Inflection Point of New Robot Market Trends

![]() 06/25 2025

06/25 2025

![]() 502

502

This year's key market trends revolve around AI computing power and robots. Recently, AI computing power has significantly rebounded from its April lows. Similarly, robots, akin to AI computing power before its surge, have been adjusting for over two months. Both sectors are accelerating their industrial progress. The AI trend has now recovered, and the robot sector is also poised for a recovery.

The catalyst for this recovery is Tesla's robotaxi, which went online for testing in North America yesterday, leading to a 10% overnight surge in Tesla's share price. With the positive signal that the robotaxi launch will not be delayed, market funds have started to allocate in advance to Tesla's robot core supply chain. Consequently, the E Fund Robotics ETF (159530) surged 4.64% today, despite only increasing by 8% this year, indicating it is still at a relatively low position.

Given the potential catalyst of Tesla robots, now is an opportune time to invest in the robot recovery trend.

Dispelling Myths About Robots

Looking back at the recent adjustments in the robot sector, market funds had two primary concerns.

1. Concerns about Robot Demand: When sector trading peaked in March, the industry had injected significant future expectations, such as the vast potential market size for service robots in the coming years. However, when the market realized that even Unitree robots still require human operation, it became evident that robots are still far from being able to serve humans in the short term. As a result, market funds reaffirmed that the most viable short-term path for robots is to replace humans in repetitive tasks, aligning with Tesla's narrative of robots entering factories rather than service robots as promoted by domestic funds.

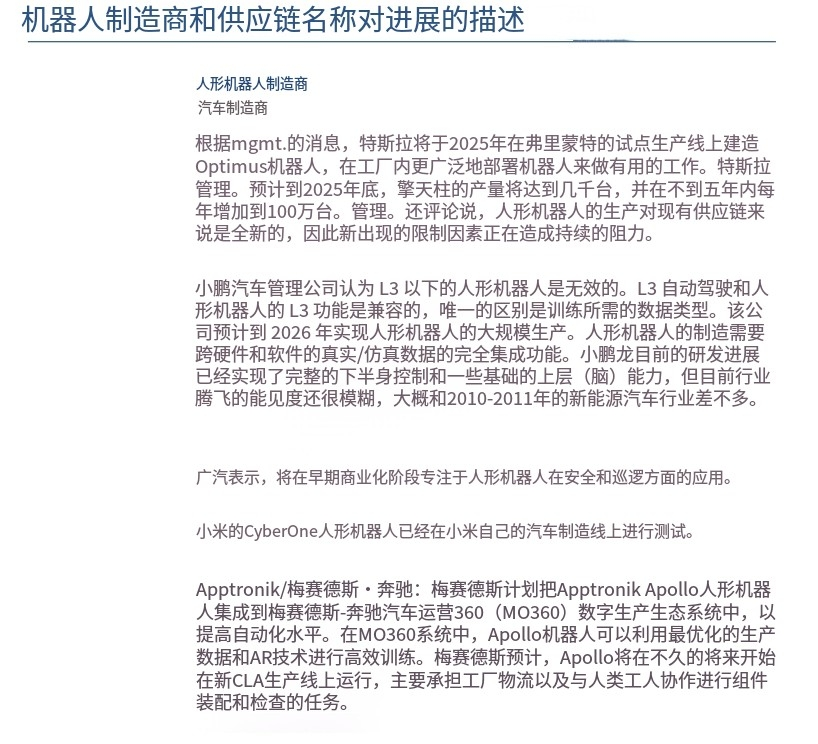

As shown in the figure below, according to Goldman Sachs' tracking, Tesla's Optimus robot is projected to reach a production volume of several thousand units by 2025, scaling up to 1 million units in less than five years. Companies like Xpeng, GAC, Xiaomi, Mercedes-Benz, and UBTech are all deploying humanoid robots.

2. Tesla Order Reduction Rumors: During the previous period, there were frequent rumors in the market about Tesla reducing orders for core components, coupled with a sharp drop in Tesla's share price, prompting market funds to withdraw and sell. However, recent research feedback from Guosheng Machinery indicates that there have been three batches of orders this year, totaling over 3,000 Tesla robot orders in early January, May, and after October. These findings contradict the previous rumors of order reductions.

Goldman Sachs' May report states that global shipments of humanoid robots will reach 20,000 units by 2025, maintaining previous forecasts without downward adjustments. Industrial research confirms that production volumes have not been reduced, and with the sudden launch of the robotaxi yesterday, the market is now focusing on the undervalued robot sector.

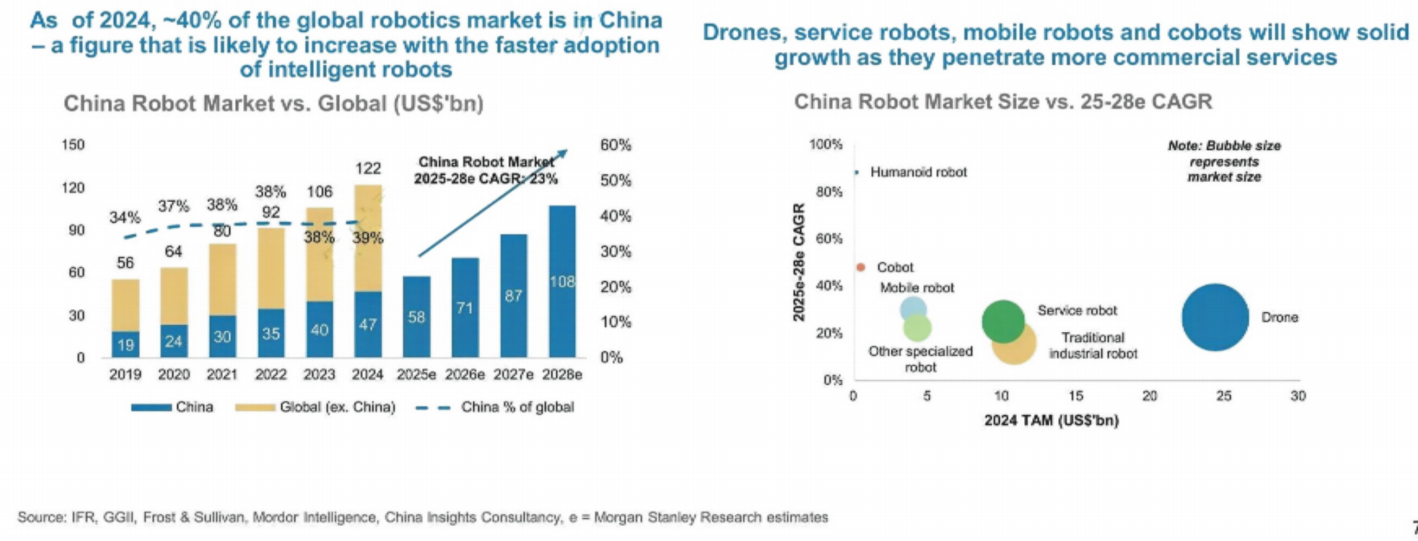

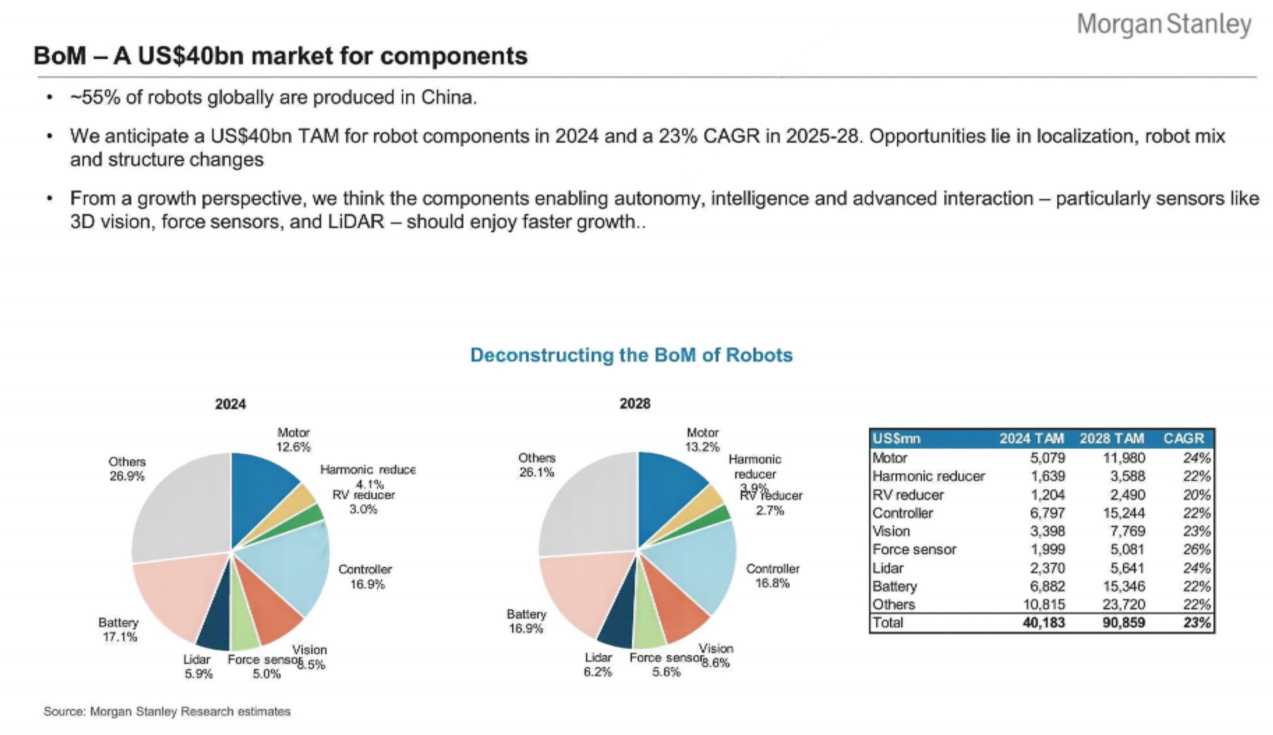

Morgan Stanley projects that the size of the Chinese robot market will double from 2024 to 2028, accounting for about 40% of the global total by 2024, with a market size of $47 billion.

Morgan Stanley anticipates a compound annual growth rate of 23% for the robot industry, reaching a market size of $108 billion by 2028.

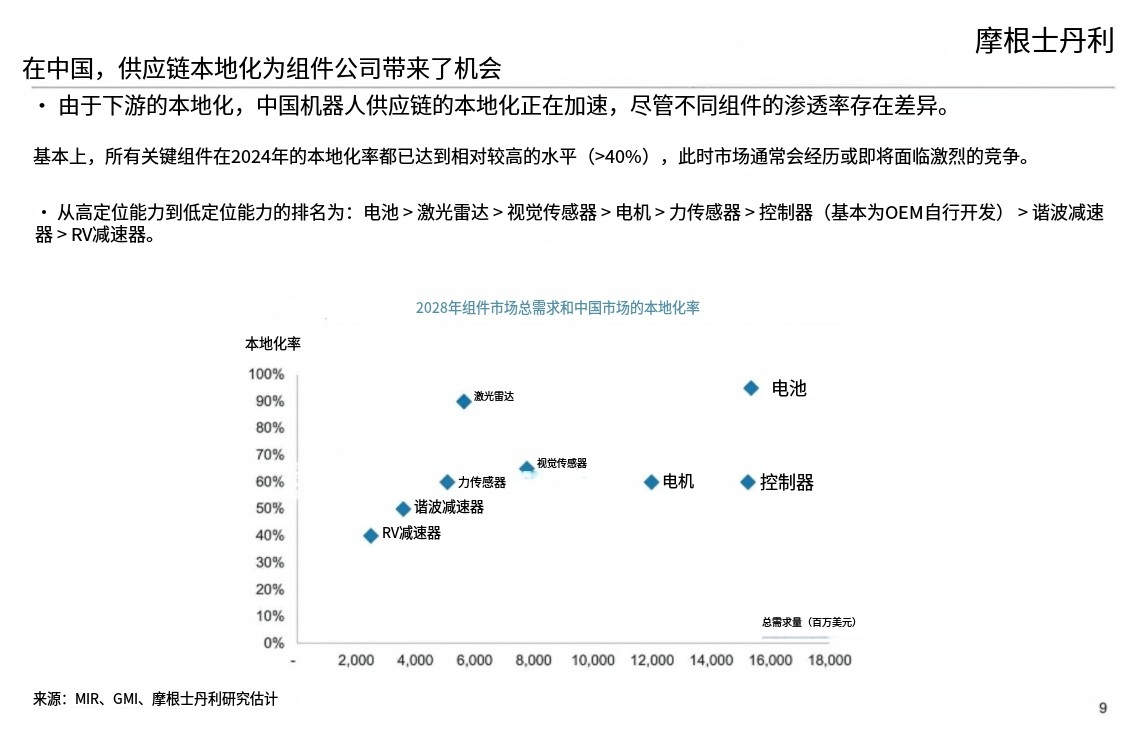

Morgan Stanley's report further states that in the long run, humanoid robots will become the largest category of robots. The firm believes that sensors, vision systems, motors, and reducers are areas worth tracking.

In terms of the Robot Bill of Materials (BoM), motors and batteries account for the largest proportion, while sensors and vision systems exhibit the fastest growth. Morgan Stanley asserts that 55% of global robots are produced in China, and the total available market (TAM) for robot components will be $40 billion in 2024, with a projected compound annual growth rate of 23% by 2028.

By 2028, Morgan Stanley expects motors and batteries to be the largest TAM categories, accounting for 13% and 17% of the total BoM, respectively, while sensors and vision systems show the strongest growth potential.

With the dispelling of the order reduction rumors, the robot sector deserves increased attention in the second half of the year. Firstly, the industry's beta is still accelerating positively. Secondly, A-share core companies stand to benefit from the mass production of Tesla robots this year.

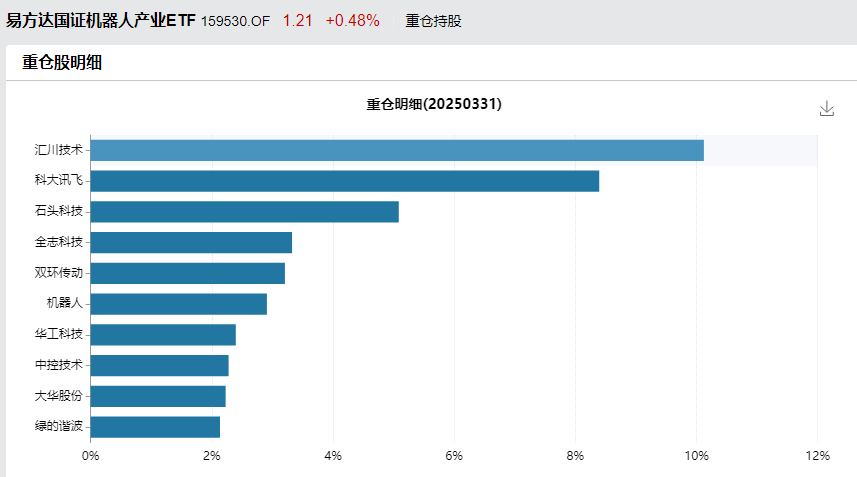

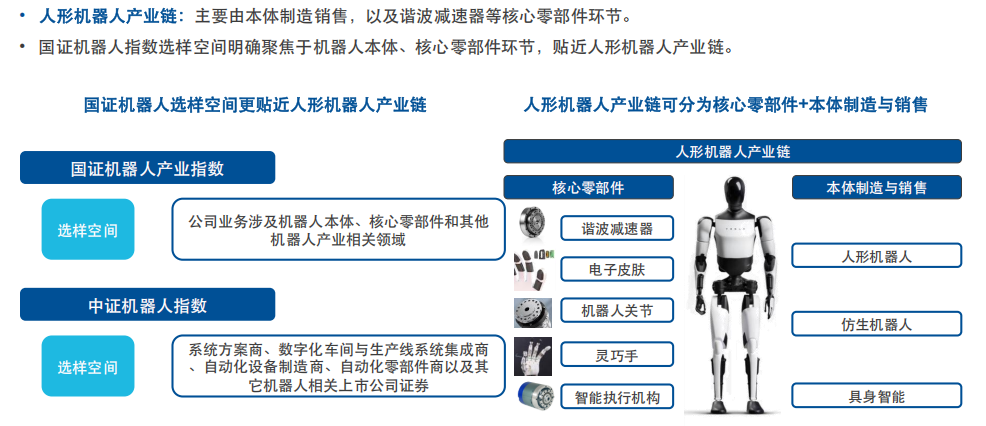

Following Morgan Stanley's report, China's robot core components currently have advantages in sensors, vision systems, motors, and reducers. Companies in these categories are all covered by the E Fund Robotics ETF (159530). This ETF tracks the CSI Robot Industry Index, which, after being revised in April this year, now has a higher proportion of humanoid robots and better elasticity.

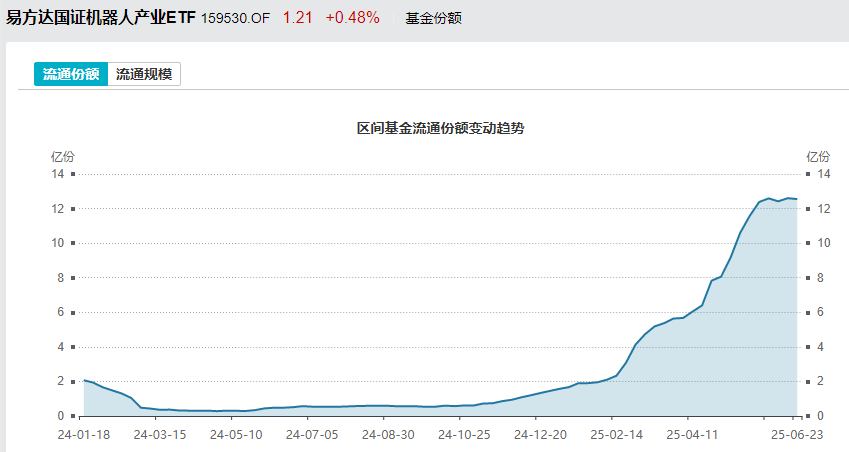

The fund shares of the E Fund Robotics ETF (159530) have surged from 100 million last year to 1.2 billion. Smart funds optimistic about the long-term logic of robots have continuously increased their allocations during the past two months of corrections.

Therefore, returning to the above, in the pre-Tesla robot era, participating through the E Fund Robotics ETF (159530, OTC links 020972/020973) and allocating from an industry-wide perspective is a more suitable choice for investors. This approach alleviates the risk of choosing the wrong company and allows investors to share in the high-growth trajectory of the entire industry.