The Chess Game Between China and the US in the AI Fog of the Middle East

![]() 06/12 2025

06/12 2025

![]() 485

485

On May 15, 2025, beneath the golden dome of Abu Dhabi's palace, President Trump stood alongside UAE President Mohammed. Trump proudly held aloft an agreement worth $15 billion, announcing that NVIDIA would annually export 500,000 of its most advanced AI chips to the UAE over the next three years.

This scene was but a microcosm of Trump's Middle East tour. Over his four-day itinerary, Saudi Arabia pledged $600 billion over four years, the UAE $1.4 trillion, and Qatar an additional $200 billion, all directed towards AI infrastructure and chip industries, with petrodollars flooding into the AI sector.

Meanwhile, deep in the Saudi desert of Dammam, the Dammam Data Center—established by the Chinese AI enterprise DeepSeek and Saudi Aramco—was debugging a new generation of AI models. Huawei and GBS have also collaborated with Saudi Arabia to build faster, greener, and more reliable all-flash data centers.

Notably, on the same day Trump led an AI delegation, including Musk, Huang Renxun, and Sam Altman, on a high-profile trip to the Middle East, the US Department of Commerce's Bureau of Industry and Security issued a policy banning the use of Huawei's Ascend chips worldwide, including China.

An invisible smoke of AI warfare seemed to be igniting in the Middle East.

But why is the Middle East embracing AI with such fervor? And in this nascent fog of AI, what are China and the US competing for?

One of the most critical factors driving the Middle East's urgent embrace of AI is its own anxiety.

As we all know, the economies of many Middle Eastern countries are heavily reliant on oil exports, and their single-economy structures face significant challenges amidst global energy transitions and oil price fluctuations. Promoting economic diversification and developing non-oil industries have become top priorities for these nations.

AI technology, with its powerful enabling role, is seen by Middle Eastern countries as a new path forward in the post-oil era.

National-level plans, epitomized by Saudi Vision 2030 and the UAE's National AI Strategy 2031, place AI at their cores. The UAE aims to have AI account for 20% of its non-oil GDP by 2031.

The UAE, the most aggressive, has made AI a mandatory course in its 12-year basic education system and purchased ChatGPT plus services for all 10.24 million citizens at a monthly cost of $20, amounting to $2.4 billion annually.

Apart from anxiety, the Middle East itself is fertile ground for AI development.

On one hand, Gulf countries possess vast sovereign wealth funds and abundant national fiscal revenues, capable of providing continuous and large-scale financial support for AI. According to the latest data from Global SwF, a global sovereign wealth fund data platform, as of December 2024, Middle Eastern and North African sovereign wealth funds managed assets worth $5.4 trillion, accounting for 41.2% of global sovereign wealth funds. Six of the world's top ten sovereign funds are from Middle Eastern countries.

On the other hand, AI training and operation are typically energy-intensive industries. Data from the International Energy Agency shows that global data center electricity consumption has grown at a rate of 12% annually over the past five years, and it is projected that energy consumption serving AI will quadruple by 2030. The Middle East's abundant oil and gas resources can provide low-cost and stable energy guarantees for AI, supporting the construction of data centers with over 100,000 chips.

Against this backdrop, a frenzy of AI construction has emerged in the Middle East.

In 2017, the UAE pioneered the world's first ministerial position for AI and launched the UAE Artificial Intelligence Strategy 2031 in 2021. In 2023, the UAE deployed the 'Condor Galaxy' global AI supercomputing network through the G42 Group, with a total computing power of 36 ExaFLOPS. Early in 2025, Saudi Arabia planned an AI data center park in Neom, the future city, with funding of $5 billion. The center is planned to have a computing power of 1.5 gigawatts, fully powered by renewable energy, and is expected to be operational by 2028.

However, as AI investment and construction progressed in full swing in the Middle East, the US could not remain idle.

Trump's ban on Huawei's Ascend chips filled the Middle Eastern AI battlefield with the smoke of great power rivalry.

As the Art of War states, "Terrain is an aid to the soldier. To estimate the enemy, win battles, and calculate dangerous and difficult distances is the way of a superior general. Those who know this and apply it in battle will surely win; those who do not know this and apply it in battle will surely lose."

The Middle East, this land connecting East and West and controlling the energy chokepoint, is rapidly emerging as a vital battleground in the global AI landscape, leveraging its substantial capital, abundant energy, and geopolitical hub status.

Just 24 hours before Trump's plane touched down in Riyadh, the White House urgently repealed the Biden administration's Artificial Intelligence Export Control Framework. This policy had placed 120 countries, including Saudi Arabia and the UAE, on a 'Tier 2' control list, strictly limiting the export of high-end chips.

Behind this abrupt policy change lies the US's fear of China's AI development.

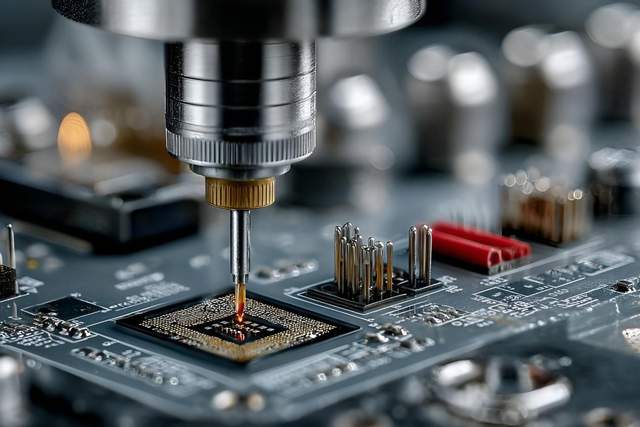

Ascend chips can already rival NVIDIA graphics cards and are priced lower. The combination of Huawei's Ascend 910C and its self-developed MindSpore has become a Chinese standard capable of competing with 'NVIDIA H100+PyTorch'.

Once the Middle East turns to Chinese chip alternatives, it will be difficult for the US to penetrate this strategic market.

This is why President Trump urgently mobilized an AI delegation including NVIDIA, AMD, and Google to the Middle East, signing the largest commercial agreement in the history of both regions.

The US's intention is clear: to comprehensively block Chinese AI enterprises represented by Huawei, from chips to the cloud and AI collaboration, to consolidate its position as a technology hegemon.

On May 13 local time, the Trump administration swiftly revoked AI chip export restrictions, allowing large-scale supplies of high-end chips such as NVIDIA's GB300 to Saudi Arabia and the UAE, and promoting local tech companies to reach multi-billion dollar cooperation agreements with Middle Eastern countries.

Among them, NVIDIA will supply 18,000 Blackwell chips to Saudi AI company Humain; AMD signed a strategic cooperation agreement worth $10 billion with Humain; and tech giants such as Qualcomm, Cisco, and IBM announced a joint investment of $80 billion in the Middle East.

Furthermore, the US and the UAE announced the joint construction of the world's largest AI data center park in Abu Dhabi. The park covers an area of 25.9 square kilometers with a capacity of up to 5GW, expected to support the computing power needs of 2.5 million NVIDIA B200 chips. Trump's ambition to win the Middle Eastern chessboard at the computing power level is evident.

But the US overlooked one point: in a sense, Chinese tech enterprises have been deeply entrenched in the Middle East earlier and further than the US.

As early as 2022, SenseTime Technology collaborated with the Saudi Center for Artificial Intelligence (SCAI) to provide AI solutions for Saudi smart city construction. In 2024, Huawei opened a cloud data center in Riyadh and launched an ICT and AI talent development program with the Saudi Data and Artificial Intelligence Authority. Previously, Huawei had cultivated over 300,000 digital talents in the Middle East and Central Asia through projects such as ICT academies.

Entering 2025, Chinese enterprises accelerated their layout. Tencent Cloud invested $150 million to build a data center in the Middle East, Lenovo reached a $2 billion server manufacturing agreement with Alat, a subsidiary of the Saudi sovereign fund PIF, and the DeepSeek large model became the first Chinese AI model deployed on a large scale in the Dammam Data Center in Saudi Arabia.

In May of the same year, Huawei released the 'Starry Intelligent Network' solution for the Middle East and Central Asia, while Pony.ai reached an agreement with the Dubai Roads and Transport Authority to deploy Robotaxi, advancing toward fully unmanned commercial operations in 2026.

It is not hard to see that the two forces converging in the Middle East exhibit distinct differences.

The US deeply binds its AI diplomacy with Middle Eastern allies such as Saudi Arabia and the UAE, exporting technical standards and using export controls to precisely curb Chinese AI forces. China, on the other hand, relying on its existing market foundation, delves deeply into cloud computing, digital infrastructure, and specific AI application fields, seeking win-win cooperation.

However, facing overtures from both China and the US, the Middle East has not taken sides but instead seeks a balancing act that maximizes benefits and avoids offending any party.

The Middle East is well aware that taking sides is not a long-term solution. The fundamental path to rise lies in accelerating the construction of local AI capabilities while flexibly hedging.

To break free from excessive dependence on external technology, Abu Dhabi's Institute for Advanced Technology in the UAE has launched the Falcon series of large models for Arabic, and Saudi Arabia has established national AI companies such as Humain.

But despite the Middle East's desire to play both sides, reality is not so rosy. While receiving investment from Microsoft, G42 was required to divest its investments in China; the US chip ban has also put its collaboration with Huawei at risk. The Middle East, without mature AI infrastructure and top talent, has to seek external forces.

Amid the Sino-US game, the Middle East may present the following AI landscapes in the future.

Prosperity on the Balancing Beam: Middle Eastern countries successfully maintain a delicate balance between China, the US, and other major powers, introducing advanced US technology and capital while also absorbing Chinese experience and investment in application scenarios and infrastructure construction. Through multilateral cooperation, the Middle East becomes a testing ground for integrated innovation, slowing down technological polarization.

The Rise of a New Center: Leveraging substantial capital, abundant energy, and successful independent innovation strategies, the Middle East, overcoming talent and technological bottlenecks, emerges as a new force changing the Sino-US-dominated global AI landscape.

Dilemma of a Proxy Battlefield: If Middle Eastern countries fail to effectively grasp autonomy and become overly involved in the whirlpool of great power technological competition, their AI development will be deeply constrained by external geopolitical factors. The Middle East may degrade into a market for the dumping of great power AI technologies or a proxy battlefield for strategic games.

Regardless of where it ultimately heads, the Middle East's moves in this AI chess game will profoundly influence the development trajectory of global AI technology.

But whether it can break out of the traditional mold of great power competition and explore a path that suits its own characteristics, benefits the regional people, and contributes to global AI development not only tests the foresight of Middle Eastern countries but also the wisdom and magnanimity of all participants.

The ultimate outcome of this chess game may not lie in who can checkmate the other but in whether they can jointly play a good game that promotes the progress of human scientific and technological civilization.