Humanoid Robot Manufacturers Embrace Frugality

![]() 06/26 2025

06/26 2025

![]() 521

521

Short-term capital injections cannot carve out an alluring business trajectory. Telling a complete business story hinges on the humanoid robot manufacturers themselves. In essence, "self-sustainability" has emerged as a new frontier for the entire robotics industry.

Editor: Lv Xinyi

Calm and pragmatic, the attitude of humanoid robot manufacturers has shifted.

As we step into 2025, a notable trend unfolds: various robot manufacturers are busy showcasing their prowess through dancing, acrobatics, and skill demonstrations. Endless videos and promotional jargon from these manufacturers paint a picture of booming development. Yet, just a few months later, the promotional fervor has significantly cooled down. Manufacturers are no longer focused on external spectacle but are instead prioritizing their production lines to narrate a tale of embodied intelligence and productivity. External discourse no longer mentions the "era of thousands of households" but instead adopts a more tempered tone.

"Reaching thousands of households is difficult at this stage"

"Humanoid robots are far from ushering in an era of productivity"

"They cannot work in factories for the time being"

For a while now, major humanoid robot manufacturers have been changing course, and even a few "top-tier" favorites of capital are striving to lower external expectations. This shift is inextricably linked to the concept of "healthiness." While excessive attention is crucial, technological advancement does not happen overnight. Elevating the narrative without substantiating it with technology inevitably leads to a disjointed result, which is detrimental to long-term healthy development.

This shift is also evident in business strategies. Several complete machine factories are no longer pursuing the solitary and daring path of "full-stack self-research" and "universality" but are instead seeking more pragmatic approaches to implement technology and overcome the barriers of humanoid robots.

Indeed, a path that initially seemed the least pragmatic is now embracing pragmatism.

After all, short-term capital injections cannot carve out an alluring business trajectory. Telling a complete business story hinges on the humanoid robot manufacturers themselves. In essence, "self-sustainability" has emerged as a new frontier for the entire robotics industry.

Universality does not equate to perfection

Specialized commercialization is clearer

History has proven that absolute "universality" is not a flawless solution. When new standard setters emerge, universality becomes obsolete.

Two decades ago, there was a product known as the "Universal Charger," which was one of the best solutions for charging all mobile phones, conferring a certain "universality" upon it. However, as smartphones replaced feature phones and batteries became non-removable, with a variety of new interface protocols flourishing, other specialized mobile phone accessories could survive in different ways, but this absolutely universal product found no use.

The field of humanoid robots is facing a similar revelation. At a time when technical standards have yet to be established, industrial consensus still needs to be built, and the maturity of the application ecosystem remains uncertain, if excessive emphasis is placed on the construction of universal capabilities, it may not only impede its long-term development path but also pose severe challenges to short-term commercialization and value realization.

From a practical standpoint, whether it's factory universality or household scenario universality, there is a considerable period of overcoming challenges ahead. Currently, there are still obstacles to entering relatively closed scenarios such as factories, and the difficulty of transitioning from factories to households is exponentially greater, to the point that Wang Xingxing candidly stated that humanoid robots entering households is not something that will happen in the next few years, and even most enterprises have noted that "it will take another 5-10 years."

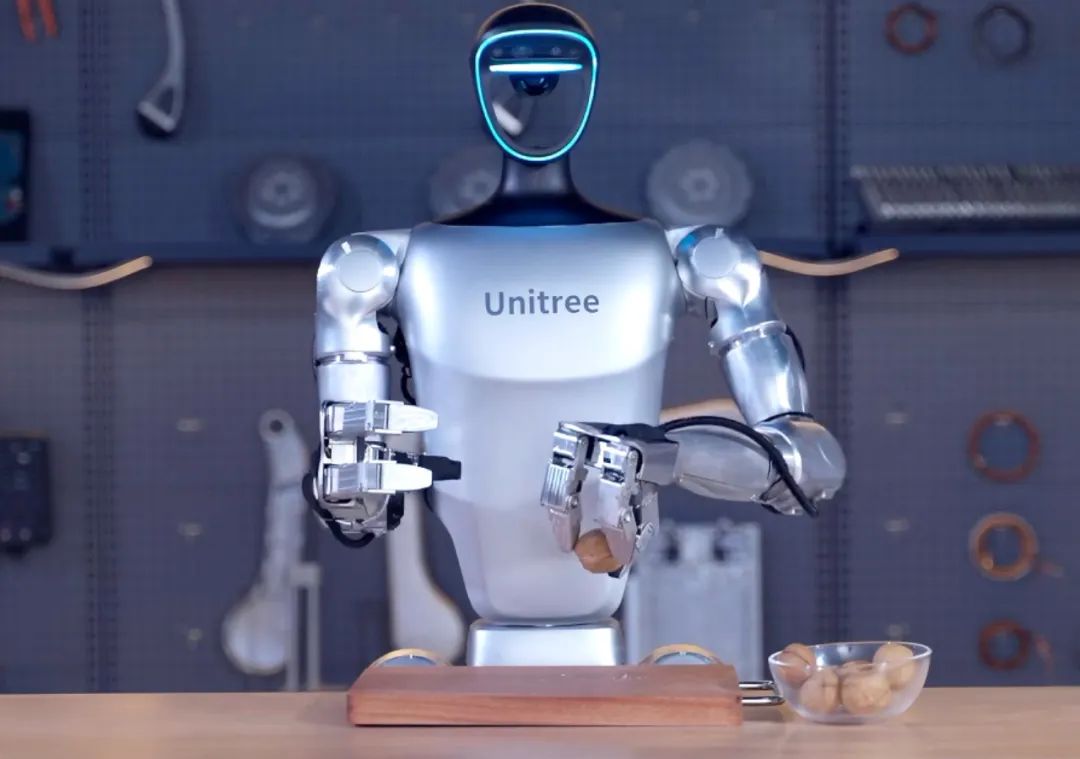

Image source: Unitree Robotics

Nevertheless, the demand for robot productivity in real-world application scenarios is real and pressing. The large-scale deployment and commercial value verification of mobile robots in fields such as factory logistics have fully demonstrated the rigid demand for robots as a productivity tool.

So, at a time when universal humanoid robots are still in their infancy, but the productivity urgently needed by application scenarios and their current supply capacity, what kind of productivity can meet this demand?

Fu Sheng, CEO of Cheetah Mobile, has offered his perspective. Starting from market demand orientation and focusing on "small scenarios" with clear structures and rigid demands may hold more commercial value than blindly pursuing large and comprehensive "universal robots."

There are already implemented cases on the market to support this viewpoint.

One approach is to add value to products. For example, both Stone and Dreame have launched sweeping robots equipped with mechanical arms this year, adding picking capabilities to the original 2D ground cleaning functions, transforming them into 3D space cleaning maids.

Adding value to products has also been validated among humanoid robot manufacturers. For instance, for a shopping guide robot, is it sufficient to merely listen and speak? Of course not. Digital Huaxia chooses to make its humanoid robot's face more biomimetic so that its image is more readily accepted by customers. Or, Zhiyuan Robotics' newly launched Lingxi X2 achieves active interaction, meaning the robot can spontaneously communicate with users rather than just responding passively. Therefore, for dedicated robots used as shopping guides in malls, products with a more biomimetic face and active communication abilities are likely to have a larger market?

Image source: Digital Huaxia

From an investor's perspective, humanoid robots are currently in the product introduction phase, where the core is supply-driven rather than demand-driven. Borrowing Jobs' words, at this stage, people's perception of humanoid robots is akin to when Apple's smartphones first emerged, "Consumers don't know what they want until we show them our products."

Thus, by adding value to products, users can see more of the usable aspects of humanoid robots.

Another approach is to streamline scenarios.

Some domestic investors believe that the term "humanoid robot" itself is somewhat "confusing and misleading." Sweeping robots, delivery robots, etc., intuitively convey the use of the product. However, humanoid robots at this stage possess the "universality" of aspiration but have never been able to map a specific, rigidly demanded scenario, often leaving only some imagination for users to pay for the future.

At this stage, robot manufacturers that deeply cultivate dedicated and single scenarios are faring quite well. For example, Digital Huaxia has chosen to take root in exhibition and performance scenarios. Its Xialan humanoid robot, characterized by its high female appearance and high emotional intelligence, is applied in government halls, exhibition halls, and other scenarios. It is said to have secured hundreds of millions of yuan in orders this year. Furthermore, enterprises deeply engaged in hotel service robots, such as CloudMinds Technology, have seen their losses narrow year by year, and in April this year, they submitted a prospectus to the Hong Kong Stock Exchange, racing towards an IPO in Hong Kong.

Perhaps humanoid robot manufacturers should consider forming accumulation and breakthroughs in a certain field before expanding outward to strive for phased victories. This point can also be referenced from the situation of the "AI Six Little Dragons." They initially aimed for AGI as their ideal, but later, some gave up on training super-large models, while others ventured into the medical vertical track. As Li Kaifu said in an interview, "Everyone sees clearly that only large factories can burn large models," the goal is to survive first.

We cannot call this abandonment a failure. Some people in the industry have their sights set on the future beyond 10 years, while others need to focus on the present.

Being a dog may have more "promise"

There's a popular meme on the internet, "It's hard to be human, it's better to be a dog." Borrowing this saying and applying it to the humanoid robot industry may seem like an exaggeration. However, the technical challenges and commercialization path of quadruped robots are indeed significantly less complex compared to humanoid robots.

The motion control ability of quadruped robots is more stable compared to bipedal humanoid robots. While humanoids are still struggling with anthropomorphic gait and straight-legged walking, quadruped robot dogs have already achieved moving speeds that humans cannot reach.

Besides the relative ease of technological research and development, its commercialization path is also very clear. Quadruped robot dogs are more often positioned as tools. Unlike humanoid robots, there are no controversies or imaginations regarding "personality." They can be machine guide dogs launched by Magic Atom and Zhiyuan Research Institute, industrial inspection dogs and fire rescue dogs launched by Unitree Robotics, or even just emotional companions that can coquettishly attract attention and have a large market.

Image source: Magic Atom

Simultaneously, in terms of price, quadrupeds have also taken the lead in reaching the thousand-yuan consumer level, becoming genuine consumer products. In the future, consumers will be able to experience the latest iterative products in the robot industry at the price of a mid-to-high-end smartphone, which is something ordinary consumers can look forward to.

However, the price of humanoid robots remains high, with quotations in the tens of thousands, determining that their users cannot be ordinary consumers. So, is it better to sell them as luxury goods? This leads to a paradox. Robots at the current stage of development are data-driven, just like large models. The more they are used, the more data they accumulate. Once the flywheel starts spinning, the product has a basis for continuous iteration. But making robots into a product that only a small number of people can afford or have specific needs (scientific research) will hinder the spinning of the flywheel.

From Fu Sheng's perspective, the current market is at a very early stage, with some pseudo-demands and half-baked products making it "not even clear whether humanoid robots constitute an industry yet."

From this perspective, wouldn't it be more practical to start with quadrupeds?

Since the beginning of this year, we have seen enterprises renowned for humanoid robots successively launching quadruped robots. For example, after several previous humanoid robots gained popularity, Zhongqing Robotics launched the JS01 quadruped robot in May this year. According to Euromonitor International, Zhongqing's layout in the field of quadruped robots is to further supplement its product matrix.

And Zhiyuan Robotics, shortly before the media conference to launch the Lingxi X2 humanoid robot, revealed that it would also release a quadruped robot D1 (tentative name) in the second quarter of this year. When asked about the reason for this layout, the person in charge of Zhiyuan frankly stated, "There is a lot of market demand."

Therefore, whether it's to enrich the product matrix or due to market demand, quadruped robots are becoming an "irresistible delicacy" that humanoid robot manufacturers cannot bypass. After all, in such a capital-intensive humanoid robot race, Unitree Robotics has been able to maintain profitability for many years after 2020, with a 60% global market share of quadruped robots being the key to its self-sustaining ability.

Making humanoids is a choice of "reaching for the stars but landing among the clouds," or even a choice that may not be achieved at all. In this wave of robot entrepreneurship, the first wave of cold starts has ended, and how to generate revenue is a practical issue that investors are pressing upon enterprises.

The more friends, the more roads

The technology landscape of humanoid robots primarily consists of three parts: the body, the cerebellum, and the brain. The industry consensus is the coordinated development of software and hardware integration. However, the current situation is that software and hardware restrict each other's development, and they cannot even achieve the same frequency, let alone move forward together. Therefore, some enterprises are unwilling to give up any part of the landscape, taking full-stack research and development capabilities of software and hardware as their core competitiveness and continuously building moats in the industry.

Moreover, full-stack just sounds imaginative, and even investors hold it in high regard and are willing to pay.

Now, it seems that the so-called "full-stack development capabilities of software and hardware" claimed by enterprises are more like a grand ambition. In the early stages of humanoid robot development, it is difficult for enterprises to encompass all technological sectors. In fact, at least from the perspective of phased development, companies making humanoid robots generally start from the body and begin to focus on embodied brains after accumulating technology and funds. Or some enterprises directly outsource the embodied brain and cooperate with model companies for development.

At the same time, these body-making enterprises are also squeezed by upstream players. The upstream core components still hold considerable discourse power among the midstream body manufacturers. Motors, lead screws, and dexterous hands account for almost the main cost of the body. And upstream enterprises, relying on the cost advantage of core components, can always explore the entire machine business.

Therefore, in the current entrepreneurial rhythm, going it alone will slow down the product iteration rhythm, and the urgency of commercialization will accelerate product cooperation.

Consider the partnership between Huawei and Ubtech Robotics, for instance. As early as November 2023, Ubtech Robotics introduced its maiden humanoid robot, KUAVO (Kuafu), leveraging Huawei's open-source Hongmeng (KaihongOS).

In March 2024, Ubtech Robotics further solidified its collaboration with Huawei Cloud, a Huawei subsidiary, to jointly explore application scenarios for the "Huawei Pangu Large Model + Kuafu Humanoid Robot" and construct an open ecological platform for "Humanoid Robot+". The Pangu-equipped Kuafu robot has witnessed substantial enhancements in intelligence and generalization capabilities, validated across both industrial and household settings.

It is anticipated that Ubtech's total delivery volume of humanoid robots will hit the thousand-unit mark this year. "Essentially, each robot is dispatched as soon as it rolls off the production line," remarked Wang Song, general manager of Ubtech, in a past interview with the "Science and Technology Innovation Board Daily".

Currently, this ecological cooperation within the embodied industry is gathering momentum. Over the past month alone, several significant developments have emerged:

• Kepler joined forces with Zhaofeng Electromechanical. Zhaofeng's humanoid robot lead screw project furnishes Kepler with core components and offers discrete industrial scenarios.

• Huawei, Ubtech Robotics, Zhiyuan Robotics, and Zhongjian Technology collaborated on healthcare humanoid robots, integrating efforts in computing power, large model platforms, data collection, solutions, and application scenarios.

• Yuejiang Technology partnered with Tencent Cloud, valuing Tencent Cloud's infrastructure, audio-video solution capabilities, and technical advantages, including full-link self-developed multimodal large models and full-stack cloud-native security systems.

• Huawei cooperated with Ubtech Technology, leveraging Huawei's Ascend, Kunpeng, Huawei Cloud, and large model capabilities, as well as its R&D, production, and supply expertise, to aid Ubtech in rapid iteration...

In essence, most current collaborations hinge on large enterprises providing computing power and model capabilities to robot manufacturers. For robots, the brain sets the upper limit of the body's potential. Among these, Huawei is actively deploying through ecological cooperation, solidifying its role as a "shovel seller" in embodied intelligence.

In summary, technology enterprises often tend to isolate themselves and go solo due to perceived technological barriers. However, in the "technology-product-market" chain, technology must swiftly transform into usable products to achieve further commercialization and marketization. In the blue ocean industry of humanoid robots, those who launch products and iterate continuously first will gain a competitive edge.

Being first often trumps being the best.

Written at the end: Far-reaching technological ideals require pragmatism

The shifts in the humanoid robot industry do not signify a retreat from technological ideals but rather a strategic adjustment and pragmatic response to the harsh realities and business laws. Within and outside the besieged city, investors' advances and retreats, along with enterprises' struggles, collectively portray the true landscape of this industry: The grand narrative of general intelligence is undoubtedly thrilling, but the steep learning curve of technological transitions and the ambiguity surrounding the definition of "universality" make implementation a pressing survival issue. Relying solely on technological bravado and grand visions is insufficient to sustain an industry.

Consequently, we observe a collective shift within the industry: from an obsession with "universality" to a focus on the deep cultivation of vertical scenarios; from the pursuit of humanoid forms to the embrace of more feasible forms like wheeled and quadruped robots; from going solo to build full-stack technological barriers to actively seeking open collaboration for technological cooperation. This is not surrender; it's about surviving first and then discussing ideals.

Humanoid robots are akin to climbing a long slope in deep snow. The priority is to firmly pack down the snow beneath your feet.