Huawei Breaks the "Loss Curse": The Watershed for Intelligent Driving Arrives

![]() 06/26 2025

06/26 2025

![]() 911

911

One year has passed, and Huawei's so-called "300,000 yuan curse" for intelligent driving has been shattered.

In June 2024, Yu Chengdong famously stated, "Now all the cars we make below 300,000 yuan are losing money." One year later, at the pre-sale launch event of the Lantu FREE+ in June 2025, Huawei's latest ADS4, as part of the vehicle price, started at a minimum of 229,900 yuan during the pre-sale phase. Given industry practice, where listed prices tend to be lower than pre-sale prices, it is likely to enter the range below 220,000 yuan.

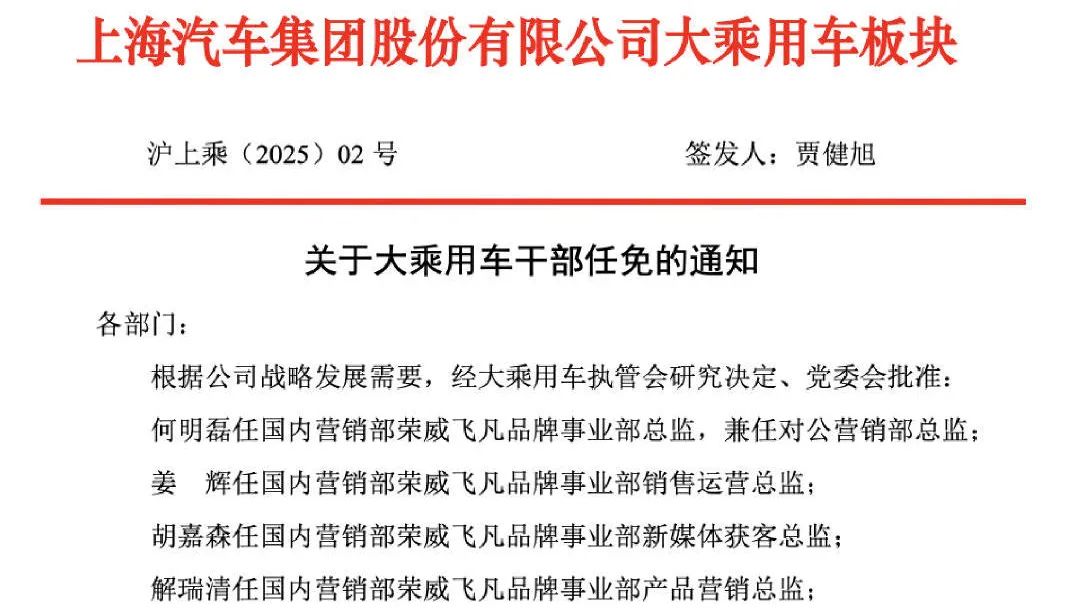

In fact, within that year, Huawei's vehicle BU revenue has entered the global top 100 in automotive parts income, and its business model has gradually expanded with the increasing sales of automakers like Lantu. Not only has a fifth realm, Shang Realm, emerged from SAIC and Huawei, but deeper cooperation models with automakers like GAC, Dongfeng Yipai, and AVATR, known as Huawei's Hi PLUS mode, have also taken shape.

In summary, the market landscape has shifted, and Huawei's full-fledged intelligent driving assistance has undergone a price reduction. The SL09 with a 192-line LiDAR costs 279,900 yuan. Among the five realms, the Wenjie M5, equipped with a 192-line LiDAR model, has a cheapest price of 229,800 yuan for the range-extended Ultra rear-wheel-drive version. Even with the additional 16,000 yuan software fee, it remains competitively priced.

Coupled with Jia Jianxu's assertion that "SAIC has system capabilities, vehicle manufacturing experience, and cost control abilities, and can help Huawei integrate their intelligent capabilities into models below 200,000 yuan," it is no longer a question of whether Huawei can stay within the 250,000 yuan range. The next challenge is whether Huawei can penetrate the sub-200,000 yuan market.

L2-level assistance will begin to depreciate, with a duration of about one year.

Breaking Yu Chengdong's "300,000 yuan curse" is straightforward to analyze. Expanding the original business model and creating a complementarity between high-end and entry-level offerings can generate competitiveness in niche markets like Wenjie. For instance, the full-fledged Huawei Wenjie M5 entering the sub-250,000 yuan range is based on the confidence garnered by the Wenjie M8 and Wenjie M9.

As of June 7, 2025, cumulative deliveries of the Wenjie M9 have surpassed 200,000 units, outpacing Mercedes-Benz, Audi, and others in the 500,000 yuan-level niche market, setting a new benchmark. Similarly, the Wenjie M8 recorded over 30,000 deliveries in 58 days, another record. Financially, Thalys' 2024 financial report showed a full-year gross margin of 26.21%, which increased to 28.7% in the fourth quarter when the Wenjie M9 was launched and began deliveries, with an average transaction price of 560,000 yuan for the Wenjie M9.

It is precisely because of this performance that the Wenjie M5 can offer pricing and configuration advantages.

The business logic behind Shang Realm, a collaboration between SAIC and Huawei, is that SAIC Motor, which does not lack funds or production capacity, has been the sales champion among Chinese automakers for 18 consecutive years from 2006 to 2023.

Today, it needs to complete its transformation rapidly and change perceptions. To regain market share and brand recognition, it can invest heavily, leveraging its outstanding production and R&D capabilities, thereby having the potential to further break the price curse.

The price fluctuations brought about by the above will also lead to changes in the business model of intelligent driving assistance. The reason is that when top automakers lower prices, mid-tier and entry-level automakers must follow suit under pressure. In recent years, there have been many such examples. For instance, in 2023, Tesla suddenly lowered the prices of the Model 3 and Model Y, ultimately sparking a price war across the entire automotive market. More dramatically, when leading enterprises face competition from other leading enterprises, they often break the rules. For example, after JD.com entered the food delivery market, Meituan had to follow up with social security and related subsidy policies.

Therefore, in the current evolution from intelligent driving assistance to supervised autonomous driving, i.e., the transition from L2 to L3, the high-value business cycle of intelligent assisted driving is also coming to an end.

Currently, the only player that can sell intelligent driving assistance at an affordable price and gain user recognition is Huawei. The collective choice of Chinese automakers today is not to sell intelligent driving assistance systems separately but to bundle them into the vehicle price. As of June 2025, this list includes automakers such as BYD, Chery, Geely, Great Wall, Changan, Li Xiang, XPeng, GAC Toyota, FAW Toyota, SAIC Volkswagen, and FAW-Volkswagen. NIO does indicate the price of the software, with a monthly subscription price of 380 yuan, currently promoted in the form of a 3-5 year gift.

Of course, the pressure will also include Tesla's FSD. With the official launch of the self-driving taxi Robotaxi in Austin, Texas, on June 22, the NHTSA immediately contacted Tesla to initiate an investigation. Two bloggers released videos exposing its safety hazards. For example, in the 12-second video released by Rob Maurer, the vehicle repeatedly attempted to enter the wrong lane. In another video released by Sawyer Merritt, the vehicle exceeded the speed limit. So, whether it's L2, L3, or L4, there is no clear conclusion yet.

In short, what needs special attention is that in today's period of technological iteration and switching, once automakers cannot keep up with the cutting-edge first tier and cannot provide a price advantage, the value of technology will quickly diminish because failure to complete transactions means failure to monetize.

In fact, such cases have occurred many times in recent years, such as four-wheel drive technology.

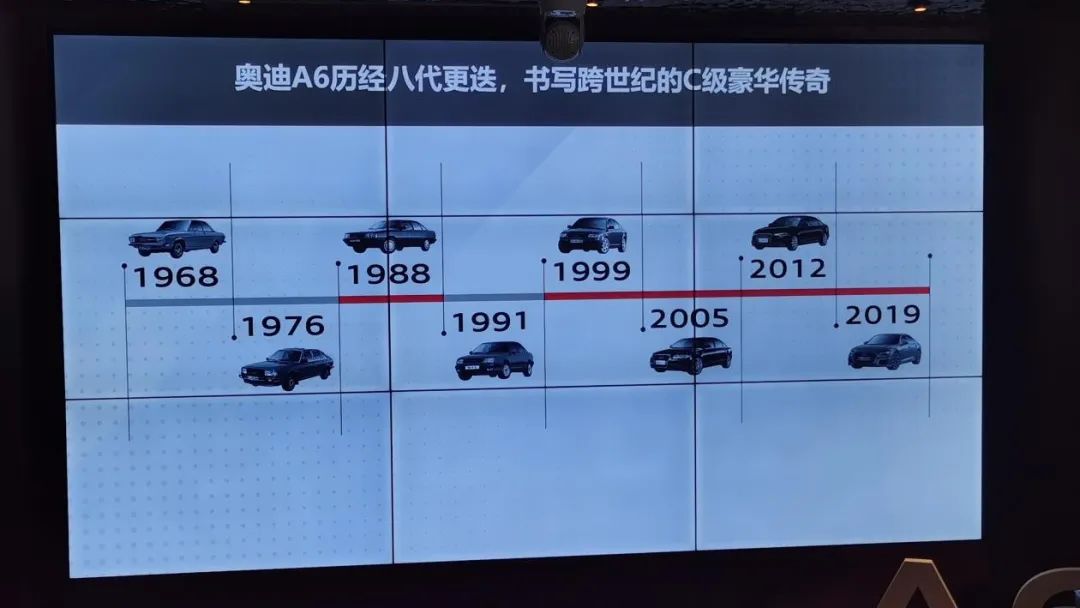

In 2009, the guidance prices for the 2.8 FSI front-wheel drive and four-wheel drive versions of the Audi A6L were 618,200 yuan and 650,200 yuan, respectively, with a price difference of 32,000 yuan. As more automakers began to launch four-wheel drive models with their own technologies, the price difference narrowed to 15,000 yuan on the 2010 Volkswagen Tiguan and was reduced to 8,000 yuan by Great Wall on the 2013 Haval H6.

This is even more evident in the new energy era. On the 2022 BYD Han Creator Edition, the guidance price for the front-wheel drive version is 289,800 yuan, and the guidance price for the four-wheel drive version is 290,800 yuan, with a price difference of only 1,000 yuan.

The conclusion is that as long as market competition is sufficient, each of the above enterprises that held market dominance at the time will cause new technologies to drop in price.

Technological watershed: Only L3 level holds high commercial value

The reason why L2-level intelligent assisted driving will experience a rapid decline in value within one year is that the second half of 2025 will mark the first year of commercialization for L3-level autonomous driving, and 2026 will be a profound technological switching period.

The automobile industry has been developing for nearly 140 years, so there are many precedents. Taking early cruise control as an example, around 2010, the first-generation assisted driving technology began to be slowly adopted by domestic vehicles. At that time, the guidance price for the 2010 Honda CR-V with cruise control was 239,800 yuan. Its competitor, the Haval H6, reduced the guidance price of the model with this technology to 131,800 yuan in the 2011 version.

In other words, the full competition of L3 autonomous driving technology will follow the same logic as seen in previous development histories. Therefore, when L3 begins to be commercialized and prices drop, the existing depreciation of L2 and L2+ levels will be unstoppable.

The latest round of L3 competition has now emerged.

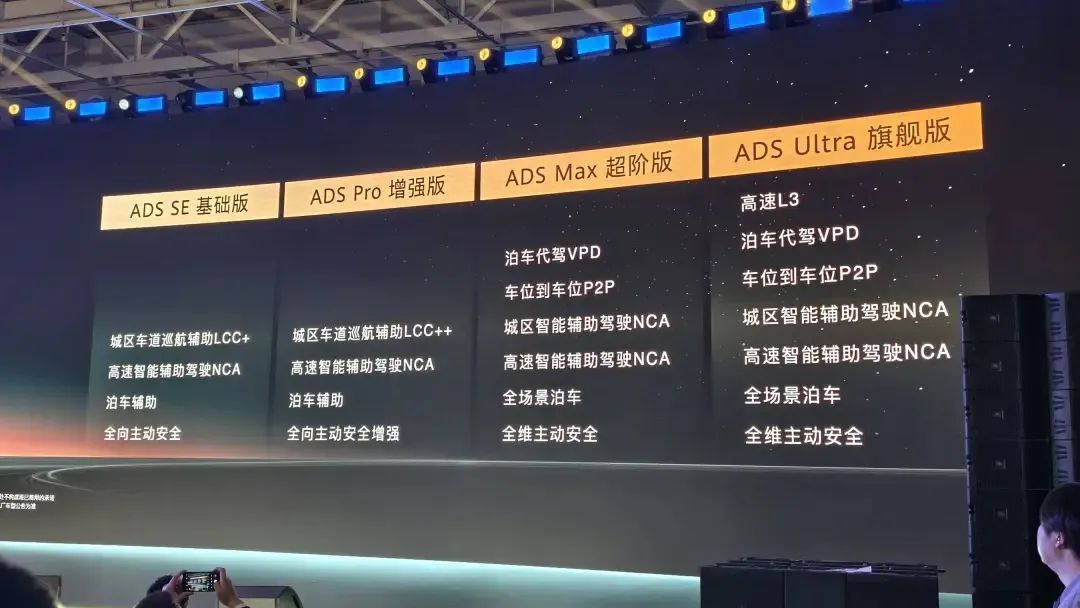

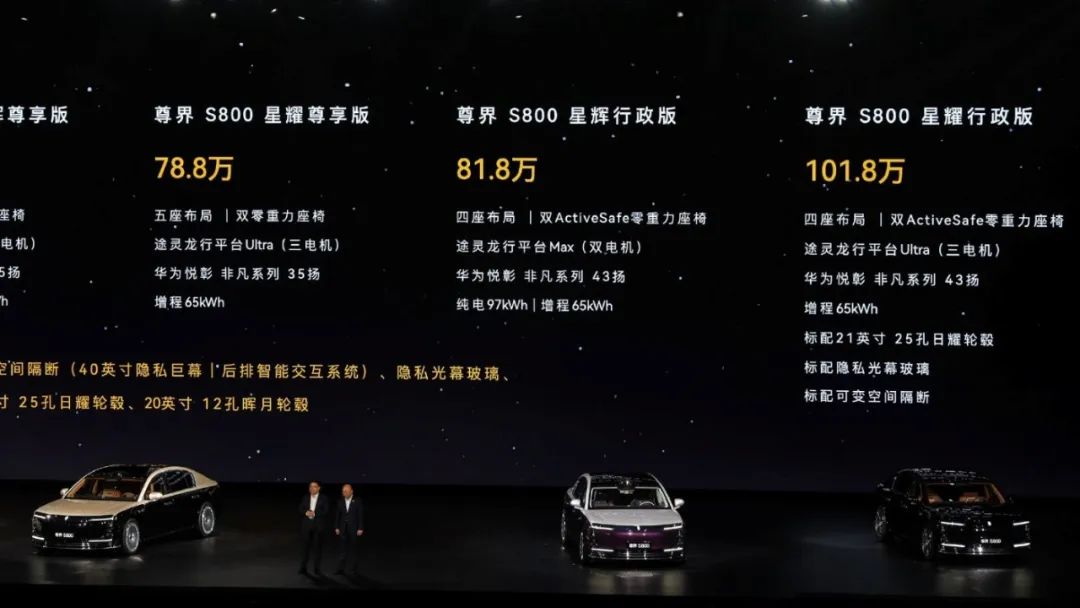

Huawei's L3 autonomous driving plan has been announced and will be launched and upgraded this September. The Ultra version of ADS4 will have the capability of L3 highway autonomous driving. The currently known models involved are expected to include the Zunjie S800. The new Xiangjie S9 and Wenjie M9 may quickly follow suit, as they already possess an L3 architecture and meet sensor hardware standards.

From a business perspective, it is logical and in line with expectations for the Zunjie S800 to be the first to receive the update. The realization of autonomous driving in million-yuan models will bring benefits to the overall business value and promotion.

However, questions remain. With Huawei's technological capabilities, what speed limit will be allowed for L3 autonomous driving on highways? Mercedes-Benz and BMW were the first enterprises to complete the application and commercialization of L3 autonomous driving in the global autonomous driving field, but both opted for high-precision maps combined with relatively low speeds of 60 km/h.

To put it simply, this is the same approach as Baidu's Robotaxi, aimed at reducing the incidence of accidents. However, as competition intensified, this speed was increased to 80 km/h by Korean automakers around 2021. Then, in 2023, it was increased to 95 km/h by Mercedes-Benz and BMW. The current speed limit allowed by German law is 130 km/h, and Mercedes-Benz's target is set more conservatively, aiming to reach this speed by 2030.

Therefore, the focus for Huawei's efforts in the second half of this year is what the speed limit for L3 autonomous driving will be. The critical threshold will be 95 km/h. If the technical application reaches this value, it proves Huawei's technical prowess. If it falls below this number, it lacks practical significance. And if it exceeds it, the scenario changes entirely.

Of course, this is also the same test question for all Chinese automakers.

Only L3 capable of reaching higher speeds constitutes true autonomous driving. If it is only used at speeds of 60 km/h to 80 km/h, it will actually have a negative impact on market communication.

In summary, within the automotive industry, the competition for L3 autonomous driving has officially commenced. Huawei announced its plan for September, while Geely made a relatively low-key semi-official announcement in June this year regarding its progress. Thousand Miles will implement the L3 autonomous driving system on the Qianli Haohan H9 in the fourth quarter of 2025.

Furthermore, numerous domestic brands have previously announced their plans. GAC will mass-produce and launch its vehicles in the fourth quarter, while Li Auto aims to achieve this by 2025 but has not yet announced a specific timeline. XPeng's stance has shifted; initially, it aimed for L3 capability but did not officially announce it would reach 100% L3. However, in

Furthermore, how many existing L2+ assisted driving systems will become obsolete? For instance, companies such as Huawei, with their advanced technology systems and ample resources, can seamlessly transition between outdated vehicles and new technologies.

However, for numerous new entrants in the market, this could prove to be yet another challenge. Simultaneously, the crux of the matter lies in the fact that for automakers, any delay in technology launches, missed deadlines, or underperformance can have adverse consequences.