Li Zexiang Endorses Wo'an Robotics: A Home "Gadget" Maker Aiming for IPO After Raking in 600 Million Yuan in a Year?

![]() 06/17 2025

06/17 2025

![]() 658

658

In 2025, the domestic robotics industry is witnessing an IPO surge.

Unitree Robotics, which made a stunning debut on the Spring Festival Gala stage, has been frequently rumored to be on the brink of an IPO, with recent activities including a name change and a reform of its shareholding system. Zhiyuan Robotics, valued at over 15 billion yuan, is urgently seeking a securities director. Additionally, Hanyang Technology and Narwal Robotics are also embarking on a Pre-IPO funding spree.

Barely halfway through June 2025, three robotics companies have already submitted listing applications to the Hong Kong Stock Exchange.

Among them, Wo'an Robotics (Shenzhen) Co., Ltd. (hereinafter referred to as "Wo'an Robotics") has officially submitted a listing application to the Hong Kong Stock Exchange, aiming to become the "first AI embodied robot stock" on the market.

According to the prospectus, Wo'an Robotics is the world's largest provider of AI embodied home robot system products and the first robotics company to achieve commercialization in this field.

Behind Wo'an Robotics stands Professor Li Zexiang from HKUST, the "godfather of entrepreneurship," who has helped incubate numerous technology unicorn enterprises such as DJI and Narwal Robotics. Can he once again uncover the "talent" in the robotics industry?

Endorsed by the "godfather of entrepreneurship," Wo'an Robotics has risen to become a global leader from a niche market worth 6 billion yuan.

Throughout Wo'an Robotics' growth trajectory, the figure of "benefactor" Li Zexiang has always been prominent.

Eight years ago, Li Zhichen, the founder of Wo'an Robotics, brought his entrepreneurial project into the Songshan Lake Robotics Research Institute (XbotPark) incubation system, jointly established by Li Zexiang, Ko Ping-kang, and Gan Jie, the "golden triangle" in the Guangdong-Hong Kong-Macao Greater Bay Area. Since then, the company has received dual empowerment of technology and capital.

In October 2017, Wo'an Robotics, which had been established for two years, welcomed its first round of external financing, with the XBOTPARK Fund leading the angel round and introducing star institutions such as Qifu Capital, RDI, and Yuntai Innovation Investment.

Since then, Li Zexiang himself and his holding companies have successively participated in multiple rounds of financing for Wo'an Robotics, including Pre-A, A, and B rounds.

As of the prospectus disclosure date, the founding team of Li Zhichen (Chairman and CEO of the Board), co-founder Pan Yang (CTO), and the Wande Innovation Employee Stock Ownership Plan form a controlling shareholder group of Wo'an Robotics, holding a total of 44.53% of the shares. Among them, Li Zhichen holds 21.82%, Pan Yang holds 14.47%, and the Wande Innovation Employee Stock Ownership Plan holds 8.24%.

At the same time, Li Zexiang indirectly holds 12.98% of Wo'an Robotics through Songshan Lake Robotics Research Institute, Yinghu Intelligence, and Dongguan Yunhe. Ko Ping-kang indirectly holds 9.72% of the shares through Brizan Ventures V. They are the third and fourth largest natural shareholders, respectively, after the founders Li Zhichen and Pan Yang. Additionally, Li Zexiang and Ko Ping-kang have also joined the board of directors of Wo'an Robotics, both serving as non-executive directors.

It should be noted that before Wo'an Robotics submitted its listing application, Ko Ping-kang had significantly boosted the company's valuation.

According to the prospectus, three years after completing the B+ round of financing, Wo'an Robotics obtained another C round of financing in May 2025, with a financing scale of 60 million yuan. Investors included company shareholder Ko Ping-kang, Kuang Yukai, and Brizan Ventures V, jointly founded by both parties.

In terms of valuation, there has been a significant increase compared to the 1.8 billion yuan valuation in the B+ round, with the post-C round valuation reaching 4.048 billion yuan.

The support of the "entrepreneurial professor group" fuels the boundless imagination of being "number one in the world."

Based on GMV in 2024, Wo'an Robotics is the world's largest provider of AI embodied home robot system products, with a market share of 11.9%.

The prospectus shows that Wo'an Robotics primarily targets the overseas market, with its products sold to over 90 countries and regions worldwide. In 2024, over 95% of its revenue came from the three major regions of Japan, Europe, and North America, with Japan accounting for 57.7%, while China and other regions combined accounted for only about 5% of revenue.

However, it should be noted that Wo'an Robotics' title of "number one in the world" is based on a niche market with a scale of less than 6 billion yuan, and the overall volume is still relatively small.

According to Frost & Sullivan data, as of 2024, the global AI embodied home robot system market was worth 5.9 billion yuan, with a penetration rate of only 2.3% for AI embodied home robots during the same period.

Compared to the global home robot market, which reached 257.7 billion yuan by 2024 with a penetration rate of 25.8%, the niche segment where Wo'an Robotics operates accounts for less than 3%.

Smart home robots, or just home gadgets?

In the deeply vertical niche market, Wo'an Robotics has almost perfected the business paradigm of "small but beautiful."

The prospectus shows that Wo'an Robotics is the first company in the AI embodied home robot system industry to achieve product commercialization. Its product line covers 7 categories with a total of 42 SPUs. At the same time, the company is also the only global provider of AI embodied home robot systems with a comprehensive layout in home scenarios.

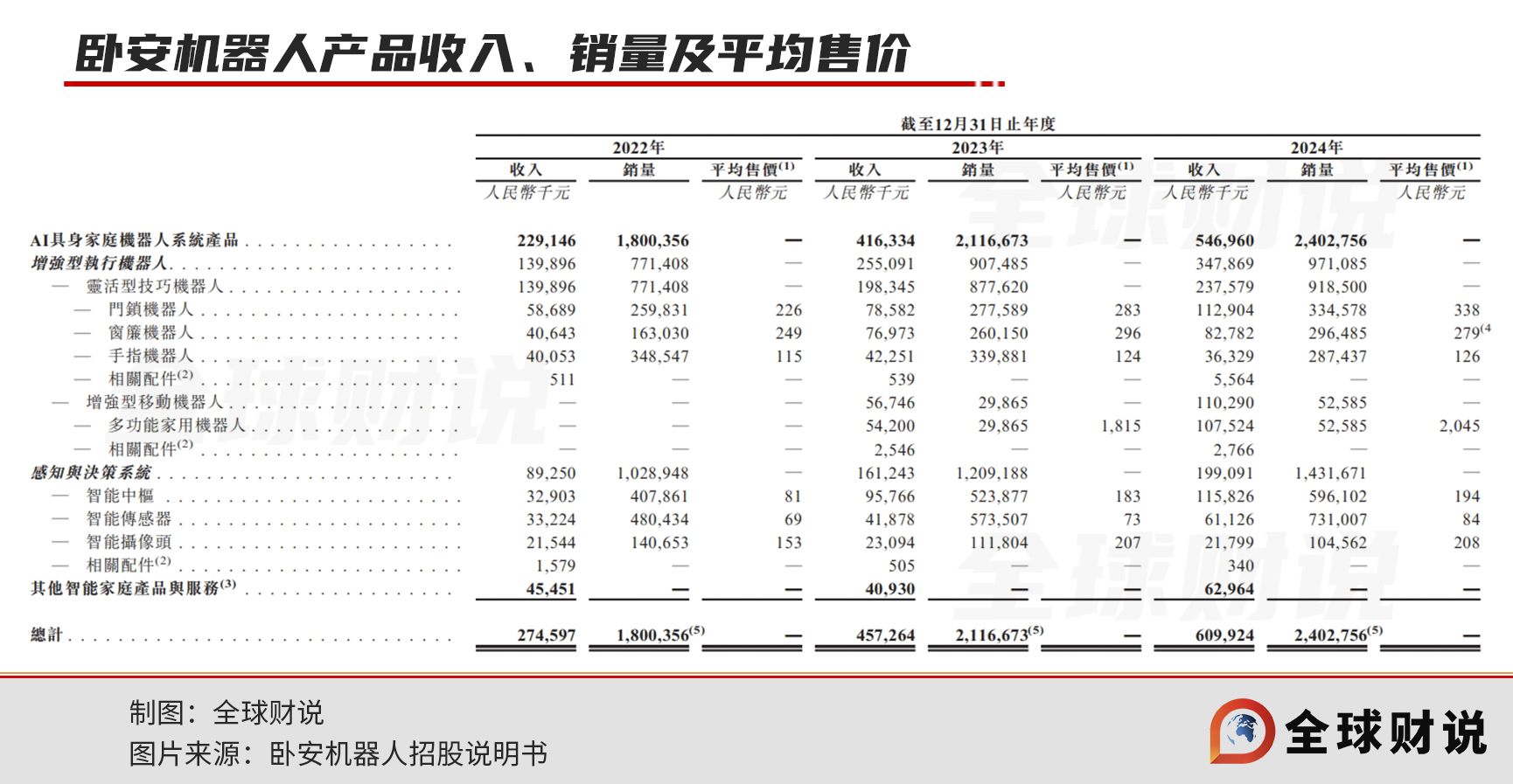

With a comprehensive layout in home scenarios and commercialization, translating into actual performance, from 2022 to 2024, Wo'an Robotics achieved operating revenues of 275 million yuan, 457 million yuan, and 610 million yuan, respectively, with a compound annual growth rate of 48.94%, demonstrating impressive growth capabilities.

At this point, some may wonder what exactly the "AI embodied home robot system," which sounds highly technological, refers to.

In the prospectus, Wo'an Robotics divides it into two main categories: enhanced execution robots, primarily including dexterous skill robots and enhanced mobile robots, and perception and decision-making systems, primarily comprising smart hubs, sensors, and cameras.

In fact, Wo'an Robotics did not choose the currently popular field of humanoid robots, which presents technical challenges, but instead opted for the relatively low-threshold non-humanoid sector to achieve commercial transformation.

According to Wo'an Robotics' introduction, the company adopts a distributed concept, simulating human brain and eye functions through the perception and decision-making system, and then mimicking human hands and feet through enhanced execution robots, utilizing AI technology to interconnect different products.

It looks familiar, somewhat like the logic of smart home full-scene interconnection, except that Wo'an Robotics' products focus more on enhanced execution robots.

In terms of revenue structure, nearly 60% of Wo'an Robotics' revenue comes from the enhanced execution robot segment. However, as the company's core business, it barely qualifies as "hard technology" and is more like various smart home "gadgets".

Taking the dexterous skill robots, which account for nearly 40% of revenue, as an example, they include finger robots, curtain robots, fingerprint door lock robots, etc. However, upon closer inspection of these products, one will find that their working principles are similar to lazy light switch controllers, electric curtain companions, and smart door locks. Many alternative products can be found on domestic e-commerce platforms, but their prices differ by several times.

Image source: Wo'an Robotics SwitchBot official website

Image source: Wo'an Robotics SwitchBot official website

Furthermore, in the field of robotic vacuum cleaners, where commercialization has been most widespread in the home robot market, Wo'an Robotics has not been left behind.

In 2024, the enhanced mobile robot segment, where Wo'an Robotics' robotic vacuum cleaners are located, achieved revenue growth of 92.98% year-on-year to 110 million yuan, accounting for only about 10% of total revenue.

Compared to IMARC research data, the global robotic vacuum cleaner market was worth 9.07 billion USD (approximately 65 billion yuan) in 2024, with Wo'an Robotics holding only about 0.2% market share.

It should be noted that among the top 5 global smart robotic vacuum cleaner shipments in 2024, four were Chinese enterprises, including Roborock, Ecovacs, Xiaomi, and Dreame, collectively occupying 47.2% of the market share.

Against the backdrop of domestic robotic vacuum cleaner brands collectively expanding into overseas markets, Wo'an Robotics, which only launched its first robotic vacuum cleaner product in 2023, must find a way to stand out.

In January 2025, Wo'an Robotics launched the world's first multi-task robotic vacuum cleaner, allowing consumers to choose DIY functional accessories such as surveillance cameras, air purifiers, and electric fans for their robotic vacuum cleaners.

Although the groundbreaking design is eye-catching, the assembly-type creativity does not constitute a strong technical barrier and is relatively easy to imitate. In fact, the frequent patent wars waged by domestic robotic vacuum cleaner giants in recent years point to the serious innovation dilemma of homogenization faced by the entire industry.

It is evident that whether it is dexterous skill robots or enhanced mobile robots, Wo'an Robotics' intelligent hardware products lack an absolute technological "moat" for protection.

Therefore, the company hopes to leverage AI technology to expand the imagination space for capital.

The prospectus shows that in May 2025, one month before submitting its listing application, Wo'an Robotics launched the world's first smart home hub that combines a large language model with edge computing, enabling multi-source perception and autonomous decision-making in various scenarios.

However, in the context of various vendors developing their own smart ecosystem platforms today, with terminal products lacking attractiveness, Wo'an Robotics' AI ecosystem is also struggling to become a competitive chip.

Not yet profitable, urgently needs to go public for "blood transfusion"

It should be noted that Wo'an Robotics still faces the problem of losses. From 2022 to 2024, Wo'an Robotics' net attributable profits were -86.983 million yuan, -16.376 million yuan, and -3.074 million yuan, respectively.

Although the loss surface is narrowing, it is to some extent based on the company's continuous price increases for its products. From 2022 to 2024, Wo'an Robotics' comprehensive gross profit margin increased from 34.3% to 51.7%.

According to the prospectus, the prices of Wo'an Robotics' core products showed an overall upward trend during the reporting period. For example, the price of the door lock robot increased from 226 yuan in 2022 to 338 yuan in 2024, the multi-functional home robot increased from 1815 yuan in 2023 to 2045 yuan in 2024, and the smart hub increased from 81 yuan in 2022 to 194 yuan in 2024.

The company's difficulty in profitability is also related to the fact that its products are primarily sold in overseas markets. Wo'an Robotics' sales channels include DTC channels, retailer channels, and distribution channels, with most of its revenue being related to the Amazon platform. In 2024, Amazon SC (third-party sellers) and VC (brand suppliers) channels combined contributed 64.2% of Wo'an Robotics' revenue.

Wo'an Robotics stated in the prospectus that as sales volume increases, Amazon and other e-commerce platforms may gain more bargaining power, demanding higher rebates, discounts, or less favorable terms. Although the company still relies on Amazon, it has been striving to expand its sales channels.

From 2022 to 2024, Wo'an Robotics' sales and distribution expenses were 102 million yuan, 137 million yuan, and 172 million yuan, respectively, with over 80% being platform commission fees, advertising and salesperson expenses, promotion and business development expenses.

In addition, as a high-tech enterprise, Wo'an Robotics' research and development expenses in recent years have been less than its sales and distribution expenses. During each period, Wo'an Robotics' research and development expenses were 61.761 million yuan, 89.192 million yuan, and 112 million yuan.

Although Wo'an Robotics disclosed a total of 270 patents in the prospectus, only 43 of them are invention patents. Compared to other leading enterprises in the robotics industry, as of the end of 2024, UBTECH held a total of 2680 authorized patents, with invention patents accounting for 57.87%.

In addition to not being profitable, Wo'an Robotics' financial health also needs attention.

From 2022 to 2024, Wo'an Robotics' net operating cash flow was -107 million yuan, 24.621 million yuan, and -31.278 million yuan, respectively. During the same period, the company's investment cash flow was all net outflows, while the net financing cash flow was 227 million yuan, -24.411 million yuan, and 60.595 million yuan, respectively.

As of the end of 2024, Wo'an Robotics' cash and cash equivalents decreased by 52.31% year-on-year to 62.337 million yuan.

It should be noted that to alleviate the tight cash flow issue, Wo'an Robotics has been transferring trade receivables to banks in exchange for low-interest loans.

The prospectus shows that from 2022 to 2024, Wo'an Robotics transferred trade receivables of 119 million yuan, 147 million yuan, and 88.1 million yuan, respectively. Reflected in the cash flow, the newly added borrowings of factoring trade receivables flowing into the net financing cash flow were 119 million yuan, 147 million yuan, and 184 million yuan, respectively.

In its prospectus, Wo'an Robotics candidly acknowledged that the factoring arrangement for trade receivables could potentially expose the company to financial risks and impact its liquidity position. Pursuant to the bank agreement, any delay in payment by trade debtors for up to 120 days may necessitate the company to compensate the bank for accrued interest losses.

Wo'an Robotics, which is in dire need of a financial injection, intends to utilize a portion of the funds raised through the initial public offering (IPO) to repay bank loans within the upcoming year.

Regarding the allocation of funds raised from this IPO, the repayment of bank loans encompasses the following: a term loan of 18 million yuan with the Agricultural Bank of China, due in August 2026, carrying an annual interest rate of 2.6%; and a trade receivables factoring facility of 436 million yen with The Hong Kong and Shanghai Banking Corporation Limited, which has an annual interest rate of 1.25% and a service fee of 0.11%.