Marvell: AI Ring Growth "Stalls," Where Lies the Next "Trump Card"?

![]() 06/03 2025

06/03 2025

![]() 652

652

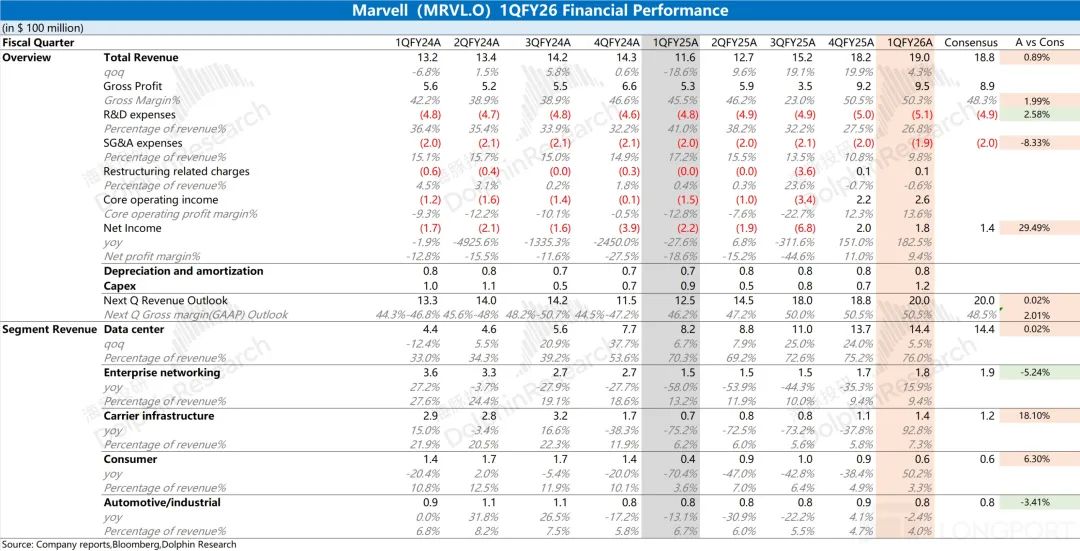

Marvell Technology (MRVL.O) unveiled its fiscal first-quarter 2026 financial report after the U.S. market closed on May 30th, Beijing time (ended April 2025):

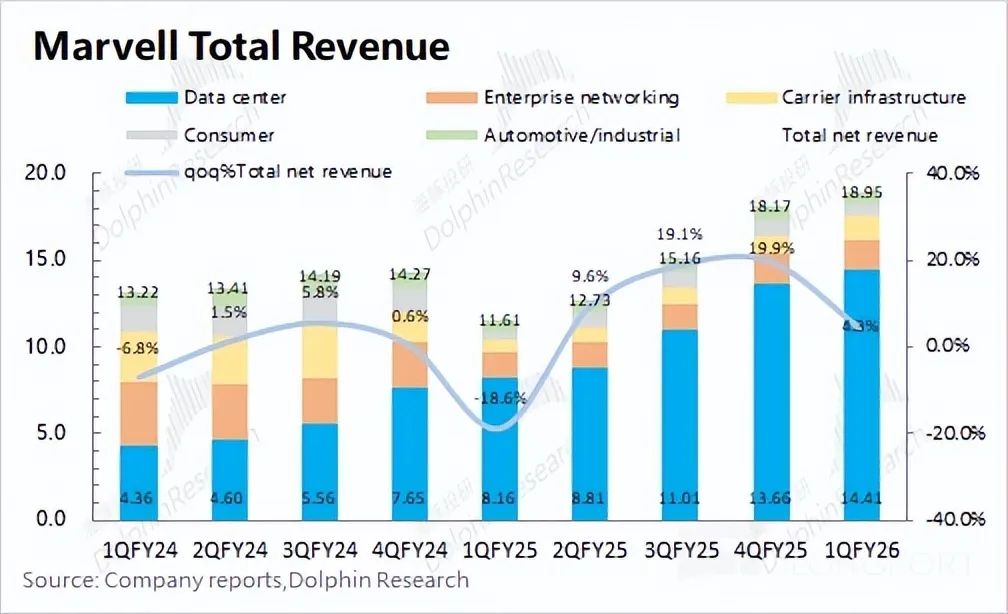

1. Overall Performance: Revenue amounted to $1.9 billion, up 4.3% quarter-on-quarter, closely aligning with expectations of $1.88 billion. The $0.08 billion increase in revenue quarter-on-quarter was primarily driven by the data center and AI segments.

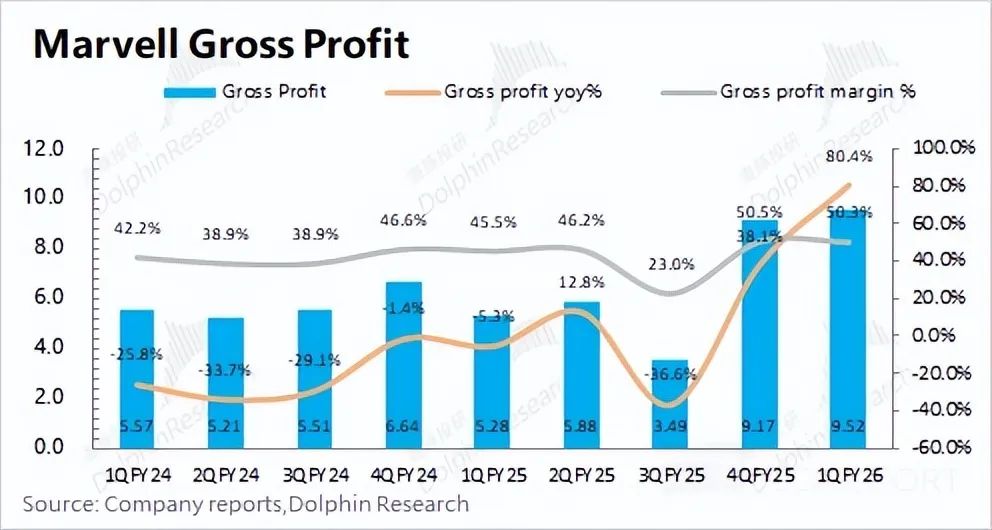

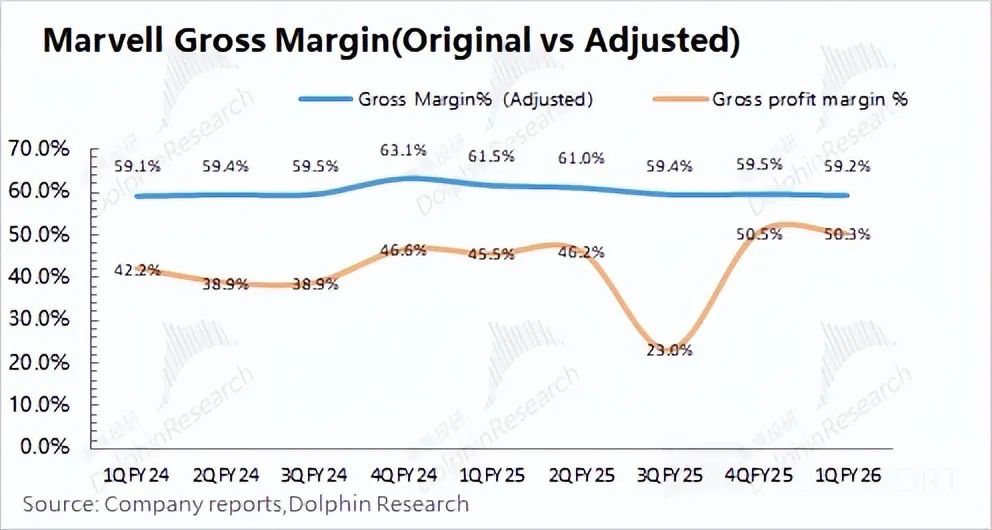

Adjusted gross margin stood at 59.2%, down 0.3 percentage points quarter-on-quarter. The company's gross margin exhibited a downward trend, mainly due to the relatively low gross margin of customized ASIC and other related businesses. With business growth, the company's gross margin experienced a structural decline.

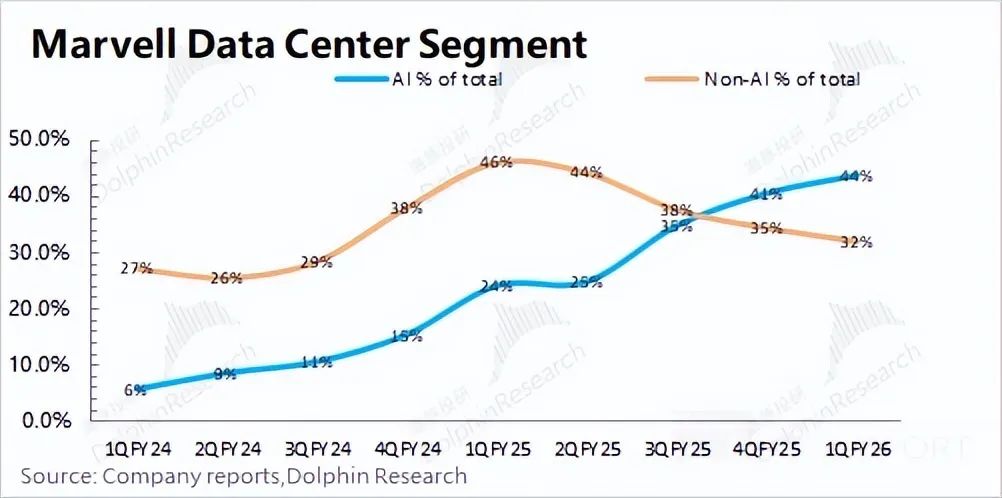

2. Data Center: Revenue reached $1.44 billion, up 5.5% quarter-on-quarter, fueled by the AI business. Data center revenue accounted for 76% of total revenue this quarter. Dolphin estimates the company's AI business revenue this quarter at $0.83 billion, up $0.09 billion quarter-on-quarter, while non-AI business is anticipated to decline slightly this quarter.

3. Next Quarter Guidance: Revenue is projected at $2 billion, in line with market expectations ($2 billion), with quarter-on-quarter growth mainly stemming from the data center and AI business.

Gross margin (GAAP) is anticipated at 50.5%, remaining stable. Dolphin estimates the adjusted gross margin for the next quarter at 59.1%, down about 0.1 percentage points quarter-on-quarter.

Dolphin's Overall View: While meeting expectations, there is a lack of incremental highlights.

As the market primarily focuses on the growth opportunities AI brings to the company, attention to changes in Marvell's core business revenue primarily emphasizes incremental aspects on a quarter-on-quarter basis.

Although the company's revenue for this quarter and next quarter's guidance have met market expectations, the quarter-on-quarter comparison failed to provide more incremental highlights.

Both total revenue and data center revenue showed a narrowing trend in quarter-on-quarter increases. In other words, the market expected accelerated growth to justify the valuation.

However, both this financial report and guidance reveal that the high growth spurred by the company's current product cycle (Amazon Trainium 2 chip) has essentially concluded, and we can only anticipate renewed growth driven by new products. Thus, although the financial report data met expectations, it may still affect the market's confidence in the company's growth potential.

For Marvell, the market pays the utmost attention to the AI business, ASIC customers, and China business:

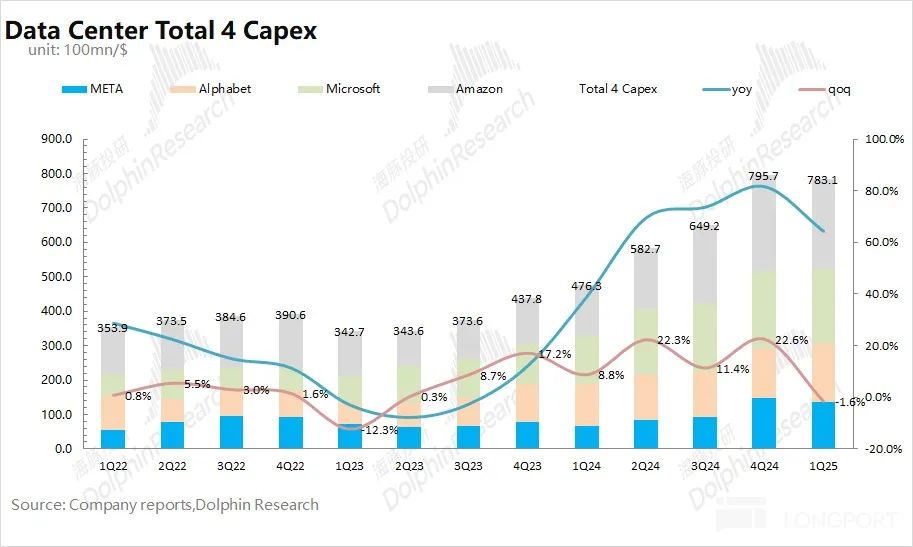

1) AI Business: Unlike NVIDIA's narrative of sovereign AI and startups, Marvell still primarily relies on core cloud vendors. Thus, the capital expenditures and product release schedules of cloud vendors will directly impact the company. This quarter, the combined capital expenditures of the four major cloud vendors declined quarter-on-quarter, while Marvell's data center revenue increased by 5%. It is evident that Marvell still gained more market share in the capital expenditures of cloud vendors, aligning with market expectations for ASIC as an entrant.

Therefore, the company's overarching strategy of "competing for the market with customized ASIC chips" remains intact, but the slowdown in quarter-on-quarter increment (from $0.2 billion to $0.2 billion to $0.09 billion in the past three quarters) may still affect some confidence.

2) ASIC Customers: Amazon Trainium 2 is currently the primary growth driver for the AI business. However, from a quarter-on-quarter increment perspective, this product cycle has not demonstrated significant sustainability. The next round of growth in the company's AI business will still hinge on new products from core customers.

Combining company and industry information, the company's next round of new products will primarily focus on Microsoft's Maia Gen2 and Amazon's Trainium 3 (whether the order will be diverted by Alchip remains controversial), which will provide new growth for the company next year. Until then, the company's AI business is unlikely to exceed expectations.

3) China Business: As the company has not yet disclosed its China revenue for this quarter, past data indicates that China accounts for 40% of the company's total revenue, making it the largest source of income.

The company originally planned to hold an investor day event on June 10th, but it was postponed to 2026 due to macroeconomic uncertainties.

Friction between China and the United States in the technology sector will persist, and the relatively large share of China revenue may still pose a potential "risk point" in the company's performance. Judging from next quarter's guidance, there is currently no significant impact on the company's China revenue, but it will remain a risk factor moving forward.

Overall, although the company's financial report and guidance met market expectations, the slowdown in quarter-on-quarter growth of the AI business is still difficult to satisfy the market.

Considering the company's current market capitalization of $56.5 billion, it corresponds to approximately 30 times PE for the company's adjusted net profit in fiscal 2026 (revenue +44%, adjusted gross margin -1.1 percentage points, adjusted tax rate 10.2%).

For Marvell, in the short term, the incremental narrowing of the AI business and the absence of a "relay" from new products make it challenging for the AI business to exceed expectations. Additionally, China revenue remains a potential "risk point".

In the absence of grand narratives such as sovereign AI, the company's AI business is influenced by CSP giants and product cycles. The next growth will primarily focus on the release of new ASIC products from Microsoft and Amazon, which is expected to bring growth opportunities to the company once again.

The following is a detailed analysis:

I. Marvell Technology Business

Marvell Technology started with storage technology and subsequently expanded its business through a series of "outbound mergers and acquisitions," making the data center business the company's largest source of revenue.

Specific Business Situation:

1) Data Center Business (about 75%): A high-growth business benefiting from the demand for data centers and ASICs, and currently the primary focus of the market. The business encompasses SSD controllers, high-end Ethernet switches (Innovium), and customized ASIC business (customized chips for Amazon AWS, etc.), primarily used in cloud servers, edge computing, and other scenarios.

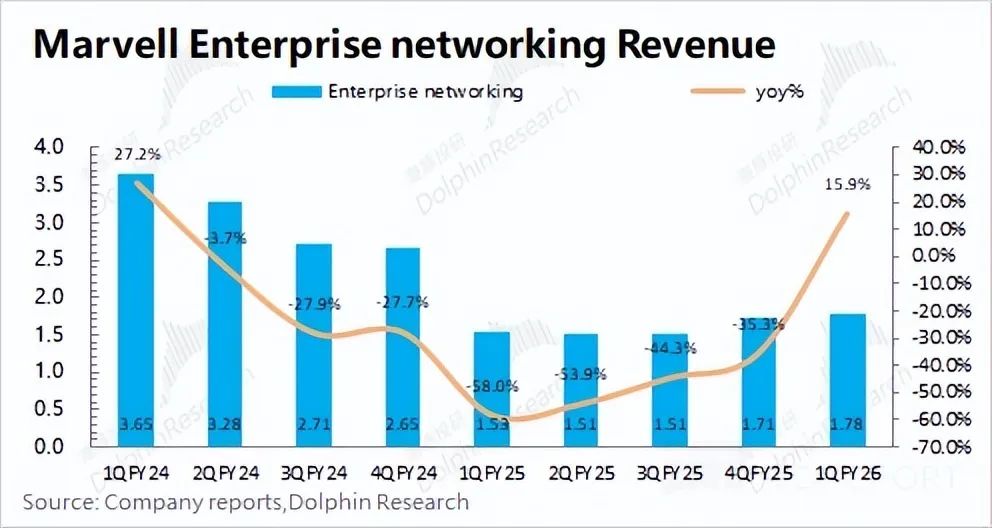

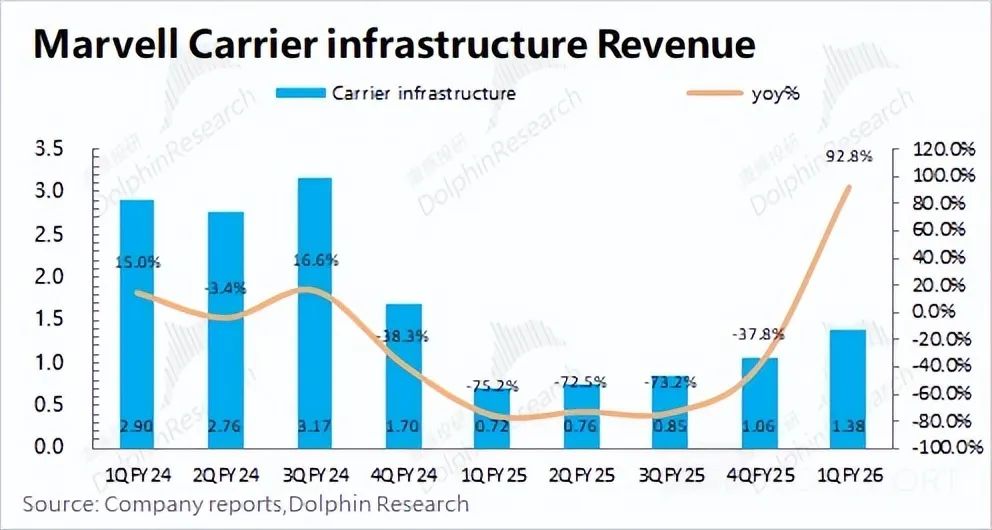

2) Other Businesses (about 25%): Traditional businesses significantly impacted by 5G large-scale infrastructure and downstream demand. ① Enterprise network and carrier infrastructure business showed a notable decline after large-scale 5G infrastructure construction. ② Consumer electronics business is affected by demand for downstream electronic products and home broadband. ③ Automotive and industrial businesses are driven by demand for the Internet of Vehicles but account for a relatively small proportion.

II. Core Data: Revenue & Profit, Mediocre

2.1 Revenue

Marvell Technology achieved revenue of $1.9 billion in the first quarter of fiscal 2026, up 4.3% quarter-on-quarter, closely aligning with market expectations ($1.88 billion). As the market primarily focuses on the growth opportunities AI brings to the company, the quarter-on-quarter perspective is more intuitive. The growth in the company's revenue this quarter primarily came from the data center and AI business, as well as the operator infrastructure business.

Although the quarterly revenue met market expectations, from the perspective of the quarter-on-quarter increase in revenue, it narrowed to about $0.08 billion this quarter, which may increase market concerns about the company's insufficient growth potential.

2.2 Gross Profit

Marvell Technology achieved a gross profit of $0.95 billion in the first quarter of fiscal 2026, an increase of 80% year-on-year. Marvell's gross margin for this quarter was 50.3%.

Due to the impact of amortization of acquired assets, the gross margin in the financial report cannot directly reflect the operating situation. After excluding this impact, Dolphin refers to the adjusted gross margin and finds that the company's adjusted gross margin for this quarter was 59.2%.

The company's overall gross margin shows a trend of downward movement, primarily due to the lower gross margin of customized ASIC-related businesses. As the proportion of this business increases, it will structurally lower the company's overall gross margin.

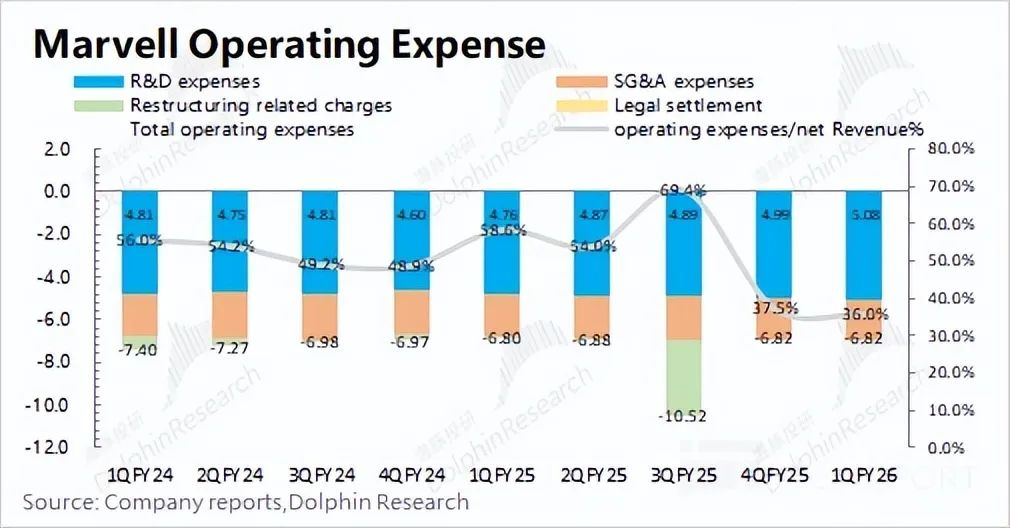

2.3 Operating Expenses

Marvell Technology's operating expenses in the first quarter of fiscal 2026 were $0.682 billion, flat quarter-on-quarter.

Specifically, the core expenses are broken down as follows:

1) R&D Expenses: The company's R&D expenses for this quarter were $0.5 billion, up 6.6% year-on-year. The company's R&D expenses continue to increase, primarily invested in customized ASIC and optical module technology directions. With the expansion of revenue scale, the company's R&D expense ratio continued to fall to 26.8%.

2) Sales and Administrative Expenses: The company's sales and administrative expenses for this quarter were $0.186 billion, down 6.8% year-on-year. While revenue grows, the company is still reducing sales and other expenses, and the related expense ratio has dropped to 9.8%.

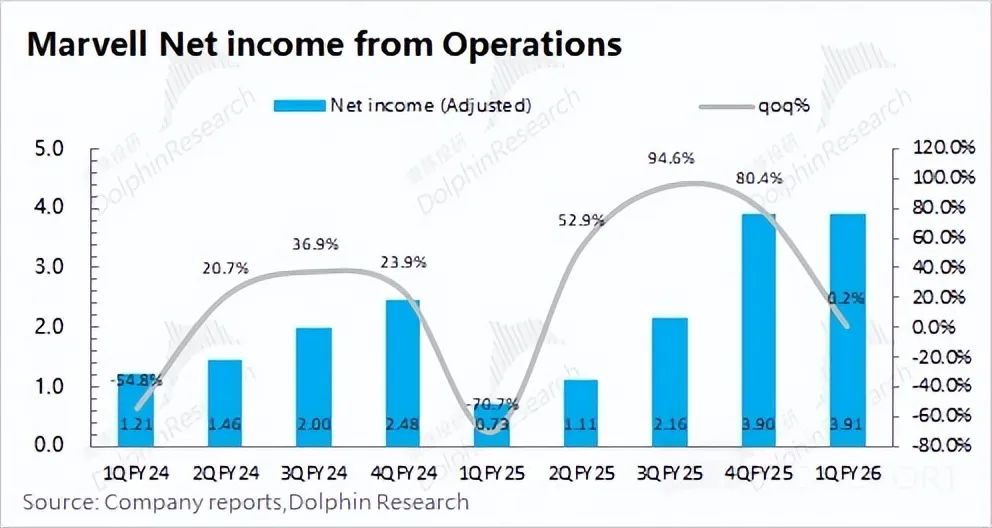

2.4 Net Profit

Marvell Technology achieved a net profit of $0.18 billion in the first quarter of fiscal 2026. The company's adjusted gross margin is around 60%, but the company's net profit in the financial report has been in a loss state for a long time, primarily due to the impact of acquisition amortization, restructuring costs, and other factors.

After excluding the impact of these factors (restructuring costs and acquisition amortization, etc.), the company's adjusted net profit can reflect the company's more true operating conditions. The company's adjusted net profit for this quarter was $0.391 billion, basically flat quarter-on-quarter.

III. Business Conditions: Narrowing Increment in Data Center, Waiting for New Product Cycle

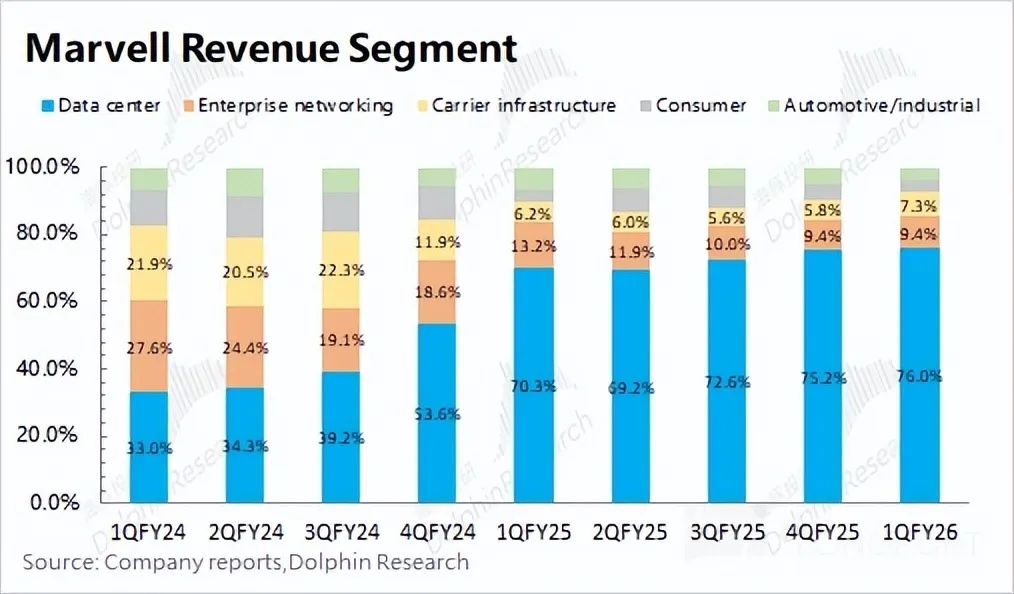

Marvell Technology has successively acquired Cavium, Innovium, and other companies since 2018, thereby enhancing the company's capabilities in AISC and data centers.

With the increasing demand for customized ASICs and DSP chips for data center optical modules from companies like Amazon and Google, the company's data center business has grown to account for more than 70% of the company's total revenue, becoming the biggest influence on the company's performance.

Additionally, the revenue share of traditional businesses such as enterprise networks, carrier infrastructure, consumer electronics, and automotive and industrial has declined to 10% and below.

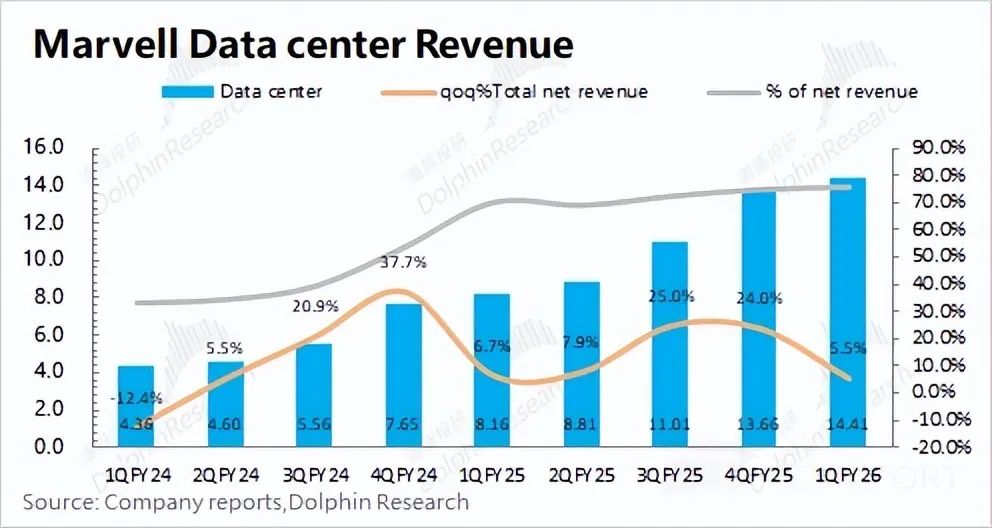

3.1 Data Center Business

Marvell Technology achieved revenue of $1.44 billion from its data center business in the first quarter of fiscal 2026, up 5.5% quarter-on-quarter, closely aligning with market expectations ($1.44 billion).

The growth of the company's data center business this quarter primarily came from the AI business, mainly in customized ASICs and optical module DSP chips.

Although the performance of the data center this quarter met market expectations, from the perspective of quarter-on-quarter growth, the quarter-on-quarter growth of the data center narrowed to $0.075 billion this quarter.

Although the capital expenditures of cloud service giants are relatively more focused on the second half of the year, the significant slowdown in the growth of the company's related businesses will still increase market concerns about the company's growth potential.

The current AI business already accounts for most of the data center business. Dolphin estimates the company's AI revenue for this quarter at $0.83 billion, up $0.093 billion quarter-on-quarter; while non-AI business is anticipated to decline slightly this quarter.

The current AI business accounts for nearly 44% of total revenue, and the company management's goal is to increase the AI revenue share to above 50%.

Unlike NVIDIA's two narratives of sovereign AI and startups, Marvell still primarily relies on the capital expenditures of CSP cloud service giants.

The company's original logic was also centered around customizing ASIC chips to gain a certain share in the AI chip market, so the capital expenditure of large factories has a greater impact on the company's performance.

Although the capital expenditure of the four major core cloud vendors fell sequentially this quarter, the company's data center still achieved positive growth quarter-on-quarter, primarily in line with the company's customized ASIC chips, which are entrants and play the role of competing for market share. Therefore, even if the capital expenditure growth of CSP cloud service factories begins to decline in the future, the company's AI business is still expected to achieve growth.

Currently, Amazon's Trainium 2 chip is a significant contributor to the company's AI business growth, with Microsoft and Amazon placing orders for subsequent products. It is anticipated that Microsoft's Maia Gen2 and Amazon's Trainium 3 will further bolster the company's AI business in 2026. However, it's crucial to acknowledge that the company still contends with competition from AVGO and AIchip in the customization of ASIC chips.

Considering the company's projection of approximately 5% sequential growth in the data center for the next quarter, the expansion of the AI business will continue to narrow, making it challenging to achieve high growth in the near term. The performance of upcoming new products will be pivotal.

Marvell's primary focus currently lies in its ASIC business, serving customers such as AWS, Google Axion CPU, and Microsoft Maia. Nonetheless, the company's heavy reliance on a single customer, AWS, is a notable concern.

Recently, there have been rumors that Alchip might divert some backend design and mass production orders for AWS's Trainium 3 training chip (3nm process, CoWos-L packaging).

It is rumored that Trainium 3 will commence mass production in the third quarter of this year and scale up significantly in 2026. The one-time development NRE for backend design services amounts to $380 million, with a mass production lifecycle value of $4.5 billion.

The weak guidance for the next quarter may partly stem from AWS's new inference chip not yet reaching mass production. However, it's also plausible that some Trainium 3 orders have been diverted.

In this context, the progress of collaborations with AWS and Microsoft, hinted at in the performance guidance for the subsequent third and fourth quarters, becomes exceptionally crucial.

3.2 Other Businesses

1) In the first quarter of fiscal year 2026, Marvell generated revenues of $178 million and $138 million from its enterprise network business and carrier infrastructure business, respectively. Both businesses saw sequential growth this quarter, reflecting the continued recovery of network product demand from enterprises and parks, along with related demand for optical communication chips and 5G base station chips from carriers.

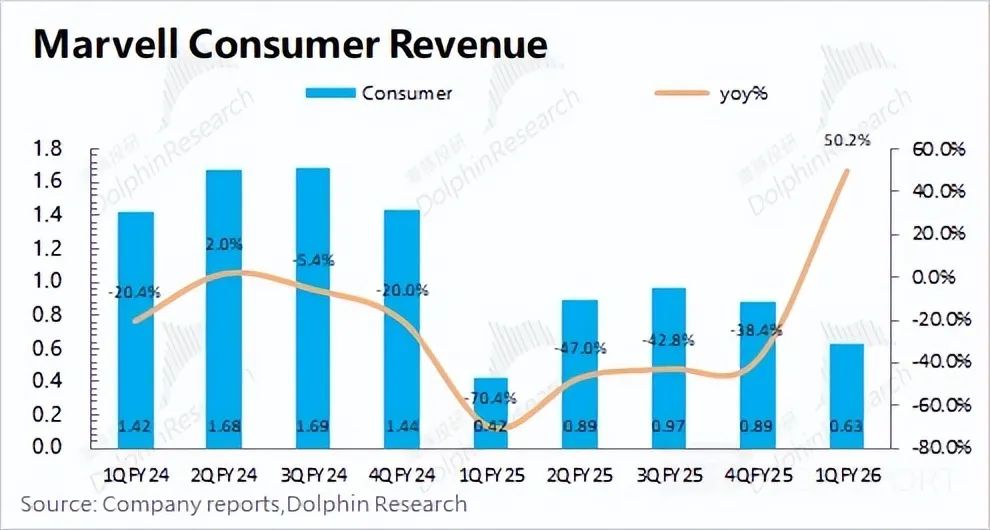

2) Marvell's consumer electronics business generated revenues of $63 million in the first quarter of fiscal year 2026, marking a year-on-year increase of 50%. This business, primarily comprising storage controllers and WiFi chips, is primarily influenced by seasonal factors and gaming demand.

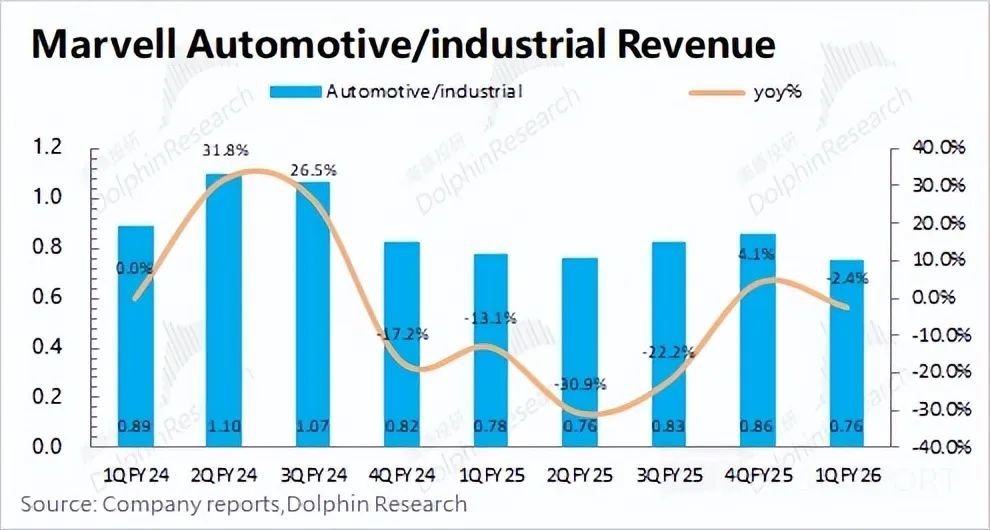

3) Marvell's automotive/industrial business generated revenues of $76 million in the first quarter of fiscal year 2026, representing a year-on-year decline of 2.4%. This business covers autonomous driving, in-vehicle entertainment systems, industrial robots, and other fields, with the company providing automotive Ethernet and other related products. While revenues in the automotive end market increased sequentially, the decline in the industrial end market fully offset this growth (order patterns in the industrial sector can fluctuate significantly from quarter to quarter).

- END -

// Reprint Authorization This article is an original by Dolphin Investment Research. Please obtain authorization for reprinting.

// Disclaimer and General Disclosure Note This report is solely for general comprehensive data use and intended for general browsing and data reference by users of Dolphin Investment Research and its affiliated institutions. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult independent professional advisors before making investment decisions based on this report. Any person who makes investment decisions using or referring to the content or information in this report does so at their own risk. Dolphin Investment Research shall not be held liable for any direct or indirect responsibility or loss arising from the use of the data contained in this report. The information and data in this report are based on publicly available sources and are for reference purposes only. Dolphin Investment Research endeavors to ensure but does not guarantee the reliability, accuracy, and completeness of the relevant information and data. The information or opinions in this report cannot be construed or regarded as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction, nor do they constitute recommendations, inquiries, or advice regarding relevant securities or related financial instruments. The information, tools, and data in this report are not intended for or to be distributed to citizens or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and data would violate applicable laws or regulations or require Dolphin Investment Research and/or its subsidiaries or affiliates to comply with any registration or licensing requirements in such jurisdictions. This report reflects the personal views, insights, and analysis methods of the relevant creative personnel and does not represent the position of Dolphin Investment Research and/or its affiliated institutions. This report is produced by Dolphin Investment Research, and the copyright belongs solely to Dolphin Investment Research. Without the prior written consent of Dolphin Investment Research, no organization or individual may (i) produce, copy, replicate, reprint, forward, or otherwise reproduce any form of copies or reproductions in any way, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Investment Research reserves all related rights.