Kunlun Wanwei's "Tiangong" Reinvents Itself, "Jieyue Xingchen" Refocuses, and Mid-Tier AI Companies Bank on Agents for a Final Push?

![]() 06/06 2025

06/06 2025

![]() 599

599

The "Matthew Effect" within the AI industry has already taken shape.

First question: Which AI company are you still using? Judging from my surroundings, top AI players from both domestic and international markets such as ChatGPT, Doubao, DeepSeek, ERNIE Bot, and Gemini cover almost all the bases. In contrast, Tiangong and Jieyue Xingchen may be unfamiliar to many users, and even Kimi, which once created a buzz, has now somewhat faded into the background.

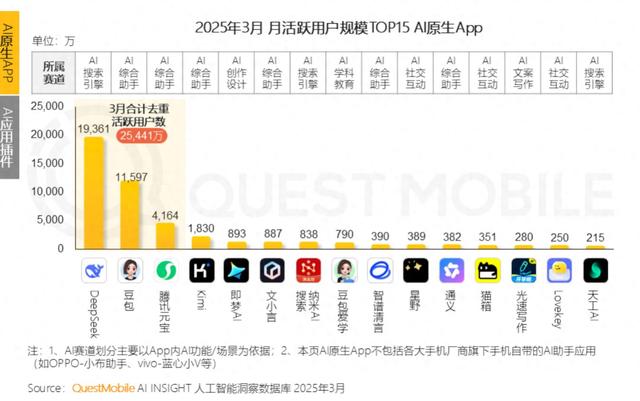

Market research supports this observation. QuestMobile's China market report released in May highlighted that the number of active users of AI-native apps surpassed 270 million in March 2025, marking a year-on-year increase of 536.8%. However, a clear hierarchy has emerged, illustrating a distinct "winner-takes-all" scenario:

The monthly active users of the app from top-ranked DeepSeek surpassed the combined total of the second to fifteenth ranks. Similarly, second-ranked Doubao led the sum of the third to fifteenth ranks. The fifteenth-ranked Tiangong AI app had merely 2.15 million monthly active users, a fraction of DeepSeek's 190 million monthly active users (3.61 million).

Image/ QuestMobile

It's not hard to understand why Kunlun Wanwei opted for a "from scratch" upgrade for the Tiangong app, even requiring users to manually export data content. On the other hand, Jieyue Xingchen, one of the "AI Six Dragons," has also made adjustments, cutting off its role-playing product "Mao Pao Ya" and renaming "Yue Wen" to "Jieyue AI," shifting its focus to model research and development, weakening its ToC emphasis, and emphasizing ToB.

However, they share a common goal: seizing the opportunity presented by agents, potentially their last chance.

Tiangong "Reinvents," Jieyue "Refocuses," and Agents Become the Common Denominator

Facts have shown that not only internet companies fear "falling behind," but AI large model companies fear it even more.

While the sudden popularity of DeepSeek at the beginning of 2025 sparked discussions about AI startups "making a comeback," today, DeepSeek remains the sole standout. As DeepSeek, Doubao, ChatGPT, and Gemini increasingly capture users' attention, more and more large models are beginning to "lag behind."

Simultaneously, model vendors in the second, third, and even fourth tiers have started to frequently adjust their directions, seeking a way out under intense pressure. Whether it's a completely rebuilt app or a no longer cherished C-end dream, they are all trying to grasp a keyword, an era: Agents.

A typical example is Tiangong under Kunlun Wanwei.

In April, the Tiangong app announced a product upgrade for May and reminded users to export data content for backup (as of June 15, 2025), hinting at a "from scratch" version upgrade. Subsequently, on May 22, Kunlun Wanwei released the Office agent based on the AI Agent architecture - Tiangong Super Agent, with the product overall shifting towards document office scenarios.

Image/ Tiangong

A few days later, the Tiangong app 3.0 was officially launched, featuring a completely revamped interface, functionality, and product positioning from version 2.0, transitioning from a large and comprehensive AI application to a deep agent platform centered on "office scenarios." According to the official introduction:

The Tiangong app is a new intelligent Office suite product with super DeepResearch capabilities... You only need to state your needs, and AI can generate documents, PPTs, and spreadsheets with one click, efficiently handling various office scenarios.

In short, Tiangong emphasizes the "closed loop" and "task completion" based on agents, significantly differing from the previous approach centered on "AI conversation."

The reality behind this shift is that users are no longer concerned with whether AI answers are ingenious but rather with what tasks it can actually "complete." Despite Tiangong's strong performance in model capability and product experience evaluations, very few users who actually use its app form a sticky relationship with the product, and even brand recognition is waning. Since the "old path is impassable," Kunlun Wanwei simply restarted Tiangong, treating agents as the last opportunity to turn the tables.

Meanwhile, another large model vendor, Jieyue Xingchen, is also making significant adjustments to its product strategy. Since the end of last year, it has gradually ceased investment in its previous key product "Mao Pao Ya" and merged the team into another key product "Yue Wen," which was renamed "Jieyue AI" this year.

Image/ Mao Pao Ya

According to reports from "Intelligent Emergence," "many Jieyue employees can feel that before Q4 2024, the senior management's emphasis on the C-end business was no less than that on model training." However, due to product growth bottlenecks and pressure from top products, Jieyue Xingchen chose to converge its products and focus on the agent direction.

Currently, one of Jieyue Xingchen's priorities is ToB. At this year's Eco Open Day, it announced that based on agents, it will establish cooperation with Geely Auto Group, OPPO, and Zhiyuan Robotics. This adjustment actually sends a signal: if the C-end doesn't work out, then shift to find opportunities in ToB customized scenarios, leveraging model capabilities and industry understanding to achieve vertical market landings.

If Tiangong is "rebuilding from the platform," then Jieyue is "clearing out from positioning." The latter's model research and development have always been renowned for their multimodal capabilities, with open-source projects released in sub-directions such as image editing, video generation, and 3D model generation. By abandoning the goal of short-term C-end user growth and betting resources on the long-term value of basic models and "multimodal agents," Jieyue may have found its business path.

The Surge of Agents: The Last Opportunity to Catch Up with Top Large Models

Since 2025, almost everyone has been talking about agents. From OpenAI's Operator to Codex, agents have continuously emerged, including Zhipu AI's AutoGLM, Fliggy's "Ask," and Manus. At the same time, agent platforms are also becoming the focus of competition among large model vendors, just as Google stated:

Large models are platforms.

But the question arises: does this battle still leave room for development for second- and even third-tier large model vendors? The answer is yes. In fact, it is precisely because large models are collectively entering a new stage of agents that agents have become a "variable" for non-top vendors to bypass. After all, the cost of directly competing with ChatGPT and DeepSeek in model capabilities is too high, and agents provide a new evaluation standard:

Can you land? Can you complete tasks? Can you establish an "experience closed loop" in vertical and segmented scenarios?

Take Tiangong as an example; it almost placed a bet on agents by "completely rebuilding the product," tearing down the original app and launching a new version equipped with the "Tiangong Super Agent." In this new version, AI is not a tool for answering questions but an office partner with actual task completion capabilities - users state their needs, and the agent can automatically generate documents, PPTs, and Excel spreadsheets.

New "Office Suite," Image/ App Store

According to official claims, it relies on Kunlun Wanwei's self-developed DeepResearch framework and a collaboration mechanism of six dedicated agents. From user experience to technical framework, Tiangong's goal is clear: not to be an AI question-and-answer machine but a true "digital employee" in office scenarios.

Looking at Jieyue Xingchen, its transformation path is more like "module splitting and capability sinking," not only redefining the product positioning of "Jieyue AI" but also clearly focusing on landing agents on four major terminals: mobile phones, cars, robots, and IoT.

According to the introduction of Wan Yulong, head of OPPO's Intelligent Assistant Department and responsible person of Xiao Bu Assistant, based on cooperation with Jieyue, users can interact with AI through multimodal vision using Xiao Bu, realizing functions such as photo question-and-answer, document question-and-answer, and screen recognition question-and-answer, and even allowing AI to independently enter various App ends to complete tasks.

Image/ Jieyue Xingchen

From the semantic understanding and execution agent integrated into the Geely Auto cockpit to the "embodied intelligence" jointly explored with Zhiyuan Robotics, the underlying idea is the same: fully embed agent capabilities into the device itself, becoming an integral part of the hardware experience, rather than a general-purpose assistant attached to a chat box.

This path of shifting from "general capability competition" to "scenario closed-loop construction" is becoming a common choice for many large model vendors. In the past year, countless AI products have enjoyed fleeting popularity, but what users truly stick with in the end will be those that can "integrate" into daily life.

And this also means that "agent" is not just a technical label but a watershed for product capabilities. Top vendors will of course continue to build all-domain ecosystems and plugin platforms, but for other vendors, "the more vertical, the more opportunities," and "the more focused, the more likely to survive" is becoming an increasingly clear consensus.

When the technology dividend is leveled, what's left for everyone is actually "who understands a specific person best." In this dimension, everyone has a chance.

Written at the End

For today's AI vendors, agents are not just a trend but more like a touchstone: large models are not better the more versatile they are, but the more "usable" they are, the more important; whoever can truly enter users' daily lives will regain their qualification to stay at the table.

Tiangong rebuilds its product, and Jieyue shifts to terminals. They have different directions but the same goal: no longer compete with top vendors to see who is stronger but to find the "most suitable" position. This is also one of the keys to agents - it is the first opportunity for non-top vendors to detach from parameters and rankings and compete on product completion, landing speed, and real value.

Opportunities still exist, but the window period is shrinking. Grasping agents may be the last leap for Tiangong and Jieyue. If they succeed, they still have a chance to become the foundation of the new generation of AI ecosystems; if not, they may be forever forgotten by users and the market.

Tiangong, Jieyue Xingchen, large model, agent, AI

Source: Lei Tech