Kuaishou's Dual Faces of Keling AI

![]() 06/10 2025

06/10 2025

![]() 696

696

Source | BohuFN

Over the past year, AI has significantly grown in importance in Kuaishou's financial reports. In June 2024, Kuaishou officially launched its video generation large model, Keling. By the end of February 2025, Keling AI's cumulative operating revenue surpassed 100 million yuan. In 2025, Keling's commercialization accelerated further, with revenue exceeding 150 million yuan in just the first quarter.

In terms of growth rate, Keling AI has emerged as a new growth engine for Kuaishou. However, when considering Keling's revenue in the context of Kuaishou's overall revenue, taking the first quarter of this year as an example, Keling accounted for less than 1% of Kuaishou's total revenue.

Therefore, while Kuaishou's "AI content" is on the rise, what the company values most is clearly not just short-term economic benefits. Keling serves more as an "ecological seed" planted by Kuaishou. Its current focus is on transforming technological advantages into real commercial barriers, helping Kuaishou "change its way of life" amidst fierce competition among large companies.

01 Kuaishou Accelerates Its AI Push

According to Kuaishou's Q3 2024 report, Keling served over 5 million users, with monthly commercialization revenue exceeding 10 million yuan. By the first quarter of 2025, Keling's quarterly revenue surpassed 150 million yuan, and its global user base had grown to over 22 million.

In the past six months, Keling's revenue surged from 100 million yuan in half a year to 150 million yuan in a single quarter, tripling its monthly revenue. Additionally, according to Gai Kun, Senior Vice President of Kuaishou, Keling's monthly active user base has grown 25 times.

More importantly, this growth rate is expected to continue accelerating. Multiple investment institutions predict that Keling is expected to achieve monthly revenue exceeding 100 million yuan in the fourth quarter of 2025, with annual revenue projected to increase from 500 million yuan to 700 million yuan.

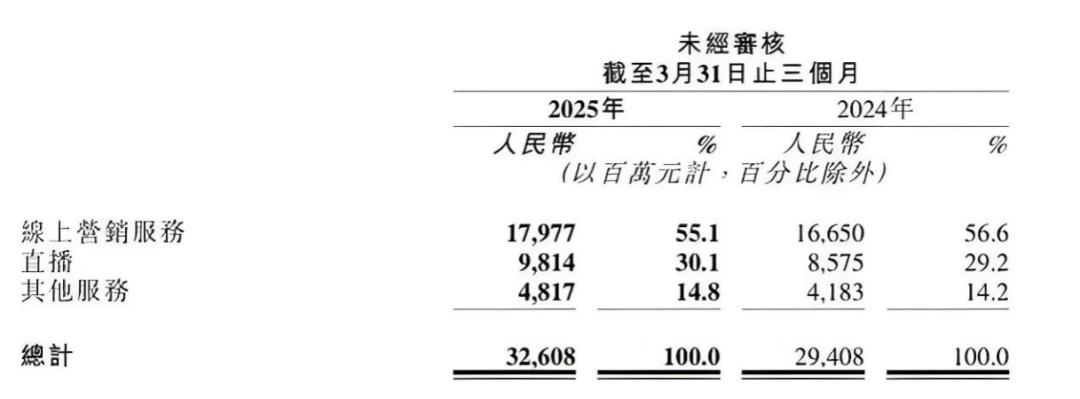

The emergence of Keling has also breathed new life into Kuaishou, which has become increasingly unremarkable in recent years. In the first quarter of this year, Kuaishou's three major business segments—online marketing services, live streaming, and other services (including e-commerce)—generated revenues of approximately 18 billion yuan, 9.8 billion yuan, and 4.8 billion yuan, respectively, representing year-on-year growth rates of 8%, 14.4%, and 15.2%.

(Source: Kuaishou Q1 2025 Report)

It is evident that Keling's revenue growth rate has far outpaced other businesses. With this "growth engine" in place, the capital market has also responded positively.

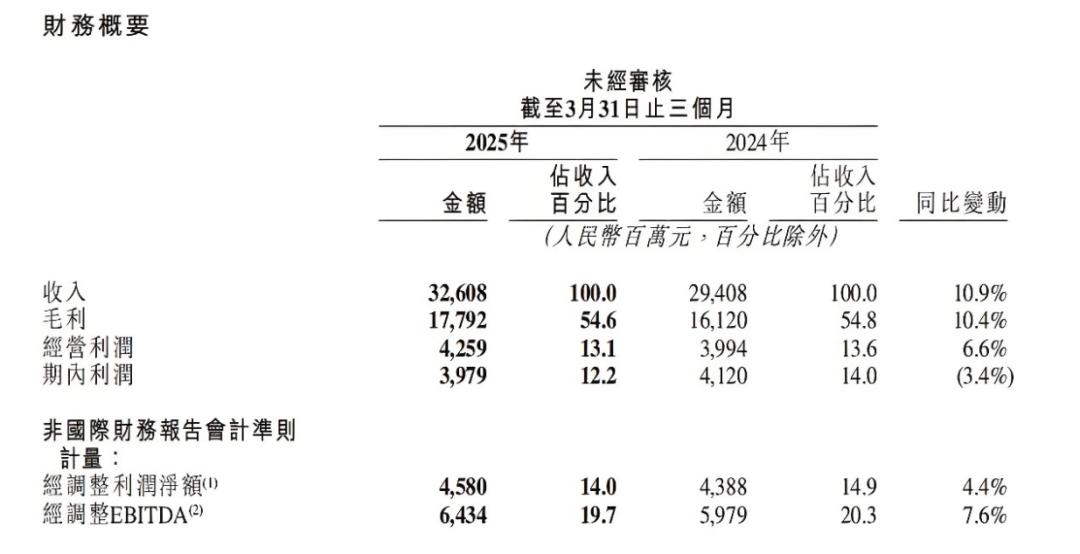

Although Kuaishou's first-quarter performance was not particularly impressive, with total revenue of 32.608 billion yuan, a year-on-year increase of 10.9%; profit during the period of 3.979 billion yuan, a year-on-year decrease of 3.4%; and adjusted net profit of 4.58 billion yuan, a year-on-year increase of 4.4%, Kuaishou's share price has continued to rise on multiple trading days since then.

(Source: Kuaishou Q1 2025 Report)

However, multiple investment institutions have also noted that their judgment on Kuaishou's sustained growth is predicated on Keling maintaining its technological lead in terms of iteration, user growth, and commercialization depth.

In other words, if Kuaishou wants to maintain its advantage as an "AI engine," it must commit to an unyielding "arms race." In April this year, according to LatePost, Kuaishou established the Keling AI Business Department and elevated it to a first-tier business department alongside its main site, commercialization, e-commerce, internationalization, and local life businesses.

After Kuaishou further allocated resources, Keling's iteration speed significantly accelerated. Since the release of version 1.0 in June last year, the Keling AI model officially launched version 2.0 in April of this year.

A month later, the Keling AI model released version 2.1, which can be described as "faster, stronger, and cheaper." For instance, the high-quality version of Keling 2.1 is already comparable to the Keling 2.0 master version, but its price has been reduced by 65%, achieving more without increasing the cost.

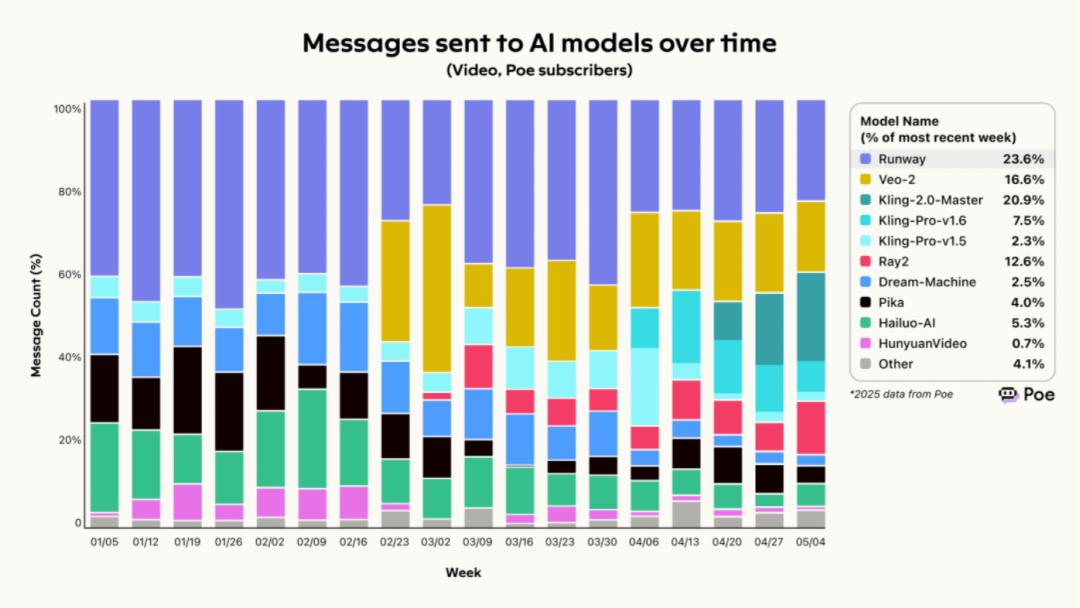

According to data released by Poe, a global large model integration application platform, the usage share of Kuaishou's Keling series of video generation large models has exceeded 30%, surpassing Runway in second place (23.6%) and killing-2.0-master in third place (20.9%), becoming a formidable competitor in this category.

Various signs indicate that Kuaishou has already accelerated its AI push, even showing a commitment to "going all in on AI." However, when Keling was first launched in June last year, sources close to Kuaishou revealed that there were no immediate plans for Keling AI's commercialization. So why has Kuaishou become more urgent now?

Growth and competition are also perennial topics for Kuaishou. From a growth perspective, Kuaishou's revenue growth has continued to slow down in recent years, with the revenue growth rate in the first quarter of this year hitting a new low.

At the same time, Kuaishou's user growth has also hit a ceiling. In the first quarter of this year, Kuaishou's monthly active users were 712 million, a year-on-year increase of 2.1%, but compared to the fourth quarter of last year, when monthly active users were 736 million, there was a decrease of 3.26% quarter-on-quarter. This means that many users attracted by Kuaishou's e-commerce and local life subsidies last year quickly left, indicating weak user stickiness.

For Kuaishou, its advertising and e-commerce businesses are essentially traffic-driven, with low barriers to entry. Once the traffic pool stagnates or even declines, Kuaishou's advantages in these two areas are not evident.

Therefore, Kuaishou must keep up the pace, using AI to secure its position in the short video world, attracting creators with smarter tools, and retaining users with richer content. Cheng Yixiao's statement that "AI is the second growth curve" is not just rhetoric.

02 The "Ecological Blueprint" Nurtured by Keling

Today, Keling has successfully integrated into the entire Kuaishou ecosystem, becoming a crucial link connecting content creators, merchants, and advertisers.

On one hand, it contributes to Kuaishou's content ecosystem. Keling focuses on Kuaishou's most advantageous video track, allowing video users to turn "fun" into "content," enabling the content ecosystem to form a positive cycle and further "feed" the content pool.

Keling integrates AI's underlying recommendation algorithm, which can automatically learn various types of content and user preference attributes, and improve user activity and usage duration through advanced reasoning, recommendation, and matching. As of April 2025, Keling had generated 168 million videos and 344 million image materials.

On the other hand, it brings value to Kuaishou's marketing service customers. In the first quarter of this year, Kuaishou announced the revenue composition of Keling, with P-end (creator-end) paid subscription members contributing nearly 70% of the operating revenue.

P-end members primarily include professional users such as self-media video creators and advertising and marketing practitioners, who regard Keling as an essential tool to enhance productivity and thus have a higher willingness to pay. This results in a higher growth rate of Keling's ARPU value and serves as the driving force behind the rapid growth of Keling's C-end subscription revenue.

Cheng Yixiao said that according to Kuaishou's internal estimates, the AI large model is expected to reduce customers' short video marketing material production costs by 60-70% or even higher, which drove the daily average advertising consumption of Kuaishou's AIGC marketing materials to reach 30 million yuan in the first quarter.

Furthermore, Keling can complement other AI tools, deeply integrating Kuaishou's AI capabilities with its core businesses, particularly in the two pillar businesses of e-commerce and advertising.

In online marketing services, the digital human live streaming room "Nuwa" has significantly improved live streaming room conversion rates after gaining real-time interaction capabilities. In e-commerce scenarios, Kuaishou has also launched a series of intelligent business products, such as intelligent customer service "Kuaiyu," intelligent broadcasting tools, and fully automatic UAX product delivery, further helping merchants reduce costs and increase efficiency.

It is evident that Kuaishou's AI capabilities can bridge the gaps between different businesses, enabling synergy and efficiency, driving the core advertising revenue "internal cycle + external cycle" dual flywheels to operate faster.

In terms of internal cycle advertising, AI technology can significantly lower the marketing threshold for small and medium-sized merchants. An increase in participation from small and medium-sized merchants can also drive growth in advertising revenue. According to Kuaishou's Q1 2025 report, its e-commerce GMV increased by 15.4% year-on-year, and the number of newly registered merchants increased by over 30% year-on-year.

In terms of external cycle advertising, AI technology has significantly improved the efficiency and effectiveness of advertising delivery. In 2024, Kuaishou's online marketing service revenue increased by 20.1% year-on-year to 72.4 billion yuan. Kuaishou pointed out that external cycle marketing services were the main driver of growth in the company's online marketing service revenue.

Lastly, Keling can also generate revenue to support itself. Currently, Keling has officially launched a membership fee model for C-end (user) and an API subscription model for B-end (enterprise).

Among them, Keling has served over 10,000 B-end enterprise customers, including Xiaomi, Alibaba Cloud, and BlueFocus. These enterprise customers have a high renewal rate and are an important foundation for Keling's commercialization.

However, it should be noted that Keling's paid subscription business is primarily dominated by P-end customers. While this group has a higher willingness to pay, they are also highly price-sensitive. Unlike the loyalty of "Lao Tie" (Kuaishou's user base), once other platforms initiate price wars, these users may migrate quickly.

Similarly, as market competition intensifies, the bargaining power of B-end enterprise customers will also continue to increase. Therefore, Keling needs to prove itself not only through technology but also through broader ecological support and higher service standards.

03 From "Useful" to "Irreplaceable"

Today, Keling almost embodies all of Kuaishou's "imagination" for the next stage. However, while impressive, Keling has not yet reached its "Sputnik moment." Transforming technological advantages into commercial barriers is the key to Kuaishou's next move.

Firstly, the research and development (R&D) and implementation of Keling face the challenge of a limited time window. Currently, there are too many players in the field of video large models, and the industry landscape remains volatile. The window of technological leadership for Keling may be shorter than expected.

Over the past three years, Kuaishou's R&D investment has continued to decrease. However, in the first quarter of this year, Kuaishou increased its R&D expenditure by 16% year-on-year to 3.298 billion yuan.

This also means that if Kuaishou wants to maintain technological leadership, it must continue to increase AI-related capital expenditures. Every coin has two sides, and Keling is no exception.

But for Kuaishou, maintaining "cost control" while maintaining a leading edge will be a significant challenge. It must demonstrate far greater capital determination and organizational endurance to face this challenge.

Secondly, Kuaishou needs to build a brand moat. Currently, Keling can indeed exhibit certain uniqueness within the Kuaishou ecosystem, but without the support of the platform ecosystem, Keling's business model does not have a high threshold.

Therefore, for Keling to stand out among numerous competitors, it needs not only technological advantages but also a comprehensive set of ecological business strategies. This requires Kuaishou to continuously expand its capability boundaries, creating a complete closed loop for users from creative conception, content generation, publishing and promotion, to commercial monetization, in order to shape brand reputation and transform it into a core competitive advantage that attracts users.

Lastly, Kuaishou also faces the challenge of integrating and balancing "AI Lao Tie" and "traditional Lao Tie." In the wave of live e-commerce, Kuaishou has supported trillions of GMV with its unique "Lao Tie economy" and advantage in the sinking market.

In this process, the authenticity and familiarity brought by Lao Tie have become Kuaishou's "persona," but this type of content with emotional connections is naturally contradictory to content generated by AI based on algorithms. Therefore, as Keling AI gradually permeates the platform, how Kuaishou maintains the "human touch" of its content is another test for the "Lao Tie economy."

Currently, Kuaishou has deeply embedded Keling, this "wedge," into the capillaries of the platform ecosystem. The large model technology has not only begun to support the three major businesses but also opened up new growth channels for the platform through content-driven innovative development models.

Nevertheless, as Kuaishou intensifies its push into the realm of AI, certain platform deficiencies have started to surface. In contrast to other major corporations, Kuaishou has encountered a more noticeable growth plateau in recent years, compounded by a relatively underdeveloped technological foundation. AI represents Kuaishou's bold "all-in" strategy, as well as an "unforeseen boon."

Ultimately, the resurgence of the so-called "Lao Tie economy" hinges not merely on the number of models introduced and the level of technological prowess, but also on its ability to forge a cohesive "ecological chain" linking content creation, e-commerce transactions, and local life.

In today's fiercely competitive AI era, it's a contest of overall strength. Kuaishou aims for both "speed" and "stability." Discovering the optimal "way of life" that suits its unique circumstances is paramount.

The cover image and accompanying visuals in this article belong to their respective copyright holders. Should any copyright holder deem their work unsuitable for public viewing or unwilling to grant free usage, please contact us promptly, and the platform will promptly rectify the situation.