Roblox: Transitioning to Metaverse - A True Safe Haven for Risk Aversion?

![]() 05/06 2025

05/06 2025

![]() 737

737

Hello everyone, I'm Dolphin!

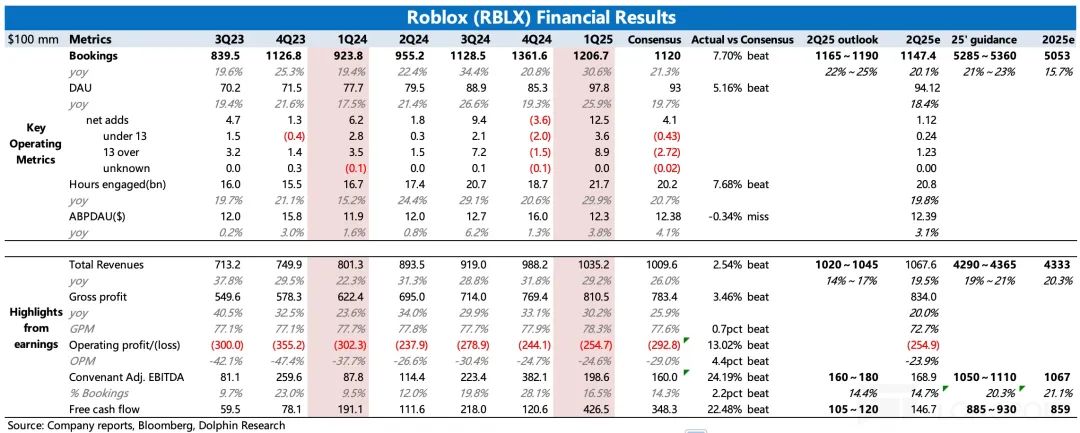

Roblox unveiled its financial results for the first quarter of fiscal year 2025 before the U.S. market opened on May 1, Eastern Time. Overall, the performance was robust, with key growth and profitability metrics surpassing expectations, underscoring the company's healthy trajectory of maintaining ecosystem vitality while steadily enhancing internal operational efficiency.

Let's delve deeper into the core highlights:

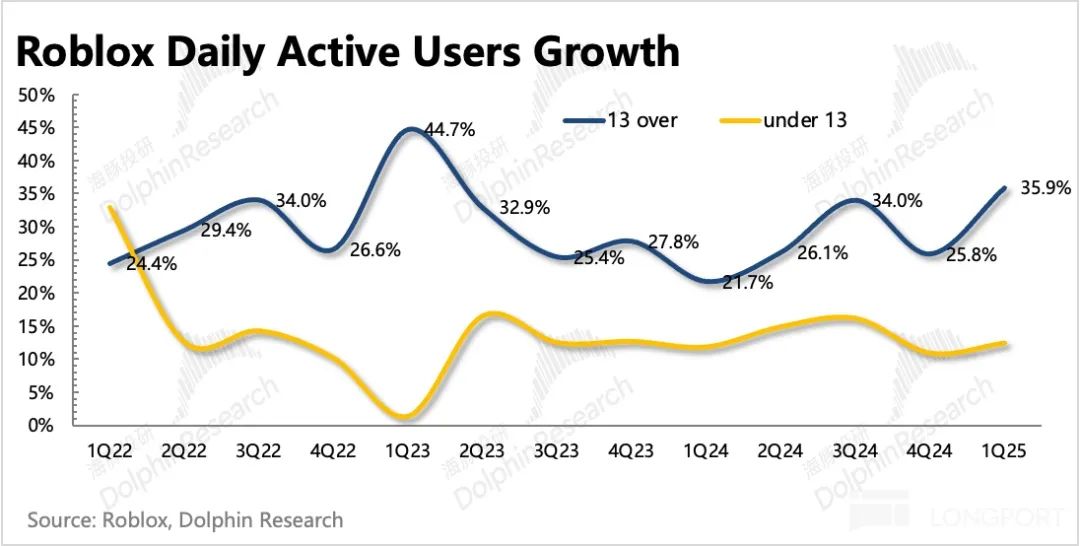

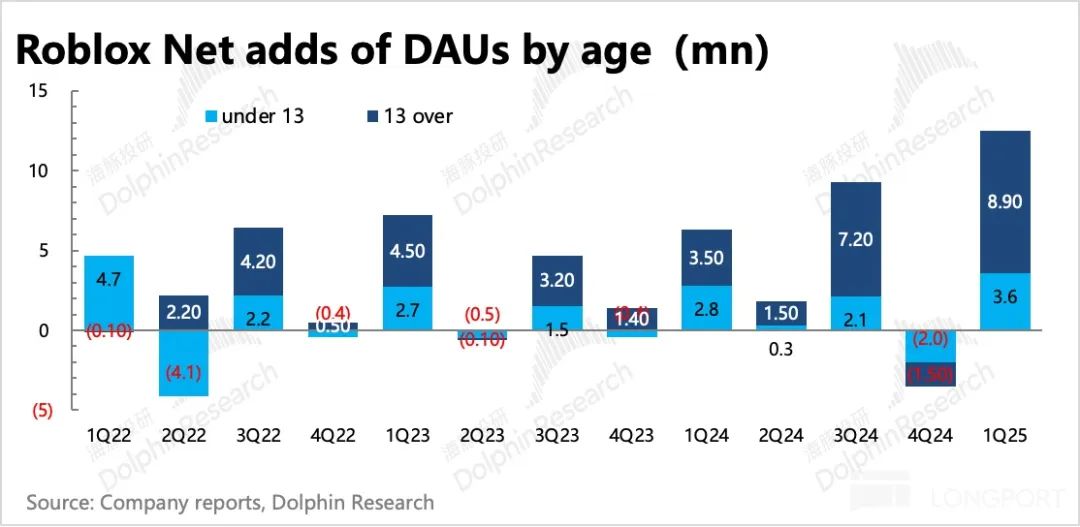

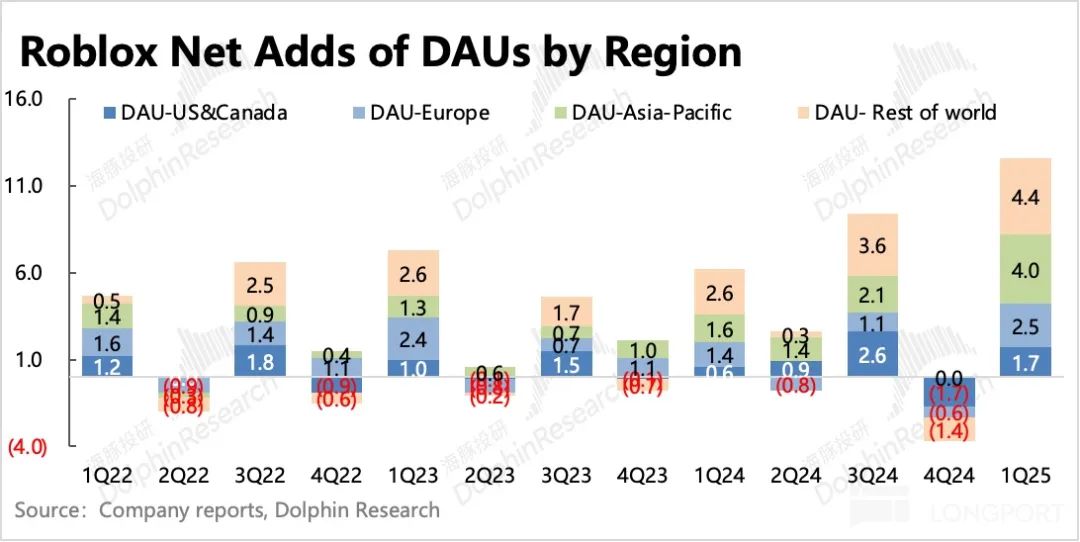

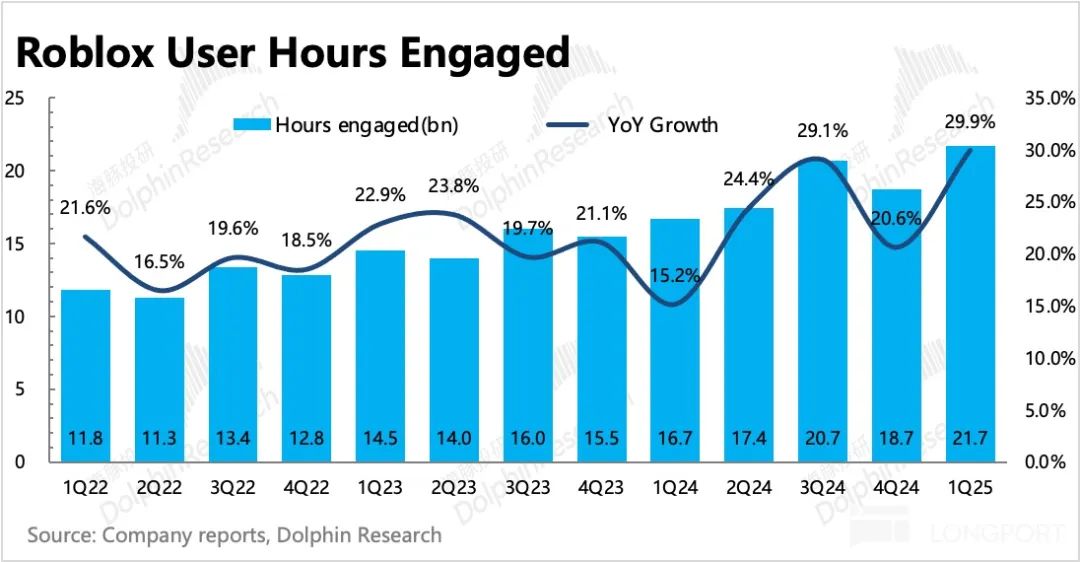

1. User Activity Rebounds as Anticipated: The decline in DAU growth during the previous quarter sparked market concerns and was the primary catalyst behind the stock price's sharp decline post-earnings. During the earnings call, the company provided explanations, including the high base from the PlayStation version's introduction the year prior and temporary bans in regions like Turkey. Additionally, the increase in parental monitoring mechanisms had some impact on users under 13 years old.

Furthermore, the company revealed at the time that January data had already improved, but given the high valuation, the market remained skeptical, leading Roblox to follow the broader U.S. stock market into a deep correction. It wasn't until the third-party data platform tracked the platform's user activity trend for multiple consecutive weeks at the end of February that the stock price stabilized and rebounded.

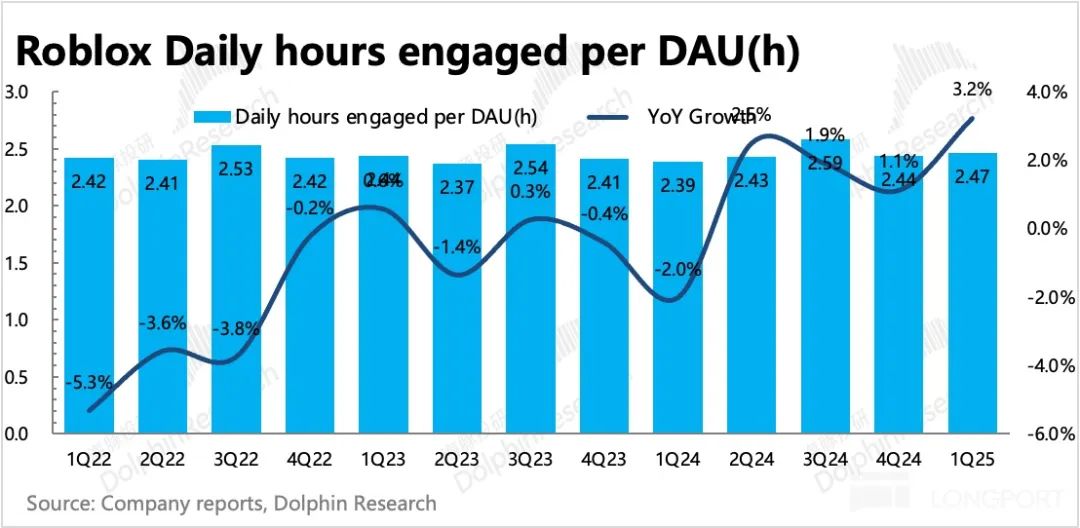

2. Engagement Maintained and Enhanced: User volume can fluctuate significantly in the short term, often influenced by current events. Therefore, Dolphin pays particular attention to the "average daily usage per user" metric to gauge changes in user engagement with the platform.

In the previous quarter, it was precisely because the average daily usage per user continued to grow that Dolphin was less concerned about Roblox's user expansion trend. In the first quarter, average daily usage per user increased by 3.2% year-on-year, especially with the addition of many new players in Q1. This engagement underscores the loyalty of core users to the platform and the continuous enrichment of platform content.

3. Increased Proportion of Young Users to 62%: Functional controls on child users due to safety concerns (such as restrictions on private messaging) have caused the net increase in new child users to lag behind that of young users. However, the potential market spaces for these two groups differ. Young users are not only larger in scale but also have higher monetization potential (payments, advertising). Therefore, as a platform, Roblox is delighted to see more and more young users on its platform.

In the first quarter, the proportion of young and adult users aged 13 and above reached 62%, with an increase of 8.9 million in a single quarter. In contrast, child users under 13 years old only net increased by 3.6 million after a significant loss of 2 million in the previous quarter.

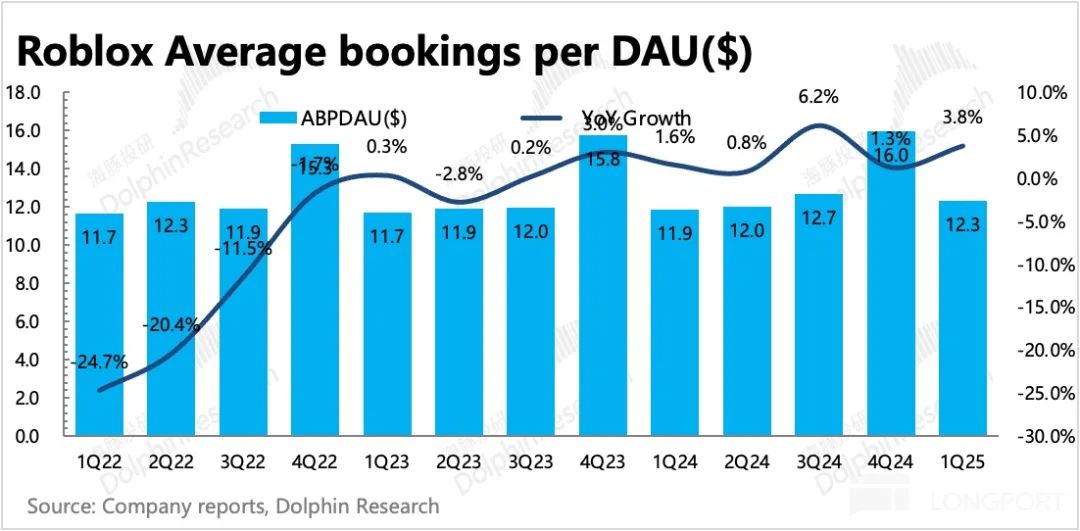

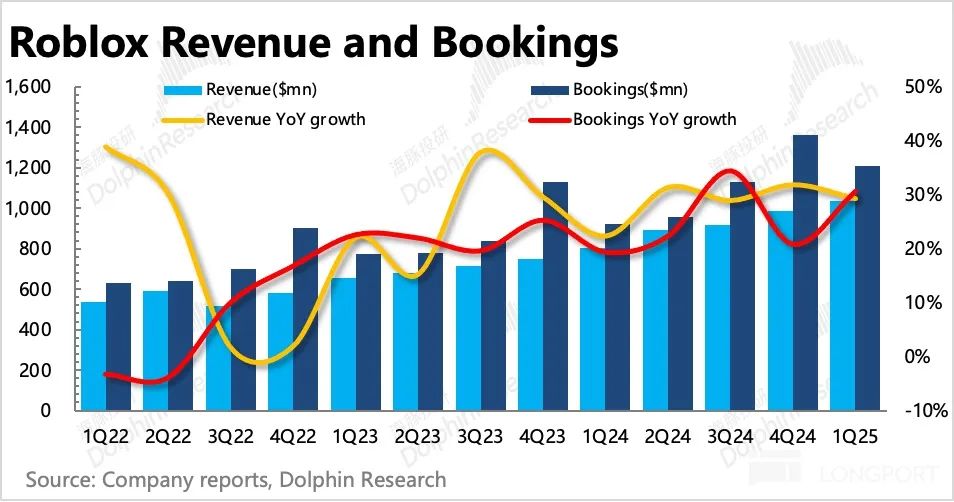

4. Bookings Return to High Growth: In the first quarter, Bookings revenue returned to 30% growth. Currently, per capita spending remains stable, so revenue changes primarily follow DAU trends. The company's guidance for the second quarter Bookings growth rate is in the range of 22-25%, exceeding market expectations, and the full-year 2025 target has been raised accordingly.

Given the high base in the second half of the year, growth pressure may not be insignificant. So, what will sustain high growth in the second half of the year and even over the next 2-3 years? Dolphin believes there are two main factors:

1) Increasing Ad Load: In April, Roblox announced its participation in Google's advertising system, allowing advertisers to find ad space on Roblox through Google's ad matching platform for placement.

2) Enriching Ecosystem Content and Improving Paid Conversions: This is a more long-term strategy. The richer the platform's content ecosystem, the more paid points it will naturally offer, attracting users to pay. To cater to the taste needs of young and adult users, the Roblox platform also requires more high-quality content.

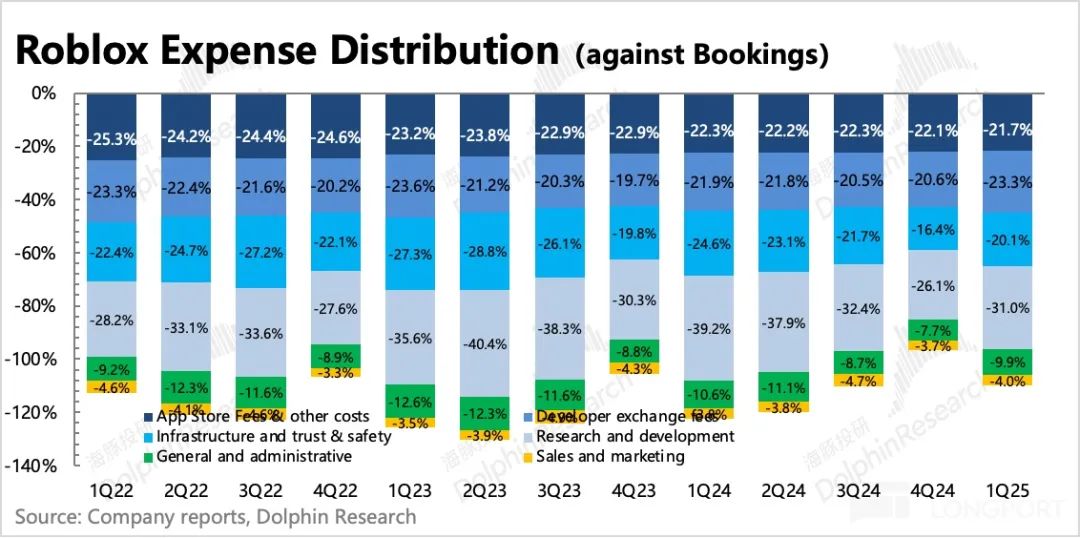

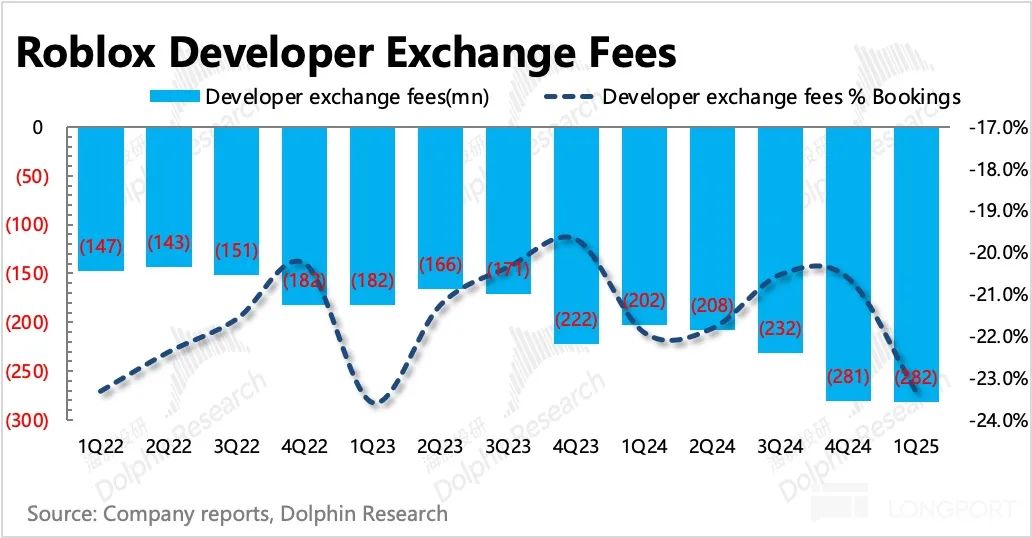

5. Greater Concessions to Developers: Under normal circumstances, Roblox's 20% revenue share doesn't offer a significant advantage in the gaming industry and may passively filter out many high-quality developers. Although management has discussed increasing the share, this quarter finally saw changes in the indicators. In the first quarter, the proportion of developer expenses in revenue increased to 23%. While this may slow down the pace of loss reduction in the short term, it is a crucial step in enhancing the ecosystem in the medium to long term.

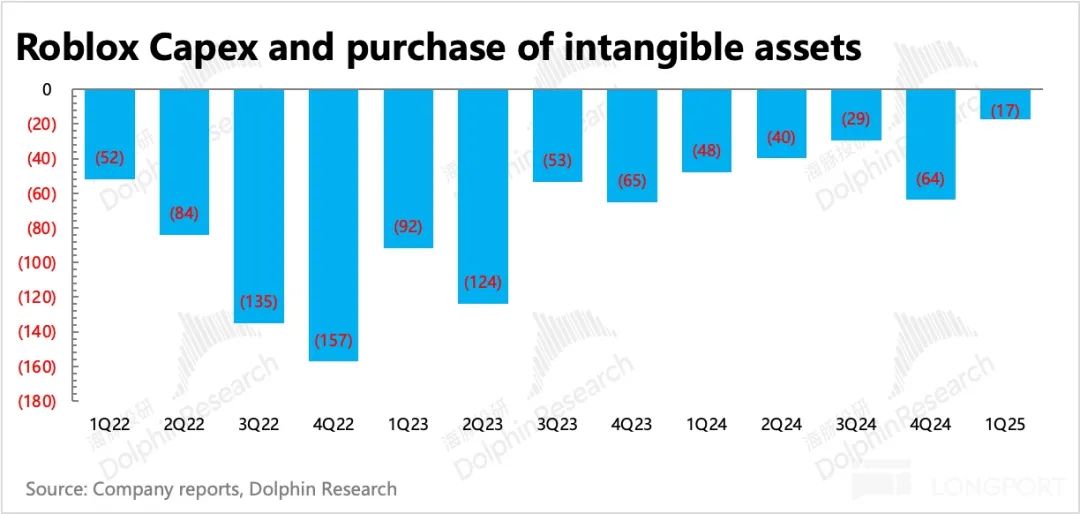

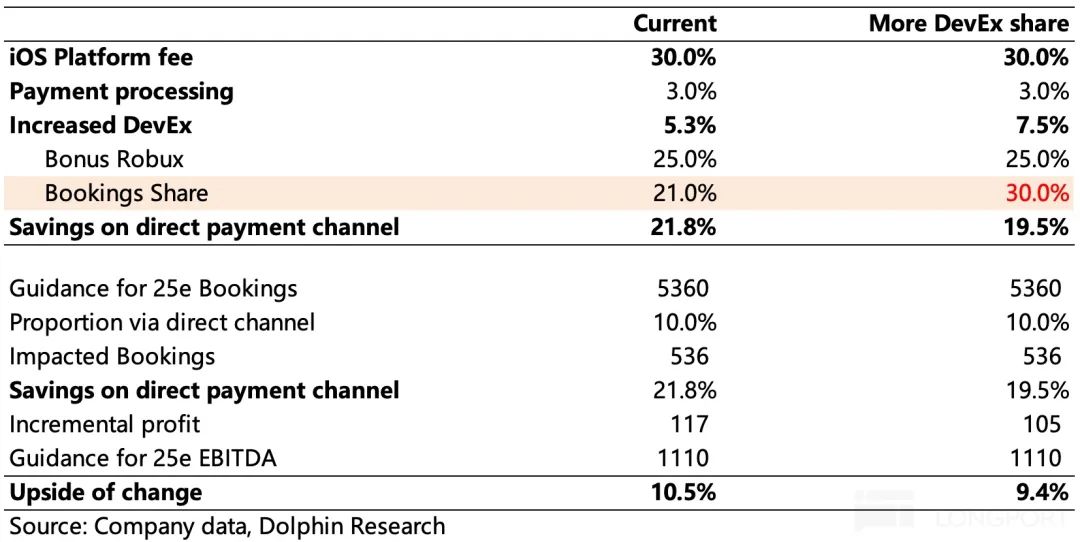

6. Effective Channel Reforms: The gross margin in the first quarter increased by 0.4 percentage points from the previous quarter to 78.3%. Roblox's primary costs are channel sharing, such as Apple's and Google's taxes on mobile payments. Starting from the last quarter, the company intentionally guided users to recharge directly on the official website (with additional Robux as an incentive), and the positive impact was evident within just one quarter.

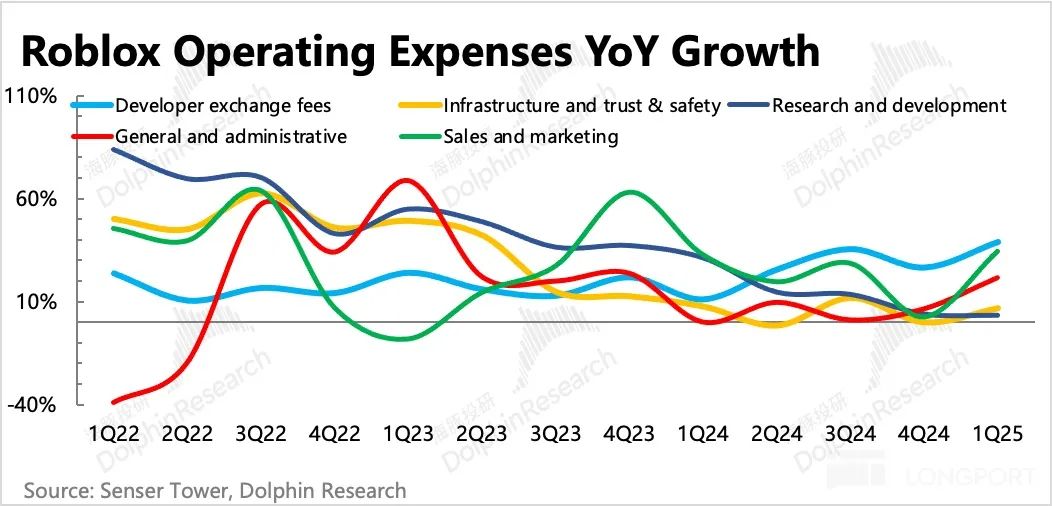

7. Slow Loss Reduction but Healthy Cash Flow: Despite just beginning channel reforms and concessions to developers, even with strict control over other operating expenses (primarily reflected in personnel optimization), Roblox's pace of truly reducing losses is bound to slow down. In the first quarter, the GAAP operating loss was $255 million, and the loss rate of 24.6% showed almost no change from the previous quarter.

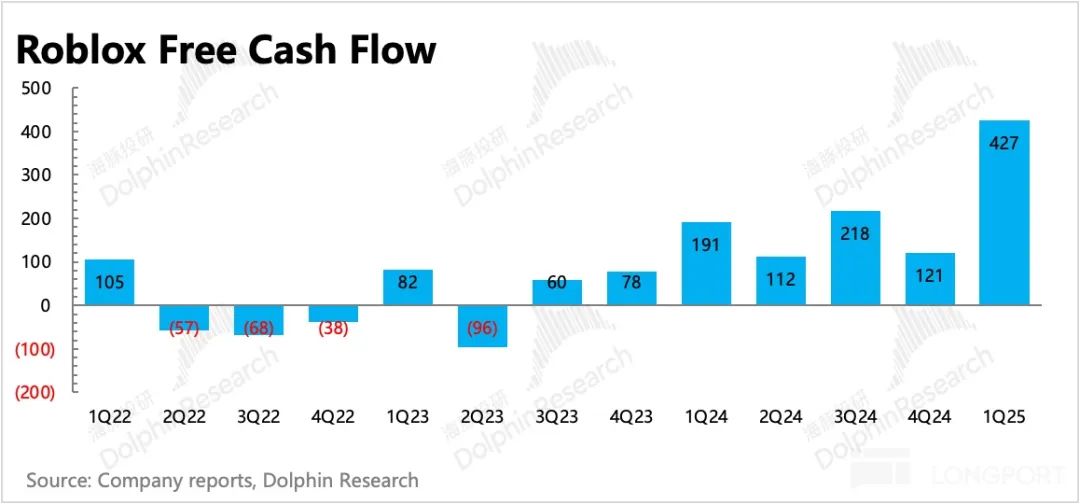

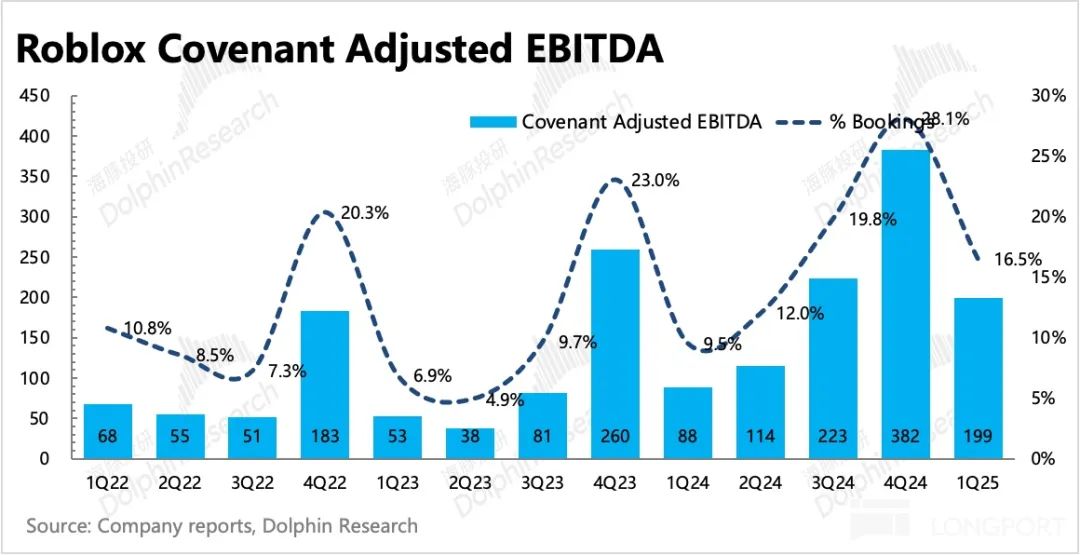

However, from a cash flow perspective, Roblox's improvement has been rapid. In the first quarter, free cash flow was $430 million, accounting for 35% of revenue. This cash flow situation is very healthy, significantly exceeding market expectations. Judging from the EBITDA guidance, the targets for the second quarter and the full year 2025 also exceeded market expectations.

8. Overview of Financial Indicators

Dolphin Investment Research Viewpoint

Roblox, which stumbled last quarter due to user numbers falling short of expectations, has proven itself with a strong performance this time. In fact, Dolphin had doubts last quarter. Logically, management had already explained in detail the reasons for short-term user fluctuations during the earnings call and quite clearly disclosed that January data had already recovered.

However, after a sharp 11% decline on that day, the stock price subsequently followed the broader U.S. stock market into a wave of deep corrections, without giving any positive reaction to management's statement. It wasn't until the end of February, when data tracked by third-party platforms continued to perform well, that the stock price saw some rebound, seemingly confirming that management had not exaggerated before funds decided to recognize Roblox's value.

In retrospect, it was the "distrust" caused by the high valuation. At that time, the EV/EBITDA ratio reached 50x, but the performance growth rate was only at the level of 20%-30%. This premium implicitly reflected the market's expectations for Roblox's performance to consistently exceed the 20% growth guidance. Under such expectations, once performance missed, the premium was the first to be eroded in the short term, reverting to a reasonable and neutral intrinsic value (based on growth rate, it's a Forward 1-Year EV/EBITDA of 30x, approximately a valuation of $40 billion).

Setting aside valuation, Dolphin has always been confident in Roblox's development prospects:

In the short term, its fundamentals include exploring advertising monetization and the continuous effect of channel reforms on gross margin. Although there may be some base effects in the second half of the year, slowing down the growth rate, after two quarters of digestion, the market should have priced in much of this expectation. Simultaneously, in the short term, Roblox also belongs to the risk-averse assets of both "subscription + entertainment" under the macroeconomic environments of trade wars and economic recessions. Benchmarked against the valuations of Netflix and Spotify, under positive sentiment, Roblox may match an EV/EBITDA of 35x-40x.

The medium-term logic lies in Roblox's solid business model, which is a self-owned traffic platform with content distribution rights, but the upstream is a perfectly competitive market where individual discourse power is not that high, or may not always be that high. This allows the platform barriers to be built higher as traffic expands under the mutual feedback of "content - traffic," and it has greater discourse power over upstream and downstream. The economic ecosystem where players need to exchange "Robux" to participate in activities will also make the cash flow of this business very healthy.

As for whether AI will disrupt Roblox, Dolphin believes it won't. Roblox is not just a platform that lowers the threshold for game development; more importantly, it has already formed a community attribute. Under the general trend of AI, platforms with pure tool attributes are more likely to be disrupted, but platforms with traffic ecosystems and social scenarios will at least benefit from the AI cycle for a longer period. For Roblox, advancements in AI (such as Roblox Assistant, and the upcoming text-to-creation model and 3D video creation model) can enrich the ecosystem content at a faster pace.

Below are the charts of Roblox's key indicators:

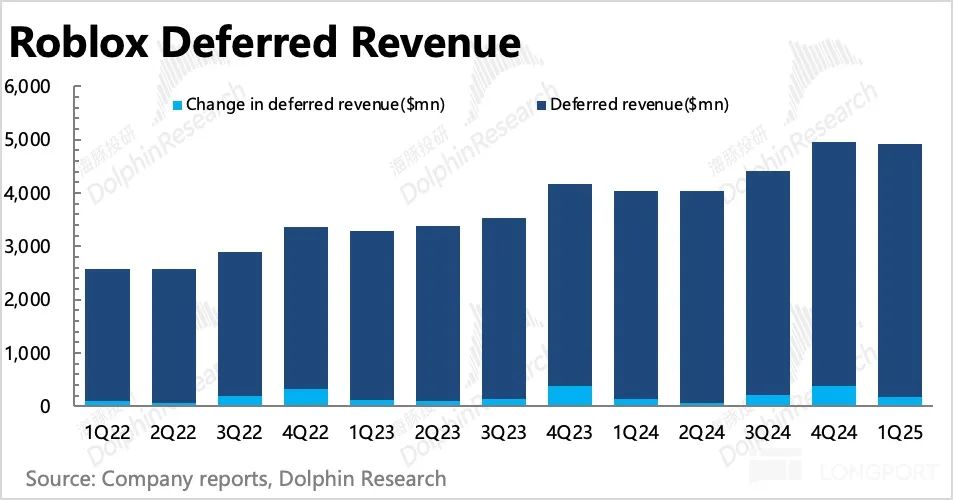

Similarly, the adjusted EBITDA indicator excluding SBC expenses, when restored using the original calculation method (i.e., adding net deferred revenue, which is deferred revenue minus deferred costs, to Adj. EBITDA), showed a year-on-year increase of 126% in the first quarter, with a profit margin (%Bookings) of 16%, an increase of nearly 700bps from the same period last year.

- END -

// Repost Authorization

This is an original article by Dolphin Investment Research. For reprinting, please obtain authorization.

// Disclaimer and General Disclosure Note

This report is intended for general comprehensive data use only, for general browsing and data reference by users of Dolphin Investment Research and its affiliates. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial status, and special needs of any person receiving this report. Investors must consult independent professional advisors before making investment decisions based on this report. Any person who makes investment decisions based on the content or information mentioned in this report shall bear the risks themselves. Dolphin Investment Research shall not be liable for any direct or indirect responsibilities or losses that may arise from the use of the data contained in this report. The information and data contained in this report are based on publicly available information and are for reference purposes only. Dolphin Investment Research strives but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information mentioned or the opinions expressed in this report cannot be used or regarded as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction. It also does not constitute advice, inquiry, or recommendation on relevant securities or related financial instruments. The information, tools, and data contained in this report are not intended for distribution to citizens or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and data would violate applicable laws or regulations or would result in Dolphin Investment Research and/or its subsidiaries or affiliates being required to comply with any registration or licensing requirements of such jurisdictions.

This report reflects only the personal views, opinions, and analysis methods of the relevant author and does not represent the position of Dolphin Investment Research and/or its affiliates.

This report has been compiled by Dolphin Investment Research and its copyright is exclusively held by Dolphin Investment Research. Without prior written consent from Dolphin Investment Research, no organization or individual is permitted to: (i) produce, copy, reproduce, duplicate, distribute, or otherwise create copies or reproductions in any format; and/or (ii) directly or indirectly redistribute or transfer this report to any unauthorized persons. Dolphin Investment Research retains all associated rights.