Meituan's "strategic deployment" proves effective, with diversified supply focusing on quality and cost-effectiveness

![]() 09/02 2024

09/02 2024

![]() 532

532

As a leader in the local lifestyle services industry, Meituan's local business has achieved steady progress, with various businesses highly overlapping with service retail, which is driving consumption growth. The focus on quality-to-price ratio in diverse supply has enabled Meituan to successfully defend its position in repeated market competitions, leveraging its long-accumulated technological advantages, operational strategies, and market insights.

Author/Wen Lin

Produced by/Xinzhai Business Review

Recently, many companies have successively released their latest financial reports.

Meituan recently released its latest financial report, showing a 21% year-on-year increase in total revenue for the second quarter to RMB 82.3 billion. Adjusted net profit increased by 77.6% to RMB 13.6 billion. Annual transaction users and annual active merchants also maintained strong growth momentum, reaching new highs of 753 million and 13 million, respectively. The average purchase frequency per annual transaction user also increased, marking the 15th consecutive quarter of sequential growth since mid-2020.

This raises curiosity about how Meituan has successfully adapted to the consumer environment and achieved steady growth amidst a slowing consumer market and ever-changing business landscape.

I. Successful Defense: Local Business Maintains Stability and Progress

The scope of local lifestyle services varies across different scenarios. Narrowly defined, it encompasses industries such as catering, entertainment, beauty, accommodation, and wedding services. Broadly defined, it also includes investment insurance, housekeeping services, and healthcare.

According to the "2023-2024 China Local Lifestyle Services Industry Market Monitoring Report" released by iMedia Research, China's local lifestyle services market is expected to reach RMB 2.5 trillion by 2025. Among them, the online food delivery market will reach RMB 1.7469 trillion, the fresh food e-commerce market will reach RMB 540.3 billion, and the Internet community service market will reach RMB 345.5 billion.

The trillion-dollar local lifestyle market has enormous growth potential, making it a highly contested territory among internet giants. For example, Alibaba has restructured its local life business, while ByteDance has established a "Local Direct Sales Business Center" dedicated to expanding local life services, leveraging its Douyin platform to successively launch group-buying, dine-in catering, dine-in comprehensive services, and hotel and travel businesses.

Amid seasonal factors and unstable demand, local businesses face short-term challenges amidst fierce competition. However, Meituan's position as a leader in local life services is difficult to shake.

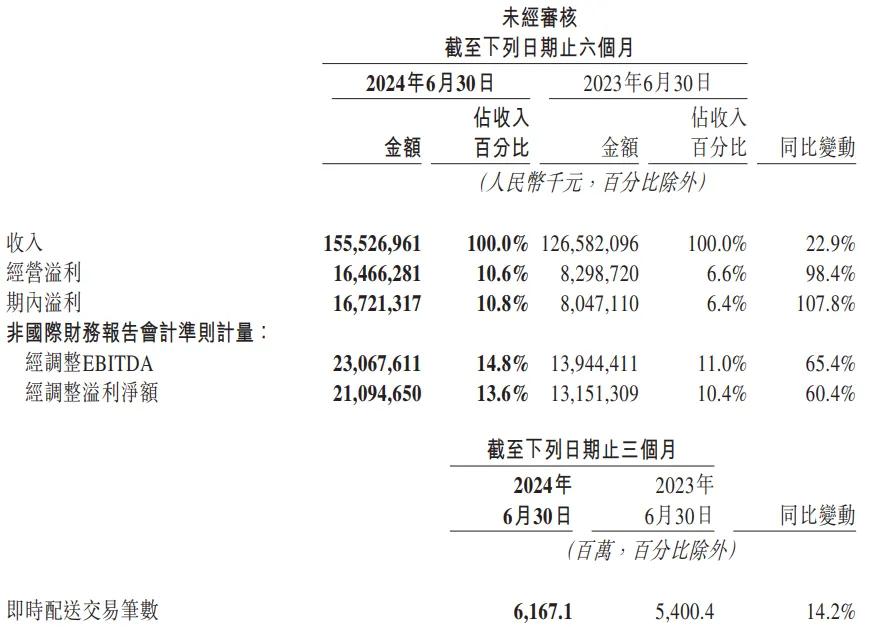

On the evening of August 28, Meituan released its financial report for the second quarter of 2024 and the first half of the year. The report showed that in just six months, Meituan's revenue exceeded RMB 155.5 billion, up 22.9% year-on-year. Specifically, revenue for the first quarter was RMB 73.276 billion, and RMB 82.25 billion for the second quarter, both maintaining stable year-on-year growth.

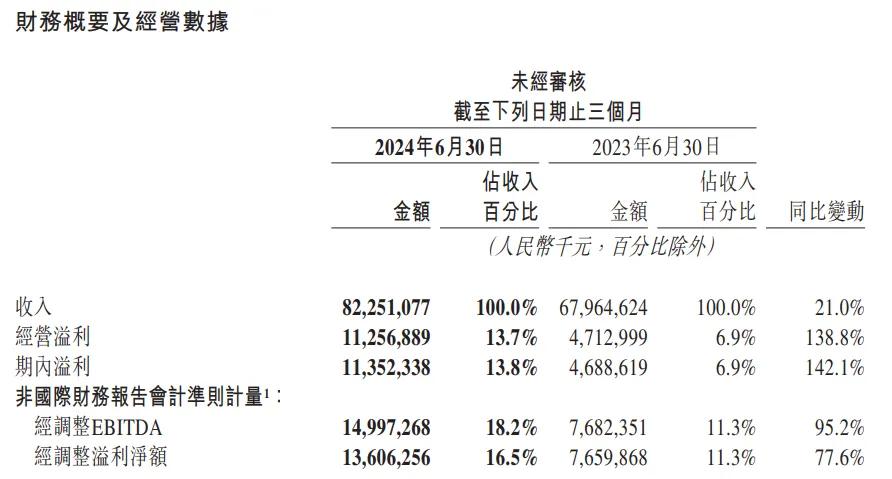

In the second quarter alone, Meituan's revenue reached RMB 82.25 billion, up 21% year-on-year, exceeding market estimates of RMB 80.42 billion. Adjusted profit was RMB 13.6 billion, up 77.6% year-on-year, also exceeding market estimates of RMB 10.61 billion.

Specifically, Meituan's core local business achieved steady growth, with second-quarter revenue reaching RMB 60.7 billion, up 18.5% year-on-year. The annual transaction frequency per annual transaction user has also achieved continuous growth for 15 quarters since mid-2020.

Among them, the food delivery business continued to maintain high-quality growth, while the flash purchase business continued to grow, with the second-quarter flash purchase order volume growing at three times the rate of food delivery orders. In terms of dine-in businesses, thanks to the arrival of traditional consumption peaks, Meituan's dine-in hotel and travel business orders increased by over 60% year-on-year, with both annual transaction users and annual active merchants reaching record highs.

In the new business segment, second-quarter revenue also increased by 28.7% year-on-year to RMB 21.6 billion. Although still incurring losses, operating losses narrowed by 74.7% year-on-year to RMB 1.3 billion.

It is worth mentioning that the primary loss-making business among the new initiatives should be Meituan Select. Sustained investment in new businesses while still achieving narrowing losses may indicate improved efficiency.

Additionally, Meituan's operating cash flow reached RMB 19.1 billion in the second quarter. Driven by strong cash flow, Meituan announced an additional US$1 billion repurchase quota after the financial report release. This follows the US$1 billion and US$2 billion repurchase plans announced by Meituan in late November 2023 and June of this year, respectively.

As stated by Meituan CFO Chen Shaohui during the financial report conference call, "This further reflects our confidence in business development and long-term stock value, and we will make timely adjustments as needed."

At present, ever-changing consumer trends pose varying degrees of challenges to various industries. However, consumer demand for local lifestyle services remains robust, and the long-term value and commercial potential of the local lifestyle services industry remain significant.

In this arena, relying solely on traffic and capital investment cannot achieve a balanced capacity configuration on both the supply and demand sides in the short term. This has made Meituan, with its long-accumulated technological advantages, operational strategies, and market insights, successfully defend its position in repeated market competitions over the past decade.

II. Integration of Supply and Demand: Remarkable Results from the Quality-to-Price Ratio Strategy

In fact, Meituan's second-quarter performance is a natural outcome of its continuous innovation and adaptation to the market environment. For instance, in continuously optimizing platform supply, Meituan demonstrates its unique "two-wheel drive" strategy, which involves parallel development of online shelf models and innovative products to meet the quality-to-price ratio demands of users across different price ranges and promote instant retail as a new consumption trend among the masses.

Specifically, the innovative product "Pinhao Fan," which focuses on the quality-to-price ratio of food delivery, has not only increased orders but also leveraged the "pin" mechanism for person-to-person marketing, expanding market share.

In terms of Meituan group-buying, the company expanded its offerings of affordable products and services in the second quarter. Not only did the GTV and order volume of leisure and entertainment products increase by over 60% year-on-year, but it also strengthened the brand image of "Meituan Group Buy, Many Stores, Save a Lot."

In flash purchase, Meituan also collaborated with more FMCG, apparel, alcohol, and beverage retail brands to meet instant consumer needs across different scenarios such as festivals, travel, and camping. Notably, the innovative alcohol retail model "Waima Wine Delivery" experienced a 150% year-on-year increase in GTV this quarter, further demonstrating Meituan's strength and potential in instant retail.

Meituan's innovative service "Shen Huiyuan" (God Membership) was also piloted in the second quarter, achieving remarkable results: user retention increased by 30%, and the number of participating merchants grew by 50% compared to before the pilot, reaching 5 million. The launch of this innovative product not only further enhanced user stickiness on the Meituan platform but also brought more traffic and sales opportunities to merchants.

It is understood that the must-eat list merchant "Chongba Niufu" saw a 25% share of orders from Shen Huiyuan members within a week, with per capita order volume increasing by 8%. The health and wellness brand Shenyuantang saw its transaction volume on Meituan increase by 556% month-on-month compared to June. The arcade brand Dawanjia saw about 45% of its July orders from Shen Huiyuan coupons, with over 40% of new customers coming from these coupons.

Cao Guanqiao, the head of Suqi Hair Salon, revealed that Shen Huiyuan drove a month-on-month increase of approximately 27% in online orders, with some package orders increasing by 58% compared to before the campaign. "Some customers may have come from other categories like catering, and there's a higher proportion of new customers," he said. Evidently, as a whole, local businesses also require more platform support for merchant traffic to generate synergies and achieve more cross-selling.

Furthermore, this quarter continued to deepen the digital capabilities of retail entities, focusing on Meituan merchants. While meeting consumer demands for quality-to-price ratio, it also drives improvements in merchant operating efficiency and economies of scale.

In recent years, new catering ventures, ranging from hot pot and local cuisine to milk tea and snacks, have flocked to the lower-tier markets. Many of these brands' expansion plans have relied on Meituan's digital support.

In the second quarter, Meituan Food Delivery's "Brand Satellite Stores" welcomed brands such as Laoxiangji and Haidilao, providing services such as commission rebates, traffic support, and operational guidance to more merchants. By the end of June, over 800 satellite stores had been opened by 120 brands nationwide.

Meanwhile, Meituan's Lightning Warehouse helped merchants improve quality and efficiency through measures such as online operations, pricing strategies, traffic support, and fulfillment services, expanding into more regions. In August, Meituan Pharmacy launched a new digital solution, the "HEALTH" growth model, aimed at helping pharmaceutical companies build brand influence and enhance pharmacy service efficiency.

It can be said that Meituan's ability to withstand external economic cycles and achieve highly stable growth stems from the high certainty of its business environment provided by rigid, high-frequency, and countercyclical local consumption. By actively iterating products and operations, Meituan has not only enhanced the experience and platform value for both supply and demand ends but also further consolidated its leading position in the market.

III. Strategic Deployment: Meituan Deepens Internal Cultivation

Since the beginning of this year, Meituan has undertaken significant reforms, with rapid and substantial organizational adjustments from business integration to the appointment of new leaders.

In February, Meituan initiated its largest organizational adjustment since its IPO, integrating multiple businesses related to its core local commerce. Subsequently, it announced a new round of business leader rotations, appointing young executives trained from the front lines to head the food delivery division, dine-in catering division, and food delivery fulfillment platform. In April, Meituan further adjusted its food delivery division, merging Meituan Platform, Dine-in Business Group, Home Delivery Business Group, and Basic R&D Platform into the "Core Local Commerce" (CLC) segment, with Wang Puzhong appointed as CEO of the segment, making the organizational structure flatter and younger.

However, in the just-concluded second quarter, Meituan did not undertake the same drastic organizational changes as before. Instead, it issued an internal letter titled "Continuing Iteration of Company Organization," focusing on identifying and addressing gaps and formally integrating previously scattered innovative businesses.

From a competitive perspective, compact strategic deployment implies a response to market changes and resistance to competitor attacks. This quarter's "inactivity" may indicate that Meituan has gradually moved away from the vortex of intense competition and is now focusing more on its own efficiency and business operations.

The second-quarter financial report is more like a period of performance realization following a series of major adjustments. The organizational restructuring not only integrates instant delivery, dine-in, hotel, and travel businesses but, more importantly, enables platform supply to better understand consumers, with the core local commerce as a whole.

It can be seen that investors' widespread concerns about dine-in business competition, new business loss reduction, and food delivery demand have all received positive responses, thanks to Meituan's strategic deployment.

Meanwhile, to address the "last 100 meters" delivery challenge, Meituan is actively engaging various parties to accelerate the "Rider-Friendly Community" project. The "Rider-Friendly Community" provides green channels for riders' entry and exit, designated parking areas, and rider rest stations. As of mid-August, Meituan's "Rider-Friendly Community" covered over 500 communities in more than 20 cities and collaborated with tens of thousands of local stores to establish "Rider-Friendly Merchants."

Additionally, it is worth noting that in August last year, China included service retail in overall consumption data for the first time. In the same year, more and more urban areas began to respond to consumer demands by distributing consumption vouchers through locally rooted consumption platforms like Meituan, further stimulating local consumption.

It is important to note that compared to commodity consumption dominated by e-commerce, service retail scenarios such as culture, tourism, entertainment, and catering are more conducive to keeping orders, consumption, and corresponding taxes local, exerting a greater driving force on a series of economic entities in the local industrial chain. Therefore, both the national and local governments are giving greater weight to service retail, whether to expand domestic demand or boost consumption.

As a leader in the local lifestyle services industry, Meituan's various businesses overlap significantly with service retail, which is driving consumption growth. It can be foreseen that with the continuous development of service retail in the future, Meituan will continue to enjoy more growth and innovation possibilities.