Near Miss Between Chinese and US Satellites: China Should Keep a Close Eye on SpaceX's Ambitions

![]() 12/19 2025

12/19 2025

![]() 542

542

On December 17, a piece of news emerged: Chinese and US satellites came within a mere 200 meters of each other in space! Recently, a SpaceX 'Starlink' executive took to social media to 'air grievances,' claiming that China's newly launched satellite failed to coordinate collision avoidance measures in advance. China Spaceflight responded promptly, emphasizing that for the launch mission, ground-based sensing systems were strictly employed to select collision-free launch windows—a mandatory step. Moreover, the close encounter occurred 48 hours after the satellite separated from the launch vehicle, well after the launch mission had been completed.

This incident has thrust the space race and SpaceX into the limelight, prompting reflections on China's space strategy.

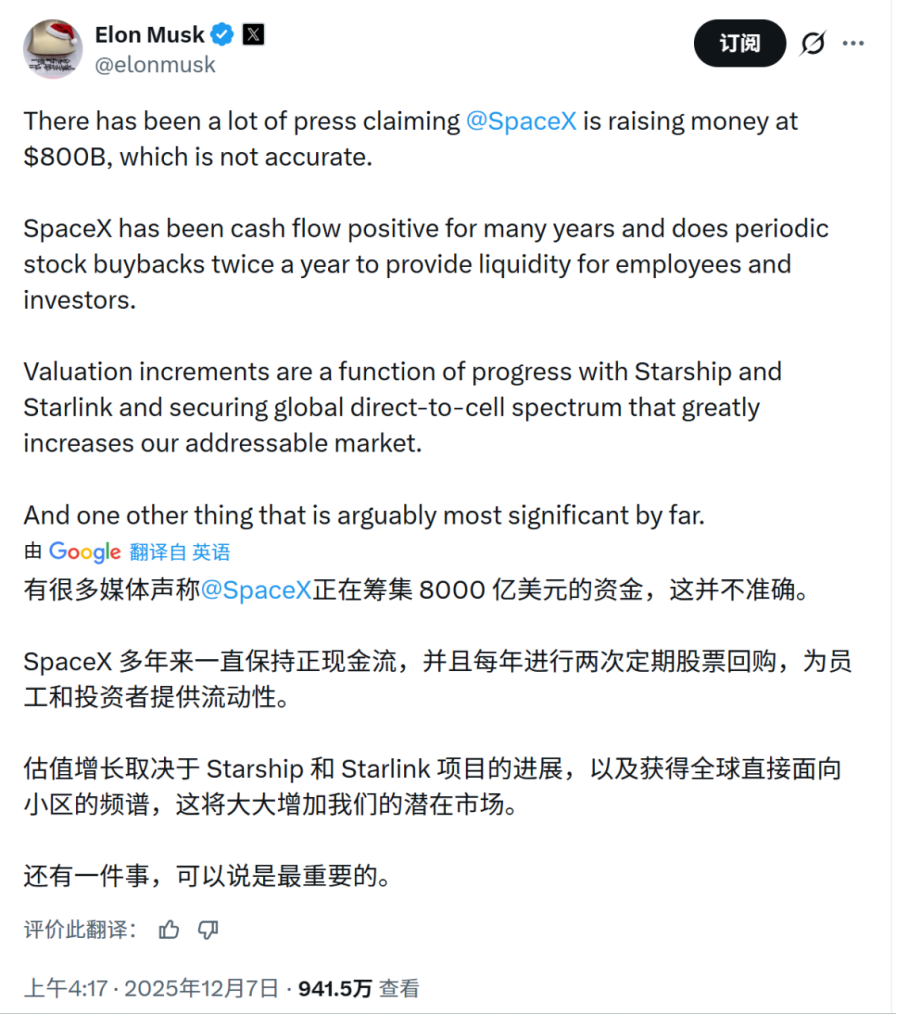

Coincidentally, recent overseas reports have indicated that SpaceX is planning to go public through an Initial Public Offering (IPO) in 2026. Both Musk and the CFO have internally confirmed that related plans are in the works. Some reports suggest that SpaceX is aiming for an $800 billion valuation and plans to raise $25 billion. Others, however, propose a staggering $1.5 trillion valuation and $30-40 billion in funding. As early as July 2025, the company was selling shares at $212 each, valuing it at $400 billion. If the IPO succeeds at this new valuation, SpaceX would rank among the top 20 global public companies and become the world's most valuable private startup, surpassing OpenAI's recent $500 billion valuation.

In a December 12 letter to shareholders, CFO Johnson acknowledged the uncertainty surrounding whether the IPO would proceed and its potential valuation. Nevertheless, he stated that if the company performs well and the market conditions are favorable, the offering could raise substantial funds.

It appears that SpaceX harbors grand ambitions.

However, Musk clarified on Twitter that the $800 billion valuation for fundraising is inaccurate. He noted that the company has maintained positive cash flow for years and regularly offers stock buybacks, implying that it is not short on cash and may be worth even more, depending on the progress of the Starship and Starlink projects, global communications services (operators), and another 'important' matter.

This statement carries significant weight—will it involve global operator services? Does it downplay the importance of the IPO? And what exactly is this 'other' matter? Musk is keeping us guessing.

The Chinese translation in the Google image, which reads 'raising $800 billion,' is inaccurate.

Even if, as some claim, SpaceX is not raising funds from the market but is instead selling shares in the secondary market to allow employees to cash out, one might question whether such a commotion is warranted, considering Musk himself said the company would buy back employee shares.

Thus, I believe Musk is laying an emotional foundation for the IPO. The 'other matter' he mentioned has piqued the curiosity of many, yet it remains unclear, offering ample room for speculation and paving the way for a high-valuation listing.

So, let's delve into SpaceX today and analyze what this 'mystery' might entail.

How does SpaceX generate revenue? What is its ultimate plan?

SpaceX's current revenue primarily stems from two sources. The first is commercial launch services provided through its Starship spacecraft, which helps others launch satellites and other equipment into space. Its reusable Falcon series rockets significantly reduce launch costs, providing a crucial competitive advantage. You've likely seen Falcon launch videos quite often.

However, Musk recently refuted on Twitter claims that SpaceX relies on NASA contracts for business. He noted that NASA orders will account for just 5% of revenue in 2026, with the commercial Starlink business being the key driver.

Starlink represents SpaceX's second revenue stream. It launches low-Earth orbit satellites via its rockets to form the Starlink constellation, enabling satellite internet services.

These two businesses are mutually reinforcing. Starlink relies on cost-effective satellite launches, a strength of SpaceX's rockets.

Multiple media outlets report that Starlink's user base grew from 1 million in December 2022 to over 8 million active users globally by November 2025. This rapid growth has made Starlink SpaceX's largest revenue source, projected to generate $7.7 billion in 2024, accounting for about 58% of total revenue.

Industry analysts predict that Starlink could generate $11.8-15 billion in revenue by 2025. Operating over 7,500 satellites in low-Earth orbit, it represents the largest satellite network deployed to date.

Additionally, SpaceX recently acquired wireless spectrum licenses worth over $17 billion from EchoStar, enabling direct-to-cell services. This allows ordinary smartphones to connect to Starlink without the need for special equipment. SpaceX has partnered with T-Mobile on this technology.

If implemented, Starlink could provide not just internet to remote areas but also low-Earth orbit broadband services to densely populated regions, potentially becoming a global communications infrastructure.

Thus, these three businesses are tightly interconnected, ultimately driving higher revenue through the Starlink network. If SpaceX goes public, the substantial funds raised would necessitate significant investments, such as developing larger, higher-throughput satellites to serve densely populated areas. Launching more and bigger satellites would require more reliable rockets capable of deploying multiple satellites per launch.

Starlink is SpaceX's current and future cash cow, not subsidizing rocket launches but sustaining them. Moreover, low-Earth orbit space is finite; establishing dominance early by filling orbits and ensuring smooth operations may justify the planned fundraising and aggressive Starlink expansion.

But Musk's remarks suggest an even grander vision.

Some netizens speculate that Starlink aims to build a space-based data center, utilizing laser communication between satellites to enable global data routing independent of ground stations. If powered by continuous solar energy and enhanced with AI computing capabilities, training more powerful large models or AI applications in space could become feasible.

Furthermore, media reports based on shareholder letters indicate that beyond deploying AI data centers in space, SpaceX plans to use IPO funds to increase Starship flight frequency, build a lunar base (Alpha), and launch Mars missions.

Combining these insights, SpaceX likely has similar plans. I believe Musk's 'important' matter refers to the space-based data center, which is at least plausible, whereas lunar bases and manned Mars missions remain distant goals.

From China's national perspective, Musk's explorations offer valuable insights, opening investment and incubation opportunities for commercial space ventures. China is unwilling to cede space, particularly low-Earth orbit, to others.

On December 12, 2025, at 7:00 AM Beijing Time, China successfully launched 16 low-Earth orbit satellites for its satellite internet constellation using the Long March 12 rocket from the Hainan Commercial Space Launch Site. The satellites smoothly entered their prescribed orbits, marking a successful mission. To accelerate orbital occupancy and secure spectrum resources, China conducted three rocket launches within seven days in December 2025, deploying multiple low-Earth orbit satellites.

China's StarNet plans to deploy approximately 13,000 satellites for its GW constellation, quietly igniting a space race.

Postscript

Infrastructure development in space sparks immense imagination. While unprofitable in the short term, SpaceX is perhaps the only private company worldwide that meets public expectations, and Musk is the most likely entrepreneur to succeed. This grants its IPO a higher 'market dream rate.'

Naturally, while many netizens express admiration and anticipation for SpaceX, they also ask: Can Tesla shareholders get priority to buy SpaceX stock?

One user remarked that anyone valuing SpaceX below OpenAI clearly needs a brain-machine interface upgrade.

A more humorous suggestion is that Musk might ultimately aim to build a satellite smartphone.

So, whether it's a 'conspiracy' or an 'open strategy,' how do you view Musk and SpaceX's space-based data center plans?

References: Musk's social media accounts, CCTV News, Our Space, and other media outlets

- END -