Non-Humanoid Robots Pioneer Consumer Market Success

![]() 06/03 2025

06/03 2025

![]() 655

655

Two home robotics firms, Lexiang Smart and Luming Robotics, have secured fresh funding rounds totaling nearly 100 million yuan.

Despite both venturing into the home sector, their product offerings diverge significantly.

Lexiang Smart aims to create compact, versatile embodied intelligent robots designed as household companions. Currently, they have developed two products: a 50-cm-tall robot named Z-Bot and a Wall-E-inspired tracked robot, W-Bot.

Conversely, Luming Robotics has opted to directly develop bipedal humanoid robots and recently forged strategic partnerships with industry leaders like Dematic Technology in smart logistics and global shipping giant COSCO SHIPPING.

With a branding background, Lexiang Smart's founder and Luming Robotics' founder, who has a technical background, adopt different product strategies, prompting an industry question: "Should we develop humanoid or non-humanoid robots for the consumer market?"

Currently, most 'employed' humanoid robots are confined to large-scale factory operations, whereas non-humanoid robots differentiate through functionality, emotion, and scenario adaptation to penetrate the consumer market.

Relevant data indicates that the compound annual growth rate of non-humanoid robot market segments currently exceeds 40%, with segments like robot dogs surpassing 100%.

Currently, humanoid robots are still in a deep technical phase, while China's consumer robot market is breaking through via a 'functional substitution' strategy—exoskeleton robots in medical rehabilitation, AI toys in emotional companionship, and robot dogs in scenario adaptation.

These three distinct paths illustrate the survival strategies of non-humanoid robots in the consumer market.

Exoskeleton Robots: Functional Leverage in the Consumer Market

During the May Day holiday, robots gained widespread attention not just for mall performances but also for offering a 'rent-a-leg' service on Mount Tai for just 80 yuan for three hours.

This 'magic tool' enabling tourists to climb easily is an exoskeleton robot—a wearable intelligent device enhancing human movement via mechanical structures, sensors, and control systems. Core functions include strength assistance, sports rehabilitation, and scenario adaptability enhancement.

More aptly described as an intelligent mechanical device due to its frame structure, exoskeleton robots are classified into upper limb, lower limb, and full-body types, with lower limb robots currently mainstream.

The technical architecture comprises mechanical structure, perception system, and intelligent hub. Key challenges include gait detection accuracy and human-robot collaboration.

Currently, exoskeleton robots exhibit deep synergy with humanoid robot technology, sharing sensors, AI algorithms, power systems, and upstream components like motors and reducers.

Moreover, advancements in humanoid robots' bionic joint design, intention recognition algorithms, and multimodal perception systems have benefited the exoskeleton industry through underlying technology spillovers.

Key technical tipping points include:

- Intention recognition accuracy exceeding 95% through LSTM algorithms migrated from humanoid robots

- Drive system power density reaching 300W/kg derived from humanoid robot joint technology

- Flexible sensor costs decreasing by 70% due to humanoid robot tactile technology

- Battery life exceeding 8 hours leveraging humanoid robot solid-state battery technology

With a functional focus on 'enhancing humans' and 70% of manufacturing costs in hardware, exoskeleton robots are commercializing faster than humanoid robots.

For instance, Chengtian Technology's 'EasyGo' series offers walking assistance without external power, priced at 2,500 yuan, achieving over 10,000 pre-orders and planning to ship 100,000 units in 2025.

Kenqin Technology, partnering with Mount Tai Scenic Area, offers products priced between 6,000 and 10,000 yuan, planning to produce over 100,000 units in 2025.

Relevant institutions predict rapid growth for exoskeleton robots from 2025 to 2028, with shipments increasing from 107,000 units in 2025 to 301,000 units in 2028.

AI Toys: A New Consumption Boom Fueled by Large Models

While exoskeleton robots validate C-end monetization through 'functional rigid demand', AI toys target the timeless home scenario theme of 'companionship'.

In recent offline stores, users, predominantly children, gather around AI smart robots, issuing commands like 'Hi xxx'.

These areas feature diverse AI robots, including EMO smart desktop robots, talking Tom AI robots, and Transformer robots.

Despite mixed online reviews, AI toys have captured a portion of the C-end market through the 'low price + high emotional value' approach.

For instance, Haivivi's BubblePal, priced at 399 yuan, has sold over 80,000 units online since its launch in July 2024, generating sales exceeding 30 million yuan.

Casio's Moflin, priced at 2,800 yuan with stronger companionship attributes, sold out on the official website and was resold for over 10,000 yuan on second-hand platforms. LOVOT, priced at 30,000 yuan, has sold over 40,000 units globally.

Simply put, AI toys combine 'AI + hardware', with some manufacturers adding IP attributes. Focusing on 'companionship', they target users from children to the elderly, primarily in home scenarios. Unlike humanoid robots, AI toys cannot physically assist humans.

User purchase decisions and subsequent product effectiveness largely depend on subjective feelings.

For most AI toys, AI large models are crucial. With interfaces opening for large models like Doubao and Tongyi Qianwen, invoking costs have decreased, enabling startups to quickly launch products with light assets.

Due to cross-age demand, AI toys can serve as educational toys for children and provide emotional comfort to adults.

Unlike direct large model conversations, AI toy interactions involve a preferred image rather than a cold phone or computer.

With 'low technical thresholds + high scenario adaptability', AI toys focus on voice interaction and content ecosystems, bypassing complex motion control issues faced by humanoid robots.

Most market products are priced within user acceptance, passing the price sensitivity test. While premium compared to traditional toys or smart speakers, they are significantly cheaper than humanoid robots.

Clearly positioned in education anxiety and the loneliness economy, AI toys adopt 'software and hardware decoupling' for rapid iteration. Thus, in pricing and positioning, AI toys offer rapid commercialization advantages over humanoid robots.

The global AI toy market size reached $18.1 billion in 2024 and is expected to exceed $60 billion by 2033, with a compound annual growth rate of about 12%.

Robot Dogs: Balancing Performance and Cost in an Intermediate Form

Last week, Zhongqing 'restarted its old business' with the new robot dog JS01, while Zhiyuan announced its entry into home scenario quadrupedal products, and Magic Atom will launch a guide dog robot.

If AI toys validate emotional interaction's commercial potential, robot dogs reveal a deeper logic—between home services and humanoid robots, the quadrupedal form explores optimal technical feasibility and commercial returns with an 'intermediate state' advantage.

Robot dogs, or quadrupedal robots, achieve stable walking and task execution by imitating animals' four-limbed structures and movements, combined with high-precision sensors, actuators, and intelligent algorithms.

The robot dog market has seen explosive growth, from 2,000 units sold in 2019 to 34,000 units in 2023, with a compound annual growth rate of 102.3%. The global robot dog market size was approximately 1.624 billion yuan in 2024.

Currently, the three major domestic players are Unitree Technology, CloudMinds, and Weilan Technology, with Unitree Technology leading both international and domestic markets.

In 2024, Unitree Technology sold 23,700 robot dogs, accounting for nearly 70% of the global market share. Weilan Technology's BabyAlpha series also sold over 15,000 units by last year.

These companies have ventured into both humanoid robots and robot dogs, with robot dogs being the initial market expansion focus.

Currently, only Unitree Technology has achieved humanoid robot mass production.

Robot dogs share more technological commonalities with humanoid robots than exoskeleton robots or AI toys. Both rely on AI algorithms, sensor fusion, and motion control technology, sharing core component supply chains like reducers and servo motors.

Robot dogs' preemptive C-end market capture over humanoid robots is attributed to:

- Technical Threshold and Cost Advantage: Robot dogs focus on motion control and terrain adaptation, with a lower design complexity than bipedal balancing systems, requiring no complex upper limbs.

- Scene Adaptability and User Acceptance: Robot dogs balance practicality and emotional value in the C-end market, offering modular designs for tasks like grocery shopping and delivery, while their bionic appearance and interactive design make them 'electronic pets'.

- Industrial Ecology and Commercialization Path: Robot dogs' adaptability to various scenarios and their lower production costs facilitate faster market entry and acceptance.

Currently, the industrial chain maturity of quadruped robots surpasses that of humanoid robots. The localization rate of upstream components, such as servo motors and reducers, is notably high. Midstream manufacturers, including Unitree and CloudMinds, have already achieved substantial production capabilities, while downstream technologies have been validated in B-end scenarios and are gradually expanding into the C-end market.

The widespread adoption of quadruped robots not only validates the practicality of this robot form but also serves as a benchmark for the commercialization path of humanoid robots.

In the future, companies deploying both quadruped and humanoid robots may foster a complementary ecosystem, fueled by synergistic advancements in AI and hardware technology.

Humanoid robots still face significant challenges in penetrating the C-end market, which underscores the robotics principle that "function precedes form".

Within the industry, there remains an ongoing debate about the necessity of building humanoid robots. Proponents argue that the humanoid form represents the ultimate path to general intelligence, with figures like Jen-Hsun Huang of NVIDIA advocating for this "humanoid faction", believing humanoid robots will be among the most influential in the future world. Elon Musk also envisions a future where humanoid robots may number in the tens of billions, becoming personal companions for everyone.

Conversely, opponents prioritize efficiency, advocating for "function first, form irrelevant". For instance, Robin Li of Baidu and Joseph Tsai, Chairman of Alibaba Group, both contend that most intelligent robots do not need to resemble humans.

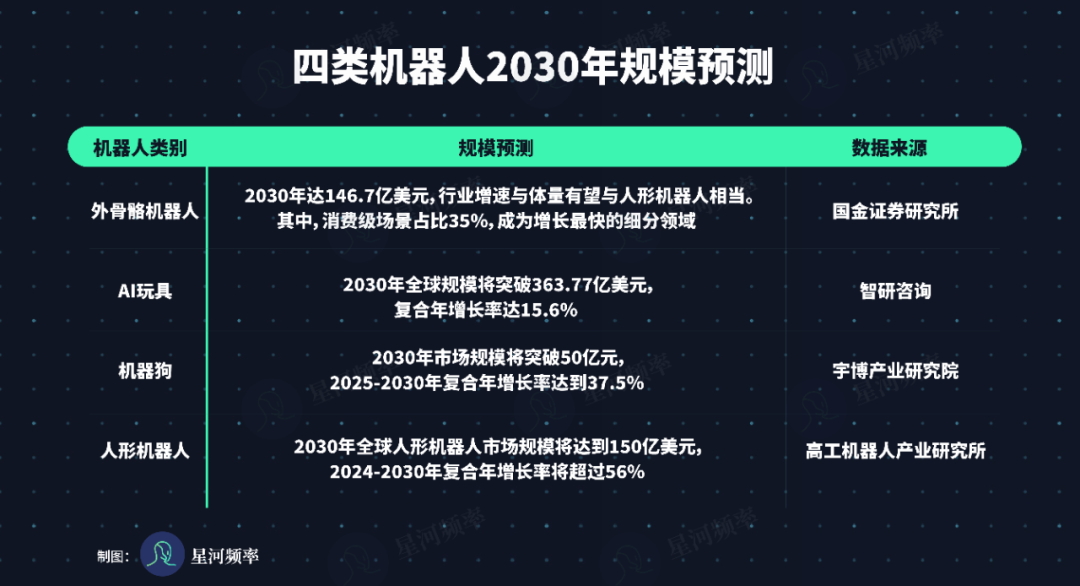

Beyond the debate on form, the past five years have also seen varying growth projections for exoskeleton robots, AI toys, quadruped robots, and humanoid robots.

This analysis reveals that both exoskeleton robots and AI toys hold substantial market growth potential. Meanwhile, quadruped robots, though a key business segment for some humanoid robot companies, have not achieved significant scale growth.

Therefore, to secure a larger market share, humanoid robots must effectively penetrate the C-end market. This requires overcoming key challenges in technology, scenarios, cost, and mass production.

At the hardware level, humanoid robots must perform delicate tasks with their upper limbs and navigate complex terrains with their lower limbs, encompassing activities like stir-frying, ironing clothes, climbing stairs, and navigating obstacles within a home environment.

At the software level, humanoid robots must address "Moravec's Paradox," where tasks difficult for humans are easy for machines, and vice versa, ultimately achieving a profound understanding and effective interaction with the physical world.

For instance, while mastering Go is challenging for humans, robots can learn it quickly through reinforcement learning. Conversely, picking up an egg, a simple task for humans, remains difficult for robots to comprehend and execute swiftly.

In terms of scenarios, humanoid robots must transition from "vertical scenarios" to "full-life penetration," necessitating the development and training of multiple functional layers, ranging from basic services like cleaning and security to personalized emotional companionship and high-precision health management.

This transition requires strong generalization capabilities, enabling the model to make accurate predictions on unseen data.

For example, π0.5, launched by American embodied intelligence company Physical Intelligence, enables autonomous household chores, though it is currently implemented in wheeled robots rather than humanoids, and its movement speed requires significant improvement.

Regarding cost and mass production, manufacturers must focus on technology iteration and supply chain scaling. Independent R&D and iterative upgrades of core technologies can reduce manufacturing costs, while integrating supply chain resources increases annual production capacity. Together, these factors can accelerate the mass production of low-cost humanoid robots.

Some institutions predict that over the next five years, the selling price of humanoid robots will decrease by 8% annually, with core material costs dropping by 11%.

Taking Unitree's G1 base model, priced at 99,000 yuan, as an example, its price could drop to 65,000 yuan in five years and potentially to 43,000 yuan in ten years.

In the short term, humanoid robots should focus on "high-value, low-complexity" scenarios to provide exemplary cases and present a positive image to the public.

In the medium term, reducing production costs through large-scale mass production is crucial. In the long term, AI breakthroughs will be essential to achieve general intelligence, transforming humanoid robots into "new partners".

The success of any robot in the C-end market hinges on a fundamental truth: users value services that meet real needs over technological showcases.

When considering the popularization of humanoid robots, the industry must focus on making them, like smartphones, indispensable tools that solve specific problems.