Intel Shuts Down Automotive Business: A Strategic Realignment

![]() 06/26 2025

06/26 2025

![]() 746

746

Produced by Zhinengzhixin

Intel recently announced the closure of its automotive architecture division and layoffs of most related staff, marking a significant step in its broader restructuring strategy.

Despite achieving tens of millions of installations in the automotive sector over recent years, Intel has opted to redirect its resources towards client and data center operations. This decision comes amidst relentless pressure on its core business and drastic shifts in the competitive landscape, aiming to regain prominence in key areas.

This article delves into Intel's technical path, investment outcomes, the rationale behind its exit from the automotive industry, and its potential implications on the industrial ecosystem, from the perspectives of technical background and business structure.

Part 1

Part 1

Intel's Automotive Chip Strategy: Platform Integration Attempts and Technical Challenges

While automotive technology has never been Intel's primary focus, the company has maintained a long-standing presence in this sector.

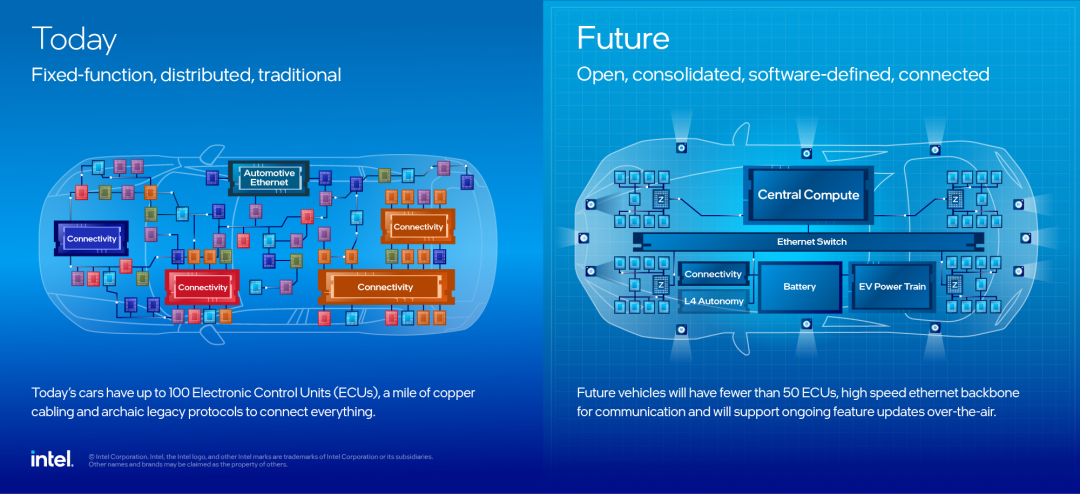

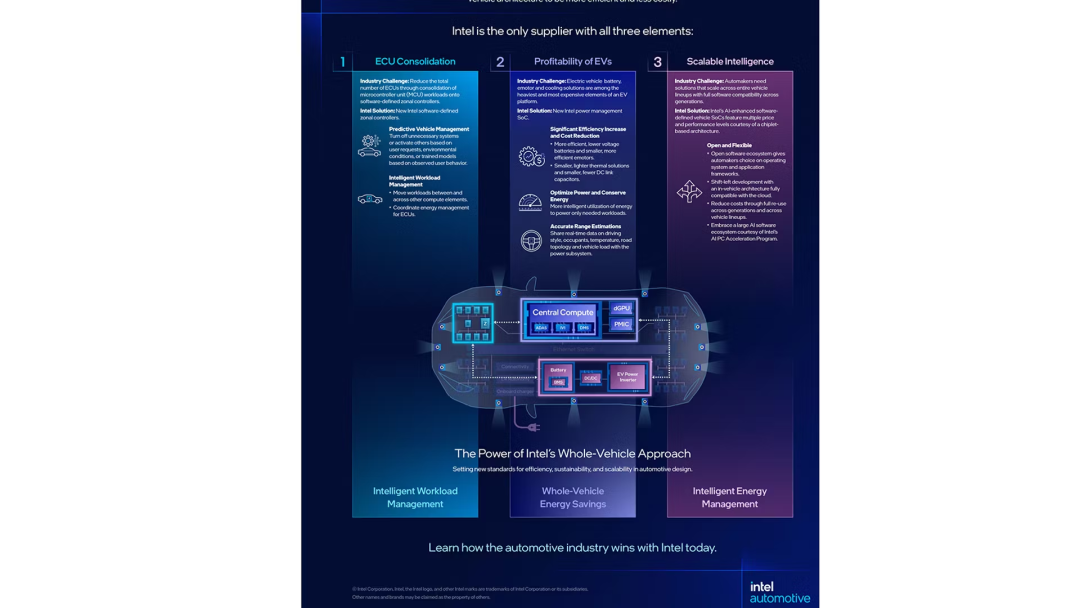

Leveraging its architectural expertise in PC and server domains, Intel's automotive chips primarily serve three functions: providing general-purpose processors for infotainment systems, offering edge computing platforms for electric vehicles and driver assistance, and aggregating and processing sensor data in specific scenarios.

From a product architecture standpoint, Intel attempted to apply its x86 architecture within the in-vehicle environment, aiming to create a heterogeneous platform akin to desktops. Representative systems include Intel's Atom series and Core series embedded platforms. These chips facilitate central information processing, in-vehicle networking, navigation, and multimedia management, while accelerating edge AI functions through the OpenVINO tool chain.

With support for various interfaces like PCIe, USB, CAN, and Ethernet, Intel has, to a certain extent, transcended traditional Tier 1 platforms by realizing the logic of "general-purpose computing on vehicles."

While this model based on general-purpose processor migration boasts superior theoretical performance, it has evident shortcomings in practical applications:

◎ Power consumption performance struggles to align with the vehicle's need for long-term stability;

◎ High adaptation costs for the software stack and prolonged integration cycles. Especially when automotive systems demand stringent safety standards (like ISO 26262), the Intel platform lacks a natural advantage;

◎ Compared to Arm architecture and RISC-V platforms, its chip packaging is complex, the development threshold is high, and ecosystem support is insufficient.

In terms of competition, players like NXP's S32 series, Renesas' R-Car platform, Qualcomm Snapdragon Ride, and NVIDIA Orin have all established hardware + software collaboration systems tailored for automotive applications. These systems come with comprehensive functional safety certification paths and robust ecosystem integration capabilities.

Intel's attempt to swiftly penetrate the market with general-purpose technology instead revealed its predicament of being caught in a middle ground that's "neither fully automotive-grade nor extreme," significantly hindering its progress in automotive chips.

Intel's automotive chip strategy overly relies on the scalability of general-purpose computing platforms, failing to fully address the automotive industry's specific requirements for power consumption, functional safety, and long lifecycles. In the face of a highly customized automotive chip ecosystem, it lacks deep-seated competitiveness.

Part 2

Strategic Retrenchment and Industrial Chain Reactions Amidst Business Restructuring

Intel's decision to shut down its automotive architecture business is not a spur-of-the-moment move but part of a broader reorganization plan.

Since early 2025, the company's new CEO has spearheaded a series of cost-cutting and organizational streamlining initiatives, including up to 20% layoffs in the manufacturing division, outsourcing the marketing department to Accenture, and transitioning the sales process to an AI-driven marketing system.

Intel needs to concentrate its limited resources on areas with genuine growth potential and profit margins – currently, these are client processors and data center chips.

Under the dual pressure from AMD's Zen architecture and Arm-based server chips, Intel's core business share has continued to shrink, and issues like lagging behind competitors in process nodes and energy efficiency ratios remain unresolved.

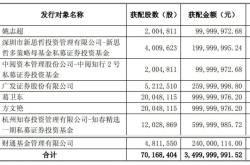

Although the automotive business boasts market data like "50 million vehicle deployments," it became an easier target for "discard" during structural adjustments due to undisclosed independent revenue, an unclear profit structure, and a lack of priority resource allocation within the system.

More critically, this business has a weak correlation with the AI accelerators and edge cloud computing directions Intel is banking on in the future, failing to contribute differentiated value in the short term.

The layoffs affect the automotive business under the Client Computing Group (CCG) and do not directly impact Intel's subsidiary Mobileye, which it holds a controlling stake in. Mobileye specializes in autonomous driving computing platforms and perception algorithms, operates independently, and has extensive industrial collaborations in Israel, Germany, and China.

From an industrial perspective, Intel's exit has limited direct impact on the entire automotive semiconductor market but serves as a reminder that general-purpose chip vendors will struggle to establish sustainable value barriers in the current highly customized and platform-based smart car chip market without offering tailored software and hardware integrated solutions for automotive needs.

Amidst increasing pressure on its core business transformation, Intel chose to abandon the automotive architecture business, which hasn't yet formed stable profits. This reflects its pragmatic choices in resource allocation and the realistic dilemma faced by non-automotive-native enterprises in establishing in-vehicle ecological competitiveness at this juncture.

Summary

The smart car market is entering a phase of rapid expansion, with chip architecture, ecosystems, and software and hardware collaboration becoming pivotal competitive factors. Intel's withdrawal from the automotive architecture business alleviates its organizational burden but also sidelines it from a crucial entry point in the era of intelligent mobility.