AI Wars: Google's Struggle for a Comeback

![]() 06/09 2025

06/09 2025

![]() 569

569

In 2025, the AI landscape is ablaze with intense competition.

OpenAI's GPT-4.5 is capable of autonomous programming, Microsoft Copilot is revolutionizing office ecosystems, Anthropic's Claude 4 excels in long-text reasoning, and DeepSeek leads the pack with its architectural innovations.

However, in this race that will shape the future, Google, once the undisputed king, has gradually faded into the background.

Three years ago, Google was the unchallenged leader in AI: the creator of the Transformer architecture, the brain behind AlphaGo, and the mastermind of DeepMind and Google Brain.

Now, its Gemini large model has failed to make the same impact as ChatGPT, earning criticism for "lack of innovation," "bureaucratic sluggishness," and "strategic indecision."

At Google I/O on May 21, the company announced a series of AI-related products and initiatives, but many of these are still in beta or pre-launch stages, awaiting user validation.

Compared to ChatGPT's groundbreaking progress with each upgrade, Google's AI advancements seem like a forced attempt to catch up, prioritizing quantity over quality.

Wedbush analyst Daniel Ives believes that Gemini's progress helps narrow the gap with OpenAI, but other analysts argue that the event was more of an integration and upgrade of existing features, lacking standout innovation.

How did Google, once on par with OpenAI, fall from the pinnacle of AI to become a follower?

Looking back at the history of AI development, Google's name has been synonymous with numerous groundbreaking breakthroughs.

In 2012, Google's neural network spontaneously identified a cat in a YouTube video, marking the dawn of the deep learning revolution. In 2016, AlphaGo defeated Lee Sedol, the world Go champion, while OpenAI was still in its infancy. In 2017, the Transformer model architecture proposed by Google researchers became the cornerstone of almost all subsequent large language models.

Google, with its numerous AI research achievements, once attracted top global AI talents like Geoffrey Hinton.

But in the unpredictable game of chess, there are no eternal winners.

As Google basked in its past glory, the advent of ChatGPT at the end of 2022 shattered this status quo.

ChatGPT's conversational abilities far surpassed all previous Google AI products, amassing over 100 million monthly active users in a short period, catching Google, which has always proclaimed "AI First," off guard.

Faced with OpenAI's offensive, Google hastily launched the large language model application Bard in early 2023, but it stumbled out of the gate. Forced into the limelight under pressure, the chatbot made a rookie mistake during its debut, causing Google's stock price to plummet 8% in a single day, erasing $105.6 billion in market value. The subsequent Gemini model also faced controversy due to allegations of racial discrimination.

Fast forward to 2025, Google held its developer conference, essentially reshaping its entire AI business. But to some extent, this was more of a "please" to investors – even if OpenAI is powerful, we can quickly catch up in a short period.

Upon closer examination of the conference details, it's evident that most products seem more like reactive catch-ups rather than proactive innovations.

Following OpenAI's upgrade of Imagen 4, users noted that the generated images were not as natural as those of its predecessor. Competing with Apple by making AI glasses Android XR, but Project Aura has yet to be sold, and its actual effect remains to be seen. The move to integrate AI Mode and AI overview into search engines came two years after Microsoft's Microsoft Bing. Gemini 2.5 Pro Deep Think, similar to DeepSeek's Deep Think R1, is in beta and only available to invited users.

It seems that every product announced at Google I/O 2025 bears the shadow of existing AI applications on the market.

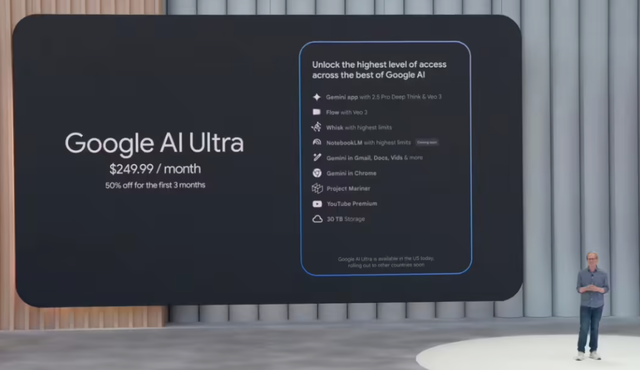

Moreover, while various AI products have yet to gain a firm footing, Google simultaneously launched an AI Ultra monthly subscription plan with a fee of $249.99 (approximately RMB 1,800), higher than ChatGPT Pro's monthly fee of $200. Google's all-in-one plan, which bundles features like Veo 3, Deep Think, and Project Mariner, forces users who only need a single function to pay an expensive full-suite subscription fee.

In other words, half of the series of AI applications announced by Google cannot be evaluated, and half require paid purchase, leaving little for ordinary users to experience.

On the day of the conference, Google's (Nasdaq: GOOGL) stock price fell 1.54% to close at $164.98 per share, with a total market capitalization of $1.99 trillion.

Clearly, investors do not seem to be overly impressed with this story either.

Faced with a fiercely competitive AI landscape, Google was initially slow to respond and later panicked, revealing its desperation to catch up quickly.

But was its downfall accidental? No.

Signs of Google's failure were already evident at the organizational and strategic levels.

To some extent, this is a common problem for large companies. Compared to startups and unicorns that focus on a single sector, Google's AI moves are more cautious, and caution means slowness and falling behind.

Why is Google, with its top-notch research team and abundant funds, still struggling?

A significant reason is that it dare not revolutionize itself.

80% of Google's revenue comes from advertising, with providing ad placements based on search engine results being its strongest cash flow business. In 2024, Google Search generated over $198 billion in revenue, accounting for nearly 60% of Alphabet's annual revenue.

However, this cash cow has faced unprecedented challenges in the AI era.

AI search essentially replaces users' need to click on links on the search page by directly generating results. After reading the answer, users no longer need to click on links, significantly reducing ad impressions and clicks. Merchants who need traffic exposure are naturally unwilling to continue cooperating with Google Search.

Therefore, to protect itself, Google, which has always been hesitant to fully promote AI search, watched as Microsoft Bing and ChatGPT seized the initiative, even allowing new players like Perplexity AI to enter and erode its search market.

In addition to strategic conservatism, the bureaucracy within the research team, leading to factionalism and resource fragmentation, is also to blame.

Google's two top AI research teams, Google Brain and DeepMind, rarely collaborate or share code, severely hindering the effective integration and rapid output of AI capabilities.

Although both belong to Alphabet and aim to advance AI, they have significant barriers in culture, technology stack (such as preferences for TensorFlow and PyTorch), research focus, and even code sharing mechanisms. Rather than a cohesive unit working together, they resemble independent kingdoms fighting their own battles.

Although the two teams merged into Google DeepMind in April 2023, previous strategic indecision and factionalism have led to the most critical factor in Google's defeat: strong research but no killer products.

Early on, Google's strategic slogan "AI First" was disconnected from actual actions and did not truly penetrate into products and business lines. The Transformer architecture it proposed was used by OpenAI for GPT, while Google failed to launch a product of equal influence.

Moreover, the 2025 developer conference appears to be Google's last-ditch effort, lacking focus and disruptive innovation. Among formidable competitors like ChatGPT and DeepSeek, whether the upgraded Gemini Google all-in-one package can stand out and regain market favor and recognition remains to be seen through practical testing.

It's worth mentioning that not only in AI but also in the search market, Google's dominant position has been challenged over the past decade. Since 2015, the myth that Google Search's market share has never fallen below 90% has been broken. In the last three months of 2024, Google Search's market share was 89.34%, 89.99%, and 89.73% respectively.

This perhaps explains why Google densely released AI products and made drastic reforms and innovations at this developer conference.

Because if Google doesn't make a move soon, it will be too late.

Can Google's efforts successfully make a comeback?

The answer is uncertain, as it has stumbled at almost every step in the first half of the AI race.

Bard's initial poor performance and significant gap with ChatGPT failed to win widespread recognition from users and the market. The seemingly formidable Gemini series models have actually caused considerable controversy in practical use, with the image generation feature being forced offline due to racial bias. Within Google, product lines such as search, Android, and cloud services operate independently, making it difficult for the AI team to integrate, and its commercialization path is not as clear and effective as Microsoft's collaboration with OpenAI.

Facing the fierce offensive from new forces like OpenAI and Anthropic, Google's lack of strength has directly led to the erosion of its competitiveness in multiple key areas.

On the one hand, there is a lack of unity within the organization, and the attractiveness of AI talent has relatively declined. Core talents choose to leave, either joining more dynamic and imaginative startups like OpenAI or starting their own ventures. DeepMind co-founder Mustafa Suleyman joined Microsoft after founding Inflection.

On the other hand, the aura of technological leadership has faded. After the rise of generative AI, Google has gradually lost its voice. The latest data from financial data firm Ramp shows that as of April 2025, 32.4% of American companies have paid subscriptions for OpenAI tools, while Google AI's subscription volume is only 0.1%.

The departure of talent and decline in reputation have directly led to a lagging developer ecosystem. OpenAI quickly built a large and active developer ecosystem by opening API interfaces and actively supporting developers, spurring a plethora of innovative applications based on GPT models. In contrast, Google was slower to act and failed to form an ecosystem of the same level. High paywalls and limited openness further weakened the enthusiasm of developers and users.

It's not hard to see that Google's downfall in the current AI war did not happen overnight and was not caused by a single factor. Rather, it is the result of multiple factors resonating, including its inherent "big company disease," long-term strategic indecision, and failure to effectively integrate internal innovation potential.

The heavy historical burden makes this technology giant struggle to quickly adjust its course when faced with emerging forces like OpenAI and Anthropic that are focused and highly executable.

But in the AI era, there are no eternal winners.

For Google, a temporary defeat is both a wake-up call and perhaps an opportunity for rebirth. As the elder brother with profound technical expertise, an excellent talent team, and abundant financial strength, if Google can learn from its mistakes and fundamentally carry out profound organizational and strategic adjustments, it still has a chance to make a comeback in the second half of the AI competition.

The biggest challenge it faces lies in whether it can truly overcome the "innovator's dilemma" by boldly embracing disruptive innovations that may upend itself while maintaining the stability of existing businesses.