Big Model Six Tigers: Navigating the Challenges of Entrepreneurship

![]() 06/23 2025

06/23 2025

![]() 655

655

Following Zhipu and MiniMax, which AI startup will be the next to hit the public markets?

Written by | Lan Dong Business Zhao Weiwei

The Big Model "Six Tigers" now face a critical juncture: going public independently or being acquired and restructured.

Two months ago, Zhipu AI officially commenced its IPO process in China, and recently, MiniMax also hinted at considering an IPO in Hong Kong. Among the Big Model Six Tigers, Zhipu AI and MiniMax have been the early frontrunners. As early as 2022, Zhipu had already trained and completed China's first 100 billion open-source model, while MiniMax launched an AI virtual social product during the same period.

Apart from going public, another viable path for AI startups under capital pressure is being acquired by larger companies.

In June, Meta acquired the US AI startup Scale AI for $14.3 billion, acquiring 49% of its equity, with the founder joining Meta to oversee AI operations. Scale AI, founded in 2016, specializes in data annotation, assisting large companies in training and enhancing model data. Following the acquisition, major clients Google and OpenAI promptly suspended their cooperation with Scale AI.

In the domestic market, after DeepSeek's meteoric rise this year, the landscape of the former "Six Tigers" has long been fragmented.

Li Kaifu's ZeroOne has retreated from the basic model arena, becoming the first to be labeled as lagging behind by the outside world. Wang Xiaochuan's Baichuan Intelligence has scaled back its strategy, focusing on the medical industry, with three co-founders leaving, also falling under external scrutiny. Jiang Daxin's Jieyue Xingchen is the latest entrant into the "Six Tigers" scene, with a relatively modest valuation, and this year it also shed C-end products to concentrate on agents. Yang Zhilin's Kimi is no longer aggressively pursuing market launches, focusing instead on basic models and agent products.

It's evident that the "Six Tigers" are already experiencing minor setbacks, with at least two to three of them no longer competing on the same level, evolving into a "Four Strong" or even smaller landscape. More critically, confronted with the advantages of companies like ByteDance, Alibaba, and Tencent in terms of traffic and product scale, the market space for domestic large model startups is further compressed, making it imperative to devise differentiated competitive strategies during this period of shuffling.

DeepSeek has prompted capital markets to reassess investment logic, and user choices have intensified the elimination within the big model industry. Should they opt for acquisition or pursue an IPO? This is a pivotal path for big model startups.

Surpassing DeepSeek: A Formidable Task

Abandoning blind pursuit of user scale, shifting from aggressive customer acquisition strategies, transitioning from the To C market to To B, and refocusing technical efforts on underlying models are key changes observed in big model startups during the first half of this year.

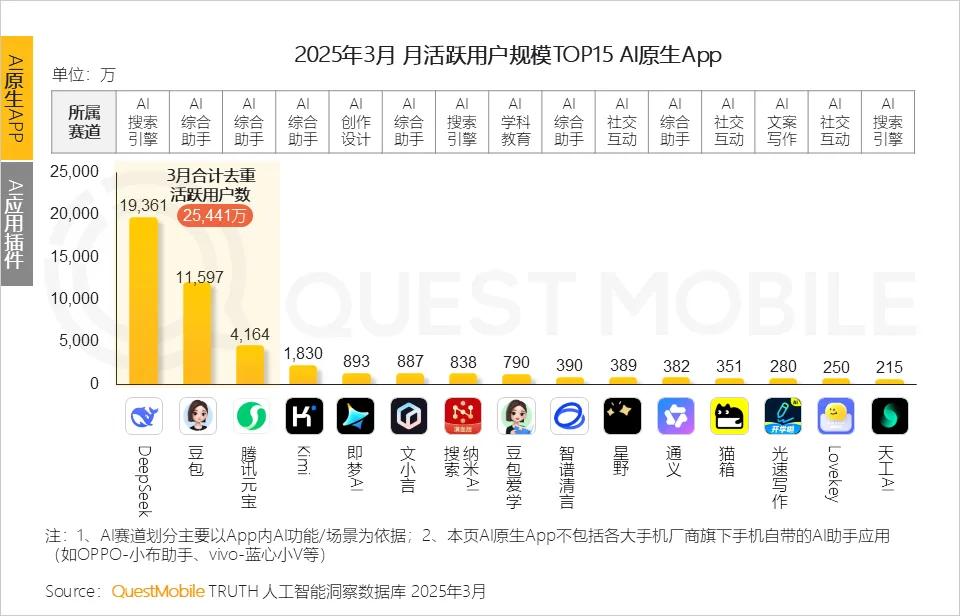

Kimi exemplifies these changes. Amidst the aggressive market entries and customer acquisition efforts of ByteDance's Doubao and Tencent's Hunyuan, Kimi struggles to compete with these large players and must venture beyond their reach. On one hand, it continues to strengthen its long-text model expertise, and on the other, it explores unique and differentiated scenarios.

In terms of unique scenarios, Kimi collaborates with Xiaohongshu, introducing a search dialogue feature in its Xiaohongshu account, enabling users to generate notes with a single click using Kimi. In partnership with "Caixin", "Caixin"'s high-quality content becomes a valuable resource for Kimi to generate answers to questions, and "Caixin" also gains the qualification to provide AIGC services externally.

However, the benefits these unique scenarios bring to Kimi remain to be seen. The collaboration with Xiaohongshu leans more towards marketing, while the partnership with "Caixin" aids "Caixin" in acquiring paying users.

Meanwhile, Kimi's underlying construction of basic models remains its primary goal, with opportunities in the application layer, including agents, also serving as key directions. Recently, Kimi open-sourced the Kimi-Dev code model with only 72B parameters, achieving an open-source SOTA score of 60.4% on SWE-bench Verified, claiming stronger programming capabilities than the latest DeepSeek-R1.

Model performance still dictates the upper limit for AI startups, and the march towards more powerful artificial intelligence continues, with benchmarking against DeepSeek becoming the main attraction.

Recently, MiniMax also open-sourced its latest inference model MiniMax-M1, challenging DeepSeek with a computational rental cost of just $534,700. Previously, Zhipu also released its fully self-developed large model Zhipu GLM, including the inference model GLM-Z1-Air and the base model GLM-4-Air0414, claiming that the former's performance reaches the level of DeepSeek-R1, with an up to 8-fold speed increase and a price that is just 1/30 of DeepSeek-R1.

Surpassing past versions of DeepSeek is manageable, but overtaking the current DeepSeek is challenging.

In March this year, DeepSeek's V3 model underwent a minor version upgrade, and in May, the R1 model completed a minor trial upgrade. However, the highly anticipated R2 deep inference model with remarkable performance has been delayed and remains the industry's most eagerly awaited event. Relevant rumors have not been officially confirmed, but according to DeepSeek's release schedule, a major version update is likely in June-July this year.

Under the pressure of DeepSeek, AI startups have accelerated their model release schedules recently, attempting to train models with fewer computational resources and forging technological breakthroughs through lower costs and more optimized algorithms. Therefore, underlying model capabilities remain the focal point of current competition.

The Talent War Continues

Competing for AI talent is one of the major threats AI startups must confront from large companies.

Recently, OpenAI CEO Sam Altman revealed in an interview that to build a top AI team, Meta offered signing bonuses of up to $100 million to OpenAI employees, with even higher annual salary packages. Previously, Meta had already poached engineers from multiple companies, including Jack Rae, a lead researcher at Google DeepMind.

Additionally, Meta recently attempted to acquire Safe Superintelligence, an AI startup founded by OpenAI co-founder Ilya Sutskever. When Sutskever rejected the acquisition offer, Zuckerberg turned his attention to recruiting the startup's CEO and co-founder, Daniel Gross.

The $100 million signing bonus has highlighted the ferocity of the battle for AI talent.

However, throughout 2024, the OpenAI founding team disintegrated, with 9 of the 11 founding members leaving, none of whom directly joined Meta. Their departure stemmed from internal disagreements over OpenAI's development direction. The departing founding team members either went independent or joined companies like Google.

It's often internal strife that leads to team splits, followed by external threats. The brain drain caused by financial pressure and strategic disagreements at OpenAI last year serves as a cautionary tale for Chinese AI startups this year.

According to Zhidongxi statistics, 12 executives left the Big Model Six Tigers in the first half of this year. Apart from Yuezhi Anmian, which had no executive changes, the most notable shifts were seen in Zhipu, Baichuan Intelligence, and ZeroOne, primarily among commercialization leaders, including Zhipu's Chief Operating Officer Zhang Fan, MiniMax's Commercialization Partner and Vice President Wei Wei, and the previously departed Baichuan Intelligence co-founder and commercialization leader Hong Tao.

One destination for the executives lost from the Six Tigers is large companies like ByteDance.

Those who joined ByteDance include Ding Ming from Zhipu and Huang Wenhao and Cao Dapeng from ZeroOne. Duan Nan from Jieyue Xingchen joined JD.com, serving as the head of the Vision and Multimodal Laboratory at the Exploration Research Institute, focusing on the research and development of vision and multimodal basic models. Nie Pengcheng from ZeroOne joined BYD, while Li Xiangang, co-founder of ZeroOne, returned to Beike.

Talent mobility in the AI industry is frequent, and the departure of AI talent from large companies like ByteDance is not uncommon.

However, the underlying trend reflected in this mobility is that the big model industry is gradually transitioning from an early stage of rapid, uncontrolled growth to a more rational stage of development. Commercialization capabilities will become crucial for enterprises' survival and development. Some companies may face survival pressures, while internet giants have greater advantages in salary and cloud computing resources.

Recent news indicates that ByteDance founder Zhang Yiming has moved his main office from Singapore to Beijing. Starting from the second half of last year, he has convened monthly review and discussion meetings with ByteDance's core management and AI project leaders.

An informed source revealed, "Zhang Yiming has always been very concerned about the AI business. Currently, Zhang Yiming frequently travels between Singapore and Beijing. Starting from the second half of last year, he attends a monthly review and discussion meeting with the core technology team."

Anticipating Fierce Competition

From talent to strategy, from products to models, AI startups are inevitably under pressure from internet giants. Breaking out of the internet giants' sphere of influence and creating differentiated models and products in a highly homogenized market is the only recourse for AI startups.

AI industry analysts point out that among AI startups, including the Big Model Six Tigers, there may only be 1-2 survivors in future competitions. With the elimination round intensifying, it's challenging for AI large model base companies to win this war in terms of resources. Therefore, partnering with different large factories and taking sides will be an important trend in the future.

Another significant trend is going public. As the most prominent player in the domestic large model commercialization track, Zhipu AI has become the first large model startup to initiate an IPO, setting an example for others. Soon after, MiniMax also hinted at considering an IPO in Hong Kong. Both Zhipu and MiniMax have received investments from Tencent and Alibaba.

Whether it's being acquired by aligning with large factories or going public, the logic is clear. AI large model startups need to establish competitive areas to raise more market-oriented funds; otherwise, it will be difficult to survive independently in the current fierce competition.

The core issue is that the big model industry has a huge demand for capital. Industry insiders have revealed that training large model bases often costs hundreds of millions of yuan, and the training time for some multimodal models can take several months or even half a year, further increasing costs. Current financing is insufficient to support AI startups on the path to achieving general AGI. Therefore, commercialization capabilities and differentiated products have become the core competitiveness of AI startups.

AI large model entrepreneurs may have already anticipated the brutality of this competitive game.

In 2024, when asked whether the ultimate fate of large model companies was acquisition by giants, Yang Zhilin believed it was uncertain but that there could be deep cooperative relationships, such as between OpenAI and Microsoft. Regarding giants investing in multiple large model companies rather than just one, Yang Zhilin's judgment was clear. This is a transitional phase, and there will be more consolidation in the future, with fewer companies remaining.

One year later, the stage of resource integration has arrived. After Zhipu and MiniMax, which AI startup will be the next to go public?