Beijing Nurtures a 15 Billion Yuan Super Unicorn: Leading Logistics Robot Firm Reveals Three Major Opportunities

![]() 06/18 2025

06/18 2025

![]() 529

529

Recently, Beijing has nurtured a remarkable super unicorn: Geek+, which has submitted its prospectus to the Hong Kong Stock Exchange.

This logistics robot star enterprise has completed over ten rounds of financing, raising a total of nearly 3 billion yuan. Following the E1 round of financing in 2022, its post-investment valuation soared to 15 billion yuan.

The ascent of this enterprise highlights three significant opportunities in the logistics robot sector:

1. Emerging Market Dividends

Regions such as Southeast Asia, the Middle East, and Africa are becoming the 'new blue ocean' for smart logistics. Southeast Asia's warehouse automation market enjoys an annual growth rate of 15.5%, while the Middle East's logistics automation market exceeds 12 billion USD. Saudi Arabia aims to increase the GDP share of the logistics industry to 10% by 2030.

2. Technological Integration and Innovation

This includes AI large models integrated with logistics robots, force-controlled robots, and unmanned full-stack solutions.

3. Deep Cultivation of Segmented Scenarios

Tobacco logistics has reduced error rates from 5% to 0.3% through AI document verification, and cross-border logistics has cut data latency by 50% using multimodal transport large models. These high-value segments remain largely uncovered by leading enterprises, offering entry points for new players through technological differentiation.

- 01 -

Founded in 2015, Geek+ is headquartered in Beijing, specializing in autonomous mobile robots (AMRs). Its core applications are in warehouse fulfillment and industrial handling.

Geek+'s logistics robots serve multiple industries, including e-commerce, retail, footwear and apparel, logistics, pharmaceuticals, automotive, and 3C manufacturing. Its impressive clientele spans over 700 global enterprises, such as Nike, Walmart, Toyota, Siemens, Suning.com, Dell, DHL, and SF Supply Chain.

Prior to Geek+'s emergence, traditional logistics warehousing relied heavily on manual operations and fixed equipment, leading to inefficiencies, high costs, and lack of flexibility. Workers spent about 70% of their time walking between shelves, resulting in a picking efficiency of only 80-100 items/hour, which could further decline with unfamiliar staff. In contrast, automated warehousing (e.g., AGV robots) boasts picking efficiencies of 500-800 items/hour, marking a 5-8 times improvement. The rapid growth of e-commerce and manufacturing has accelerated the obsolescence of traditional solutions, particularly in the realm of efficient and flexible supply chains, where robots are emerging as viable alternatives. For instance, during peak shopping festivals like 'Double 11' and '618', a renowned e-commerce enterprise would see an instantaneous surge in order volume, requiring warehouse staff to work long, intense hours. Even so, goods sorting speeds struggled to keep pace with order generation, leading to substantial order backlogs and shipment delays. Traditional models saw warehouse staff walking an average of 20 kilometers per day, expending significant physical effort to search for goods, with less than 30% of time spent on effective sorting. The manufacturing sector faces similar challenges, with shortening product iteration cycles and the rise of small-batch, multi-batch production modes placing immense demands on the timeliness and flexibility of material supply. Traditional manufacturing plants relied on manual forklifts and trolleys, with workers shuttling between vast warehouses and production lines, leading to inefficiencies and frequent material misdeliveries and omissions due to human error, affecting production schedules. For example, a 3C product manufacturing enterprise experienced over 500 hours of cumulative production line downtime annually due to material supply issues under traditional logistics warehousing models, resulting in millions of yuan in direct economic losses. In extreme environments like cold chain logistics, robots demonstrate superior adaptability. In a cold chain food enterprise, the traditional warehousing model's low-temperature environment severely impacted workers' operational efficiency and goods sorting accuracy, leading to high goods loss rates. Conversely, robots can operate continuously for 24 hours. According to Geek+'s prospectus, robots reduce labor costs by about 60% and goods loss rates to less than 5%. These demands have fueled Geek+'s business growth. For instance, during promotional periods, a company's warehouse used to recruit numerous temporary workers to manage order peaks. Now, with logistics robots, manpower demands have significantly decreased, and order processing volume has soared from 50,000 to 500,000 orders per day. Currently, Geek+'s highest revenue-generating business is the sale of AMR solutions. Simply put, it sells 'intelligent handling robots + supporting systems' to enterprises, aiding them in achieving automated handling, picking, sorting, and other tasks in warehouses and factories.

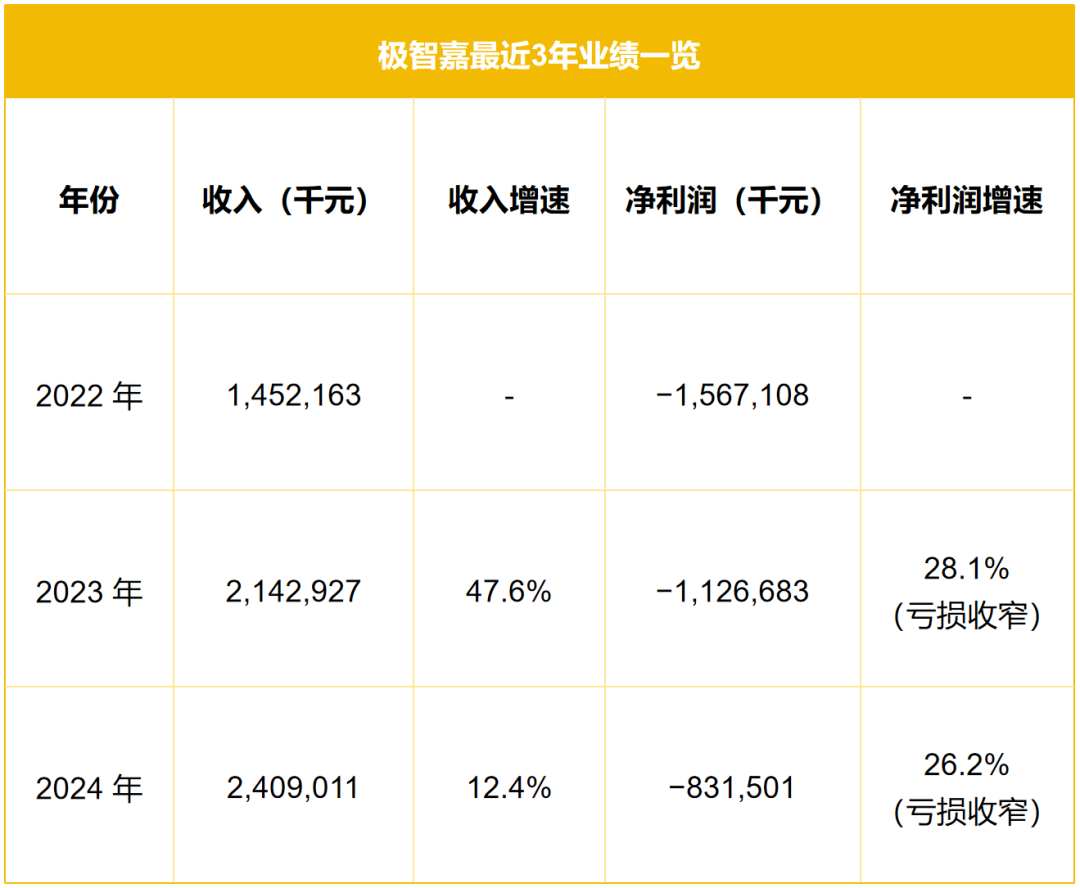

In terms of warehouse fulfillment, Geek+ has been the global revenue leader for five consecutive years. From 2022 to 2024, its revenue surged from 1.452 billion yuan to 2.409 billion yuan, albeit with continuous losses over the past three years.

- 02 -

The logistics robot industry traces its origins back to the 1950s.

In 1953, the world's first Automated Guided Vehicle (AGV) was developed in the United States by Barret, evolving from a simplified traction-type Automatic Guided Cart (AGC).

Early AGVs were primarily utilized in the industrial manufacturing sector. Limited by the technological capabilities of the time, their navigation methods were rudimentary, relying on magnetic strips on the ground or preset fixed paths, akin to being pulled by an invisible rope, performing simple material handling tasks between factories and warehouses with inadequate flexibility and autonomy.

Entering the 1990s, advancements in computer technology, sensor technology, and wireless communication technology ushered in significant changes.

The navigation system underwent a transformation, evolving from rigid preset path models to more flexible and intelligent advanced models like laser navigation and visual navigation, enabling logistics robots to navigate complex environments.

Simultaneously, the coordinated application of various sensors, such as lidar and visual sensors, enhanced robots' precision in perceiving the surrounding environment, making obstacle avoidance functions increasingly reliable.

During this period, logistics robots found widespread use in industries demanding high production precision and efficiency, such as automobile manufacturing and semiconductors. Subsequently, their application fields expanded to key logistics links like warehousing and distribution centers.

Entering the 21st century, with the development of cutting-edge technologies like artificial intelligence and the Internet of Things, Autonomous Mobile Robots (AMRs) emerged.

Equipped with laser or visual SLAM systems, robots no longer depend on pre-laid guidance objects. They simply need to identify the starting and end points and can automatically plan the optimal operation path using algorithms.

For example, by the end of 2010, QR code technology had gained widespread popularity in China and was quickly integrated into AGV navigation systems. Through a QR code matrix on the ground, AGVs could accurately obtain location information, achieving millimeter-level positioning and path planning.

Since then, the advent of composite AMRs has enabled robots to integrate multiple functional modules like mechanical arms, grasping devices, and sensor arrays, capable of completing more complex operations like cargo sorting, stacking, and handling, expanding their application scenarios throughout the logistics process.

Currently, the global logistics robot market is expanding rapidly. According to Interact Analysis, global shipments of logistics robots (for logistics warehousing and manufacturing) tripled from 2019 to 2021. It is estimated that from 2023 to 2028, the global AMR market size will grow at a compound annual growth rate of 36.8%, reaching 172.5 billion yuan by 2028.

This growth is primarily fueled by industries like e-commerce, retail, and manufacturing, which have increasing demands for efficient logistics.

- 03 -

In recent years, the Chinese government has issued a series of policies to support the development of the smart logistics and robotics industries. For instance, the '14th Five-Year Plan for Intelligent Manufacturing Development' emphasizes promoting the research and application of smart logistics equipment.

Furthermore, with industry growth, the demand for smart warehousing has surged in regions like Southeast Asia, the Middle East, and Africa. From 2023 to 2028, Southeast Asia's warehouse automation market is expected to grow at a compound annual growth rate of 15.5%. Singapore, a key market in Southeast Asia, boasts an internet penetration rate of 98%, a smartphone adoption rate of 93%, and a 58% online transaction rate among citizens. By 2026, its e-commerce market size is projected to reach 10 billion USD. Meanwhile, countries like Indonesia, Malaysia, Thailand, and Vietnam exhibit strong momentum in manufacturing industry development, with rapid growth in sectors like electronics, textiles and apparel, automobiles, and food and beverages. In 2021, Singapore's manufacturing industry contributed 13.2% to GDP growth. The Middle East's e-commerce market is expanding rapidly, with the logistics automation market exceeding 12 billion USD and a compound annual growth rate of 18.7%, far surpassing the global average. Saudi Arabia aims to increase the logistics industry market size from 5.3 billion USD in 2022 to 15.3 billion USD by 2030, boost shipping volume from 5.5 million TEUs to 16.7 million TEUs, and elevate the GDP share of the logistics industry from 6% to over 10%. Africa's demand for smart warehousing is also gradually increasing. In the first half of 2024, Africa's transport and logistics industry attracted 218 million USD in investment, surpassing the fintech industry. During the pandemic, Africa's e-commerce market flourished and is projected to reach 2.35 billion USD by 2030. Another emerging trend in smart robots involves new technologies like the integration of AI large models. Taking Geek+ as an example, it integrates AI large models with navigation technology to launch laser-vision fusion SLAM (Simultaneous Localization and Mapping) navigation technology. This technology enables AMR robots to achieve ±10 millimeter positioning accuracy in complex environments and improves motion planning efficiency by 40%. Additionally, through AI large model-optimized picking strategies, a single workstation's picking efficiency reaches 400 items per hour, far exceeding the industry average of less than 180 items, with a picking accuracy rate of 99.99%, compared to the industry average of 99.90%.

- 04 -

The logistics robot industry is fiercely competitive on the international stage, with countries like Europe, the United States, and Japan holding certain advantages.

The United States stands as a powerhouse in the realm of logistics robots. As early as 1953, the world's first Automated Guided Vehicle (AGV) was introduced at Barret. Over the years, American logistics robot enterprises have taken the lead in core technology research and development. For instance, Alert Innovation's Alphabot system, equipped with mobile robots capable of navigating structured three-dimensional spaces, efficiently and accurately fulfills picking and packaging tasks for online shopping orders, granting it a substantial edge in e-commerce logistics warehousing. Boston Dynamics' wheeled robot, Stretch, can manage 800 boxes per hour and lift boxes weighing up to 50 pounds, excelling in scenarios such as truck and container unloading. Europe, too, boasts formidable strengths in logistics robots. As one of the cradles of Industry 4.0, Germany has achieved remarkable feats in warehouse automation. According to data from the International Federation of Robotics (IFR), Germany boasts 294 robots per 10,000 workers, ranking among the world's leaders. Many established European enterprises, including Swisslog Holding from Switzerland and KUKA from Germany, possess extensive experience in logistics automation system integration and robot manufacturing. Market research data predicts that the European warehouse automation market will grow at a compound annual growth rate of 13.67% (2022-2027). Comparatively, domestic logistics robots are still catching up, but the gap is narrowing. While there are no absolute monopolistic enterprises in the domestic market, market concentration is gradually increasing. Hikvision Robotics, leveraging its security technology background, excels in key technological domains such as visual navigation, with its products applied across multiple fields like industrial manufacturing, warehousing, and logistics. Quicktron specializes in automated warehousing and logistics solutions, and its intelligent warehousing robot system has garnered numerous clients in industries such as e-commerce and express delivery. In contrast to its competitors, Geek+ distinguishes itself with a more comprehensive product line, encompassing various types of robots like picking, handling, sorting, and intelligent forklifts, capable of meeting the needs of the entire industry, spanning e-commerce, retail, footwear and apparel, logistics, pharmaceuticals, automotive, and 3C manufacturing. So, what new opportunities await new players? Firstly, they can venture into emerging markets like Southeast Asia, the Middle East, and Africa. Furthermore, they should pay heightened attention to emerging technologies, particularly in the realm of large models. 1. AI Large Models + Logistics Robots: A New Race for Intelligent Scheduling. For example, Ant Robotics integrates the DeepSeek large model to optimize task allocation for multiple robots. 2. Force-Controlled Robots: Rigid Demand in Precision Scenarios. Their core value lies in enhancing operation quality and safety through high-precision force feedback and adaptive adjustment capabilities. 3. Unmanned Full-Stack Solutions: Flexible Implementation. Uqi Intelligence's humanoid robots + unmanned logistics vehicles, for instance, enable fully unmanned operations in BYD parks, tripling efficiency. 4. Segmented logistics scenarios, such as tobacco logistics and cross-border logistics, also present promising avenues.

The content of this article is for reference only and does not constitute any investment advice.