Differences Between Mechanical, Semi-Solid-State, and Solid-State LiDAR: Which Suits Autonomous Driving Best?

![]() 06/05 2025

06/05 2025

![]() 532

532

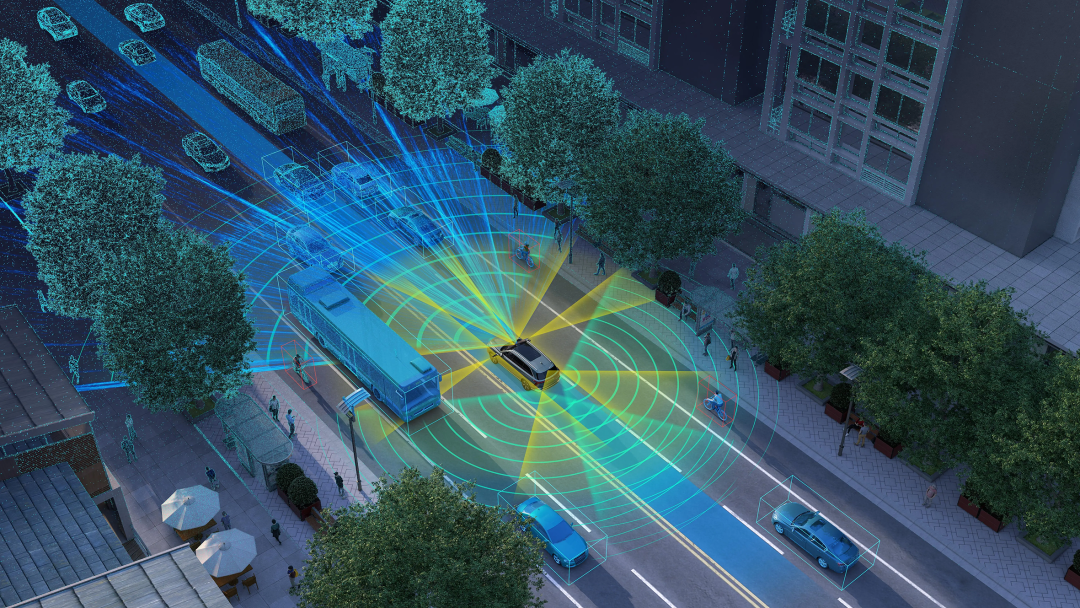

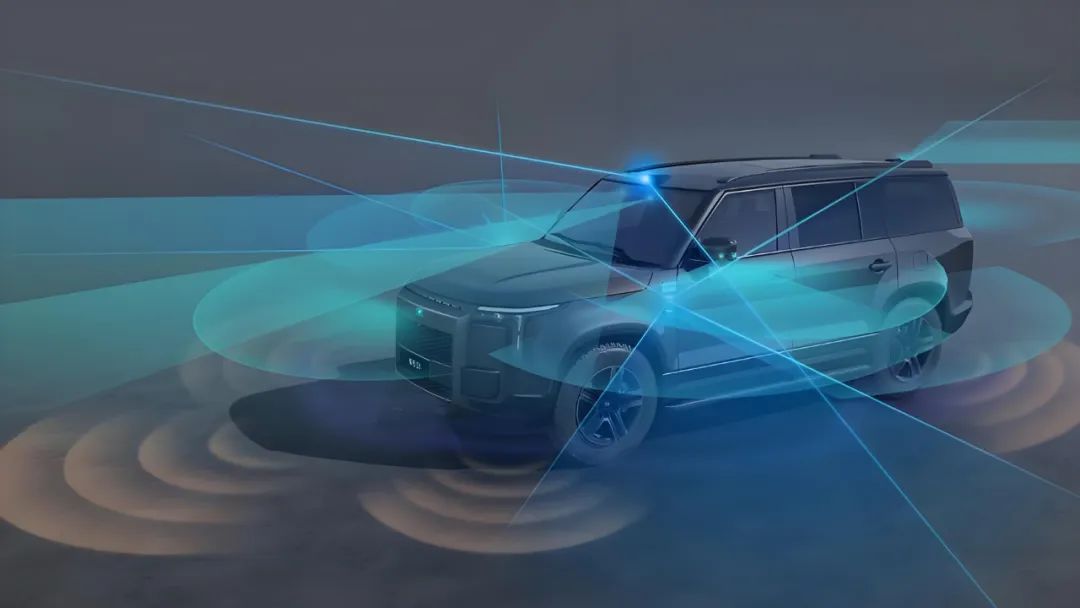

LiDAR (Light Detection and Ranging), a pivotal sensor for autonomous vehicles to perceive their surroundings, gathers real-time 3D position information of objects through laser pulses, enabling precise environmental modeling for vehicle decision-making and control. Based on scanning methods and structural forms, LiDAR can be broadly categorized into three types: Mechanical, Semi-solid-state, and Solid-state.

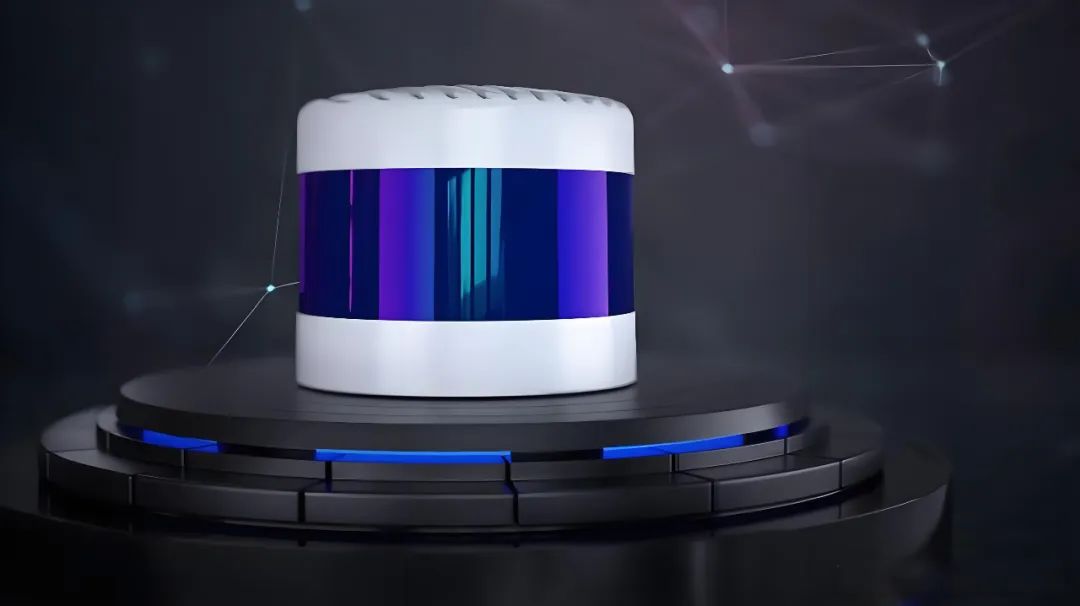

Mechanical LiDAR employs a motor-driven rotating disk or prism to achieve 360-degree laser beam scanning. Semi-solid-state LiDAR features stationary reception or transmission modules, with only scanning components (like rotating mirrors or MEMS micro-mirrors) moving mechanically. Solid-state LiDAR, devoid of any mechanical moving parts, relies on Optical Phased Array (OPA) or Flash technology for instantaneous laser scanning of the entire detection scene. Each type has unique strengths and weaknesses in terms of technical maturity, cost, size, and lifespan. For autonomous driving, selecting the right LiDAR involves balancing performance indicators, mass production feasibility, and automotive-grade certification requirements.

Comparison of Different Types of LiDAR

LiDAR's core principle involves an emitter transmitting laser pulses, controlled by an optical system. When the laser hits an object, it reflects back to the receiver, which converts the reflected light into an electrical signal. The backend unit analyzes the Time-of-Flight (ToF) and intensity to determine distance and reflection characteristics. While all types follow this principle, they differ significantly in optical scanning methods, transmission and reception module integration, and mechanical component count. Mechanical LiDAR boasts a mature "rotating disk + laser emitter + receiver array" structure but is large, costly, and has a limited lifespan. Semi-solid-state LiDAR reduces mechanical motion to smaller components, cutting size and cost. Solid-state LiDAR, using OPA or Flash technology, requires no moving parts, offering small size, high reliability, and strong mass production potential, though it's still evolving.

Mechanical LiDAR

As the earliest commercial LiDAR, mechanical LiDAR uses a motor-driven rotating mount to enable 360-degree scanning. Velodyne's HDL-64E, a representative model, uses 64-line multi-transmit-multi-receive design for high-density point cloud data, enabling precise object detection and classification. Mechanical LiDAR excels in technical maturity, long detection distances (often exceeding 200 meters), and high point cloud density, suiting L4+ autonomous driving. However, it's costly, large, power-hungry, has heat dissipation issues, and rotating parts have limited lifespans.

Semi-solid-state LiDAR

Semi-solid-state LiDAR reduces mechanical dependence, typically retaining small scanners like rotating mirrors or MEMS micro-mirrors. Rotating mirror LiDAR uses electric rotating mirrors for moderate cost and production ease. MEMS micro-mirrors utilize MEMS technology for tiny mirrors on chips, oscillating rapidly to scan laser beams. Both outperform mechanical LiDAR in size, power consumption, and cost, and are easier to certify for automotive use.

Rotating mirror semi-solid-state LiDAR, like Wanji Technology's 760, offers 192-line scanning, 200-meter detection, and automotive-grade reliability, targeting ADAS scenarios. MEMS micro-mirror LiDAR, like RoboSense's M1 series, achieves high point cloud density and stability, attracting attention from multiple LiDAR companies. With process maturity, MEMS LiDAR costs are expected to drop, promoting its use in L2+ and L3 autonomous driving.

Solid-state LiDAR

To eliminate mechanical wear and further reduce costs, solid-state LiDAR emerged as the industry's "ultimate form." It uses OPA or Flash technology. OPA controls laser beam direction without moving parts, offering optimal reliability and potentially the smallest size. However, challenges include phased array chip yield, phase modulation accuracy, and optoelectronic device packaging. Flash-type LiDAR illuminates the entire scene instantly, collecting echoes through a large receiving array. It excels in short-distance scenarios but faces SNR and sensitivity challenges in high-speed driving. Further breakthroughs are needed in mass production costs, thermal management, and optical system stability.

Advantages and Disadvantages of Different LiDAR Types

Mechanical LiDAR leads in detection distance and point cloud resolution, supporting accurate ranging beyond 200 meters. However, it's costly and bulky. Semi-solid-state LiDAR focuses on 100-200 meter detection distances, with flexible horizontal scanning fields but requiring sensor integration for blind spot compensation. Costs are lower, sizes are compressed, facilitating hidden integration. Solid-state LiDAR promises the smallest size, lowest cost, and highest reliability, but faces challenges in long-distance detection accuracy and process demands.

How to Choose?

Selecting the right LiDAR involves balancing technical maturity, cost, size, and lifespan against autonomous driving needs. Semi-solid-state LiDAR, particularly MEMS micro-mirror variants, offers a promising balance, gradually being applied to mass-produced vehicle models. Solid-state LiDAR, though promising, still needs technological advancements for widespread adoption.

To address varying levels of autonomous driving needs, mechanical, semi-solid-state, and solid-state LiDAR technologies can be functionally tailored. For L4 and L5 ultra-high-level autonomous driving, where human intervention is minimal, the perception system demands exceptional performance and redundancy. High line counts, high resolution, and long-distance detection are crucial for timely detection of pedestrians, bicycles, other vehicles, and road obstacles in complex urban and highway environments, along with precise trajectory prediction and path planning. Mechanical LiDAR, known for its mature and stable performance, was initially favored for L4/L5 test vehicles. However, its high cost and limited automotive adaptability hinder mass production. Consequently, although leading autonomous driving companies initially equipped their test vehicles with numerous mechanical LiDARs, such as Velodyne HDL and Quanergy M8, these are gradually being replaced by semi-solid-state arrays in mass-produced models.

For L3 and lower levels of autonomous driving, including L2 Advanced Driver Assistance Systems (ADAS), L2+, and L3 semi-autonomous driving, semi-solid-state LiDAR offers an optimal balance between performance and cost. For instance, rotating mirror semi-solid-state products provide ample detection distances (typically 150-200 meters for 10% reflective targets) and high vertical line counts (64-128 lines), satisfying functional requirements like lane keeping and automatic emergency braking (AEB) in urban and highway scenarios through 360-degree or local multi-sensor fusion. MEMS micro-mirror semi-solid-state radars enable discreet in-vehicle installation due to their compact size, reducing aerodynamic drag and visual intrusion, making them ideal for mass-produced models with stringent styling requirements. When integrated with cameras, millimeter-wave radars, millimeter-level high-precision maps, and high-performance domain controllers, semi-solid-state LiDAR constructs a multi-modal perception system with enhanced redundancy and safety, ensuring sufficient performance and cost of ownership (CoO) control for L3 autonomous driving.

Over the past two years, numerous domestic and international automakers and LiDAR companies have collaborated on semi-solid and fully solid-state technologies for mass production. Huawei and ARCFOX jointly launched a 96-line semi-solid-state LiDAR, extensively tested in mass production on the ARCFOX Alpha S HI version. XPeng's G9, in partnership with RoboSense, employs the M1 semi-solid-state LiDAR utilizing MEMS micromirror technology. Models like GAC Aion and WM Motor M7 have also integrated rotating mirror semi-solid-state LiDARs. Regarding fully solid-state LiDARs, Wanji Technology's 750 fully solid-state blind spot detection LiDAR is operational in multiple domestic low-speed driverless scenarios (e.g., sanitation vehicles and delivery robots), demonstrating its feasibility in short-range applications. Additionally, startups like Innoviz, Aeva, Hesai (Hesai Technology), and domestic companies such as RoboSense and Leishen Intelligence are focused on OPA and Flash technology research and development, aiming to commercialize fully solid-state LiDAR with automotive-grade mass production capabilities by 2025-2026.

Mechanical LiDARs, reliant on precision machining and high-end optical components, remain challenging to scale down to consumer-level automotive prices. For example, Velodyne's early 64-line mechanical LiDAR exceeded $50,000 per unit, and the 32-line version surpassed $20,000, unsustainable for mass production. Semi-solid-state LiDARs have reduced unit prices to around $1,000 through decreased mechanical components and improved optical and electronic integration, with costs expected to decline further with increased shipments. Leading suppliers are optimizing automotive certification, reliability testing, and supply chain construction through Tier 1 and automaker partnerships, aiming to lower semi-solid-state LiDAR costs to the $500~800 range. With the maturation of MEMS manufacturing, monolithic integration and production yield are improving, potentially enabling further cost reductions within the next two years.

Fully solid-state LiDARs theoretically offer the greatest cost optimization potential. If high-yield chip manufacturing and modular packaging are achieved, their overall cost could significantly undercut semi-solid-state and mechanical solutions. However, from a technological maturity perspective, fully solid-state LiDARs face critical challenges in mass production scale, automotive-grade reliability, and supporting ecosystems. The OPA architecture is hindered by phased array chip glow effects (Speckle) and temperature drift, necessitating significant R&D investments in chip processes and system thermal design. The Flash architecture grapples with optical power divergence and reception noise, requiring high-performance high-speed AD (analog-to-digital converters) and large-scale pixel-level readout circuits. Currently, both OPA and Flash fully solid-state LiDARs are predominantly deployed in low-speed logistics, unmanned delivery, and intelligent manufacturing scenarios. To achieve large-scale applications in L3+ or L4 autonomous driving, breakthroughs are needed in reliability verification, automotive-grade temperature adaptability, and high-power thermal management.

Future Trends

LiDAR technology will continue to advance, aiming for "higher performance, lower cost, smaller size, and higher reliability." Performance-wise, high-line (e.g., thousand-line level) high-precision designs will enhance point cloud density, reduce noise, and improve target and texture feature identification in complex environments. Cost-wise, deep integration with CMOS processes will integrate laser emission and reception modules onto a single silicon substrate, leveraging semiconductor giants' production capacity and mature packaging/testing processes for manageable batch prices. Size-wise, as optical, electronic integration, and heat dissipation solutions mature, fully solid-state modules are expected to shrink to headlight camera module dimensions, enhancing exterior design flexibility. Reliability-wise, automotive-grade certification for high temperature and vibration resistance will set a new industry benchmark, necessitating comprehensive investments in environmental adaptability, EMC (electromagnetic compatibility) testing, and long-term stability verification.

Moreover, LiDAR will integrate deeply with other in-vehicle sensors (cameras, millimeter-wave radars, ultrasonics, etc.), coordinating with high-precision maps, in-vehicle edge computing platforms (Edge Computing), and V2X (Vehicle-to-Everything) communications to drive autonomous driving system perception layer upgrades. In future architectures, sensor fusion will transcend simple redundancy, achieving deep correlation and joint reasoning of multi-dimensional, multi-modal information. For instance, under low light or rain/fog, while cameras may falter, millimeter-wave radars and LiDARs maintain robust detection. In high-speed scenarios, high-line mechanical or semi-solid-state radars provide long-distance warnings. In low-speed scenarios like obstacle avoidance and parking, fully solid-state Flash radars swiftly complete short-range depth reconstruction. Phased array technology will enhance anti-interference and target classification capabilities, providing autonomous driving systems with more precise and reliable depth information.

Mechanical, semi-solid-state, and fully solid-state LiDARs represent different stages and focuses of LiDAR technology. Mechanical LiDAR excels in mature technology and high detection accuracy but is transitioning to semi-solid-state and fully solid-state due to size, lifespan, and cost constraints. Semi-solid-state LiDAR is mainstream for mass-produced models, balancing cost, reliability, and performance for L2+ to L3 autonomous driving. Fully solid-state LiDAR, with minimal size, optimal reliability, and strong cost optimization potential, is the industry's ultimate goal but faces challenges in phased array chips, Flash detection device processes, and system integration.

When selecting LiDAR, automakers must consider the target autonomous driving scenario, functional requirements, and cost budget, evaluating performance indicators, automotive certification, mass production feasibility, and supply chain maturity to match the most suitable LiDAR solution for different vehicle lines and autonomous driving levels. With technological evolution and industrial chain improvement, semi-solid-state and fully solid-state LiDARs are expected to accelerate penetration into multi-level autonomous driving models between 2015 and 2026, ultimately transforming from high-cost experimental products to low-cost mass-produced components.

-- END --