Audi Revises Electrification Strategy: A Bold Gamble or a Wise Adaptation?

![]() 06/26 2025

06/26 2025

![]() 658

658

As the global automotive landscape hurtles towards an electrified future, Audi has unexpectedly hit the brakes.

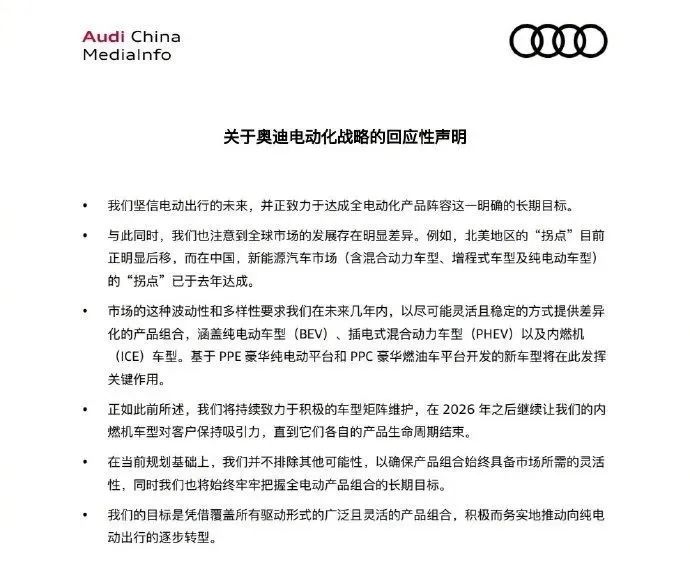

On June 18, Audi announced a significant adjustment to its electrification strategy, abandoning the original goal of full electrification by 2033 and committing to continue producing internal combustion engine vehicles for the next decade. This shift is not unique to Audi; Mercedes-Benz, Volvo, and other traditional luxury automakers have also revised their electrification plans. However, Audi's reversal is particularly noteworthy as it speaks volumes about the future of the brand and highlights the deep-seated contradictions and uncertainties inherent in the automotive industry's transformation.

Audi's strategic pivot on electrification is not a spur-of-the-moment decision.

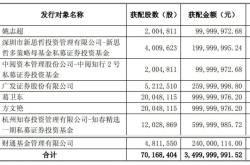

Initially, Audi planned to cease selling internal combustion engine vehicles by 2026 and fully transition to electric models by 2033. However, Audi's global CEO, Markus Duesmann, recently conveyed a markedly different message: "From 2024 to 2026, Audi will introduce a new series of internal combustion engines and plug-in hybrid vehicles, providing us with greater flexibility for the next decade." This announcement signifies that Audi will not only continue to produce fuel vehicles but will also invest in the development of next-generation internal combustion engine technology.

It's important to clarify that Audi is not abandoning electrification altogether but rather adopting a pragmatic 'dual-track' strategy. On one hand, it continues to develop pure electric models based on the PPE platform. On the other hand, it updates its fuel vehicle models using the PPC platform. This dual approach embodies the classic dilemma faced by traditional automakers during this transition period – they cannot afford to miss out on future trends but are reluctant to abandon current profit streams.

Audi's financial data offers insight into the rationale behind this strategic shift.

In 2024, Audi's global sales declined by 11.8% year-on-year, with pure electric vehicle deliveries falling by 8%. This performance pales in comparison to the rapid growth of Tesla and China's new energy vehicle makers. More concerningly, Audi's operating profit margin in the first quarter of 2025 stood at just 3.5%, well below its annual target of 7%-9%. The myth of high profit margins for traditional luxury car brands is being shattered by the fierce competition in the electric vehicle era.

Currently, pure electric vehicles account for only 11.9% of Audi's total sales. Despite a 30% year-on-year increase, this base remains small. The e-tron series has failed to become a market sensation, and models like the Q4 e-tron face stiff price competition from Chinese brands. Under these circumstances, doubling down on electrification would undoubtedly be a risky proposition.

Fuel vehicles continue to be Audi's profit engine. Despite the electric vehicle's dominance in public discourse, the demand for luxury fuel vehicles remains robust in reality. Traditional models like the Audi A6 and Q5 still boast a significant and loyal customer base worldwide. Abandoning this market segment would be detrimental, especially amid increasing economic uncertainty.

Audi's statement specifically notes 'significant differences in the development of global markets,' underscoring the biggest challenge facing the promotion of electric vehicles: market differentiation. While the penetration of new energy vehicles in China continues to rise, with government policies, charging infrastructure, and consumer awareness reaching maturity, the North American market is progressing slowly. Outside of areas like California, the adoption of electric vehicles faces multiple hurdles, including insufficient infrastructure and political controversy.

The European market occupies an intermediate position. Although the European Union has enacted stringent emission regulations to drive electrification, consumer acceptance varies widely. Countries with strong automotive industries, such as Germany, exhibit far less enthusiasm for electric vehicles than policymakers had anticipated. This uneven global market development renders a one-size-fits-all electrification strategy impractical.

Another often-overlooked factor is supply chain issues. The surging demand for key raw materials like lithium, cobalt, and nickel in electric vehicles has led to volatile price fluctuations. Geopolitical factors, such as the Russia-Ukraine conflict, have further exacerbated supply chain uncertainties. In this context, maintaining diversity in technology pathways has become a critical risk management strategy for automakers.

In conclusion:

Audi's 'strategic retreat' should not be viewed as a failure of electrification but rather as a sign of industry maturation. The shift towards sustainable mobility in the automotive industry is inevitable, but the path may prove more diverse and complex than initially anticipated.

This transformation is a multi-dimensional game encompassing technology, market dynamics, and consumer psychology. There is no universal solution, and each brand must strike a balance based on its unique positioning and market realities. Audi's choice may not be the most radical but could prove the most pragmatic given the current environment.

Over the next decade, we may witness more such strategic adjustments as the industry seeks a new equilibrium. In this century-long transformation, the only certainty is uncertainty itself. Automakers that can adapt flexibly while maintaining a clear long-term vision are most likely to emerge as the ultimate winners.