ByteDance Sells Southeast Asian Gaming Giant for $5 Billion: Can Middle Eastern Investors Handle It?

![]() 12/05 2025

12/05 2025

![]() 726

726

Source: Yuan Media Group

From the humid and restless Southeast Asia to the desert-and-oil-rich Middle East, the largest commercial migration in the history of Chinese gaming is continuing to unfold.

According to media reports, ByteDance intends to place its subsidiary Moonton Technology (hereinafter referred to as 'Moonton') on the negotiating table, aiming to sell it to Saudi Arabia's sovereign wealth fund, PIF, for no less than $5 billion.

Acquired for $4 billion in 2021, Moonton seems to have become a financial burden that ByteDance is eager to offload. A $1 billion surplus unfolds the destiny map of this Chinese gaming company in the era of the internet's great voyage.

Moonton embodies a typical narrative tension of structural extrude (Note: ' extrude ' is translated as 'pressure' or 'squeeze' in context, but kept as pinyin here for accuracy in representation).

Founded in Shanghai in 2014, Moonton emerged during China's explosive '100 billion yuan' era in the gaming industry. Instead of surviving in the cracks of a massive industrial machine, it actively avoided direct competition and shifted from a 'land-based civilization' to a 'maritime civilization.'

Moonton Technology Logo

Its first product, 'Magic Rush: Heroes,' was distributed by the then-overseas-prominent IGG, achieving TOP 10 rankings on iOS game charts in 94 global markets, setting a clear 'course' for Moonton's future. Its second MOBA product, MLBB (officially translated as 'Mobile Legends: Bang Bang'), launched in 2016 and quickly gained popularity in Southeast Asia.

Unlike the historical context of 'heading south to Southeast Asia,' Moonton's shift to the region was a premeditated 'migration.' MLBB launched around the same time as Tencent's 'Honor of Kings.' Instead of competing head-on with 'Honor of Kings' in China, Moonton chose to enter the Southeast Asian market, where Tencent had yet to establish a foothold.

There, Moonton gradually transformed market gaps into opportunities. Leveraging MLBB's competitive gameplay and eSports event system, it bridged infrastructure, language, and cultural differences, unifying the Indochinese Peninsula and Malay Archipelago and bringing Southeast Asian youth into a collective frenzy for MLBB.

However, maritime civilization is highly susceptible to climatic and geographic influences, inherently accompanied by uncertainty and risk. From the moment it set sail, Moonton was destined to navigate alongside waves, creating ripples in Southeast Asia; later elevated as a strategic asset of ByteDance, it 'returned' to China without a clear direction; now, it may be pushed toward the Arabian Peninsula by another wave, with tidal fates repeatedly unfolding.

What truly surges behind this is not just the course displacement of a Chinese gaming company but a recurring tilt in the balance of China's gaming industry amidst the tides of the times.

01

Southeast Asia Enters the 'Moonton Era'

For Southeast Asia, MLBB represents an invisible 'crossing' across the seas between the Indochinese Peninsula and Malay Archipelago, synchronizing the maritime and land-based civilizations into the 'Moonton Era.' Behind this lies Moonton's precise 'grafting' onto Southeast Asia's complex social fabric, accomplishing a profound 'social transformation.'

Southeast Asian Region | Screenshot from Google Maps

The Southeast Asian region's rise began during its 'Golden Decade' from 2010 to 2019. Leveraging its vast young population, rapid smartphone adoption, and increasingly robust digital infrastructure, Southeast Asia's economy transitioned from traditional export-oriented models (primarily low-end manufacturing and resource extraction) toward a digital economic structure.

This foundational economic restructuring, like a domino effect, propelled societal changes. Mobile gaming, with its dual potential in economics and entertainment, became the first 'domino' pushed into the hands of young people from diverse cultural backgrounds, speaking different languages, and practicing varied religions.

In this emerging market untapped by 'Honor of Kings,' combined with Southeast Asia's year-round humid climate and constant air conditioning, a fertile ground for mobile eSports was cultivated.

However, Southeast Asia has never been an easy region to conquer due to its cultural diversity, linguistic complexity, and uneven development. Before MLBB, domestic game exports rarely broke through individual markets. In 2005, Kingsoft's martial arts MMO 'JX Online' became a phenomenon in Vietnam, achieving millions of concurrent players within three months.

When Moonton 'anchored' itself in this new geographic coordinate, demographic dividends, the golden decade, and climatic conditions were merely 'external factors.' The real challenge was creating a universal experience.

From the serene countryside of northern Thailand to the shocking slums of Manila and the towering skyscrapers of Kuala Lumpur, across varying physical distances and escalating consumption scenarios, nearly everyone could enjoy a consistent experience in 10-minute matches.

This 'fair play' scenario, where 'any phone can join,' was achieved by compressing game package sizes, optimizing for low-end devices, and collaborating with local mobile carriers to offer bundled data plans. In economically uneven and resource-disparate Southeast Asia, this became the true starting point for MLBB's connection with players.

Reddit users discuss why MLBB is more popular among Southeast Asian youth

As a result, it evolved into a social symbol, permeating different social strata. It could be a cultural consumption vehicle for Indonesia's rising middle class, a 'social currency' for friends at Philippine convenience stores, or entertainment for monks at Myanmar temples. Even the son of former Indonesian President Joko Widodo was once an MLBB eSports athlete.

Integrating players from diverse linguistic and cultural backgrounds into a unified entertainment realm required more than just language localization. Emotional resonance arising from regional cultural fusion became MLBB's second breakthrough.

In Indonesia, Moonton introduced the Javanese mythological figure Gatotkaca into the game; in the Philippines, MLBB featured the national hero Lapulapu; and in Myanmar, the hero Minthar was inspired by the historical king Anawrahta. Culture, intangible and fluid, was encapsulated by MLBB into the game, forming a universal language beyond cultural boundaries.

MLBB launches national hero character Lapulapu in the Philippines | Source: Mobile Legends: Bang Bang Wiki

Both the 'invisible' and 'visible' elements reinforce MLBB's 'moat' in Southeast Asia. Official Moonton data shows that MLBB has surpassed 1 billion cumulative downloads, with monthly active users peaking at over 100 million, becoming a 'national game' in multiple Southeast Asian countries and regions. Based on comprehensive multi-party data, MLBB's total revenue in Southeast Asia over a decade of operation conservatively exceeds $1 billion (excluding event revenue).

Becoming a 'national game' marks only the first half of commercial conquest. Moonton needs to inject MLBB with enduring vitality and answer a deeper question: How can a game transcend entertainment itself?

02

eSports as 'National Narrative'

The answer lies in eSports. When a popular game integrates with Southeast Asia's vast youth population, becoming an entry point for socialization and identity, it propels individual destinies alongside the explosive growth of MLBB's eSports ecosystem.

Since Indonesia's first offline MLBB event in 2017, MLBB has developed a multi-tiered event system spanning professional leagues (MPL), international tournaments, and secondary leagues, establishing a complete eSports industry chain in the region.

MLBB eSports event scene | Source: esports.gg

Beyond shaping 'urban landscapes,' MLBB events hold deeper significance by providing substantial prizes through tournament mechanisms, enabling social mobility, and linking eSports to a pan-entertainment ecosystem, offering Southeast Asian youth career options and potential upward mobility—a narrative blueprint favored by national governance.

Edward Dapadap, a member of the renowned Philippine MLBB team Blacklist International, stated in an interview that eSports helped his family escape poverty. After retiring as an Indonesian MLBB pro, Jess No Limit launched an MLBB-focused YouTube channel, amassing over 54 million subscribers and 6.7 billion views, receiving recognition from the Indonesian President, with reports estimating his net worth at tens of millions of dollars.

Similar stories frequently appear in Indonesian, Malaysian, and Philippine media. This bottom-up 'social feedback' has attracted government endorsements, even becoming part of the 'national narrative' in several Southeast Asian countries.

MLBB events are described by Philippine officials as windows into national soft power. Malaysia officially incorporated MLBB into its 'national agenda,' integrating it into school education to foster diverse skills among the younger generation. Indonesia's Ministry of Tourism and Creative Economy acknowledged MLBB, viewing eSports as a vital sector of the digital economy.

From a phenomenal digital consumer product to a 'driver' of national policy, this is MLBB's unique value. While it follows 'Honor of Kings'' domestic path in product strategy and ecosystem development, in Southeast Asia, it penetrated multilingual social structures and deeply embedded itself into regional cultural contexts, unlike a typical 'outsider.'

This is the fundamental reason why 'Honor of Kings'' subsequent 'surge' into Southeast Asia failed to shake MLBB's position and underpins the $4 billion acquisition logic behind ByteDance's 2021 purchase of Moonton. This famous acquisition brought Moonton from tropical rainforests and island beaches back into China's competitive landscape.

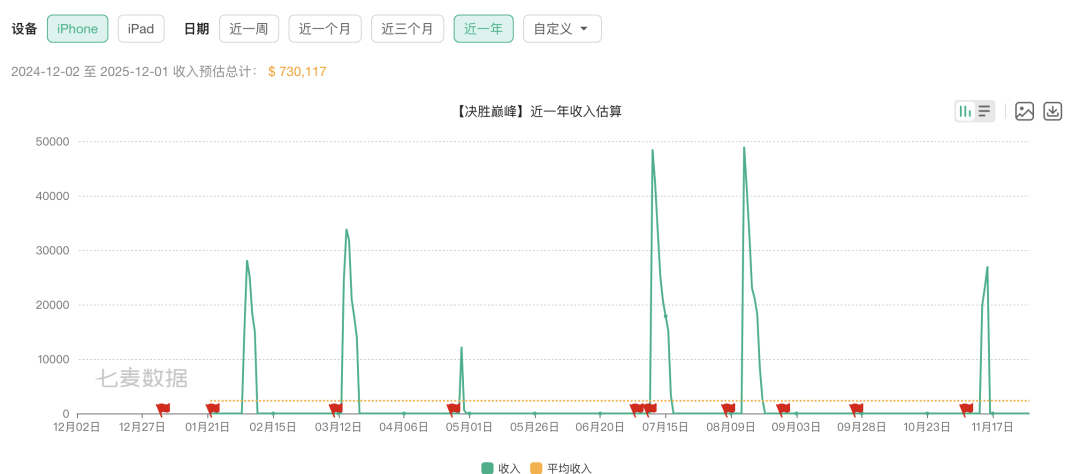

High-profile 'return' MLBB, renamed 'Mobile Legends: Bang Bang,' should have reversed its fortunes under ByteDance's resources. However, facing the entrenched 'Honor of Kings,' it struggled to find its place. Qimai Data shows that 'Mobile Legends: Bang Bang,' launched on January 22, 2025, generated only $730,000 in iOS revenue to date. Meanwhile, internal turmoil in ByteDance's gaming division, oscillating between divestment and contraction, and organizational restructuring 'delays,' caused Moonton's prominence within ByteDance to decline.

Qimai Data estimates MLBB's domestic app store revenue over the past year

As Saudi capital aggressively 'shops' globally, Moonton's 'hunting' by Saudi interests hinges only on ByteDance's approval.

03

Next Stop: The Arabian Peninsula?

The 'black gold' of the Middle East has flowed through maritime routes into Southeast Asia, nourishing regional industrial development. If Moonton's deal materializes, it would establish a digital 'game + eSports' feedback loop between its fortuitous Southeast Asian base and the Middle East, beyond existing petroleum trade links.

Just over 400 kilometers west of Saudi Arabia's 'oil lifeline,' the Ghawar Field, lies the 'national icon' of Tuwayq Mountains. Here, Qiddiya, a world-class resort encompassing gaming, eSports, and entertainment, is rising under the leadership of Saudi Arabia's sovereign wealth fund, PIF, heralding Saudi Arabia's transition from a petroleum-based to a digital economy.

Qiddiya official planning rendering

If negotiations between Saudi Arabia and ByteDance proceed smoothly, Moonton and MLBB will contribute to realizing Saudi Arabia's grand vision.

In fact, Moonton's connection with Qiddiya dates back to 2023 when the latter became the global sponsor of MLBB's M5 World Championship and renewed the partnership in 2024. Thus, this potential acquisition by PIF resembles a 'mutually beneficial union after sound out (Note: ' sound out ' is translated as 'exploration' here, but kept as pinyin for accuracy),' undoubtedly enhancing Moonton's commercial prospects in Saudi Arabia and the broader Middle Eastern market.

In 2016, Saudi Arabia launched its national strategy, 'Vision 2030,' to reduce reliance on oil and drive economic diversification. Gaming and eSports are key components, expected to create 35,000 related jobs by 2030.

PIF, with $900 billion in assets under management, serves as 'Vision 2030's' external investment window and has prioritized gaming and eSports as critical investment targets. Its subsidiary, Savvy Games Group, acts as a 'global buyer,' acquiring gaming assets across multiple countries. To date, PIF has invested over $37.8 billion in gaming and eSports.

A firm national strategy, massive capital flows, and a high-quality eSports asset in demand align perfectly with Saudi Arabia's economic transformation expectations.

On one hand, Moonton's mature and replicable eSports industry experience in Southeast Asia aligns with Saudi Arabia's national strategy, fostering local gaming and eSports ecosystems, creating sustainable employment, and driving talent development through industry growth.

On the other hand, PIF's strategic rationale for targeting Moonton mirrors ByteDance's: leveraging ample capital to accelerate gaming and eSports expansion, integrating with other key sectors to further increase non-oil economic contributions in Saudi Arabia. According to Savvy Games Group, Saudi Arabia's gaming market generated approximately $1.19 billion in revenue in 2024, with over 25.81 million gamers.

Notably, Riyadh began hosting the eSports World Cup in 2024, showcasing an open and inclusive attitude toward eSports development. Whether 'Moonton's expertise' can extend from Saudi Arabia across the Middle East may also factor into PIF's valuation considerations.

The 2025 Riyadh Esports World Cup

But in any case, for Moonton, which is facing the risk of being sold off by ByteDance, this is not a bad thing. Its rare regional integration capabilities have been recognized by Middle Eastern capital, reflecting the evolving role of Chinese gaming companies in the global gaming ecosystem.

From initially serving as service providers to absorb the overflow of the overseas gaming industry, to relying on China's domestic demographic dividend for self-research and self-distribution, building an industrial stage, and then transitioning to overseas markets due to domestic market saturation, the Chinese gaming industry has undergone transformations and restructurings in different periods.

Moonton, on the other hand, is poised to play a pivotal role in the next phase—exporting Chinese technology and expertise globally.

This new role will also bring new challenges. The dispute with LOL represents a flaw in its past experiences. More critically, as Moonton attempts to transcend the product and industry cycles of MLBB, its continuously expanding product lineup has yet to produce a core product that can rival MLBB. Regardless of its next destination, Moonton must prove its ability to consistently produce core products, transitioning from 'single-point breakthroughs' to 'multi-point prosperity.' To some extent, this will determine the weight of its global influence.

What will Moonton's next-generation flagship project be? Once the deal with Saudi Arabia is finalized, will it undertake functions such as Saudi esports infrastructure development and event ecosystem construction? As of press time, Moonton had not responded to inquiries from Yuanmeihui via email.

Of course, Moonton's rare experience in bridging digital links amid complex geopolitical landscapes remains its unique asset. As more countries elevate gaming to the level of strategic assets, capital is no longer the sole decisive factor. Market insight, geopolitical integration, and cultural adaptability will collectively shape the destiny of a gaming company.

In 2018, Saudi Prince Mohammed bin Salman stated at the Future Investment Initiative Summit in Riyadh, 'The determination of the Saudi people is like the Tuwaiq Mountain.' Moonton has long been intertwined with the Tuwaiq Mountain, but whether it can become part of the 'Tuwaiq Determination' ultimately rests in ByteDance's hands.

Once the gaming and esports link between Saudi Arabia, Southeast Asia, and China is established, it could mark the most exciting moment since the oil trade.

Some images are sourced from the internet. Please inform us if there is any infringement for removal.