Kuaishou Shifts from Defense to Offense with Keling AI

![]() 06/06 2025

06/06 2025

![]() 673

673

But it is proceeding cautiously.

But it is proceeding cautiously.

Author|Jingxing Editor|Wenchanglong

Kuaishou Keling is picking up speed.

On May 29, Kuaishou Keling AI officially announced the launch of its new 2.1 series model, emphasizing enhanced semantic response and motion performance. Keling 2.1 is available in two versions: the Standard Edition (optional 720p or 1080p, supporting only image-to-video generation) and the Master Edition (1080p, cinematic-quality effects, supporting both image-to-video and text-to-video generation). In terms of output, the Standard Edition targets common short video design needs, while the Master Edition caters to cinematic content requirements.

More importantly, Keling 2.1 further reduces video production costs. In the Keling 2.0 Master Edition, generating a 5-second video required 100 Inspiration Points (1 RMB equals 10 Inspiration Points). After this upgrade, the price for a 5-second 720p video has been reduced to 20 Inspiration Points, while a longer 1080p video costs 35 Inspiration Points, and a Master Edition video costs 100 Inspiration Points.

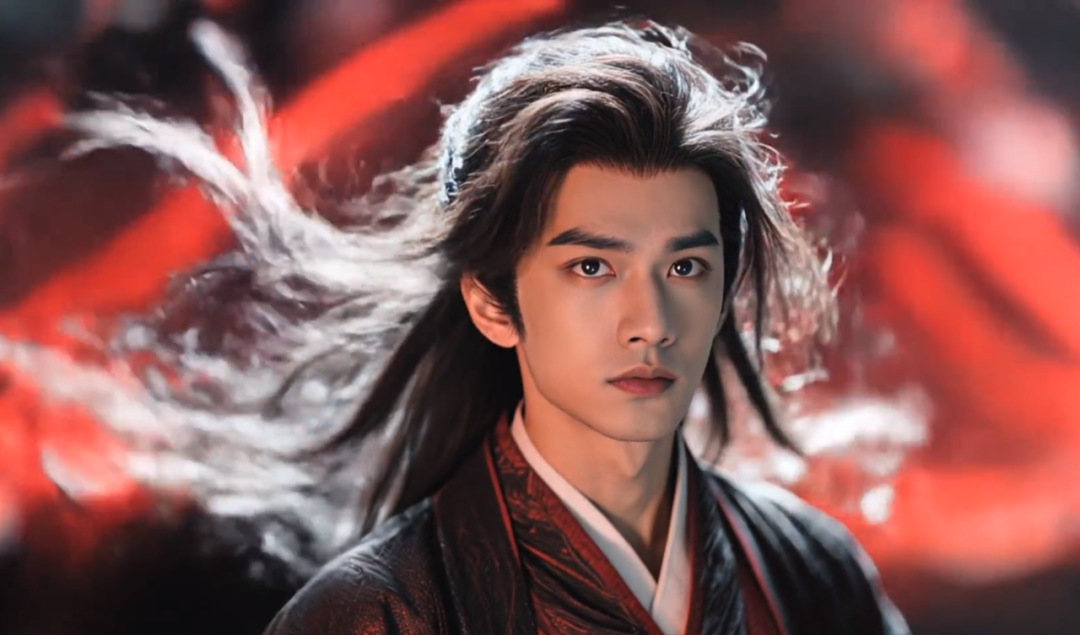

(Image source: Keling 2.1 demonstration video)

This aligns with Kuaishou's previous announcement. During Kuaishou's first-quarter financial report conference call on May 27, CEO Cheng Yixiao mentioned that Keling would soon introduce more cost-effective versions to provide users with diverse options to meet different video production needs.

Behind this lies the accelerated research and development of Kuaishou Keling.

According to publicly available information on the official website, since the release of the 1.0 version in June last year, the update of the Kuaishou Keling model has significantly accelerated, with four updates released within one month in March this year. Following the release of the 2.0 version on April 15, which upgraded the base model and introduced multi-modal video editing functions, Keling expedited the launch of the 2.1 version at the end of May, reducing the generation time of a 1080p five-second video to less than one minute.

In the capital market, Keling's performance has prompted a reevaluation of Kuaishou by investors. In the 2025 first-quarter financial report, Pinduoduo's net profit attributable to ordinary shareholders declined by 47% year-on-year, causing its share price to plummet by over 13%. Kuaishou's performance was also weak, with profits declining by 3.4% year-on-year during the period, and adjusted net profit increasing by 4.4% year-on-year. However, its share price still rose by more than 10% over the following two trading days. Anchored in AI, Kuaishou is redefining its positioning.

01 Kuaishou Transitions to Strategic Offense

AI is emerging as a core highlight in Kuaishou's financial reports.

According to Kuaishou's classification, the company's business is divided into several segments: AI, online marketing services, e-commerce, live streaming, and local life. In the financial report, Kuaishou specifically places the AI business at the forefront of the introduction.

In the revenue table classified by business type, Kuaishou divides its business into three categories: online marketing services, live streaming, and other services.

Among them, the year-on-year growth rate of Kuaishou's marketing services decreased from 13% in the fourth quarter of last year to 8%, compared to 27.4% in the same period last year. In terms of e-commerce, Kuaishou's e-commerce GMV was 288.1 billion yuan in the fourth quarter of last year, with a year-on-year increase of 28.2%. This year's first-quarter GMV was 332.3 billion yuan, with a year-on-year increase of 15.4%. Regarding live streaming, Kuaishou's live streaming revenue has been declining for four consecutive quarters last year, with first-quarter live streaming revenue of 9.8 billion yuan, a year-on-year increase of 14.4%.

User scale has become a bottleneck limiting Kuaishou's further growth. In the first quarter of this year, Kuaishou's average daily active users (DAUs) and monthly active users (MAUs) were 408 million and 712 million, respectively, with year-on-year growth rates of 3.6% and 2.1%. While Kuaishou's DAUs are setting new historical records, user growth potential is also increasing under the competition from Douyin and WeChat video accounts.

AI has become a star business in Kuaishou's financial reports. The financial report shows that the commercialization process of Keling AI is entering an acceleration phase, with Keling AI revenue exceeding 150 million yuan in the first quarter of 2025. Kuaishou wrote in the financial report: "Keling AI has been widely adopted in multiple industries such as advertising and marketing, short dramas, and intelligent terminals, which also bolsters our confidence in our vision of Keling AI becoming the infrastructure for video creation in the new AI era."

In the third-quarter report of last year, Kuaishou disclosed that Keling's monthly revenue exceeded 10 million yuan. In the fourth-quarter report of last year, Kuaishou revealed that as of February 2025, Keling AI's cumulative operating revenue since commercialization had surpassed 100 million yuan.

In terms of growth rate, Keling AI is leading the way at Kuaishou. At the Kuaishou Keling AI 2.0 model launch event on April 15 this year, Gai Kun, Senior Vice President of Kuaishou and head of the community science line, revealed that Keling has undergone more than 20 iterations since its launch, with the global user base exceeding 22 million. The monthly active user base has grown 25 times in 10 months, with over 168 million videos produced cumulatively.

Another crucial signal is that Kuaishou is now willing to invest more.

Since 2021, Kuaishou has significantly reduced its expenses, with R&D expenses showing particularly notable decreases. From 2021 to 2024, Kuaishou's annual R&D expenditures experienced three consecutive declines, falling from 14.96 billion yuan to 12.2 billion yuan. For instance, in the first quarter of 2023, Kuaishou achieved overall profitability at the group level for the first time, and its R&D expenditure for the same period decreased from 3.5 billion yuan in the first quarter of 2022 to 2.9 billion yuan, with the proportion of revenue falling sharply from 16.7% to 11.6%.

In recent years, due to the combined pressure from Douyin and WeChat video accounts, as well as the rapid expansion of its own organization, Kuaishou has adopted a strategic defensive posture, with its expense sheet consistently showing an overall state of contraction.

In the first quarter of this year, Kuaishou uncharacteristically launched an offensive. Administrative expenses amounted to 828 million yuan, a year-on-year increase of 79.2%, while R&D expenses increased from 2.843 billion yuan in the first quarter of 2024 to 3.298 billion yuan, a year-on-year increase of about 16%. Kuaishou explained that the increase in R&D expenses was due to higher welfare expenses for R&D personnel (including share-based compensation expenses).

The direct reason for the increase in these two expenses is Kuaishou AI's aggressive hiring. In the financial report conference call, Jin Bing, CFO of Kuaishou, stated that in the future, Kuaishou AI's expense expenditures will rise, primarily due to increased costs for R&D personnel, which will be primarily used for attracting, retaining, and building AI technology talent teams.

At the organizational level, Kuaishou further strengthened the strategic position of AI. At the end of April this year, Kuaishou officially established the Keling AI business unit as a first-level department, with the creation of Keling AI product, operations, and technology departments, responsible for Keling, Ketu, and other large model businesses.

The elevation of Keling AI to a first-level department, alongside Kuaishou's core departments such as the main site, commercialization, e-commerce, and internationalization, signifies higher decision-making autonomy and more resources or financial support. Additionally, Gai Kun, Senior Vice President of Kuaishou, serves as the head of the Keling AI business unit, reporting directly to Cheng Yixiao, the founder and CEO of Kuaishou Technology, further enhancing the reporting hierarchy.

During the financial report meeting, Keling AI also became a central topic of on-site questions and senior management interpretations. Cheng Yixiao revealed that currently, nearly 70% of Keling AI's revenue is contributed by P-end users (professional creators, advertising practitioners), while the number of P-end members and average revenue per user are growing rapidly, driving rapid growth in Keling's paid subscriptions. On the B-end, Keling has provided API services to 10,000 enterprise customers, with an exceptionally high renewal rate.

Expanding overseas will become the next growth focus for Keling. Cheng Yixiao mentioned that Keling will continue to carry out related operational activities, particularly in overseas regions, to achieve user growth:

"Keling AI will become the new infrastructure for video creation in more industries in the future."

02 Keling Reaches a Pivotal Moment

Currently, large companies' AI endeavors are entering an arms race stage, with research and development investments vying to increase. While clearly betting on the AI business, Kuaishou has not adopted the all-in approach of leading companies towards AI.

In the fourth quarter of last year, Tencent's operating cash flow was 54 billion yuan, of which 39 billion yuan was used to support capital expenditure payments related to the development of AI projects, resulting in free cash flow falling to 4.5 billion yuan. In the first quarter of this year, Tencent's R&D expenditure was 18.91 billion yuan, a year-on-year increase of 21%.

At Alibaba, Wu Yongming, the group's CEO, concurrently serves as the CEO of Alibaba Cloud and has announced an investment of 380 billion yuan over three years for Alibaba Cloud and AI hardware infrastructure construction, with a total investment exceeding the sum of the past decade.

On the other hand, Kuaishou is generally defensively positioned in its main business and is cautiously offensive in the AI battlefield. Compared to other large companies, Kuaishou's investment intensity is not yet pronounced. Jin Bing mentioned in the financial report meeting that Keling AI has achieved positive marginal profit at the inference level. From a full-year perspective, the impact of the AI strategy, including Keling, on the group's overall profit margin will be between 1% and 2%. In the medium to long term, AI is expected to become one of the company's second growth curves:

"As the business scale expands, even if we increase investment in inference computing power, the impact on the group's profits will be relatively minor. Simultaneously, we are highly confident in further reducing inference costs through technological iterations. With the expansion of operating revenue scale, the dilution of fixed costs such as training costs and labor costs will narrow the overall losses and loss rate of Keling AI."

Kuaishou's statement sends a clear signal that senior management is optimistic about the commercialization potential of Keling AI, but the investment in Keling is still predicated on cost control, and it will strive to avoid profit declines caused by excessive investment in AI research and development.

Cheng Yixiao repeatedly emphasized in the financial report meeting that Keling AI will form strategic synergies with Kuaishou's existing mature businesses. These scenarios include using large models for content understanding and precise recommendations to increase user time and activity; providing AI materials, marketing agents, and marketing recommendations in advertising scenarios; and offering content production, precise matching, and intelligent customer service capabilities in e-commerce scenarios.

Cheng Yixiao said: "Kuaishou Keling AI will grow its marketing through information stream placement, but the scale of this placement will be relatively limited and accompanied by strict ROI considerations."

Against the backdrop of increasingly fierce industry competition, Kuaishou's cautious exploration may seem conservative, which could be related to management's assessment of the market situation. For leading enterprises like Alibaba, Tencent, and ByteDance, the priority is to deploy as early as possible and seize the commanding heights of future AI.

For Kuaishou, spreading investments to share risks is the path to steady progress. Cheng Yixiao mentioned in the financial report meeting that current market consumer demand still poses challenges. Amidst the pressure on the growth rates of traditional businesses such as advertising and live streaming, Kuaishou needs to proceed with small, steady steps.