The Commercialization Journey of Robotaxi

![]() 06/06 2025

06/06 2025

![]() 521

521

Produced by Zhineng Technology

With Tesla's entry into the market, anticipation for Robotaxi services has surged, prompting Goldman Sachs to release a report titled "The Road to Commercialization of Robotaxi in China".

Amidst the concurrent advancements in artificial intelligence, perception systems, computing power chips, and policy frameworks, L4 autonomous driving taxis (Robotaxi) are progressing towards large-scale commercialization at a predictable pace.

In China, this transformation signifies not only a technological breakthrough but also a comprehensive reconfiguration of urban transportation systems, regulatory frameworks, travel modes, and even industrial ecosystems.

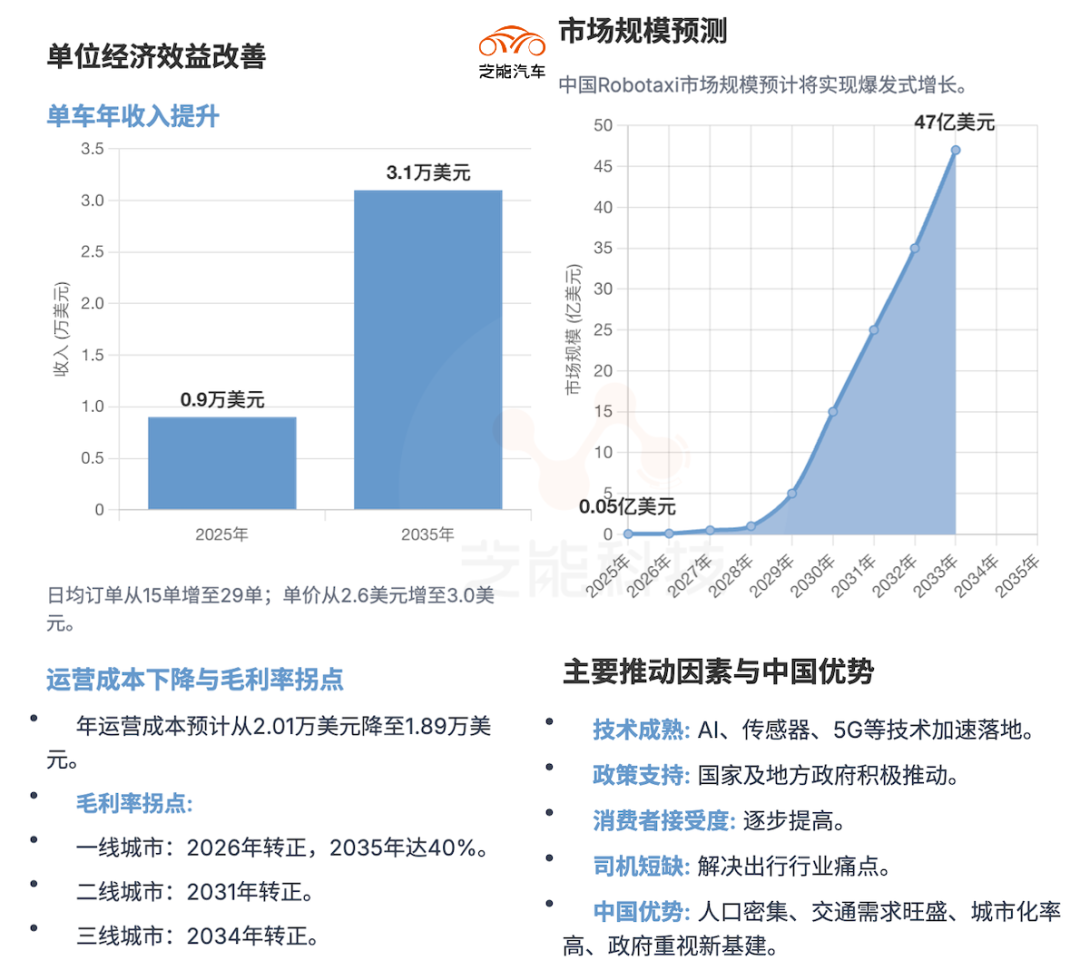

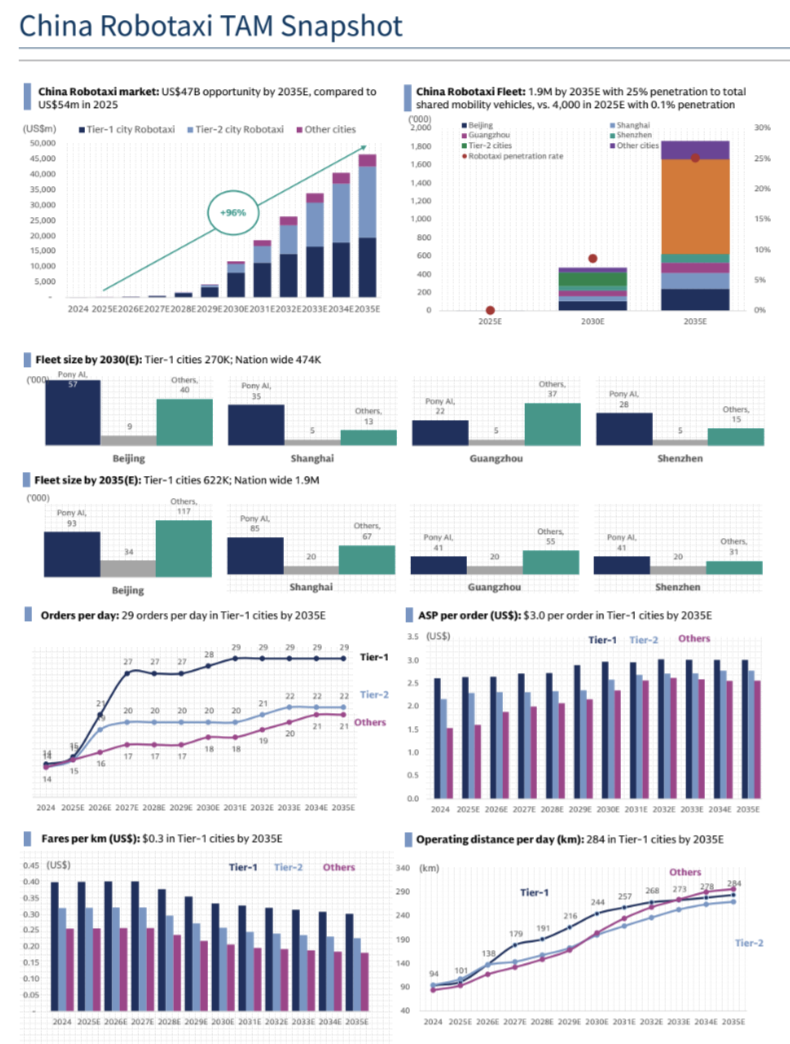

Goldman Sachs projects that the Chinese Robotaxi market will reach $47 billion by 2035. Despite the challenges on the path to profitability, its strategic value cannot be overlooked.

01

From Vision to Reality:

Why is China Leading the Robotaxi Revolution?

Among the myriad paths being explored globally for autonomous driving business models, Robotaxi stands out as the most emblematic and challenging implementation. In China, this model is swiftly transitioning from concept to real-world application.

This rapid progress stems from the convergence of several unique advantages: the rigid travel demand fueled by high urbanization, robust government support for new infrastructure initiatives, and the labor crunch currently plaguing the ride-hailing industry.

According to Goldman Sachs' forecast, by 2030, over 10 Chinese cities will operate 50,000 Robotaxis, with a market size approaching $47 billion by 2035. This growth, from a modest $5.4 million in 2025, is not merely theoretical but tangible.

First-tier cities such as Beijing, Shanghai, and Shenzhen, which grapple with limited transportation resources, high user acceptance of new technologies, and advanced deployment of smart infrastructure, provide an ideal setting for Robotaxi technology validation and commercial trials.

Conversely, the traditional taxi industry faces structural challenges: aging drivers, volatile revenue streams, and limited operating hours. In this context, Robotaxi emerges not just as a technological replacement but as a tool to optimize industrial efficiency.

China's high urban density and complex traffic pose the "toughest global challenge" for autonomous driving technology. Once large-scale deployment is achieved, there is potential to export the Chinese model globally.

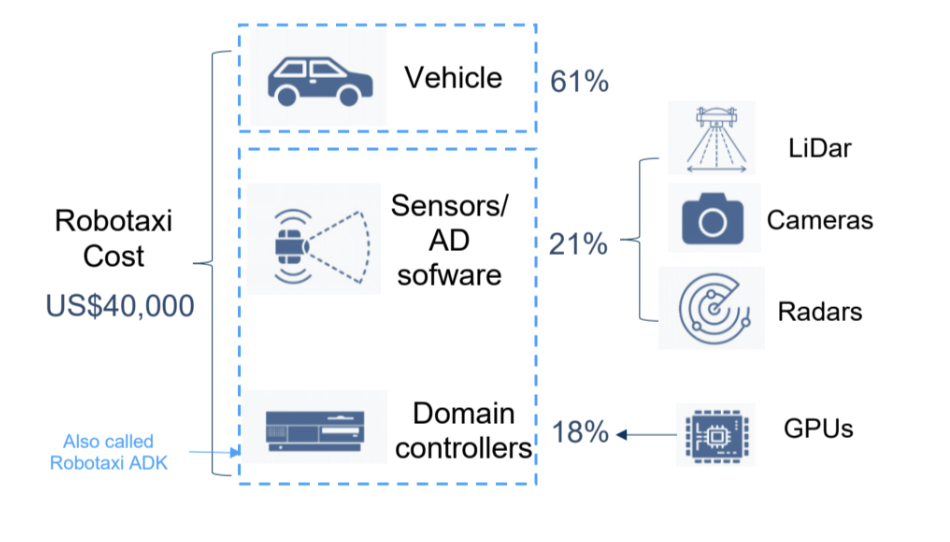

The viability of Robotaxi profitability is the linchpin determining its true commercialization. Currently, this proposition is shifting from "impossible" to "possible," primarily driven by two factors: the rapid decline in hardware costs and exponential advancements in algorithmic capabilities.

Pony.ai's Gen7 platform serves as a prime example. It constructs a 360-degree perception system using 4 lidars, 11 cameras, and millimeter-wave radars, with a computing power platform exceeding 1000 TOPS, enabling robust L4 autonomous driving capabilities.

As expensive lidars enter a cost reduction phase, falling from $10,000 per unit in 2024 to below $5,000 in 2025, with the potential to drop below $2,000 by 2030, prices of other core sensing devices such as cameras, millimeter-wave radars, and computing chips are also declining at a double-digit rate.

Beyond hardware, algorithms have become a crucial determinant of Robotaxi's commercial viability. Companies like Baidu Apollo and Pony.ai have developed extensive "world models" through a combination of real-world road testing and virtual simulations, enhancing the system's responsiveness to extreme traffic scenarios.

Taking Pony.ai as an example, its simulation platform generates millions of diverse traffic scenarios daily, significantly reducing the need for real-world road testing and accelerating iteration cycles. This translates into improved economic benefits per vehicle.

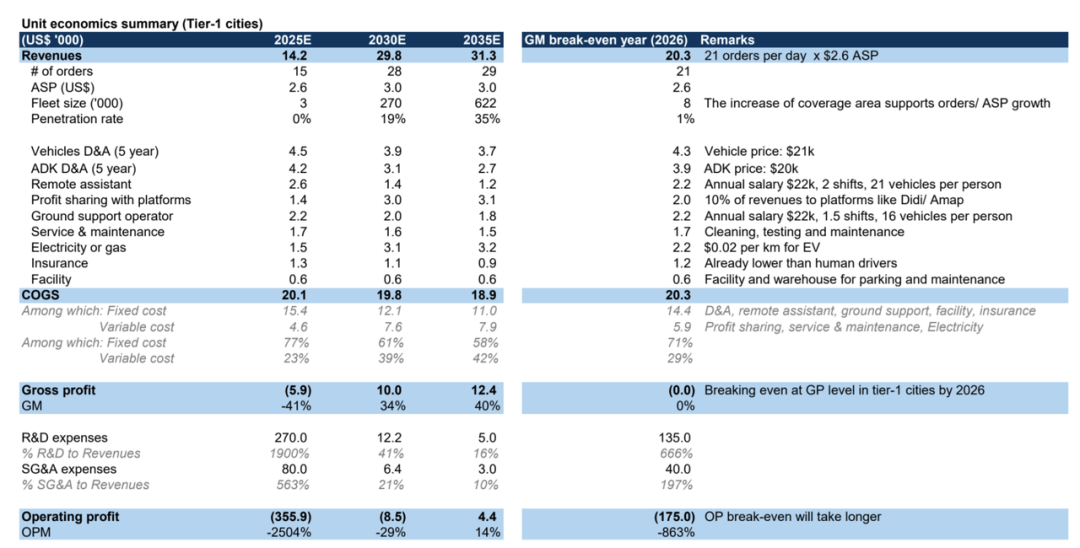

Goldman Sachs data indicates that by 2035, annual revenue for Robotaxi in first-tier cities could reach $31,000, while operating costs will decline from $20,100 in 2025 to $18,900. By then, the gross margin is expected to reach 40%, providing crucial support for a sustainable business model.

02

Policy and Infrastructure:

Laying the Groundwork for Robotaxi Operations

For Robotaxi to truly embark on the commercialization highway, it relies on the dual impetus of policy and infrastructure.

In recent years, the Chinese government has consistently released policy dividends in the field of autonomous driving. As early as 2022, the 14th Five-Year Plan included intelligent and connected vehicles as a key focus for digital economy development. In 2023, the Ministry of Transport and three other ministries jointly issued road testing management measures, explicitly supporting the commercial pilot operations of L4 vehicles in designated areas.

Cities like Beijing and Shenzhen are at the forefront, granting full driverless testing rights, designating commercial pilot zones, and clarifying accident liability, thereby clearing legal obstacles for Robotaxi. For instance, Shenzhen allows Robotaxi to operate without safety officers in the core area of Nanshan District, while Beijing's Yizhuang District provides a 225-square-kilometer enclosed operating area.

Beyond technology, infrastructure is indispensable. Robotaxi relies on high-precision maps and V2X (vehicle-to-everything) support, with this "soft infrastructure" determining the system's environmental understanding and real-time response speed. Currently, Baidu, Gaode, and others have achieved map coverage of major cities and integrated 5G communication, while Wuhan, Changsha, and other cities are deploying smart traffic lights and roadside sensing units to enable coordinated control between people, vehicles, and roads.

Robotaxi typically adopts electric drive forms, making it more reliant on charging networks. By 2024, the total number of charging piles in China will exceed 8 million, with the proportion of ultra-fast charging networks continuing to rise. Some Robotaxi operators are also collaborating with battery swapping platforms to establish dedicated swapping stations, ensuring an average daily operating time of over 20 hours, far surpassing traditional taxis.

In China, three types of players are deeply intertwined in forming a new travel ecosystem for Robotaxi: operators, vehicle manufacturers, and supply chain vendors.

◎ In terms of operators, Pony.ai and Baidu Apollo undeniably occupy the forefront. The former has deployed over 250 Robotaxis in Beijing, Shanghai, Guangzhou, and Shenzhen, with cumulative road test mileage exceeding 40 million kilometers. The latter operates hundreds of autonomous vehicles through the Apollo Go platform and is rapidly expanding city coverage through the RT6 low-cost model (priced at just $29,000).

◎ In the automotive sector, Tesla, XPeng, GAC, Honda, and others are accelerating their Robotaxi layouts. Tesla plans to launch Robotaxi services in Texas by 2025 and has adopted HW4.0 as its hardware platform. XPeng is collaborating with Didi to develop customized models, aiming to achieve mass production of L4 capabilities.

◎ The supply chain sector has achieved a high degree of specialized division of labor: Hesai Technology has emerged as the world's largest lidar supplier, Horizon Robotics provides a high-computing power platform through the Journey 6 chip, and Will Semiconductor offers high-definition camera solutions for the system. The trend towards ecosystem-wide collaboration is evident, with conditions in place for rapid scale replication.

However, this does not guarantee perpetual prosperity. Autonomous driving is a high-input, high-risk, long-cycle endeavor, and the few enterprises that can truly endure until the profitability threshold will inevitably possess the "three forces" of capital, technology, and resources.

As the benefits of scale gradually materialize, leading players will also experience a leap in their ecological niche, evolving from mere travel service providers to comprehensive urban transportation platforms.

Summary

The development trajectory of Robotaxi in China serves as both a microcosm of the technological industrialization process and a window into the intelligentization of urban transportation. From technological evolution to policy guidance, from infrastructure to profit models, every step underscores that Robotaxi is not a "false proposition" but rather an "ongoing process" of progress and innovation.