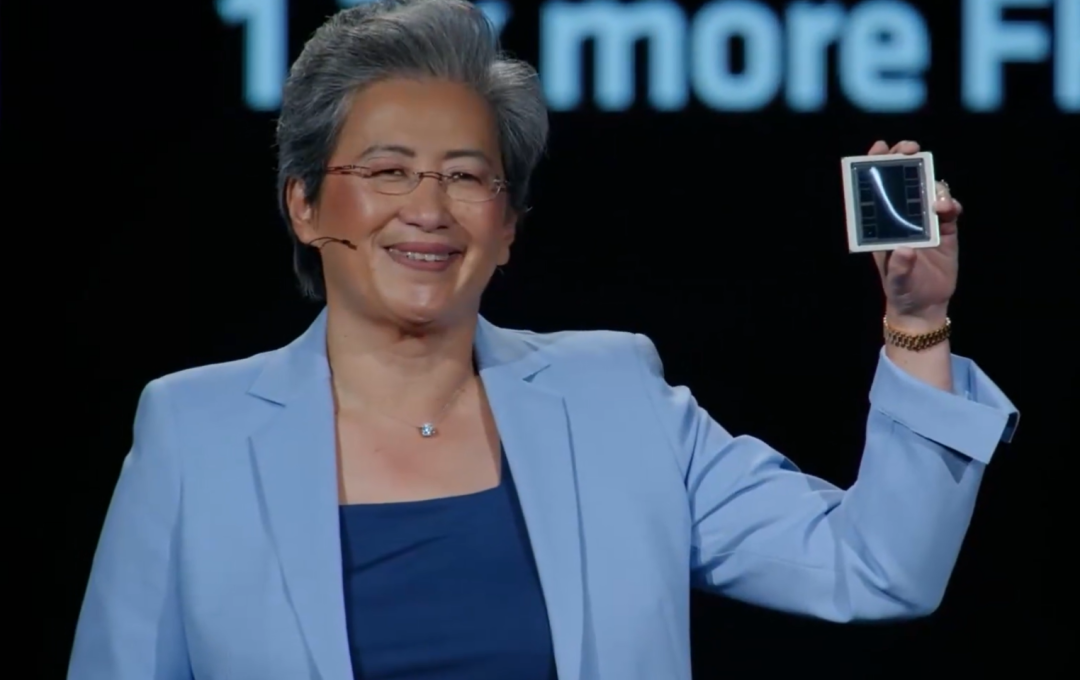

Over the past few years, NVIDIA has established a dominant position in the data center GPU market, approaching a monopoly. However, amid the AI wave, AMD, long in second place, has been relentlessly chasing NVIDIA. Earlier this year, NVIDIA unveiled its most powerful product, the B200, offering nearly 30 times the computational speed of its predecessor, the H200 chip. Scheduled for mass production in the fourth quarter of this year, the B200 is poised to widen the gap with its competitors. Recently, AMD also released a new generation of products, directly challenging NVIDIA's Blackwell chip and accelerating its pursuit. On October 10, AMD CEO Lisa Su delivered a nearly two-hour keynote, highlighting the AI chip named Instinct MI325X.

Image: Lisa Su showcasing the MI325X GPU

Public data shows that compared to NVIDIA's H200 HGX integrated platform, the MI325X platform offers 1.8 times the memory capacity, 1.3 times the memory bandwidth, and 1.3 times the computing power.

Furthermore, AMD announced its latest AI chip roadmap, including the MI350 series based on the CDNA 4 architecture launching next year and the more advanced MI400 series to follow. It's challenging to predict the future standing of AMD and NVIDIA in AI chips, as both companies claim superiority based on their published data. However, NVIDIA currently holds a significant market share lead that AMD is unlikely to surpass in the short term.

Despite this, AMD's AI business has secured numerous orders, primarily due to NVIDIA's insufficient production capacity, which has led to overflow orders flowing to AMD. For AMD, the real turning point lies in the growing demand for AI application-level solutions as AI models scale up. Companies seeking to reduce AI service costs and expand AI's reach will prioritize GPUs with high inference efficiency.

Here, AMD's MI325X positioning is clear: providing enterprises with cost-effective AI computing power to support AI application deployment. This explains why companies like Microsoft and OpenAI have endorsed AMD, not only to reduce NVIDIA's influence but also to secure early access to more MI325X chips as a key to AI service adoption. This presents a significant opportunity for AMD, even if it cannot overtake NVIDIA's leadership, to capture a substantial market share.

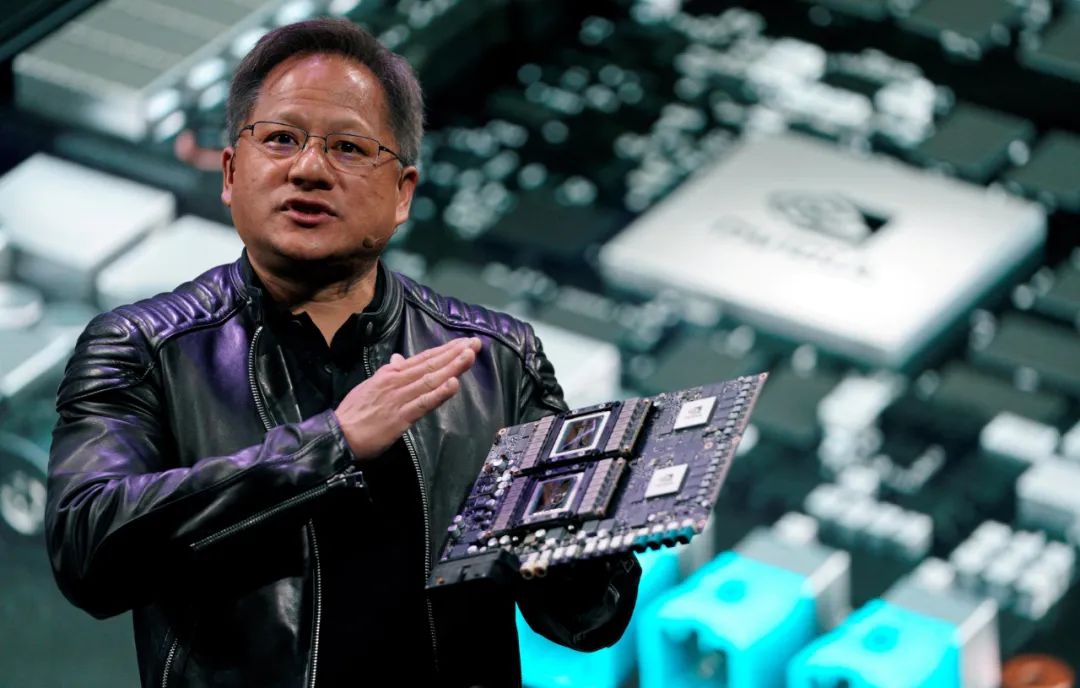

Constrained Hands

More than competitors or production supply issues, NVIDIA faces its biggest challenge in the form of U.S. export restrictions. In recent years, the U.S. has tightened export restrictions on China, particularly in high-tech sectors, with AI chips being a key target. Before the reported restrictions on exports to Gulf nations, the U.S. had already limited NVIDIA and AMD's exports of AI chips to over 40 countries in the Middle East, Africa, and Asia, largely due to concerns about technology transfers to China.

China, as the world's largest computer manufacturing base and a promising AI application market, holds a strategic position in NVIDIA's global market layout. The repeated tightening of U.S. export controls on advanced AI chips has directly impacted NVIDIA's revenue in China and overall performance. In fiscal year 2023, China's sales contribution to NVIDIA's data center revenue fell to 19% and further dropped to 14% in fiscal year 2024, with a single-digit percentage in the fourth quarter. However, under U.S. government pressure, NVIDIA has not completely abandoned the Chinese market.

Image: NVIDIA Founder and CEO Jensen Huang

NVIDIA has introduced China-specific AI chips like the A800, H800, H20, L20, and L2 and transferred some business operations to mainland China and Hong Kong, including testing, validation, supply, and distribution.

Based on these efforts, in the second fiscal quarter from April to July this year, NVIDIA's revenue in China reached $3.7 billion, up 33.8% year-on-year and 47.2% quarter-on-quarter. However, this is still below pre-export control levels. Notably, in the second quarter, NVIDIA launched its latest Blackwell architecture chip, outperforming its previous Hopper architecture. According to Reuters, NVIDIA has developed a Blackwell-based AI chip exclusively for the Chinese market, tentatively named B20. In the long run, the U.S. government's export control policies not only constrain American chip companies like NVIDIA but also risk eroding the global competitiveness of the U.S. tech industry.

Especially in recent years, China's chip industry has made significant breakthroughs, breaking new ground and increasingly substituting imported chips with domestically produced ones. NVIDIA faces significant challenges navigating U.S. government pressures and the rising Chinese market. Its future path is bound to be challenging.