Palantir: "DOGE + Tariff" Double Edged Sword, Will AI Belief Fall from the Pedestal?

![]() 05/07 2025

05/07 2025

![]() 766

766

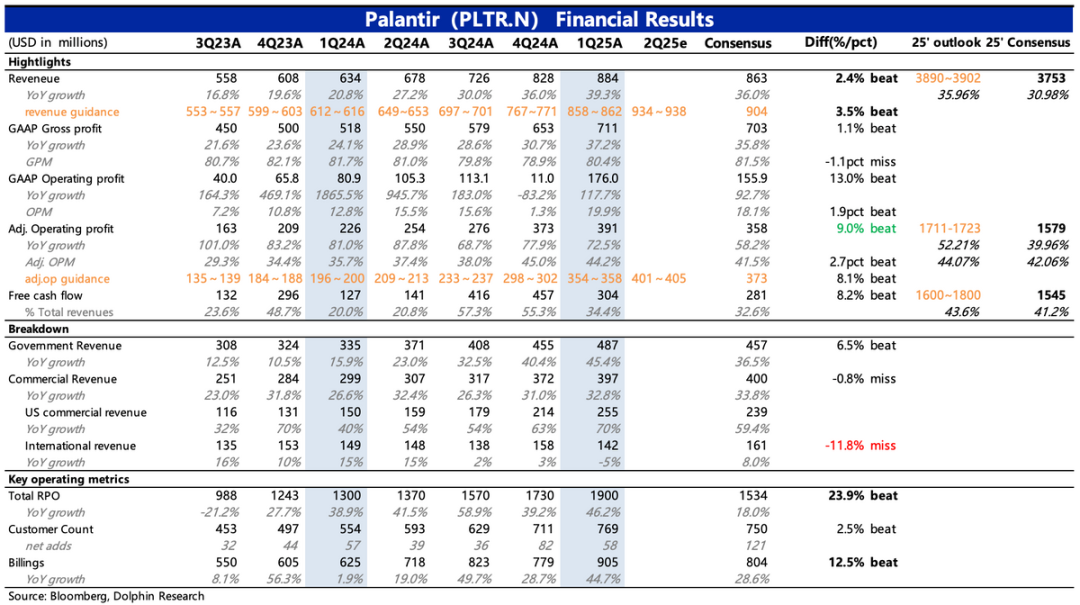

Palantir released its Q1 2025 earnings after the market close on May 5, EDT. Overall, the Q1 performance exceeded expectations. Although it was not as impressive as the previous quarter, the short- to medium-term high-growth trend remained intact, and both the Q2 and full-year guidance were better than institutional expectations.

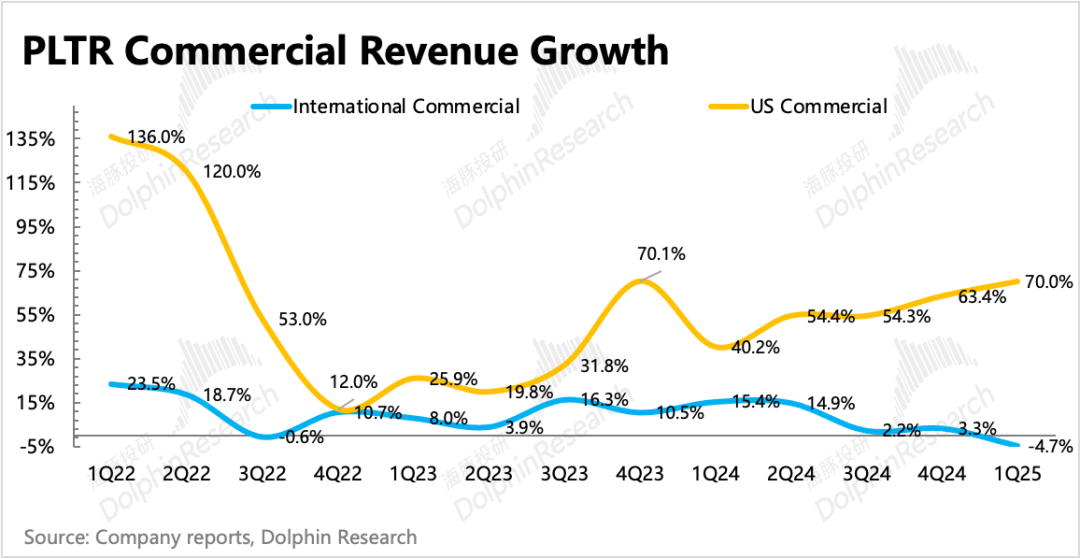

However, market tolerance is decreasing under high valuations. Before the financial report, the market ignored the impact of tariffs and DOGE, and the market capitalization hit a new high, approaching 300 billion USD, implying a 25-year EV/Sales ratio of 75x. Therefore, in addition to being picky about the "not impressive enough" results, the first-quarter revenue from the international commercial market, which represents medium- and long-term growth potential, saw its first year-on-year decline, which is probably the main reason for the poor market feedback after the financial report.

Specifically, the core information of the financial report is as follows:

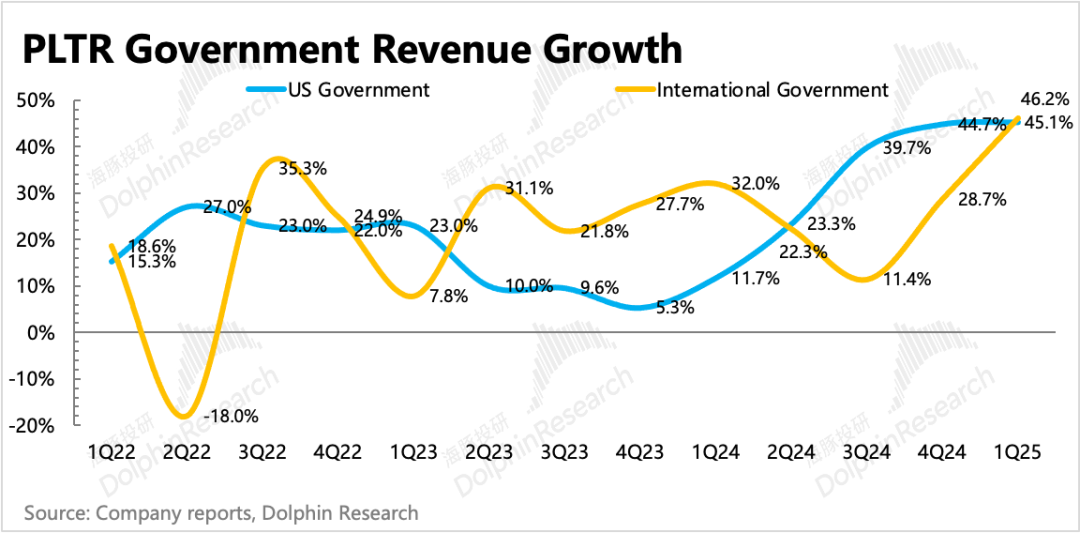

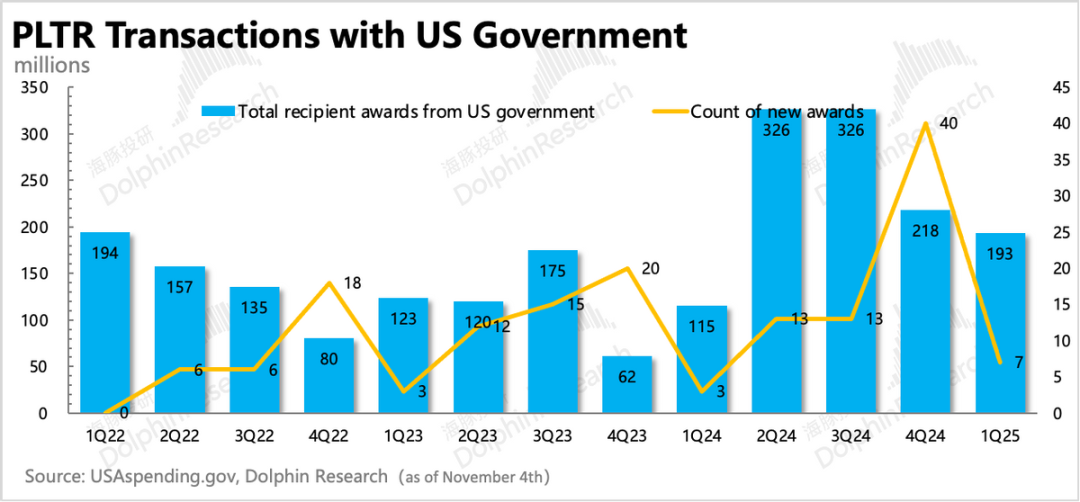

1. The impact of the Government Efficiency Year has not yet been reflected: In Q1, US government revenue increased by 45% year-on-year, a slight expansion compared to Q4, which slightly alleviated pre-financial report concerns about government revenue growth among some investors. On the official government revenue and expenditure website, the scale of contracts awarded to Palantir in Q1 did indeed show a quarter-on-quarter decline in growth rate, but short-term seasonal fluctuations cannot explain much based on past years' data.

The deep adjustment in Palantir's stock price in the first two months was mainly due to the impact of the government's DOGE. In February, the Secretary of Defense dropped a bombshell: future defense department spending will be reduced by 8% annually. The market immediately raised concerns about revenue growth for Palantir, which derives more than 40% of its revenue from the US government.

However, the Secretary of Defense had a second half to his statement: concentrate investments in high ROI areas. And the AI and data analysis fields where Palantir operates are among the high ROI technology areas. Therefore, even if the overall budget is to be cut, Dolphin believes that the budget allocated to Palantir may not decrease.

In addition, a "Trump-style reversal" has also arrived. The defense budget for fiscal year 2026 will reach 1 trillion USD, implying an average annual compound growth rate of 10%, which seems to contradict the Secretary of Defense's statement. But regardless of how the budget ultimately lands, the reversal of the government's attitude can reignite valuation belief in Palantir.

2. Explosion of EU defense demand: Despite a high base, the growth rate in Q1 continued to rebound to a year-on-year increase of 46%, on par with the US government, reflecting the increasing demand emanating from international governments in the short term.

Due to national security considerations, Dolphin has not been overly optimistic about the revenue growth of international government business. However, as the EU's demand for investment in military modernization has surged, Palantir's growth momentum in this area has begun to emerge.

For example, both Germany and the UK intend to expand their military spending, but there are not many capable local defense companies such as BAE Systems, Airbus, and Leonardo (due to slower AI transformation). Compared to more "American" traditional military companies like Raytheon, Palantir has a "relatively neutral" stance, making it a core technology supplier for EU countries.

3. Macro pressure continues, and international enterprise demand continues to weaken: In Q1, international commercial revenue saw its first year-on-year decline of 5%, significantly lower than market expectations. Although this segment accounts for the lowest revenue share among the four businesses, it is also the main business entrusted with medium- and long-term future growth potential.

Unlike government budgets, corporate IT budgets are often greatly influenced by macroeconomic conditions. The European economy has been under pressure for a long time since the pandemic. Although the "unexpected" tariffs had not been introduced in Q1, companies may have already factored in some expectations of tariff impacts in advance.

Palantir's applications in the enterprise sector are mainly in the supply chains of manufacturing industries such as automobiles, as well as consumer service companies in finance and pharmaceuticals. European automobile and pharmaceutical companies have a high degree of multinational attributes and are therefore significantly affected by tariffs, leading to higher incentives for enterprises to cut IT budgets.

In addition, Dolphin suspects that there may also be concerns about data security among customers regarding the storage and analysis of corporate data on non-domestic software. Look out for the management's explanation on the earnings call for more details.

4. AI investments are successively recognized, and profit margins remain stable: Due to the recognition of more AI investments in the current period, the gross margin in Q1 declined year-on-year, and R&D and sales expenses continued to maintain a year-on-year growth rate of over 20%, with only more significant expenditure control on administrative expenses. Finally, the adjusted operating profit margin was 44.2%, down 0.8 percentage points from the previous quarter but still significantly exceeding market expectations.

5. Future growth targets are raised accordingly: The Q2 revenue guidance implies a growth rate of around 39%, which remains robust compared to the Q1 growth rate despite a higher base. In Q1, the proportion of revenue from the US mainland has risen to 71%. Therefore, the strong demand from the US government and enterprises ensures that Palantir's high growth this year is worry-free, and management has steadily revised upwards the full-year growth target to around a 36% growth rate.

In terms of profitability, the full-year operating profit margin is similar to that of Q1, implying that the recognition of more AI expenses in the future will slow down the pace of profit improvement. However, Palantir's adjusted operating profit margin is already close to 45%, which is not low in profitability for non-subscription, heavily customized software services. To a certain extent, this reflects that Palantir's current product competitive advantage has been converted into sustained bargaining power.

6. Forward-looking indicators show strong short-term growth: Palantir mainly provides customized software services to customers (with a trend towards standardization in the AIP segment), so revenue is highly predictable in the short term. The company's guidance range is also relatively narrow, implying a high degree of certainty in revenue.

However, for this reason, to reflect Palantir's true business growth, the market pays more attention to indicators related to new contracts, such as TCV (Total Contract Value), RPO (Remaining Performance Obligation), the number of customers (mainly commercial customers), and Billings (current billing flow).

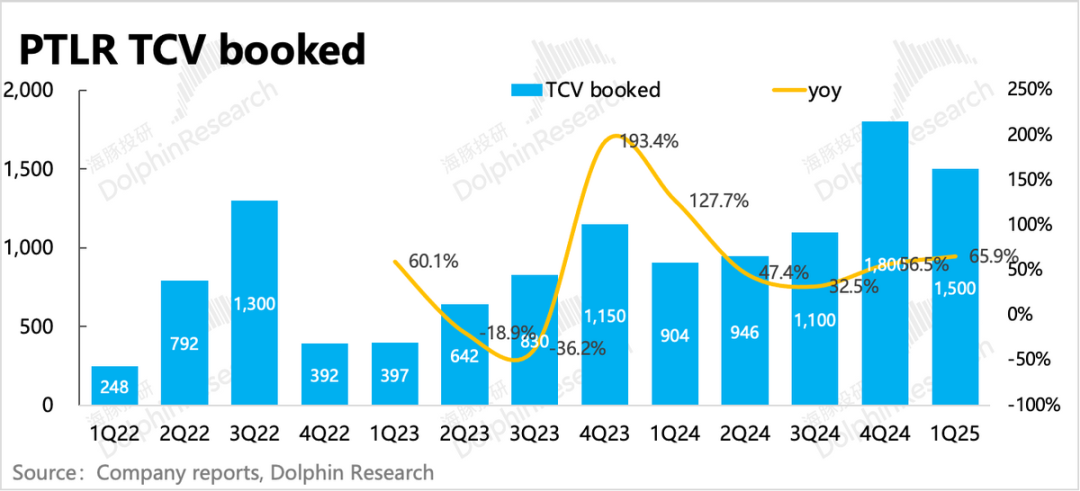

(1) The first three (TCV, RPO, number of customers) involve the issue of the impact of different cooperation cycles on revenue changes, so they are more helpful for medium- and long-term growth prospects: In Q1, TCV continued its healthy trend of high growth. US commercial TCV grew faster, and the application penetration of AIP smoothed out short-term seasonal revenue fluctuations, with Q1 showing a reverse quarterly growth.

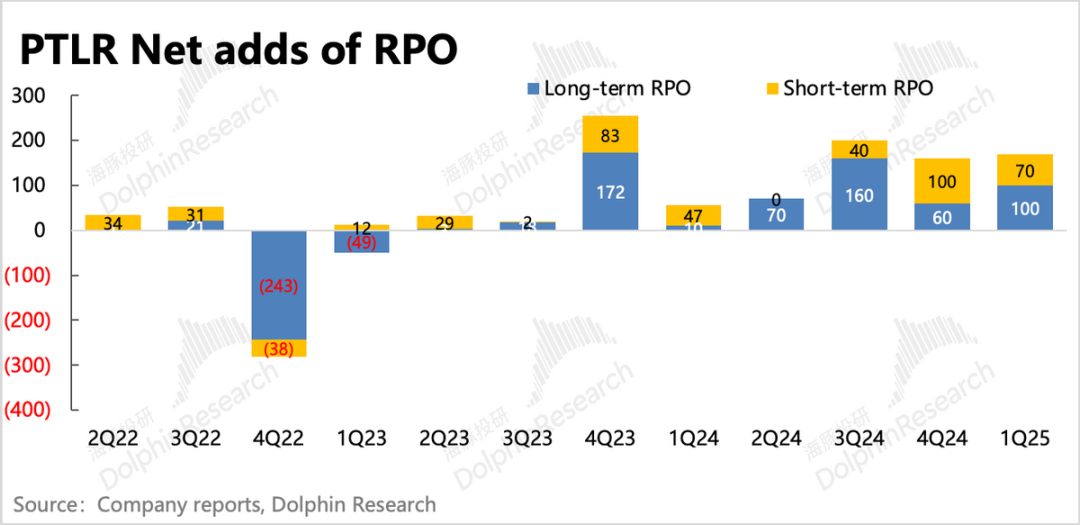

Among them, the irrevocable contract amount RPO also maintained "high growth on a high base". Breaking down long-term and short-term contracts, the net increase in medium- and long-term contracts expanded slightly compared to the previous quarter.

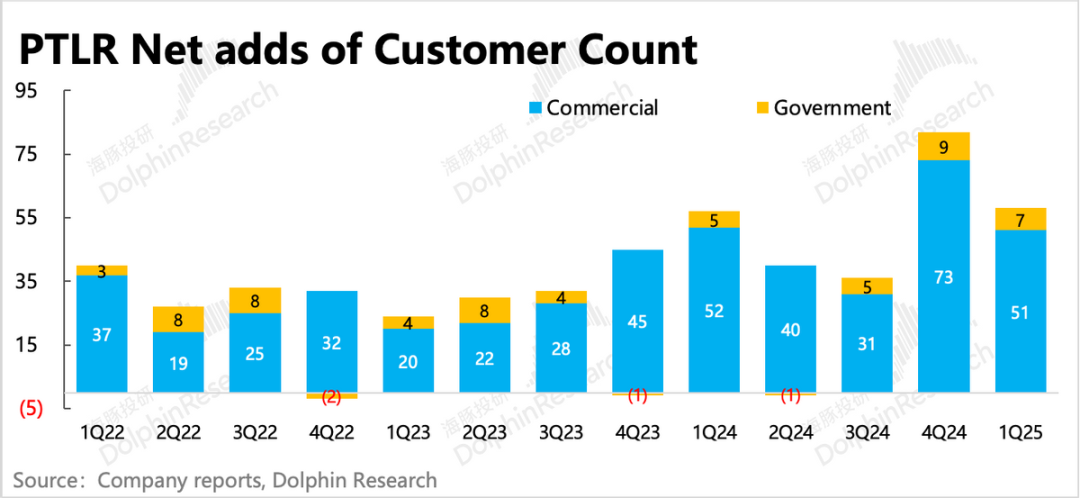

In terms of the number of customers, Palantir net added 51 customers in Q1, but mainly from US enterprise users, with only one net increase in international enterprise users. Therefore, under macroeconomic pressure, reductions in expenditures by existing customers have put downward pressure on the revenue side, and expansion obstacles + partial loss of existing customers may affect medium-term growth expectations.

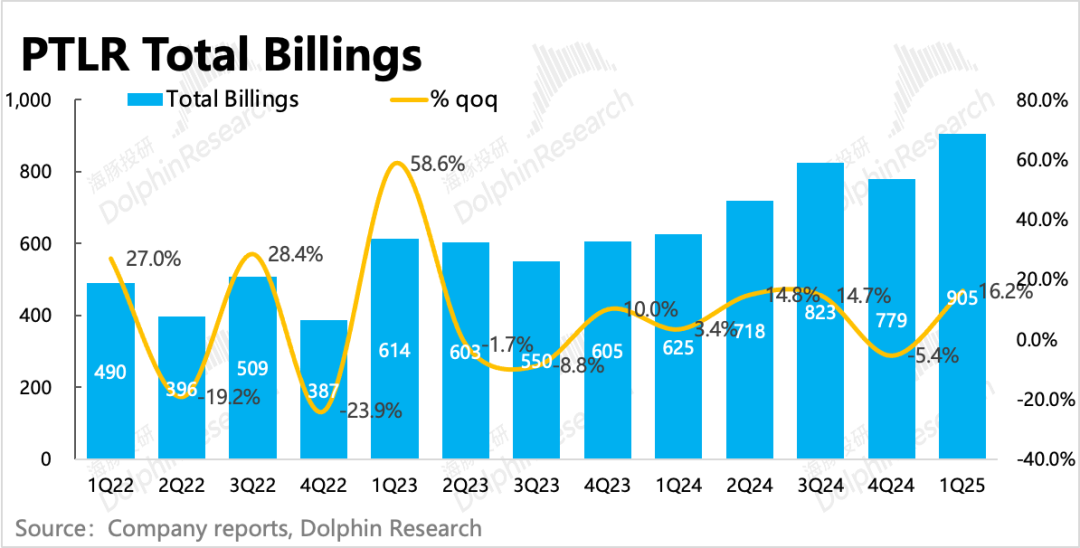

(2) In the short term, the market mainly focuses on changes in Billings and NDR: In Q1, Billings increased by 45% year-on-year, exceeding expectations. The overall contract liabilities (including customer deposits) increased net on a quarter-on-quarter basis, with a net revenue retention rate of 124%, continuing to increase quarter-on-quarter, reflecting a trend of short-term marginal net expansion.

7. Overview of performance indicators

Dolphin's Viewpoint

For Palantir, whose market capitalization has risen to nearly 300 billion USD, the absolute valuation is definitely detached from fundamentals, and the calculator is blown up and still out of reach. However, fundamentals are not unimportant. Short-term performance margins, good or bad, will continuously challenge market tolerance and are therefore a key factor determining the direction of valuation changes upwards or downwards.

From a competitive perspective and market expectations, the Q1 performance was not bad, with comprehensive financial indicators exceeding expectations. Operating indicators such as the number of customers and contract amounts were also good, indicating that short-term high revenue growth is sustainable. On balance, Dolphin believes that the core point of Palantir's fundamentals - product competitiveness - has not changed much.

So what exactly is the market dissatisfied with? Or, under high valuations, what are the market's picky points?

Before the financial report, the market's main concern about Palantir, or the biggest firepower attack point for the shorts, was the impact of the US government's DOGE on the signing/performance progress of Palantir's government contracts, putting pressure on government revenue growth. The evidence supporting this view is that the growth rate of contracts awarded to Palantir on the US government expenditure website declined significantly in Q1.

However, market expectations of pressure mainly existed in the first half of the year. In the second half of the year, when DOGE ends, and the AI field represented by Palantir is not a major expenditure category subject to government cuts, from the current investment policy of the Department of Defense, Palantir's AI belongs to the "high ROI" area and is instead a direction for substantial investment. Therefore, the delayed expenditures will be restored and released.

But the actual situation is that Q1 has not yet reflected the delivery pressure after the US government set efficiency targets. On the contrary, under the explosive growth of technology and defense demand from European governments (but without any local companies that can compete with Palantir, so there is no better choice), international government revenue growth rebounded significantly.

The flaw in performance lies in the macroeconomic uncertainty triggered by tariff confrontations, which in turn affects the IT budgets of multinational enterprises. In Q1, international commercial revenue saw its first year-on-year decline, with only one net increase in customer numbers. This shows that it is not just a hindrance to market expansion; existing customers are not just temporarily cutting back but directly canceling cooperation. Dolphin suspects that there may also be concerns among customers about data security regarding the storage and analysis of corporate data on non-domestic software.

Scaling potential has always been one of the few points repeatedly questioned about Palantir, especially after becoming a company with a market capitalization of 300 billion USD. In addition to continuing to dominate the US mainland, such as eating into the market share of some traditional data analysis software (e.g., Tableau, Informatica, and even Salesforce, which is relatively less advanced in AI), internationalization is an important direction. However, as of Q1, Palantir's US mainland revenue share continued to increase to 71%, moving further away from internationalization.

The international government market has not been given high expectations due to concerns about national security. We believe that the surge in demand from European governments can provide some support for Palantir's short-term revenue growth, but this is only a "reluctant choice" for European governments. In the medium to long term, once local enterprises effectively catch up technologically, changing suppliers will only be a matter of time.

Commercial internationalization, which does not involve national security, has always been a direction with high hopes for sustained long-term growth in the future, especially with the bundled product strength of AIP+Foundry overwhelming global peers. Therefore, the year-on-year decline in Q1 revenue may be the most unsatisfactory aspect for the market.

However, Dolphin believes that the above flaw is not a critical and difficult problem, unrelated to product competitiveness but related to macroeconomic and other objective factors. In other words, Palantir's expansion pace has only been temporarily delayed, not a retreat due to inability to compete. From the customer perspective of institutional research, Palantir's competitiveness in "product AIization", "efficient deployment", and the benefits enterprises ultimately derive from using the platform (cost optimization by replacing traditional labor and traditional IT operation and maintenance labor) have all received good feedback. Therefore, even though the price is not low, enterprises still have the intention to maintain investment and expenditure on the Palantir AIP+Foundry platform in the short term.

This is also why Dolphin believes that the valuation will not truly be knocked down by Q1 performance. But as mentioned earlier, despite the seemingly promising product crushing, Palantir is still absolutely overvalued (the scaling issue makes it impossible to accurately estimate TAM and the development timeline), so it does not meet Dolphin's preferred investment opportunities. Subsequent focus on Palantir will be more on fundamental tracking and research to understand the dynamics of cutting-edge AI technology applications.

Detailed Analysis Below

I. Overall Strength, Subtle Flaws

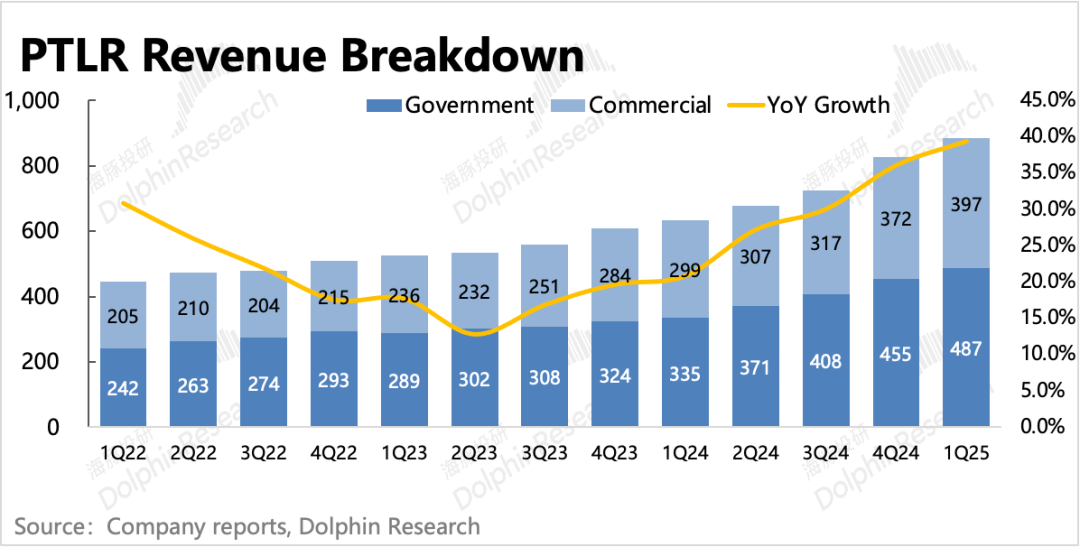

In Q1, total revenue reached 884 million USD, a year-on-year increase of 39%, exceeding market expectations (~863 million USD), and the growth rate continued to increase quarter-on-quarter.

Palantir mainly provides customized software services to customers, so revenue is highly predictable in the short term, and the company's guidance range is relatively narrow, implying a high degree of certainty in revenue. However, exceeding the upper limit of guidance for multiple consecutive quarters still reflects strong customer demand for AIP and Foundry.

1. Business Segmentation

(1) Government Revenue: No Impact of DOGE Yet in the US, Explosion of EU Defense Demand

Q1 government revenue increased by 45% year-on-year, with accelerating growth driven by both the US and international governments.

The market's concern about the impact of DOGE due to the decline in the growth rate of the scale of government-awarded contracts did not materialize in Q1, with US government revenue still accelerating at 45%. In Q1, three of the Palantir TiTAN intelligence vehicles contracted last year have been delivered since the beginning of the year. These intelligence vehicles are planned for operational testing and evaluation between 2027 and 2028 to collect, integrate, and analyze data from numerous sources such as satellites and aircraft to target and determine the locations of enemies and allies.

The growth driver for international governments mainly comes from Europe. To emulate the US investment in military modernization technology, governments of countries such as Germany, the UK, France, and Sweden are significantly increasing defense spending. For example, Germany is amending its constitution to expand military spending, and the UK is also reviewing a new defense budget to increase investment in areas such as software and AI technology.

Despite concerns about national data security, local enterprises are struggling with slow AI transformation, such as BAE Systems, Airbus, and Leonardo, which cannot quickly develop leading technology systems similar to Palantir's. Palantir's positive effects on these defense departments are not only in data analysis and decision-making capabilities but also in reducing corresponding staffing and lowering the operation and maintenance costs of traditional software platforms through automation processes.

(2) Commercial Market: Macro Drag, Internationalization Hindered

Commercial revenue in the first quarter grew at a year-on-year rate of 33%, roughly the same as the previous quarter, mainly due to underperformance in the international market. Unlike government budget considerations, corporate IT budgets are often significantly impacted by macroeconomic factors.

The number of international enterprise customers only increased by 1 net person in the first quarter, indicating a significant slowdown in expansion. Dolphin Research speculates that in addition to macroeconomic pressures leading to existing customers cutting expenses, there may also be concerns about data security, where customers worry about their corporate data being stored and analyzed on non-domestic software, leading to direct customer loss.

The European economy has been under pressure for a long time since the pandemic. Although the "unexpected" tariffs have not been introduced in the first quarter, companies may already be anticipating some impact from tariffs. For more details, see the management's explanation on the conference call.

II. Contract Situation: Short-term Growth is Not a Concern

For software companies, future growth potential is the core of valuation. However, the revenue recognized each quarter is a relatively lagging indicator. Therefore, we suggest focusing on the acquisition of new contracts, mainly reflected in contract status (RPO, TCV), current billings, and the increase in the number of customers.

(1) Remaining Performance Obligations (RPO): Marginal Expansion in New Medium- and Long-term Contracts

In the first quarter, Palantir's remaining contract value was $1.9 billion, an increase of $170 million from the previous quarter, consistent with the net increase in the previous quarter. Among them, long-term contracts, which showed weak growth in the previous quarter, recovered somewhat in the first quarter, with seasonal fluctuations not altering the long-term trend.

(2) Current Billings & Deferred Revenue: Growth Rebounds

Billings in the first quarter were $905 million, a year-on-year increase of 45%. Contracts billed in the current period mainly reflect fluctuations in short-term demand (including the portion of revenue already recognized in the current period). Although considering historical data, Dolphin Research believes that fluctuations in a single quarter do not say much about product competitiveness. However, due to the company's high valuation, the market will pay close attention to changes in this short-term indicator.

Overall contract liabilities (including customer deposits) increased net-on-net in the first quarter, with a net revenue retention rate of 124%, continuing to increase quarter-on-quarter, reflecting a trend of short-term marginal net expansion.

(3) Total Contract Value (TCV): Fluctuations Between Quarters, Continued Healthy Growth

The total value of new contracts recorded in the first quarter was $1.5 billion, a year-on-year increase of 66%. Although there were fluctuations between quarters, the overall trend of healthy growth remained unchanged.

(4) Customer Growth: Growth Driven by American Enterprises

Looking at the most intuitive indicator, the number of customers, which is also a medium- to long-term indicator, there was a net increase of 58 customers quarter-on-quarter, of which 51 were from commercial customers and 50 were from the United States. The remaining 7 net new customers were from government agencies.

Combining <1-4>, Dolphin Research believes that while demand from international corporate customers has indeed been affected, both local American customers and international government customers have shown strong interest in Palantir. The growth dividend from Palantir's leading product capabilities still exists.

III. Profit Margins Maintained, AI Investments May Increase Costs

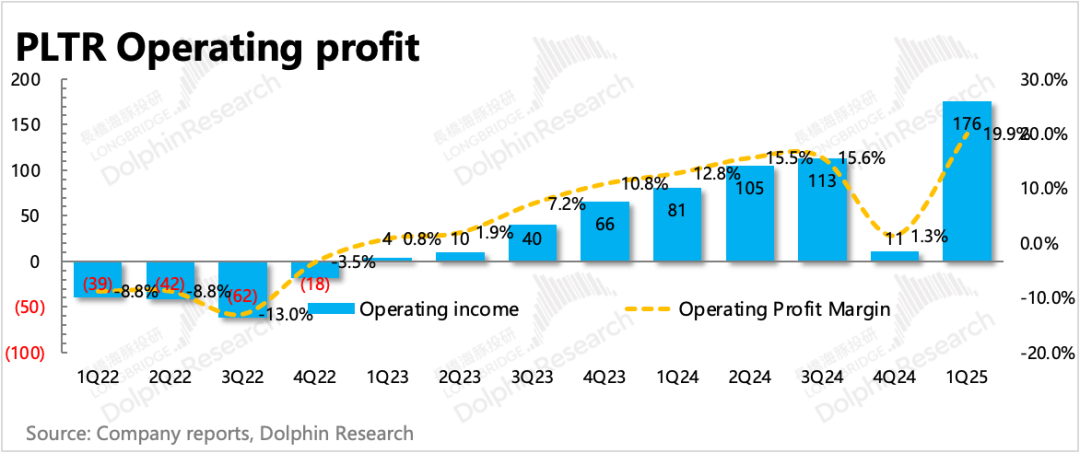

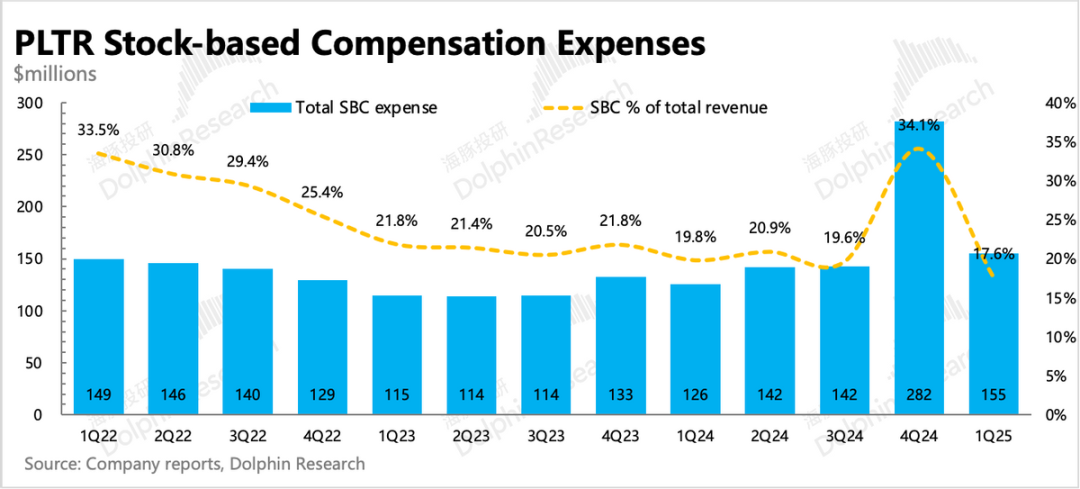

In the first quarter, Palantir achieved a GAAP operating profit of $176 million. Due to the recognition of more AI investments in the current period, the gross margin declined year-on-year. Research and development, as well as sales and marketing expenses, continued to maintain year-on-year growth rates of over 20% but remained lower than revenue growth. The only significant expenditure control was in administrative expenses. The abnormal SBC in the previous quarter returned to normal in the first quarter.

Finally, the adjusted operating profit margin was 44.2%, down 0.8 percentage points from the previous quarter but still exceeding market expectations.

Judging from the full-year guidance (Adj. OPM profit margin of 44%), it indicates that there will still be an increase in AI costs recognized in the second half of the year, thus delaying Palantir's profit improvement pace. However, for non-subscription and heavily customized software services, Palantir's profit margin is not low. Especially at the current valuation, expanding TAM and revenue are the key to supporting the valuation. It is not a bad thing to trade short-term profits for scale expansion.

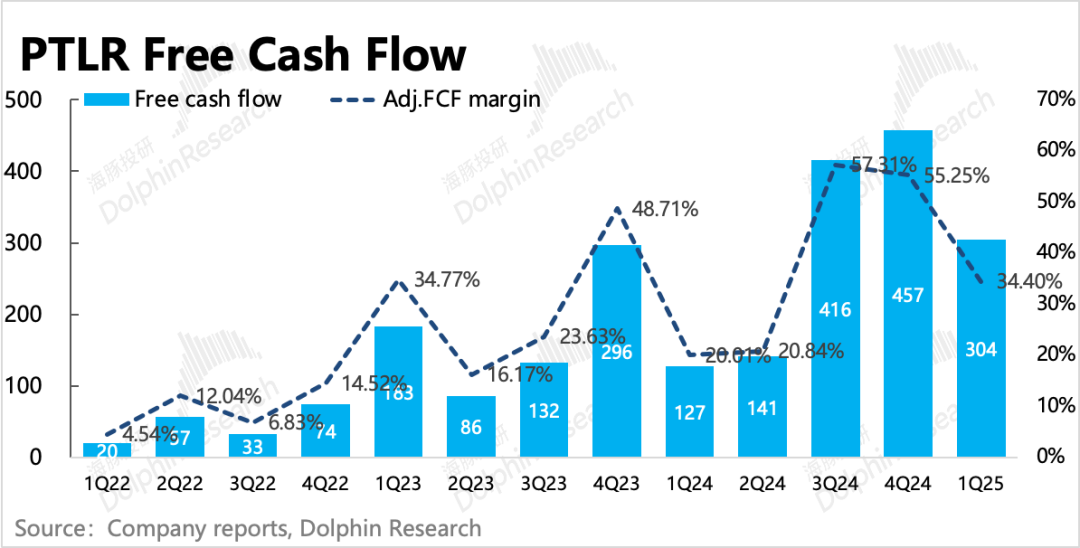

Palantir's cash flow is related to contract payments, so there will be fluctuations between quarters. Generally speaking, the fourth quarter may involve annual recognition points, and short-term cash flow performance will be better.

Unlike companies investing in large models, Palantir tends to focus on applications. Therefore, capital expenditures for AI investment have remained relatively stable, with most actual investments already recognized in advance. Although the current capital expenditures are not large in absolute terms, they have more than doubled year-on-year, indirectly indicating that although DeepSeek has brought a certain degree of computing power deflation, with the accelerated penetration of leading applications, it will still drive an increase in demand for computing power.

- END -

// Reprint Authorization

This article is an original article by Dolphin Research. For reprints, please obtain authorization.

// Disclaimer and General Disclosure Note

This report is for general comprehensive data use only and is intended for general browsing and data reference by users of Dolphin Research and its affiliated institutions. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any person receiving this report. Investors must consult the opinions of independent professional advisors before making investment decisions based on this report. Any person who makes investment decisions using or referring to the content or information mentioned in this report bears the risk themselves. Dolphin Research shall not be liable for any direct or indirect responsibilities or losses that may arise from the use of the data contained in this report. The information and data contained in this report are based on publicly available information and are for reference purposes only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or opinions expressed in this report cannot be used or considered as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction, nor do they constitute recommendations, inquiries, or promotions regarding relevant securities or related financial instruments. The information, tools, and materials contained in this report are not intended for distribution to citizens or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and materials would violate applicable laws or regulations or require Dolphin Research and/or its subsidiaries or affiliated companies to comply with any registration or licensing requirements of such jurisdictions.

This report only reflects the personal views, opinions, and analysis methods of the relevant creative personnel and does not represent the position of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and the copyright belongs solely to Dolphin Research. Without the prior written consent of Dolphin Research, no organization or individual may (i) produce, copy, reproduce, reprint, forward, or create any form of copies or reproductions in any way, and/or (ii) directly or indirectly redistribute or transfer them to other unauthorized persons. Dolphin Research reserves all relevant rights.