Compared to a secondary listing, Roborock needs a safe haven more

![]() 06/16 2025

06/16 2025

![]() 530

530

Instead of focusing on their "old businesses," players in the vacuum cleaner industry are waging a next-level battle.

Recently, Roborock Technology (hereinafter referred to as Roborock) announced that it will list in Hong Kong. If successful, it will achieve a secondary listing after its debut on the STAR Market in 2020.

According to Roborock's 2024 financial report, the company achieved an annual revenue of 11.945 billion yuan, a year-on-year increase of 38.03%. While revenue increased significantly, its globalization progress also went smoothly. In overseas business, Roborock's revenue was 6.388 billion yuan, achieving a year-on-year increase of 51%, and overseas revenue accounted for more than half of the total.

Beneath the glamorous surface, we also found that Roborock is in a dilemma of "increasing revenue without increasing profit." The 2024 financial report showed a decline of 11% in Roborock's non-deductible net profit. The first-quarter report of 2025 showed that Roborock's non-deductible net profit was 242 million yuan, a decrease of 29% from the same period last year, which was 342 million yuan.

To address the issue of revenue quality, Roborock chose to accelerate its diversification strategy. However, the industries it chose to enter are highly mature "red ocean battlefields" - washing machines and automobiles.

In May 2024, Roborock established a washing machine division and has already launched a washing and drying combo set. Additionally, Roborock Technology's founder, Chang Jing, frequently promoted the company's Zeekr vehicles throughout 2024.

The current predicaments and choices faced by Roborock indicate that companies in China's vacuum cleaner industry are facing a collective "anxiety."

Among the top five players in China's vacuum cleaner industry, Ecovacs, like Roborock, is "silently enduring" pressure on operating performance; Dreame has embarked on a breathtaking diversification strategy spanning overseas markets, home appliances, catering, finance, AI, and more; Narwal Robotics has set 2025 as a crucial node for going overseas and aims to triple or quadruple its overseas revenue. As for "Number Five" Xiaomi, it relies on Xiaomi's AIoT ecosystem, so it is "temporarily unworried."

Amidst collective anxiety, Roborock urgently needs funds to explore new businesses and markets. This listing in Hong Kong is mainly to advance the company's overseas business development.

Listing in Hong Kong is also a "serious valuation" of Roborock for the second time. If the equity cannot fetch sufficient consideration, it means that Roborock cannot use more abundant resources to support its globalization and other diversification "dreams."

Can Roborock win in the competition for going overseas and diversification?

Globalization is one of the few new stories for Roborock

In a sense, Roborock may have missed the best opportunity for a secondary listing in Hong Kong.

When it first listed on the STAR Market in 2020, Roborock was hailed by investors as the "vacuum cleaner king." This nickname was not only because Roborock's share price once surpassed 1,000 yuan in 2021, becoming the second thousand-yuan stock after Moutai. It was also because investors at that time reached a consensus on Roborock's market value of 100 billion yuan.

Investors favored Roborock mainly because it had three advantages.

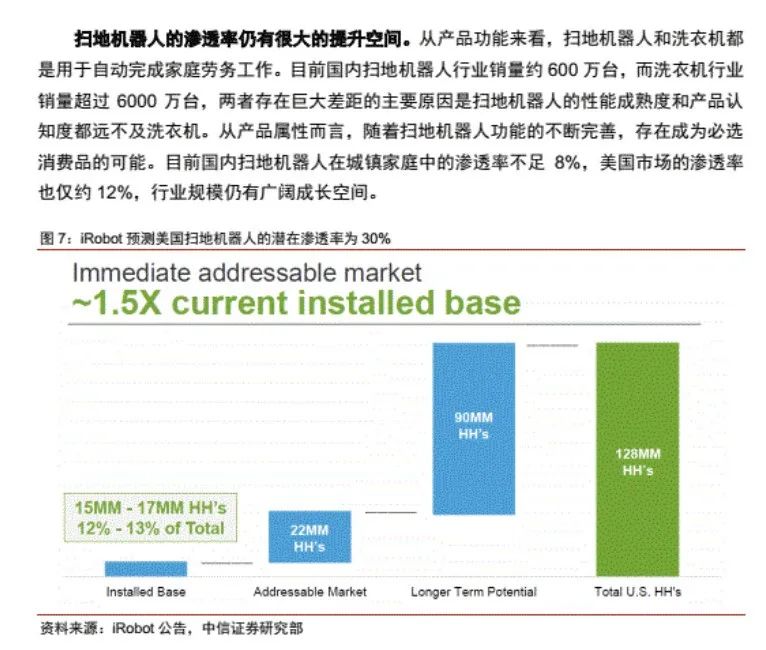

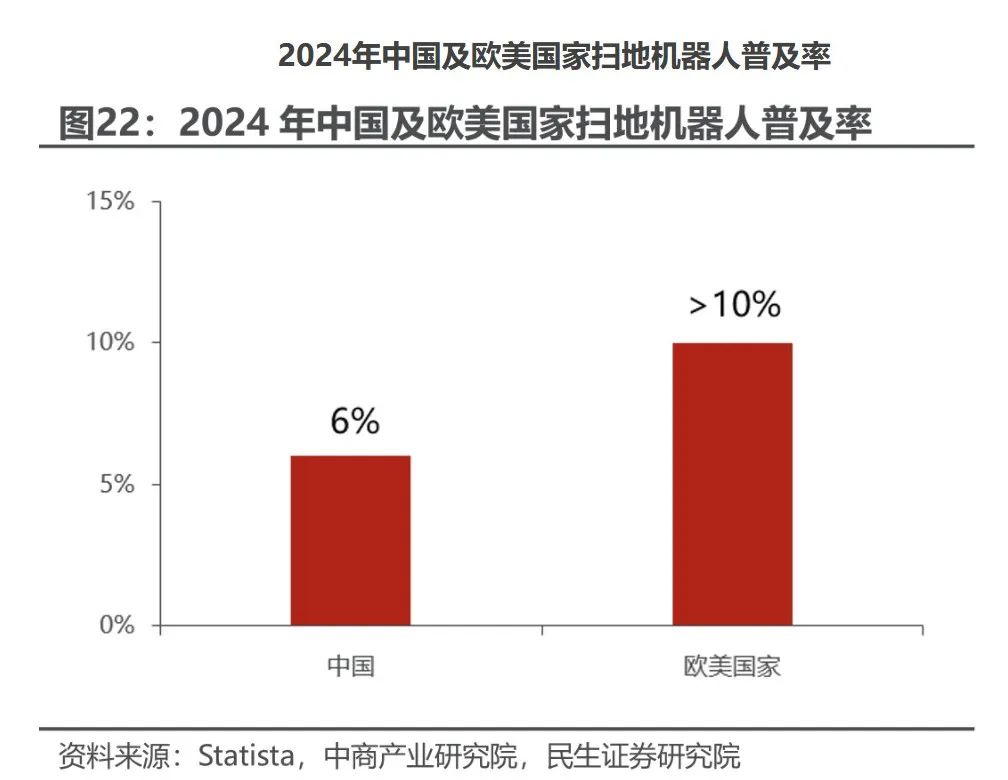

First, Roborock started as an OEM for Xiaomi. Its products had already proven their Product-Market Fit (PMF), and it also had its own factories and technology. Second, compared to Ecovacs, which emphasized high-end products at that time, Roborock's pricing system was relatively flexible, allowing it to reach a broader consumer base. Third, analysts at that time believed that the vacuum cleaner market had huge potential but low penetration. According to CITIC Securities' 2020 report on the vacuum cleaner industry in the machinery sector, analysts believed that the penetration rate of vacuum cleaners in urban households in China was less than 8% and gave a "generous" expectation that annual sales would align with those of washing machines.

However, five years have passed, and the vacuum cleaner market has not fully exploded. According to Statista, the overall penetration rate of the vacuum cleaner market in China is 6%, indicating that there is still considerable room for growth in the industry. But when Roborock wanted to exchange equity for capital resources, the company's market value had hovered around 40 billion yuan for a long time.

Why hasn't the market space changed much, but Roborock's valuation has dropped by 60%?

From the perspective of company operations, there is an "inverted" relationship between Roborock's current revenue and profit.

Since 2023, Roborock's net profit margin and gross profit margin have shown a continuous downward trend. The net profit margin fell from 23.7% to 7.8% in the first quarter of 2025, while the gross profit margin fell from 55.13% to 45.48%. During this process, Roborock's revenue grew rapidly. Revenue in 2024 was 11.945 billion yuan, a year-on-year increase of 38%; revenue in the first quarter of 2025 was 3.428 billion yuan, a year-on-year increase of 86%. The company as a whole showed a clear trend of "scale being inversely proportional to profit."

Where did the profits that should have been accumulated go? Mainly into marketing.

Financial data shows that Roborock embarked on an aggressive marketing strategy in 2024. Annual marketing expenses increased by 73% to 2.967 billion yuan. Among them, advertising and marketing promotion expenses almost doubled to 1.9 billion yuan. In the first quarter of 2025, Roborock's sales expense ratio (sales expenses / total operating revenue) reached 27.76%. Compared with small home appliance companies with relatively high sales expense ratios in the home appliance industry, Roborock was significantly higher than Bear Electric (15.30%).

Using a 73% increase in marketing expenses to exchange for a 38% increase in revenue, Roborock's marketing leverage is obviously not high enough.

It is worth noting that Roborock's marketing expenses may remain high in the long term. Since Roborock emphasized its diversification strategy in 2024, its marketing not only has to cover the existing vacuum cleaners and floor washers but also the business expansion of major appliances (washing and drying combo sets). This means that Roborock's marketing "firepower" is also not sufficiently focused.

The most prominent part of Roborock right now is going overseas.

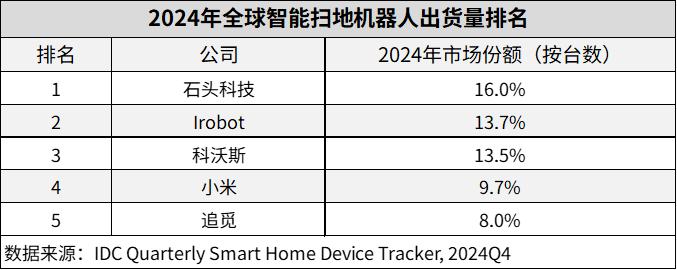

According to IDC data, Roborock's overseas strategy is progressing smoothly. In 2024, whether measured by shipments or sales, Roborock ranked first globally. In markets such as Northern Europe, Turkey, Germany, France, and South Korea, Roborock achieved the top position in terms of both volume and sales for multiple consecutive quarters. As a result, Roborock generated 3.688 billion yuan in revenue from overseas markets in 2024 and became the company's revenue focus with a growth rate of 51%.

However, corresponding to the high overseas growth is Roborock's marketing investment overseas.

Taking the US market as an example, in offline retail channels, Roborock has entered more than 1,400 Target stores and nearly 700 Best Buy stores, accounting for 72% and 78% of the total number of stores of the two retailers, respectively. This means that Roborock's offline expansion in the US is facing saturation.

It is evident that Roborock's performance growth engine driven by marketing has shown diminishing marginal returns. In the eyes of Hong Kong stock investors who are "not very sentimental," it is difficult for them to offer sufficient monetary consideration for Roborock's valuation.

If Roborock cannot fundamentally get out of its predicament, perhaps nothing can change.

Vacuum cleaners await a rescue

The predicament faced by Roborock has already permeated the entire industry.

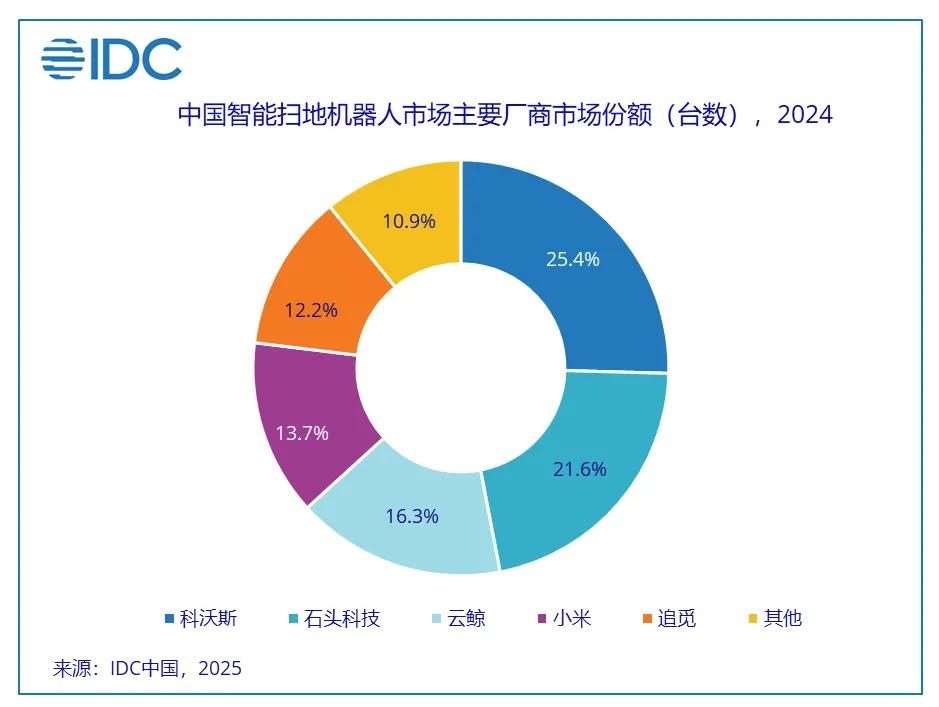

According to the CR5 of China's vacuum cleaner industry given by IDC, Ecovacs, Roborock, Narwal Robotics, Xiaomi, and Dreame can be roughly divided into two categories: brands emphasizing their own factories and internet brands. Throughout 2024, Ecovacs, the leader in China's vacuum cleaner industry and like Roborock, emphasizes its own factories, also had a difficult year.

According to Ecovacs' 2024 financial report, the company's total revenue was 16.542 billion yuan, a year-on-year increase of 6.7%; net profit was 806 million yuan, a year-on-year increase of 31.8%; and gross profit margin was 46.5%, a year-on-year decrease of one percentage point.

On the surface, Ecovacs experienced a year of increased revenue and profit. However, compared to the "good times" of 2022, with revenue of 15.3 billion yuan and net profit of 1.7 billion yuan, and 2021, with revenue of 13 billion yuan and net profit of 2 billion yuan, the growth in 2024 was merely "profit recovery."

Regarding a company's strategy of sacrificing gross profit margin for revenue, Duan Yongping once commented, "Low prices will not expand market share, but being forced to lower prices has the opportunity to retain market share."

It seems to confirm this statement as Ecovacs is also losing confidence in its leading position. In 2024, Ecovacs only revealed in its financial report that it "has nearly 60% of the domestic offline market share." Previously, Ecovacs disclosed its overall market share to demonstrate its leading position.

If the industry leader is in such a situation, it is natural that internet brands are also struggling. To find new growth curves, Dreame has initiated a series of diversification strategies.

At CES 2025, we saw a wide range of products on the Dreame exhibition stand, including robot vacuum cleaners, cordless vacuum cleaners, floor washers, personal care products, pool robots, window cleaning robots, air purifiers, and water purifiers. In March this year, Dreame announced the Dreame Ecosystem Family, officially becoming a borderless ecosystem enterprise.

Occupying the home appliance sector is not the limit for Dreame. According to public information, Dreame's (including its subsidiaries and invested incubator companies) business lines are occupying the cleaning, personal care, robotics, automotive, and major appliances sectors. Beyond the home appliance sector, Dreame covers a series of layouts such as action cameras (Photon Transition), humanoid robots (Magic Atom), embodied large models (Qianjue Technology), high-end new energy electric vehicles (Yuechuan Tuojing), and even hot pot, coffee, and financial businesses (Falcon Digital Technology).

Why are players in the vacuum cleaner industry so anxious? Perhaps the market has been severely overdrawn due to long-term internal competition among industry players.

From 2018 to 2020, the vacuum cleaner industry also experienced "good times." According to the Foresight Industry Research Institute, annual sales of vacuum cleaners exceeded 6 million units during these three years. However, subsequently, market demand began to decline, and sales only rebounded to 5.39 million units in 2024 due to the influence of national subsidy policies.

Why couldn't vacuum cleaner products maintain sales trends after the initial market explosion? Mainly because the vacuum cleaners sold at that time followed a low-price strategy. The average price of vacuum cleaners at that time was less than 2,000 yuan, and they did not have the self-cleaning function and LiDAR mapping that they have now. The user experience at that time was that the vacuum cleaner "ran around" the house by bumping into obstacles, and the dust it sucked was stored inside its "belly."

It was not until 2021, when vacuum cleaners became popular with base stations and AI vision, that the problem of difficult-to-use products was solved, and product prices also rose accordingly. Reflected in the industry, sales of vacuum cleaners have declined in recent years, but average prices have risen.

After solving the problem of making vacuum cleaners "easy to use," the industry entered a stage of "numerical internal competition." For example, after a vacuum cleaner was launched with a 60°C hot water washing function, highlighting high-temperature disinfection, products with 65°C and 70°C soon followed in the industry.

But common sense tells us that to kill most viruses and non-spore normal/low-temperature bacteria, boiling water at 100°C is required for 20-30 minutes. This means that part of the internal competition in the vacuum cleaner industry is not aimed at solving core problems but rather at being "stronger than competitors."

Until CES 2025, the vacuum cleaner industry presented what seemed to be a higher-level solution - integration with embodied intelligence. Judging from the products already unveiled by Roborock and Dreame, by adding dexterous hands and connecting to AI large models for autonomous decision-making, vacuum cleaners will completely handle functions such as clearing debris and changing mop cloths. However, considering the trend of new players flooding into the robotics industry, this also means a more difficult competitive environment for the industry.

"First, the pace of robot intelligence is accelerating, and a large number of traditional robots are becoming intelligent. Second, new robotic startups with new forms emerge every month and quickly become industry hotspots."

As summarized by Wang Cong, CEO of Digua Robotics, the entire cleaning robotics sector has been "open-sourced" by large models. Among them, new products such as commercial cleaning robots, snow removal robots, pool cleaning robots, and lawn mowing robots are emerging frequently, and DJI's vacuum cleaner will also be officially released in June.

For the vacuum cleaner industry, expanding the pie in overseas markets can alleviate competition anxiety to a certain extent. But if the industry wants to last long, it may also learn from home appliance giants that have also experienced "disorderly internal competition" in their industries.

After all, from the perspective of liberating human household cleaning work, the vacuum cleaner market has the potential to compete with the washing machine market. Compared to competing for "short-term gains" in products, company revenue quality, market share, etc., it is more important to deepen market operations.