Broadcom: ASIC Growth Faces Hurdles, Trillion-Dollar ASIC Story Navigates 'Pitfalls' or Seizes 'Opportunities'?

![]() 06/06 2025

06/06 2025

![]() 599

599

$Broadcom.US On the morning of June 6, Beijing time, after the U.S. market closed, Broadcom released its fiscal Q2 2025 financial report (ending April 2025):

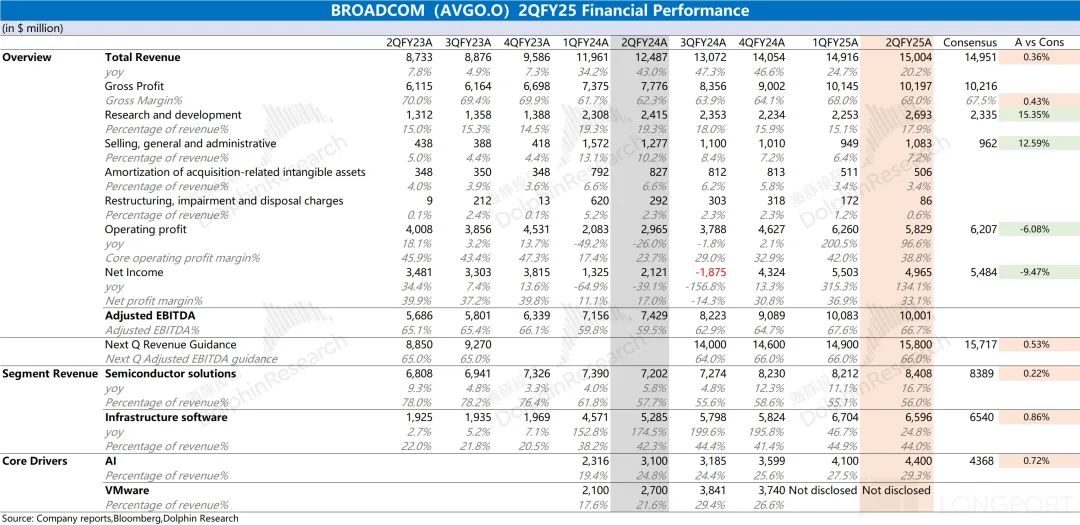

1. Overall Performance: Broadcom (AVGO.O) reported revenue of $15 billion for the quarter, marking a 20% year-over-year increase, in line with market expectations ($14.95 billion). The year-over-year growth was primarily driven by the expansion of the AI business and the consolidation of VMware. The company's gross margin for the quarter stood at 68%, with the integration of VMware, which boasts a higher gross margin, contributing to a gradual uptick in the company's overall gross margin.

2. Semiconductor Business: This quarter's revenue totaled $8.4 billion, representing a sequential increase of $0.2 billion, with the AI business being the main driver of growth. Specifically:

① AI Business: $4.4 billion, a sequential increase of $0.3 billion, aligning with market expectations. The sequential growth slowdown in the AI business was primarily attributed to the generational transition of major customer Google's TPU products. With the ramped-up mass production of TPUv6, the AI business is anticipated to accelerate its growth in the second half of the year. The company projects AI business revenue of $5.1 billion for the next quarter, with sequential growth rising to $0.7 billion.

② Non-AI Business: $4 billion, with a slight decline. From the perspective of various downstream sectors, while enterprise storage and broadband businesses increased sequentially, wireless and industrial businesses continued to decline.

3. Infrastructure Software: This quarter achieved $6.6 billion, a sequential decrease of $0.1 billion. Impacted by VMware's M&A integration and fee model adjustments (fully transitioning from a perpetual license model to a subscription model), the company's software business, which had been growing over the past year, experienced its first decline this quarter. However, the software business will still benefit from the rise in VMware's subscription model in the future, albeit with the high-growth phase coming to an end.

4. Operating Expenses: Core operating expenses (R&D expenses + selling, general, and administrative expenses) for this quarter amounted to $3.77 billion, a sequential increase of $0.57 billion, with a core operating expense ratio of approximately 25%. Post-VMware acquisition, the company has been committed to compressing and integrating operating expenses; however, they increased again this quarter, primarily due to the company's enhanced equity incentives. Excluding the impact of equity incentives, the company's core operating expenses for this quarter were $2.2 billion, a sequential increase of $0.13 billion, as the company increased its R&D investment in AI semiconductors.

5. Broadcom's Guidance: Expected revenue for fiscal Q3 2025 is approximately $15.8 billion, with market expectations at $15.7 billion. The company projects an adjusted EBITDA margin of 66% for fiscal Q3 2025. Among these projections, the AI business is expected to continue growing to $5.1 billion.

Dolphin's Overall View: Unspectacular, No Obvious Highlights

Broadcom AVGO's revenue performance this quarter met expectations, with a modest sequential increase. The increment was primarily fueled by the semiconductor AI business, while the software business and VMware remained relatively stable. The company's core profit fell sequentially, primarily due to the company's increased equity incentives and related expenses this quarter. Excluding this impact, the company's financial report this time largely met expectations.

Specifically, the market's focus on Broadcom AVGO is on the AI business and VMware, which have also contributed the main increments over the past year:

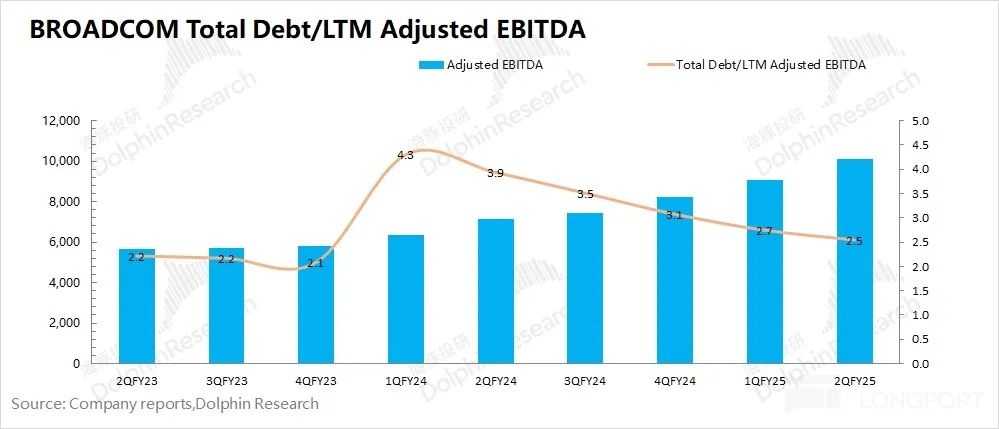

1) VMware M&A Integration: Basically completed. This can be observed from two perspectives: impact on performance and impact on debt:

① Impact on Performance: In terms of revenue, the company's acquisition of VMware has been finalized for over a year, with the subscription fee conversion rate exceeding 60%. The sequential decline in the software business this quarter further signifies that the high-growth phase brought about by M&A integration has passed. In terms of operating expenses, post-acquisition, the company also began compressing core expenses. Excluding the impact of equity incentives, the company's core operating expenses (R&D expenses + selling, general, and administrative expenses) have remained relatively stable at around $2.1-2.2 billion for three consecutive quarters.

② Impact on Debt: Dolphin introduced the debt repayment indicator (Total Debt/LTM Adjusted EBITDA) and calculated that the company's indicator further declined to 2.5 this quarter. The company's past acquisitions and consolidations have all occurred when this indicator fell to around 2. With the continuous decline of this indicator, Dolphin believes that the impact of this VMware acquisition on the company's debt side has also been largely digested.

2) AI Business: As the impact of VMware gradually wanes, the performance of the AI business becomes the focal point. The company achieved AI business revenue of $4.4 billion this quarter, meeting market expectations. Since the AI business represents growth potential, the market pays closer attention to its sequential performance.

The company's AI business increased by only $0.3 billion sequentially this quarter, with a notable narrowing in sequential growth (recent three quarters: $0.4 billion - $0.5 billion - $0.3 billion). This is primarily because the company's major customer Google's TPU is undergoing a generational shift. With the mass production of TPUv6 in the second half of the year, the company's AI business growth is expected to accelerate again. The company projects AI business revenue of $5.1 billion for the next quarter, with sequential growth reaching $0.7 billion.

Currently, the company's AI revenue has a ratio of approximately 6:4 between computing and networking revenue. With the mass production and shipment of custom ASICs, the proportion of computing revenue will continue to rise in the future, thus imparting a distinct product-driven attribute to AI revenue. The company's customer situation and product rhythm will be areas of significant focus.

① From the Perspective of Customer Situation: Broadcom's customer base in the ASIC field is quite robust. The company has collaborated with seven customers on custom ASIC business, including Google, Meta, ByteDance, OpenAI, SoftBank, and two other new customers.

Currently, the company's AI revenue is primarily contributed by Google, Meta, and ByteDance. With the mass production of OpenAI and SoftBank products in 2026, it is anticipated to bring new increments to the company.

② Current Major Customer Product Rhythm: The ASIC custom chips of Google, Meta, and ByteDance have achieved mass production, with Google contributing the bulk of the current AI business revenue, primarily based on the company's long-standing collaboration with Google. The increased mass production of Google TPUv6 will also contribute the main increment to the company's AI business in the second half of the year. Entering 2026, Google TPUv7, Meta's 3nm new products, and OpenAI and SoftBank's products can provide relatively sustained growth prospects for the company's AI business.

Since Google contributes the vast majority of the current AI business revenue, the situation regarding Google TPUv7 is also a concern for the market. Although Broadcom AVGO has encountered competition from MediaTek, it is not overly concerned about Google TPUv7 orders. Combining industry conditions, Dolphin anticipates that Google's TPU v7 will still launch two versions: v7p and v7e. Among them, v7p will continue to be designed by Broadcom, while the v7e version will feature the ASIC die designed by the Google team, paired with MediaTek's I/O solution. Although Google has collaborated with MediaTek to produce the e-series products, the core p-series products are still entrusted entirely to Broadcom.

From Google's perspective, introducing MediaTek can reduce costs while also enhancing its self-research capabilities. However, the current impact on Broadcom is relatively minor, and core products still need to be developed by Broadcom.

[Note: Google offers different versions of TPUs, usually distinguished as the 'e' series (focusing on efficiency and inference, running pre-trained models) and the 'p' series (focusing on the raw performance of training large models).]

Considering the next quarter's guidance, the company expects revenue of $15.8 billion, marking a sequential increase of $0.8 billion. Among these projections, the sequential growth of the AI business will accelerate, aligning with market expectations for increased TPUv6 volumes, without providing any more than expected highlights. Coupled with the company's current market capitalization of $1.2 trillion, it corresponds to approximately 33 times PE for the company's expected after-tax core operating profit for fiscal year 2026 (revenue +23%, gross margin -1pct, tax rate 14%).

Overall, Broadcom AVGO's financial report this time is unspectacular, and the company's current share price already factors in the market's growth expectations for Google TPU mass production and new products in 2026. For the share price to achieve further breakthroughs, the company still needs to deliver performance that surpasses expectations in terms of customers, products, and AI prospects.

#Broadcom #Broadcom Q2 Financial Report #Broadcom Financial Report

- END -

// Reprint Authorization

This article is an original by Dolphin Investment Research. Please obtain authorization for reprinting.

// Disclaimer and General Disclosure Prompt

This report is solely for general comprehensive data use, intended for general browsing and data reference by users of Dolphin Investment Research and its affiliated institutions. It has not taken into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, and special needs of any person receiving this report. Investors must consult the opinions of independent professional advisors before making investment decisions based on this report. Any person who makes investment decisions using or referring to the content or information mentioned in this report must bear the risks themselves. Dolphin Investment Research shall not be liable for any direct or indirect responsibilities or losses that may arise from the use of the data contained in this report. The information and data contained in this report are based on publicly available information and are for reference purposes only. Dolphin Investment Research strives to but does not guarantee the reliability, accuracy, and completeness of relevant information and data.

The information or views expressed in this report cannot be used or deemed as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction, nor do they constitute recommendations, inquiries, or promotions for relevant securities or related financial instruments. The information, tools, and materials contained in this report are not intended for or to be distributed to citizens or residents of any jurisdiction where the distribution, publication, provision, or use of such information, tools, and materials would contravene applicable laws or regulations or result in Dolphin Investment Research and/or its subsidiaries or affiliates being required to comply with any registration or licensing requirements in that jurisdiction.

This report solely reflects the personal views, insights, and analysis methods of the relevant authors and does not represent the position of Dolphin Investment Research and/or its affiliated institutions.

This report is produced by Dolphin Investment Research, and the copyright belongs exclusively to Dolphin Investment Research. Without the prior written consent of Dolphin Investment Research, no institution or individual may (i) produce, copy, replicate, reprint, forward, or make any form of copies or reproductions in any way, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Investment Research will reserve all relevant rights.