Marvell's FY2026 Q1 Financial Report: Navigating the AI Boom with Custom Chip Strategies

![]() 06/06 2025

06/06 2025

![]() 479

479

Produced by Zhineng Zhixin

In the first quarter of FY2026, Marvell presented a robust, albeit unspectacular, performance, characterized by record-breaking revenue, sustained growth in data center revenue, and a burgeoning AI-driven custom chip business. However, the narrowing sequential growth and the absence of a clear growth trajectory for the future are undermining market confidence in its ability to maintain momentum.

Starting from Marvell's core business structure, we delve into the real progress of its AI custom ASIC business, changes in customer composition, and hidden revenue risks in China amidst macro-geopolitical considerations. Amidst the AI boom and its calmer moments, we seek the pivotal factors that will propel Marvell's next wave of growth.

Part 1

Data centers remain the bedrock, yet growth momentum is subtly waning

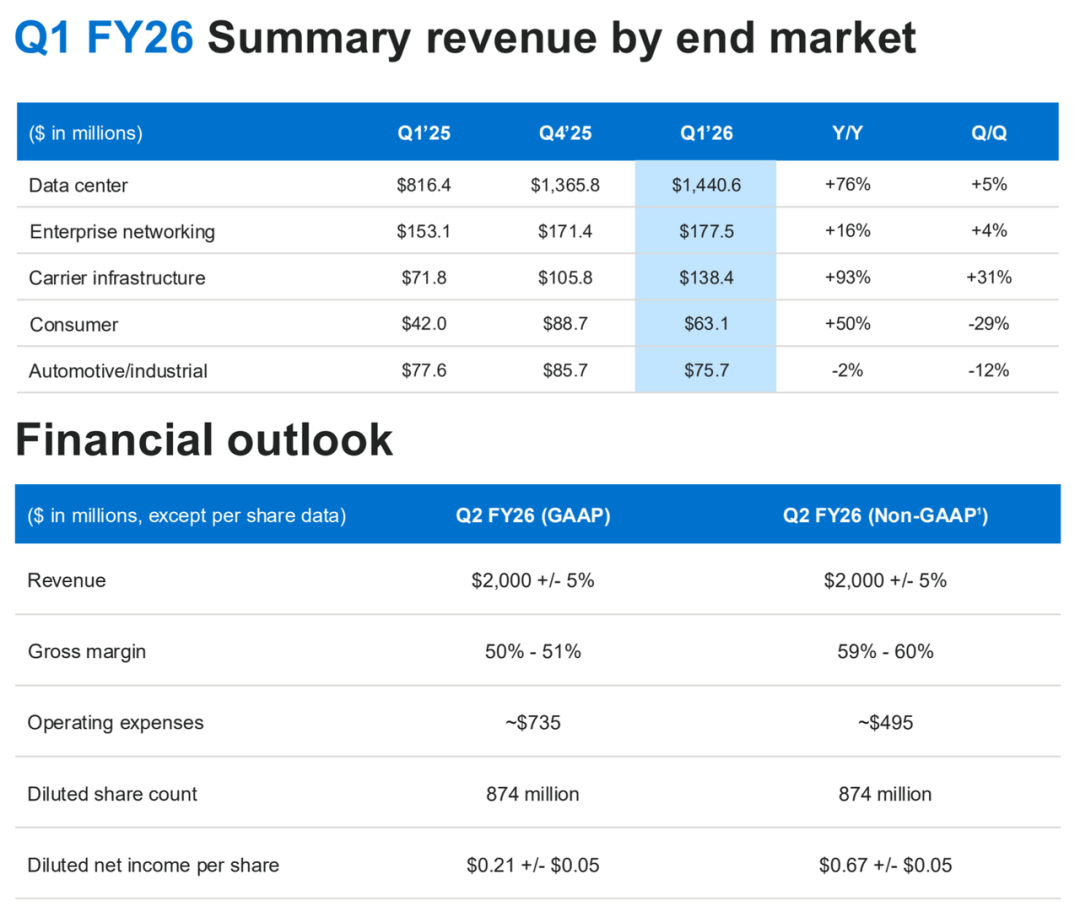

◎ Driven by AI, Marvell Technology reported revenue of $1.895 billion, a 63% year-over-year increase, setting a new record and surpassing the previous guidance midpoint by $20 million.

◎ On a GAAP basis, the company reported net income of $177.9 million, or $0.20 per diluted share, while non-GAAP net income stood at $540 million, or $0.62 per diluted share.

◎ In terms of gross margin, GAAP gross margin was 50.3%, and non-GAAP gross margin was 59.8%, slightly lower than the previous quarter.

◎ Operating cash flow amounted to $333 million.

◎ Revenue for the next quarter is anticipated to be approximately $2 billion, with a margin of plus or minus 5%. Non-GAAP gross margin is expected to be between 59% and 60%, and non-GAAP EPS is forecasted at $0.67, with a margin of plus or minus $0.05.

Overall, the company's financial performance remains stable and aligns with market expectations, albeit with a slowdown in sequential growth.

While year-over-year performance is commendable, sequential revenue growth amounted to only $80 million (approximately 4.3%), indicating a relatively muted growth trajectory.

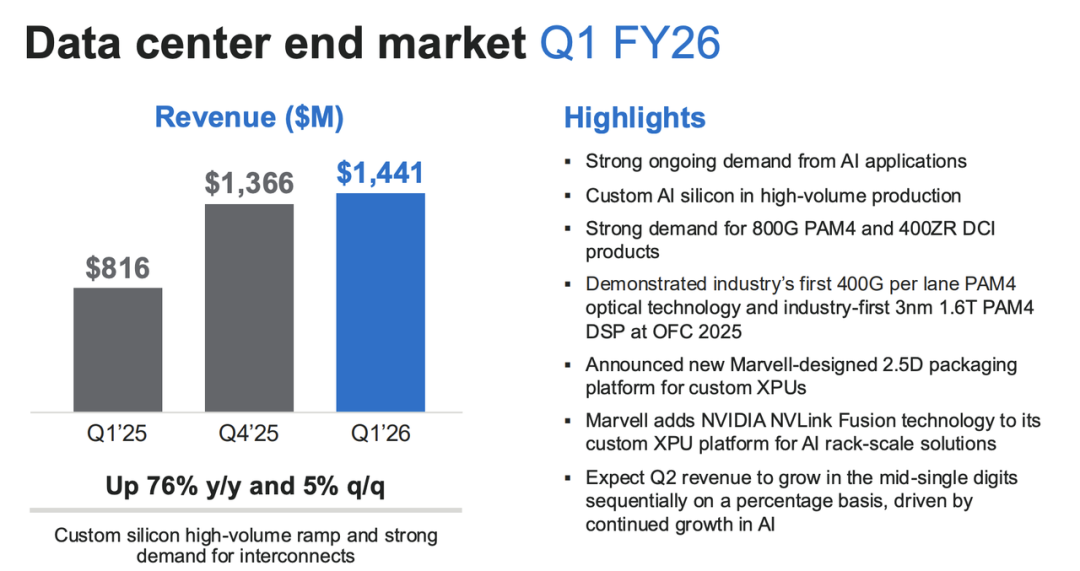

◎ Data center revenue reached $1.44 billion, accounting for 76% of total revenue, but the sequential increase was a mere 5.5%, significantly lower than previous growth rates exceeding $200 million.

◎ AI-related revenue also grew modestly, increasing by only $90 million, as the growth impetus primarily fueled by Amazon Trainium 2 wanes, and growth rates start to decelerate.

◎ Gross margins are also under structural pressure. This quarter's non-GAAP gross margin was 59.2%, a decline of 0.3 percentage points from the previous quarter. The primary reason is that the high-growth custom ASIC business, with its lower gross margin, is diluting overall profit margins as its revenue share increases.

This suggests that as Marvell captures market share in the AI era, it is gradually entering a phase where it is 'trading volume for price' - revenue prospects are promising, but profit margins are coming under pressure.

The growth narrative is also shifting from 'performance delivery' to 'expectation management.' AI remains the primary driver, but the future growth path and sustainability urgently require more convincing narratives to support.

Part 2

Custom AI Chips: Opportunities Amidst Dual Challenges from Customers and Geopolitics

During the earnings call, Marvell's CEO Matt Murphy emphasized multiple times that custom AI chips are a key strategic direction for the company's future, noting that 'we are at the heart of building the transformation of AI infrastructure.'

This assertion holds true. As traditional general-purpose GPUs struggle to meet the differentiated needs of large cloud vendors, custom ASICs, with their efficiency and performance advantages, are emerging as a critical development path for supercloud vendors like Amazon and Microsoft.

This path, while clear, is fraught with challenges. Marvell's AI business heavily relies on a highly concentrated customer base, particularly growth spurred by Amazon's Trainium 2 project.

Looking ahead, the company's growth potential hinges on the successful progression and large-scale deployment of subsequent projects, such as Trainium 3 and Microsoft Maia Gen2. As the Trainium 2 cycle plateaus, incremental growth this quarter has significantly diminished, while new projects are still in the research and development or deployment phases, with uncertain release dates and potential disruptions from factors like order diversions.

This 'project-driven' growth model is highly volatile, and the absence of a seamless transition between new projects will directly result in growth disruptions.

Unlike NVIDIA, which boasts more enticing narratives like 'sovereign AI' and 'startup explosions,' Marvell's custom AI chips are still tethered to the investment pace of core CSPs (cloud service providers).

Given the overall decline in capital expenditures by the four major cloud vendors this quarter, even if Marvell gains more market share through competition, the shrinking total market size remains a fact that cannot be overlooked.

Amidst macroeconomic uncertainty and rationalizing AI investments, dependency on a single customer group makes it exceedingly challenging to achieve 'exceeding expectations' growth in the long term.

The investor day event originally scheduled for June 10, 2023, has been postponed to 2026 due to macroeconomic uncertainty, further intensifying market concerns about the transparency of Marvell's future business. Balancing technological advantages and geopolitical risks, Marvell is treading a delicate line.

Summary

Marvell has chosen the right path. The customization of AI infrastructure is an unstoppable long-term trend, and ASICs will increasingly permeate cloud computing, edge computing, and dedicated AI acceleration scenarios.

With years of deep expertise in Ethernet switching, storage controllers, and chip packaging capabilities, Marvell indeed possesses the core technology and customer base to participate in this transformative shift.