Roborock Faces Revenue Growth Without Profitability: A Dilemma

![]() 06/09 2025

06/09 2025

![]() 728

728

Written by Zhu Tianyu / Artwork by Ren Yingying

On June 6, Roborock unveiled its plans to list on the Hong Kong Stock Exchange.

While the announcement came as a surprise, it had long been anticipated. This company, initially known for its robot vacuum cleaners, witnessed its overseas revenue surpass domestic revenue for the first time in 2024, totaling 6.388 billion yuan. Overseas markets have now emerged as its primary source of income.

However, the capital market's response was underwhelming. In February 2020, Roborock's closing price on its first day of listing was 500.10 yuan. By June 2021, its share price had soared to 1,494.99 yuan, hitting an all-time high. Yet, as of June 6, 2025, Roborock's share price stood at 222.70 yuan.

Previously, Roborock founder Chang Jing reduced his shareholding to cash out nearly 900 million yuan while urging investors to "be patient," a move that provoked widespread dissatisfaction among shareholders.

At the heart of this controversy lies Roborock's sluggish growth in the domestic market. During the initial phase of the 2025 618 shopping festival, Roborock's robot vacuum cleaner sales surged 57% year-on-year, and floor-washing machine sales grew by over 10 times. Nonetheless, just as the promotional fervor began to wane, another "price blunder" occurred.

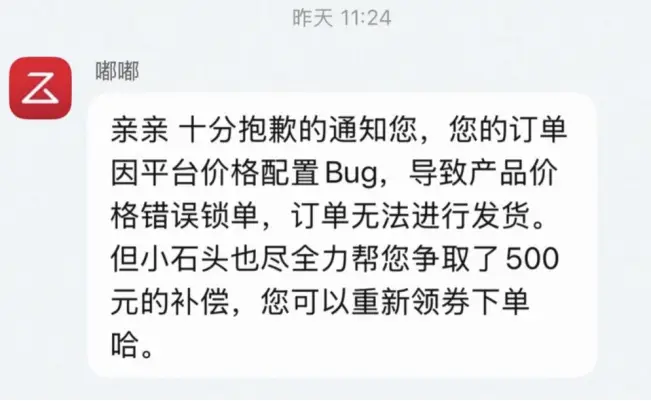

After some consumers snapped up products originally priced at 5,000 yuan at a "discounted" price of 1,000 yuan, their orders were abruptly canceled, and they were only compensated with a 500-yuan Taobao platform voucher. A similar scenario unfolded during last year's 618 shopping festival.

01 Trust Breach Behind the 'Price' Error

At the outset of this year's 618 shopping festival, Roborock delivered impressive results.

From May 12 to June 1, online sales of Roborock's robot vacuum cleaners increased by 57% year-on-year, while floor-washing machine sales soared by an astonishing 1,064%, far exceeding the industry average.

Consumers exhibited a particular fondness for the G30 Space Exploration Edition, which can "extend its arm." This product, equipped with a five-axis folding bionic manipulator, was hailed by The Verge at the CES exhibition earlier this year as "redefining the future of intelligent cleaning."

However, the popularity of the promotion could not conceal operational flaws. On the evening of May 16, in Li Jiaqi's live streaming room, the P20 Ultra mopping and vacuuming robot, originally priced at 5,499 yuan, was listed at 1,000 yuan, prompting a rush of orders. However, just a few hours later, these orders were forcibly canceled due to a "price configuration error."

Angry consumers were only compensated with a 500-yuan platform voucher. This marked the second consecutive year that Roborock encountered a similar scenario during a major sales event.

Was it a technical glitch or a marketing stunt? It's impossible to verify from the outside. Nonetheless, repeated price controversies are eroding the cornerstone of consumer trust.

02 Behind Increasing Revenue Without Profit Growth

Roborock's first-quarter report for 2025 reveals that behind the 86.22% revenue growth, net profit declined by 32.92%. This trend of "growing in size but not in profitability" has persisted for three quarters.

Even more alarming is the inventory data: Inventory in the first quarter of 2025 reached 2.587 billion yuan, a 195.32% increase from the same period in 2024, with products piling up in warehouses.

Currently, Roborock's operating cash flow has turned negative for the first time, signaling tight capital chain pressures.

Furthermore, changes in the market landscape have exacerbated these pressures. According to a report published by Guanyan Research Network, with the development of the robot vacuum cleaner market, more and more brands are entering the fray, making market competition increasingly fierce.

From 2019 to 2023, the CR5 of the robot vacuum cleaner industry increased from 70% to 93%. As all players jostle in the red ocean, price wars have become the only viable weapon.

The diverted focus of Roborock founder Chang Jing has raised concerns among investors. His Jishi Auto received a $1 billion investment from Weiqiao Group in 2023. On one hand, there are significant investments in the new car-making project, and on the other hand, Chang Jing has reduced his holdings in Roborock twice since its listing, cashing out nearly 900 million yuan.

When shareholders voiced their discontent on Douyin's comment section, "Don't just play with cars," Chang Jing's response was subdued: "The company is in a transitional period of pain."

03 Betting on a Dual-Track Breakthrough

Listing in Hong Kong is a pivotal move for Roborock to achieve a breakthrough. The announcement clearly states that the funds raised by Roborock will be allocated towards international expansion and product research and development.

This choice is inevitable: In 2024, Roborock's overseas revenue accounted for 51.06%, surpassing domestic revenue for the first time.

IDC data indicates that in 2024, Roborock ranked first globally in both sales volume and sales amount for smart robot vacuum cleaners, with a 16% share of the global sales volume market and a 22.3% share of the sales amount market, witnessing a 20.7% year-on-year increase in shipments. Its market advantage is even more pronounced in Germany, Northern Europe, South Korea, and other markets, ranking first in both sales volume and sales amount for multiple consecutive quarters.

As the robot vacuum cleaner market nears saturation, Roborock needs additional pillars to support its future growth. In 2023, Roborock launched its washing and drying machine, positioning it internally as a "dual-wheel drive" business equally important to robot vacuum cleaners.

Xie Haojian, CEO of Roborock's washing machine BU, explained that they genuinely believe the washing machine market, with its tens of billions in scale, can offer ample opportunities for the enterprise. Moreover, in recent years, there has been a growing demand for drying functions. For instance, this year, the south has experienced continuous rainfall, making it difficult to dry clothes naturally. This is where the drying function comes in handy.

However, this path is fraught with formidable competitors. Traditional giants like Haier, Little Swan, and Midea dominate the market. Liu Buchen, a home appliance industry analyst, pointed out, "In the race for washing machines and drying machines, there are numerous powerful players, and Roborock does not have a significant advantage."

Conclusion: Roborock Must Break Free From Gravity

As of 2024, Roborock's products have entered over 170 countries and regions worldwide, serving more than 15 million households. Meanwhile, Chang Jing's Jishi Auto production line has commenced operations at the BAIC manufacturing base in Qingdao.

On one hand, Roborock is consolidating its existing advantages, and on the other hand, it is expanding into uncharted territories. Listing in Hong Kong has opened up international capital channels for Roborock, but what investors truly anticipate is how Chang Jing will balance the foundation of his "robot vacuum cleaner" empire with the ambition of his car-making dream.

As one user commented in the G30 Space product review, "When the manipulator picks up my socks from the floor, I hope its creator doesn't lose sight of their original intentions."

Corporate transformation is akin to space exploration, requiring both the courage to break free from gravity and a continuous supply of fuel.

END