Zhipu AI: A Time-Sensitive Pursuit for a Hong Kong IPO

![]() 12/22 2025

12/22 2025

![]() 669

669

Zhipu AI and MiniMax are embroiled in a fierce, high-stakes contest for a Hong Kong IPO.

On December 17, 2025, Zhipu AI successfully cleared the listing hearing stage at the Hong Kong Stock Exchange. In a remarkable coincidence, MiniMax also passed its listing hearing that very same evening.

According to pertinent data, since its inception in 2019, Zhipu AI has secured over 15 rounds of financing, with its most recent valuation soaring to 40 billion yuan (approximately $5.6 billion). In 2025, MiniMax completed a new round of Series C financing, raising nearly $300 million, and its post-investment valuation surpassed $4 billion (around 30 billion yuan).

The first company to go public will reap substantial benefits in the capital market. For Zhipu AI, a successful listing could see it become the "pioneering global foundational large-model stock."

The Rationale Behind Competing for Hong Kong's "First Large-Model Stock"

For Zhipu AI, rushing to list on the Hong Kong Stock Exchange is not merely about claiming the title of "first global large-model stock." Being the first listed large-model stock means it will attract more attention from capital investors and enjoy higher price-to-earnings and price-to-sales ratios. Zhipu AI's bid to become Hong Kong's first large-model stock is underpinned by strong confidence.

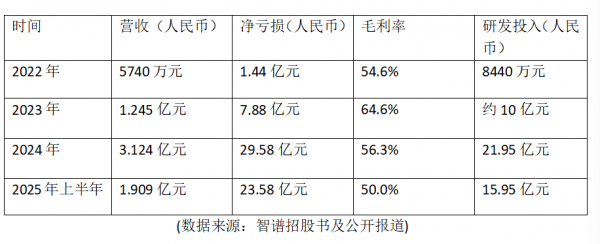

Firstly, there is the remarkable growth in AI large-model revenue. Although the early stages of large-model R&D are costly, with Zhipu AI reporting a net loss of 2.958 billion yuan in 2024 and 2.358 billion yuan in the first half of 2025, and R&D expenditures reaching 1.595 billion yuan—over eight times its revenue in the same period—with most of the funds going towards purchasing expensive computational power (GPUs) and recruiting top talent, the revenue growth is equally impressive.

The capital market highly values Zhipu AI's revenue growth. From 2022 to 2024, Zhipu AI's revenue skyrocketed from 57.4 million yuan to 312.4 million yuan, with a compound annual growth rate of 130%. The total revenue for 2025 is projected to grow by over 100% year-on-year.

Secondly, there is the star-studded investor "circle." Zhipu AI is backed by China's leading capital and internet tech giants, including Hillhouse Capital, Sequoia Capital, and Legend Capital, as well as internet behemoths like Meituan, Tencent, Alibaba, Xiaomi, and Ant Group.

More impressively, it has garnered investments from state-owned assets in Beijing, Shanghai, Hangzhou, Chengdu, and other regions, giving Zhipu AI a unique "national team" attribute. This is a significant advantage when bidding for government and state-owned enterprise contracts.

Lastly, there is the business model that the capital market favors. Zhipu AI is currently transitioning from a "capital-intensive" to an "asset-light" model.

Currently, Zhipu AI's primary revenue comes from localized deployments for governments (ToG) and large enterprises (ToB). However, this approach is resource-intensive, requiring significant manpower and facing challenges in rapid scalability, despite having high gross margins of 50%.

Nevertheless, Zhipu AI is shifting towards an "asset-light" model, heavily betting on MaaS (Model as a Service). This allows developers to call models on-demand via API interfaces, similar to OpenAI's model, and has exponential growth potential.

However, strong confidence does not guarantee that Zhipu AI's Hong Kong IPO will be stress-free or highly regarded by the capital market.

The Invisible Forces Shaping Zhipu AI's Future

Based on the 2024 revenue figures, Zhipu AI is indeed remarkable, leading among China's independent general-purpose large-model developers with a 6.6% market share. Most importantly, Zhipu's GLM architecture has achieved full domestic adaptation and has started to gain a foothold in overseas markets like Southeast Asia.

However, Zhipu AI also faces invisible challenges.

One challenge is the uncertainty surrounding its bid for Hong Kong's first large-model stock. MiniMax, another member of the "Six Little Tigers," is also preparing for a Hong Kong IPO, with an expected listing date in January 2026. This indicates that industry competition has extended from technological prowess to capital market positioning.

Another challenge is Zhipu AI's heavy reliance on computational power, which entails multiple risks.

The first risk is immense cost pressure. Currently, computational power service fees account for over 70% of Zhipu AI's total R&D expenditures, which is not conducive to long-term R&D. Zhipu needs to allocate more funds to AI technology advancement and top talent acquisition rather than computational power costs to sustain its leadership in the AI large-model field.

The second risk is significant supply chain vulnerability. The global supply of high-end chips is highly uncertain, especially under U.S. chip sanctions, leading to persistent shortages of domestic high-end AI chips. This directly impacts Zhipu AI's model iteration.

The third risk is the uncertain timeline for profitability, a key concern for the capital market. Despite rapid revenue growth, Zhipu AI's burn rate is even faster, raising questions about when it will truly start generating profits. The prospectus does not provide a clear profitability timeline.

Hong Kong IPO: China's Large Models Transition from "Technological Competition" to "Capital Scrutiny"

This time, whether it's Zhipu AI, MiniMax, or Yuezhi'anmian (Moonshot AI) preparing for a Hong Kong IPO later, their listings will mark China's large-model industry's formal transition from "technological competition" to "capital scrutiny."

For companies, a Hong Kong IPO will raise more funds, significantly alleviating the substantial R&D costs of large models. It's not just an opportunity for financial "replenishment" but will also determine who can go further in the expensive AI large-model race.

For the entire AI large-model industry, going public means accepting regular performance evaluations. The era of relying solely on storytelling is over; the ability to generate profits and provide sustained investment returns to shareholders will become a more crucial metric.

Zhipu AI is still in a massive "money-burning" phase but has proven that AI large models can generate scalable revenue. However, after this Hong Kong listing, Zhipu AI will face even stricter "capital scrutiny," especially regarding whether it can find a sustainable path to profitability.