"Payment+" Era: Payment as an Ecosystem | Top 10 Trends in China's Cross-border Payment in 2025

![]() 06/18 2025

06/18 2025

![]() 471

471

As the underlying infrastructure for international economic and financial cooperation and an indispensable part of the globalization of Chinese enterprises, China's cross-border payment has now penetrated deeply into various enterprise-level business scenarios and consumer-level transaction scenarios. Its strategic significance and value are not only reflected in China's accelerating realization of a dual domestic and international cycle as a key hub in the global value chain but also in providing non-USD-based secure payment options for countries along the "Belt and Road" Initiative, enabling China to gain financial discourse power commensurate with its economic strength in formulating international economic and trade rules. In the future, with the continuous support of cutting-edge technologies such as blockchain, digital currencies, and even AI, the technological upgrading and model innovation of China's cross-border payment will further reconstruct the global payment and receipt system and international financial order. Accordingly, Xiaguang She & Xiaguang Think Tank have launched the "Report on Top 10 Trends in China's Cross-border Payment in 2025," aiming to delve into the new round of global market opportunities and business growth engines for China's cross-border payment.

(I) China's Cross-border Payment Transaction Scenarios

Cross-border payment refers to the cross-country and cross-regional transfer, receipt, and payment of funds through certain payment systems and settlement tools due to economic activities such as international trade, international investment, and international financial transactions between two or more countries or regions. For example, in cross-border e-commerce, the buyer and seller hold different currencies, so it is necessary to use certain payment systems and settlement tools to achieve fund conversion between two or more countries and ultimately complete the transaction loop. Cross-border payment transaction scenarios cover a variety of different business areas and transaction types. Common payment transaction scenarios include personal cross-border consumption scenarios such as cross-border e-commerce shopping, digital content subscriptions, offline overseas consumption, cross-border remittances, and overseas asset allocation, as well as enterprise-level scenarios such as cross-border trade and service settlement, cross-border transactions and international acquiring, overseas investment and financing, and overseas loans.

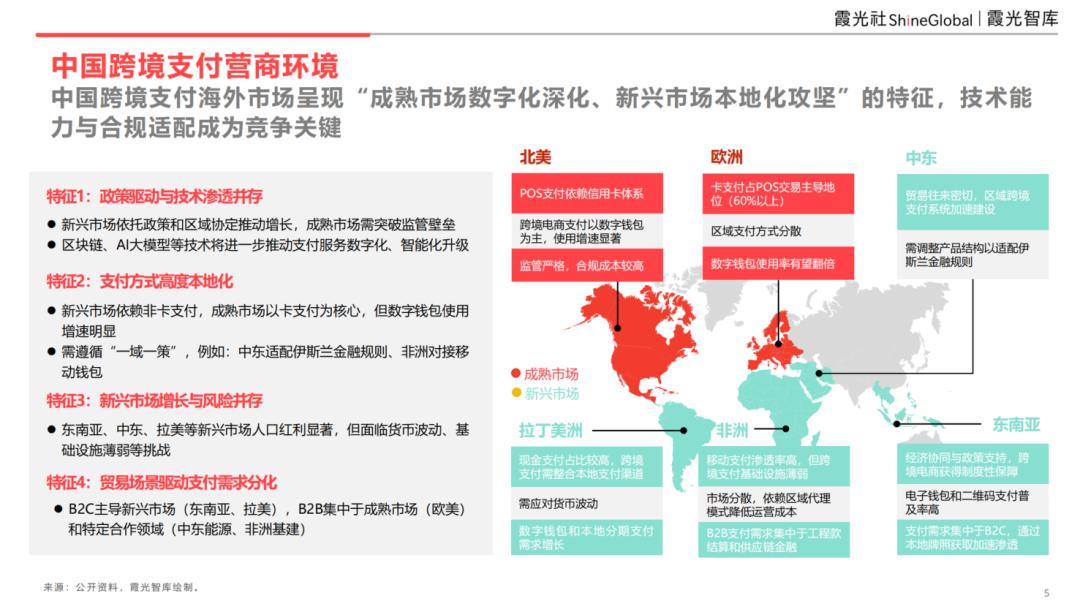

(II) Business Environment for China's Cross-border Payment

Mature markets such as North America and Europe and emerging markets represented by Southeast Asia, the Middle East, and Latin America generally exhibit the characteristics of "deepening digitization in mature markets and tackling localization in emerging markets" in the field of cross-border payment. Mature markets are centered on card payments, for example: POS payments in North America rely on the credit card system, and card payments in Europe account for more than 60% of POS transactions, but the use of digital wallets in both regions is currently showing significant growth. Emerging markets mainly rely on non-card payments, and payment methods are highly localized, requiring adherence to the principle of "one strategy for each region," such as compliance with Islamic financial rules in the Middle East and connections to mobile wallets in Africa. In addition, technological capabilities such as blockchain and large AI models will further promote the digitalization and intelligent upgrading of payment services.

(III) Development History of China's Cross-border Payment

China's cross-border payment has undergone multiple rounds of deep transformations, from B2C to B2B service expansion, from the rise of domestic institutions to the entry of foreign institutions, and from traditional payment dominance to technological innovation and change. In 2015, the opening of non-bank foreign exchange business registration nationwide marked the official start of China's cross-border payment service market, with third-party payment service providers emerging one after another, including cross-border acquiring institutions represented by Oceanpayment and cross-border collection institutions represented by LianLian Global and Pingpong, driving down fees and promoting the inclusiveness of payment services.

Since 2017, the wave of small and medium-sized enterprises going abroad has spurred the emergence of professional B2B payment service providers, with institutions such as XTransfer beginning to explore the B2B market, assisting small, medium, and micro foreign trade enterprises in going abroad. Around 2020, with policy support, technological innovation, and the influx of foreign institutions represented by Airwallex, cross-border payment was further pushed into a stage of rapid development, with the market size continuing to grow rapidly, and payment institutions are assisting Chinese enterprises in going abroad through "Payment+" services. In the future, with the improvement of policies and technological progress, China's cross-border payment is expected to become a global business innovation center. Embedded finance enables seamless integration of payment services, and cross-border payment APIs will become increasingly intelligent and standardized in the future. At the same time, with the accelerated progress of blockchain technology applications in the payment field, models such as DLT may drive retail payments in digital currencies. In addition, events such as Stripe's acquisition of Bridge and the launch of CPN indicate that the overseas payment market will usher in the PayFi era, and if tokenization becomes the next-generation global cross-border payment solution, it may subvert the existing market landscape.

(IV) Industrial Map of China's Cross-border Payment

China's cross-border payment industrial ecosystem is relatively complete overall, from underlying infrastructure to comprehensive cross-border payment services, plus related service providers such as payment gateways, card organizations, data security, and compliance risk control, collectively empowering enterprise-level and consumer-level cross-border payment transaction scenarios and methods in various industry sectors and business areas such as cross-border e-commerce, pan-entertainment, and B2B foreign trade.

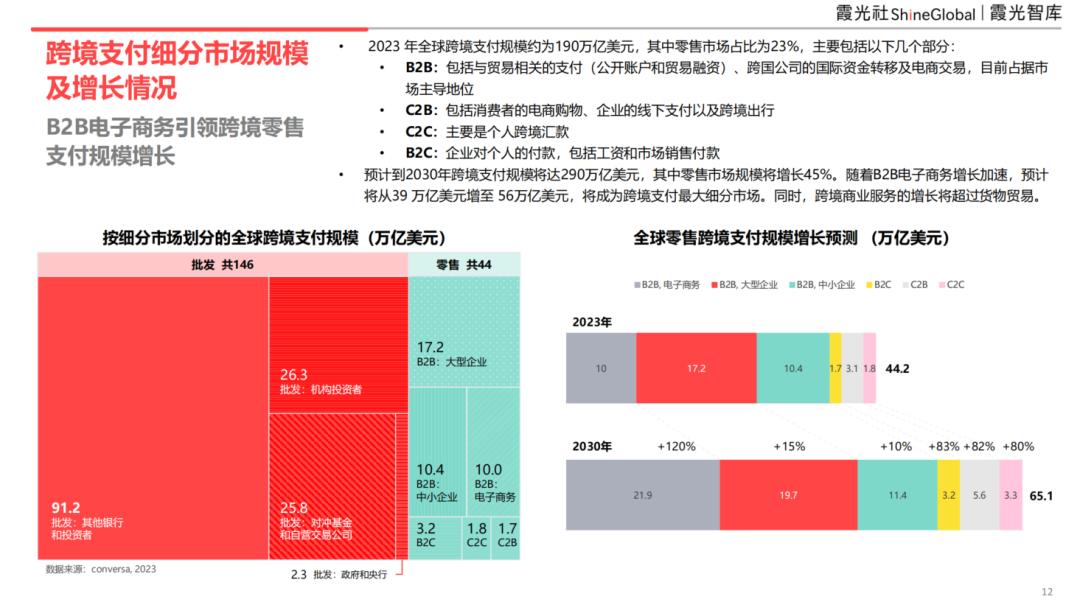

(I) Market Size and Growth Forecast for Cross-border Payment

In 2023, the global cross-border payment scale was approximately $190 trillion, with the retail market accounting for 23%, mainly comprising the following segments: B2B: including trade-related payments (open accounts and trade finance), international fund transfers of multinational corporations, and e-commerce transactions, currently occupying a dominant position in the market. C2B: including consumers' e-commerce shopping, enterprises' offline payments, and cross-border travel. C2C: mainly refers to personal cross-border remittances. B2C: enterprise-to-individual payments, including salary and marketing sales payments. It is estimated that the scale of cross-border payment will reach $290 trillion by 2030, with the retail market size growing by 45%. With the accelerated growth of B2B e-commerce, it is expected to increase from $39 trillion to $56 trillion, becoming the largest segment of cross-border payment. At the same time, the growth of cross-border business services will exceed that of goods trade.

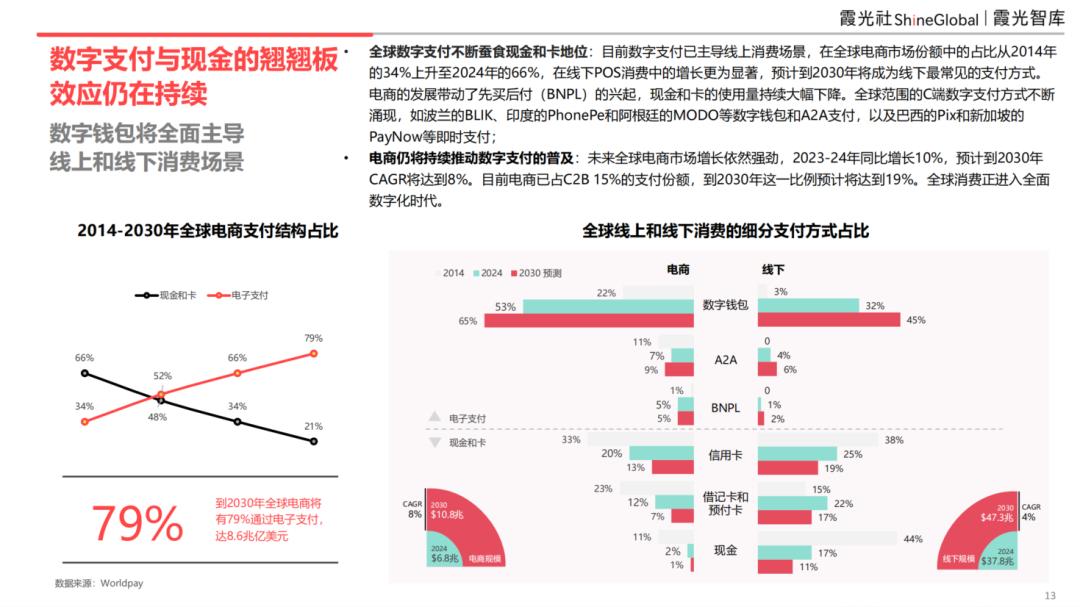

(II) Global Cross-border Payment Types and Transaction Structures

Currently, digital payments are dominating online consumption scenarios, with their share in the global e-commerce market rising from 34% in 2014 to 66% in 2024, and their growth in offline POS consumption is even more significant, expected to become the most common offline payment method by 2030. The development of e-commerce has driven the rise of Buy Now Pay Later (BNPL), leading to a continuous significant decline in the use of cash and cards. C-end digital payment methods continue to emerge globally, such as digital wallets and A2A payments like BLIK in Poland, PhonePe in India, and MODO in Argentina, as well as instant payments like Pix in Brazil and PayNow in Singapore. The global e-commerce market will continue to grow strongly in the future, with a year-on-year increase of 10% from 2023 to 2024, and a projected CAGR of 8% by 2030. Currently, e-commerce accounts for 15% of the C2B payment scenario market share, which is expected to reach 19% by 2030. Global consumption is entering a comprehensive digital era.

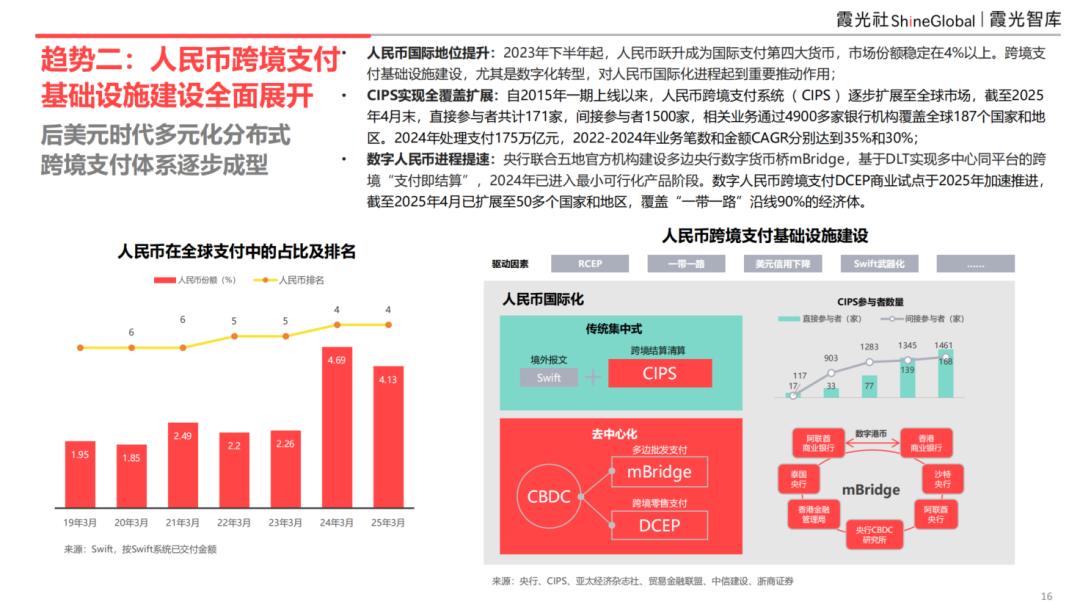

(I) Comprehensive Development of RMB Cross-border Payment Infrastructure

Since the second half of 2023, the RMB has become the fourth largest currency for international payments, with a market share stabilizing above 4%. The construction of cross-border payment infrastructure, especially digital transformation, has played an important role in promoting the internationalization of the RMB. Since the launch of Phase I in 2015, the Cross-border Interbank Payment System (CIPS) has gradually expanded to the global market. As of the end of April 2025, there were a total of 171 direct participants and 1,500 indirect participants, with related businesses covering 187 countries and regions through more than 4,900 banking institutions. The People's Bank of China has joined forces with official institutions in five locations to build the multilateral central bank digital currency bridge (mBridge), realizing cross-border "payment versus settlement" on a multi-center, same-platform basis based on DLT, which entered the minimum viable product stage in 2024. The commercial pilot of the digital RMB for cross-border payments (DCEP) accelerated in 2025, expanding to more than 50 countries and regions by April 2025, covering 90% of the economies along the "Belt and Road" Initiative.

(II) Emerging Alternative Models Expected to Drive Fundamental Changes in Cross-border Payment

The current payment system is dominated by traditional correspondent banking networks, with relatively complex correspondent banking models and processes. Individual payment channels are not entirely efficient and cannot guarantee payment transparency. As private enterprises become prominent in cross-border trade, they have put forward higher requirements for the convenience, security, and efficiency of cross-border payments; central banks of various countries are exploring CBDCs or conducting related pilot projects, which will form a more direct and state-backed cross-border settlement method. Third-party payments are also building independent payment network systems with mobile payment scenarios as the entry point. Innovative means based on blockchain technology, such as CBDCs and tokenized deposits, are expected to improve settlement efficiency and optimize settlement outcomes.

(III) Continuous Horizontal and Vertical Extension of Cross-border Payment Business Scenarios from Foreign Trade and E-commerce

Building on e-commerce acquiring and foreign trade collection services, payment service providers continue to expand their business models, such as tax refunds, VAT, and supply chain financing, which have gradually become standard services, with payment and collection scenarios and service industries becoming increasingly diversified and extensive. More and more payment institutions are transforming into providers of financial infrastructure for comprehensive services covering payment and collection, with their service capabilities being integrated into open API platforms, including interfaces for VA accounts, foreign exchange settlement declarations, foreign exchange conversions, VCC card issuance, overseas remittance issuance, etc., further enhancing their ability to provide global one-stop asset management financial services to customers.

(IV) Increasingly Widespread Application Scenarios of AI in Cross-border Payment

The integration of AI and machine learning with cross-border payment helps identify abnormal behaviors in payment transactions, simplifies cumbersome payment processes, and makes fund flows more efficient and secure, continuously expanding and deepening in specific scenario applications such as routing, exchange, review, reporting, and customer service. AI has achieved remarkable results in addressing the complex challenges of cross-border payment, especially in anti-money laundering (AML), fraud detection, and data protection. For example, AI's anti-fraud system has helped Mastercard reduce false positive fraud reports by 85%. In addition, AI can analyze transaction data in real-time, and embedding AI fraud detection models in blockchain payments can automatically complete operations such as payment, settlement, and asset transfer, making risk control more precise and efficient. Click to read the original article for the complete trends.

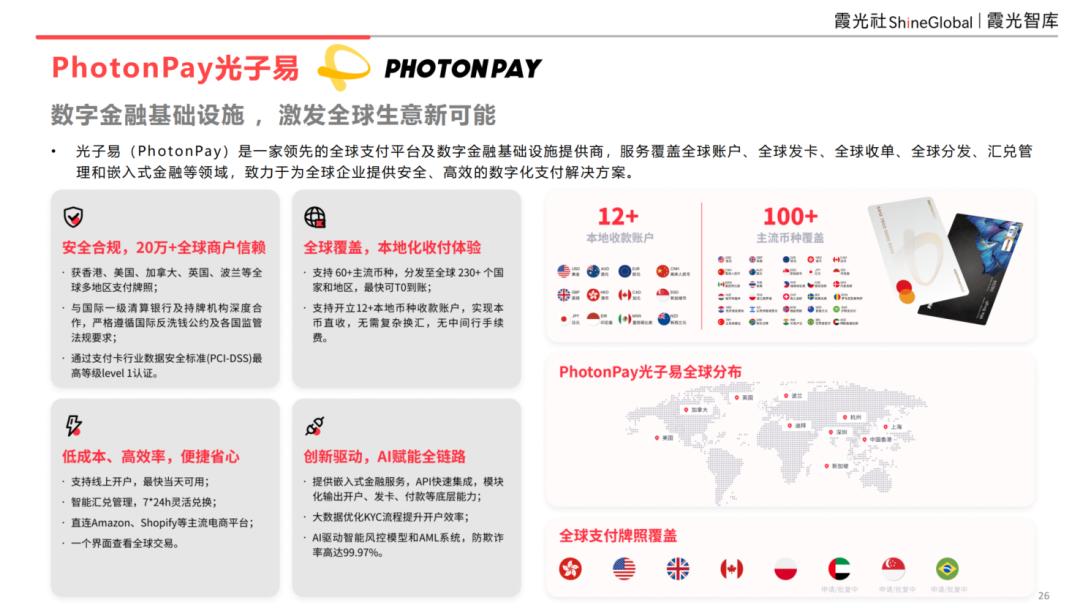

(I) PhotonPay

PhotonPay is a leading global payment platform and digital financial infrastructure provider, offering services covering global accounts, global card issuance, global acquiring, global distribution, exchange management, and embedded finance, aiming to provide secure and efficient digital payment solutions for global enterprises.(II) Airwallex

Airwallex is a leading global payment and financial platform, providing global payment, financial management, expense control management, and embedded finance solutions for modern enterprises. Utilizing its self-built global financial service infrastructure, Airwallex innovatively solves various pain points in global payments and financial operations, enabling enterprises of all sizes to achieve boundless growth.(III) Oceanpayment

Oceanpayment is a globally leading provider of digital payment technology solutions, dedicated to offering full-process payment solutions from Pay-in to Pay-out for internet B2C(B) e-commerce models such as cross-border foreign trade, tourism and aviation, digital games, and education and training. It covers the entire chain of cross-border payment scenarios including "collection, management, payment, and exchange", accelerating payment conversion efficiency and improving overall operational quality.