SpaceX Networking Chain Reaction: AI's Transformative Role in Satellite and V2X Cloud Networks

![]() 06/19 2025

06/19 2025

![]() 657

657

Recently, SpaceX's announcement has once again captured the global communication industry's attention. The success of Starlink's direct satellite networking for mobile phones signals SpaceX's imminent entry into the realm of global direct satellite internet services for mobile devices. While this news hasn't garnered widespread media coverage, it's akin to a pebble tossed into a still pond, creating ripples and posing unprecedented challenges to the traditional communication industry, particularly 5G, which could be described as a paradigm shift.

Let's shift our focus to the mobile networks we rely on daily, which heavily depend on base stations for signal transmission. In densely populated urban areas, base stations abound, ensuring seamless network connectivity. However, when venturing into remote mountainous regions, vast oceans, or traveling on high-speed trains in areas without base station coverage, mobile signals weaken or vanish altogether. Both 4G and 5G, relying on terrestrial base stations, face two insurmountable challenges: high costs and limited reach. Building base stations in remote locations often results in significant losses for operators due to the disparity between investment and user base. In scenarios like the sea and sky, geographical constraints and technological limitations preclude the construction of base stations, leaving these areas as network coverage 'dead zones'. According to a 2024 report by the International Telecommunication Union (ITU), 32% of the global population, or roughly 2.6 billion people, remain disconnected from the internet, unable to enjoy its conveniences.

Musk's Starlink plan, like a beacon of hope, offers a novel approach to address these challenges. He aims to launch 42,000 satellites to form a colossal satellite network encircling Earth, ensuring global coverage, including areas inaccessible to terrestrial base stations, such as Mount Everest, the East African Rift Valley, the Pacific Ocean, and aircraft in flight. From a cost perspective, China invested a staggering 730 billion yuan by the end of 2023 to build a 5G network with 3.377 million base stations, yet still lacks comprehensive nationwide coverage. Conversely, each Starlink satellite costs approximately $250,000, with a launch cost of $350,000, totaling around $600,000 per satellite. If the Starship achieves commercial viability, costs are projected to drop to $300,000 per satellite. Based on these calculations, the total cost for 42,000 satellites is approximately $25.2 billion, equivalent to 180 billion yuan, significantly less than the colossal investment in 5G infrastructure and capable of achieving true global coverage.

Previously, a major drawback of the Starlink network was the need for users to equip additional receivers, like large antennas, which hindered convenience and adoption. Nowadays, SpaceX's breakthrough in direct satellite networking for mobile phones allows standard mobile devices to connect to the satellite internet without modifications or external devices. Currently, over 300 satellites with direct mobile connectivity orbit Earth, functioning as 'space-based network stations,' sufficient to cover the globe and provide network services to users.

In terms of commercial prospects, US operators are leading the way. For instance, T-Mobile offers satellite internet services free to premium package subscribers, while others can access this service for an additional $10-$15 per month, roughly 70-105 yuan. As user numbers grow, economies of scale will emerge, potentially lowering service prices further. This trend profoundly impacts the traditional communication industry. For telecom equipment manufacturers, demand for 5G base stations may decline, particularly in countries amidst large-scale 5G construction yet lacking comprehensive coverage. For operators, collaborating with satellite internet providers like SpaceX and introducing satellite internet services will be crucial to enhancing competitiveness. SpaceX, with its pioneering reusable rocket technology, has drastically reduced satellite launch costs. In 2024, SpaceX successfully launched 134 times, surpassing all other countries combined. These savings are invested in technological research and development, such as the ambitious Mars plan, rather than purely for commercial expansion, further solidifying its technological edge and monopoly in the satellite internet sector.

This event underscores a vital rule of technological advancement: disruptive innovations often stem from interdisciplinary breakthroughs. Just as electric vehicles disrupted the traditional gasoline vehicle market, autonomous driving technology now promises new changes in the EV industry. Similarly, SpaceX, renowned for its rocket technology, is challenging the traditional telecommunications industry through satellite internet. In today's rapidly evolving technological landscape, understanding technological trends is essential to seize the opportunities presented by the times; clinging to outdated technologies will inevitably lead to obsolescence. Satellite internet, with its advantages like low cost, global coverage, and direct mobile connectivity, poses a significant challenge to the traditional 5G model, potentially reshaping the future landscape of the communication industry.

V2X Cloud Network: The 'Highway' to Intelligent Mobility

Expanding our perspective from satellite internet to the V2X Cloud Network reveals a shared underlying logic despite their differing application scenarios. Vehicles, akin to mobile intelligent terminals, require real-time, accurate information about their surroundings, interacting with vast cloud data and achieving high-speed, stable data transmission with other vehicles and road infrastructure. This need for data interaction and transmission imposes stringent requirements on network stability, speed, and coverage, necessitating uninterrupted signals and zero data loss to ensure vehicles remain 'always connected' for travel safety.

Existing mobile communication networks, thanks to densely deployed base stations, achieve extensive coverage in urban areas, supporting daily communication and some intelligent transportation applications. However, once vehicles leave cities and enter remote regions, oceans, deserts, or other special environments, high base station construction costs or complex geographical conditions hinder coverage, making it difficult to meet the stringent network demands of the Internet of Vehicles and hindering its development.

Faced with this challenge, the industry is looking skyward, aiming to leverage satellite communication to build a new automotive network and transcend the path dependence of traditional mobile networks. A recent collaboration between GalaxySpace and the Smart Mobility Team at the Hong Kong Applied Science and Technology Research Institute exemplifies this exploration. In Hong Kong, with numerous islands and mountainous terrain causing communication blind spots, they successfully tested a connected autonomous driving system using low-orbit satellite internet for the first time. By installing GalaxySpace's satellite mobile terminals on autonomous vehicles and utilizing a constellation of 'little spider webs' composed of low-orbit satellites, a stable connection between the vehicles and the autonomous driving cloud management platform was established, facilitating the transmission of autonomous driving data and the reception and execution of navigation information.

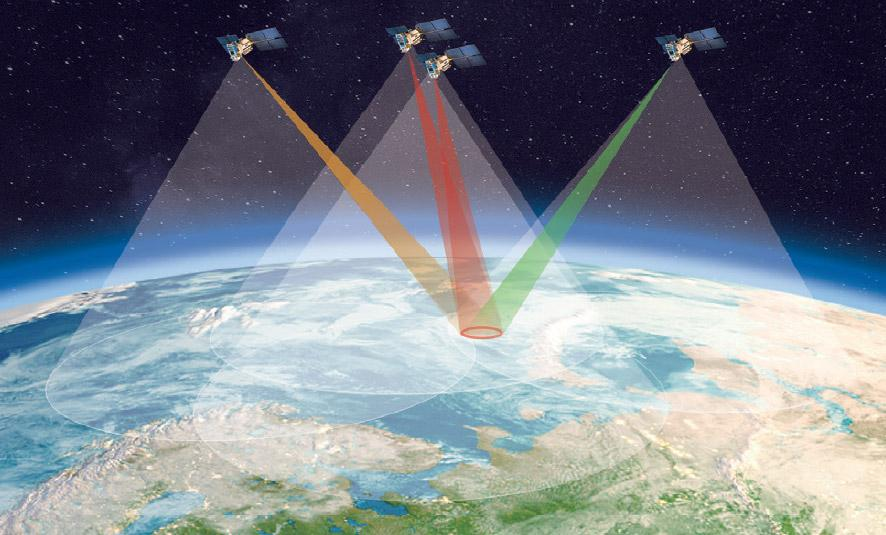

When unexpected situations like construction or road diversions arise ahead of the vehicle, the cloud management platform can instantly update navigation information via the satellite network based on the vehicle's current location, aiding in timely route adjustments and enhancing travel efficiency. During testing, three low-orbit satellites successively covered the test area, providing stable satellite network connectivity. The results were promising, demonstrating low-orbit satellite communication's excellent performance with an end-to-end data transmission delay of less than 100 milliseconds, fully meeting autonomous vehicles' stringent low-latency data transmission requirements.

Technological Evolution: The Rise of the Integrated Space-Ground Network Revolution

The emergence of satellite internet is not coincidental; it's an inevitable trend in global communication network technology evolution and a bold disruption of traditional network development. From 2G to 5G, mobile internet speeds have achieved a qualitative leap, from early 100kbps to tens of Gbps, meeting people's growing communication needs. However, in the new era of the Internet of Everything, emerging application scenarios like autonomous driving, the Internet of Things, telemedicine, and the Industrial Internet continuously arise, imposing higher and more complex demands on network performance. 5G is gradually revealing its limitations when confronted with these emerging applications.

During the early stages of promoting 5G communication development in China, a clear development plan was formulated based on the ITU's three primary 5G application scenarios, encompassing enhanced mobile broadband, ultra-large-scale machine-type communications, and ultra-reliable and low-latency communications. However, in actual commercialization, due to telecom operators' core resources and business focus being primarily in public mobile communication networks, large-scale 5G technology deployment tends to lean more towards enhanced mobile broadband. While ultra-reliable and low-latency communications, originally planned for automotive, industrial control, and other fields, have made certain technological breakthroughs, they haven't yet achieved large-scale commercial applications due to various constraints, lagging behind expectations.

The integration of satellite internet offers new possibilities for 5G to transcend its limitations. With advantages like global coverage, low transmission delay, high cost-effectiveness, and superior performance, satellite internet can complement terrestrial networks, becoming a powerful extension and supplement to 5G networks. As the 6G era approaches, the blueprint for communication technology development expands even further. Building on 5G's three application scenarios, 6G extends to six core scenarios, with 'ubiquitous connectivity' becoming a hallmark of the 6G era. 'Ubiquitous connectivity' aims to achieve global three-dimensional coverage by deeply integrating terrestrial and non-terrestrial networks, making communication services ubiquitous and enabling users to enjoy stable, high-speed network services regardless of location on Earth. As a core supporting technology for realizing 'ubiquitous connectivity', satellite internet will play an irreplaceable role in the 6G era.

Low-orbit satellites deploy large-scale satellite constellations in near-Earth orbits at altitudes of 200-2000 kilometers above the ground (Image source: Visual China)

The 'White Paper on the Overall Vision and Potential Key Technologies of 6G' published by the China Academy of Information and Communications Technology clearly states that realizing integrated satellite-terrestrial networking is a key 6G technology. In future communication network architecture, terrestrial networks will continue to handle routine coverage in urban hotspots, while space-based and air-based networks will leverage their unique advantages to provide on-demand coverage in special areas like remote regions, the sea, and the air. Through this space-ground coordination, the ultimate goal is to achieve deep integration of air-based, space-based, and ground-based networks, constructing a globally seamless communication network system. The evolution from 5G to 6G is not a simple linear upgrade of the traditional network path but a comprehensive, disruptive transformation encompassing the entire communication network structure. In this process, satellite internet will deeply integrate with terrestrial communication networks, becoming a cornerstone in building an integrated space-ground network. It will break the geographical constraints of traditional communication networks, opening new development avenues in fields like global communication, the Internet of Things, and intelligent transportation, propelling human society into a new era of ubiquitous connectivity.

Strategic Positioning: Securing the Vanguard of Future Communications

Amidst the rapid evolution and transformation of the global communication network towards an 'integrated space-ground' architecture, satellite internet has emerged as a strategic high ground fiercely contested by nations and a pivotal area for securing the commanding heights of future communications. A communication industry expert emphasized, "Without an independently controllable industrial ecosystem, we risk losing our voice in standard-setting within international telecommunication organizations. By strategically deploying satellite networks, we are effectively seizing strategic commanding heights for the formulation of next-generation communication standards, which is paramount for future industrial competition."

Since April 2020, when the National Development and Reform Commission (NDRC) included satellite internet in the category of 'new infrastructure,' China's satellite internet development has accelerated significantly. At the beginning of 2025, the NDRC, the National Data Administration, and the Ministry of Industry and Information Technology jointly issued the 'Guidelines for the Construction of National Data Infrastructure,' explicitly proposing the establishment of an 'integrated space-ground' satellite internet system. Related deployments are now in full swing in cities such as Shanghai, Shenzhen, Xi'an, and Wuhan. Two major national-level constellation projects approved by the NDRC have made significant progress. In 2021, with the approval of the State Council, the State-owned Assets Supervision and Administration Commission established China Satellite Network Group Co., Ltd. (abbreviated as 'China Satellite Network'), a national strategic initiative aimed at the overall planning of China's satellite internet industry. By the end of 2024, China Satellite Network had completed the first batch of networking for the 'State Grid' constellation, marking the entry into a substantive phase of China's low-orbit internet constellation construction. Similarly, the G60 constellation, approved by the NDRC and led by Huanxin Satellite, launched its first batch of 18 constellation satellites in August 2024.

As satellite communication networks rapidly take shape, their application fields continue to expand, gradually infiltrating emerging areas such as automobiles, smart cities, low-altitude aviation, and emergency disaster relief, in addition to traditional broadcast television and mobile phone communication. Among these diverse applications, automobiles have emerged as ideal carriers for satellite communication due to their unique characteristics. Car antennas, larger than those of mobile phones, can receive stronger satellite signals, and their wider elevation angle range allows for a larger effective area to receive signals, giving cars a natural advantage in satellite communication. Experts predict that the application prospects of satellite communication in the automotive sector will far surpass those of mobile phones, with the period from 2025 to 2030 potentially becoming a new battleground for competition among automakers. Leading automakers like Tesla, Geely, and BYD have keenly recognized this trend and are pioneering deployments in the satellite communication field.

Musk's SpaceX has deployed over 6,600 low-orbit satellites for its 'Starlink' constellation. In May 2024, Julien Villa-Massone, a Starlink software developer, revealed that SpaceX is actively promoting a direct satellite connection plan for Tesla vehicles. By the end of 2025, all Tesla vehicles equipped with 4G functionality are expected to gain basic network access, offering Tesla owners a new network experience.

From Communication Network to AI Network: The Ultimate Evolution of Technology Convergence

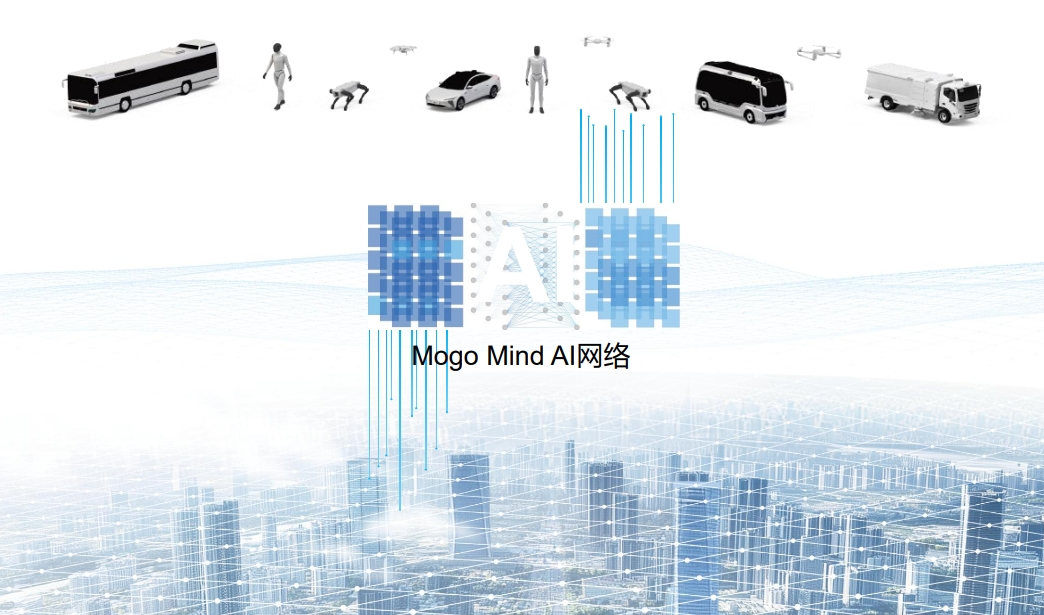

Upon delving into the fundamental logic of satellite internet and vehicle-road-cloud networks, it becomes evident that both are essentially composite networks comprising "communication + sensing + computing." Satellite internet constructs global communication links through constellations deployed in space, achieves environmental sensing via satellite-borne sensors and ground terminals, and completes data processing and application output through the collaboration of onboard computing and ground data centers. Conversely, the vehicle-road-cloud network leverages 5G/6G communication as a bridge, integrating vehicle-mounted sensors, roadside sensing devices, and cloud computing power to enable real-time interaction between vehicles and their surroundings. The core difference between the two lies solely in the spatial distribution of network nodes and the form of sensing devices, with their technological architectures inherently converging.

This ternary architecture of "communication + sensing + computing" is evolving towards the intelligent logic of "sensing - cognition - reasoning." Taking autonomous driving scenarios as an example, low-orbit satellites not only provide global communication coverage but also achieve centimeter-level positioning (with an error range of 5-10 centimeters) through high-precision positioning payloads. When combined with vehicle-mounted LiDAR, visual cameras, and other devices, a three-tier "sky-ground-vehicle" sensing system is established. In mountainous areas without ground network coverage, satellite communication links transmit real-time data on road obstacles, weather changes, etc., to cloud-based large models (such as multimodal models based on the Transformer architecture). These models utilize deep learning algorithms to recognize and understand the data, make reasoning decisions based on traffic rules and historical experience, and transmit the optimized driving path back to the vehicles. The end-to-end latency of the entire process can be controlled within 100 milliseconds, fully meeting the real-time requirements of autonomous driving.

This intelligent interaction logic is reshaping the technical boundaries of traditional networks. SpaceX plans to deploy its third-generation Starlink satellites in 2026, integrating AI acceleration chips to enable onboard data preprocessing and edge computing, thus transforming satellites from simple communication nodes into intelligent nodes with cognitive capabilities. China's State Grid Satellite Constellation also intends to introduce federated learning technology, enabling globally distributed satellite constellations to enhance data processing efficiency through collaborative training. Meanwhile, the application of large models in the vehicle-road-cloud field is accelerating. SenseTime's vehicle-road large model can already generate real-time 3D road topology maps based on satellite remote sensing data and roadside camera footage, providing more precise environmental modeling for autonomous vehicles.

Industry Insights in Conclusion

When Satellite Internet Meets AI Large Models

The history of technological evolution has repeatedly proven that technological systems capable of achieving "economies of scale + intelligent upgrades" will ultimately become the driving force behind industrial transformation. Satellite internet has reduced the cost of a single satellite to below $300,000 through reusable rocket technology, and with a global network of 42,000 satellites, it has achieved coverage and cost advantages that traditional 5G cannot match. The vehicle-road-cloud network, through the integrated networking of "5G + satellite + PC5," reduces the deployment cost of RSUs by over 40% and, with the assistance of large models' cognitive reasoning abilities, evolves the network from an "information transmission pipeline" to an "intelligent decision-making hub."

The essence of this transformation is the leap of networks from "connection tools" to "intelligent agents." Future AI networks will possess three key characteristics:

- Omnipresent Sensing Capability: Devices such as satellite remote sensing, vehicle-end sensors, and roadside cameras constitute trillions of sensing nodes, collecting dynamic data from the physical world in real-time.

- Cloud-based Cognitive Reasoning: Based on ultra-large-scale pre-trained models (with parameter scales reaching hundreds of billions), real-time analysis and decision-making are performed on multi-source heterogeneous data.

- Edge Real-time Interaction: Through technologies such as low-orbit satellite communication and 5G-A, decision instructions are swiftly fed back to terminals, forming a closed loop of "sensing - cognition - execution."

Looking back from the technological node of 2025, SpaceX's successful networking of direct mobile phone connections to satellites is not merely a breakthrough in communication technology but also the prelude to AI networks. When 42,000 Starlink satellites and tens of millions of intelligent automobile terminals form a data interaction network, and every time vehicle lane-changing data can be learned and optimized by large models, we may be witnessing the third network revolution after the internet and mobile internet—a transformation driven by satellite communication and AI large models towards an "integrated space-ground intelligent network." Those enterprises that can clearly foresee the convergence trend of "communication + sensing + computing + AI" will ultimately prevail in this race to reshape the industrial landscape.