Can YU7 Realize Xiaomi's High-End Vision, Surpassing SU7 in Price?

![]() 06/27 2025

06/27 2025

![]() 637

637

After much anticipation, Xiaomi has officially unveiled its YU7.

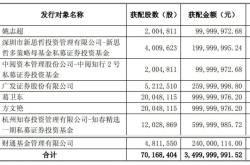

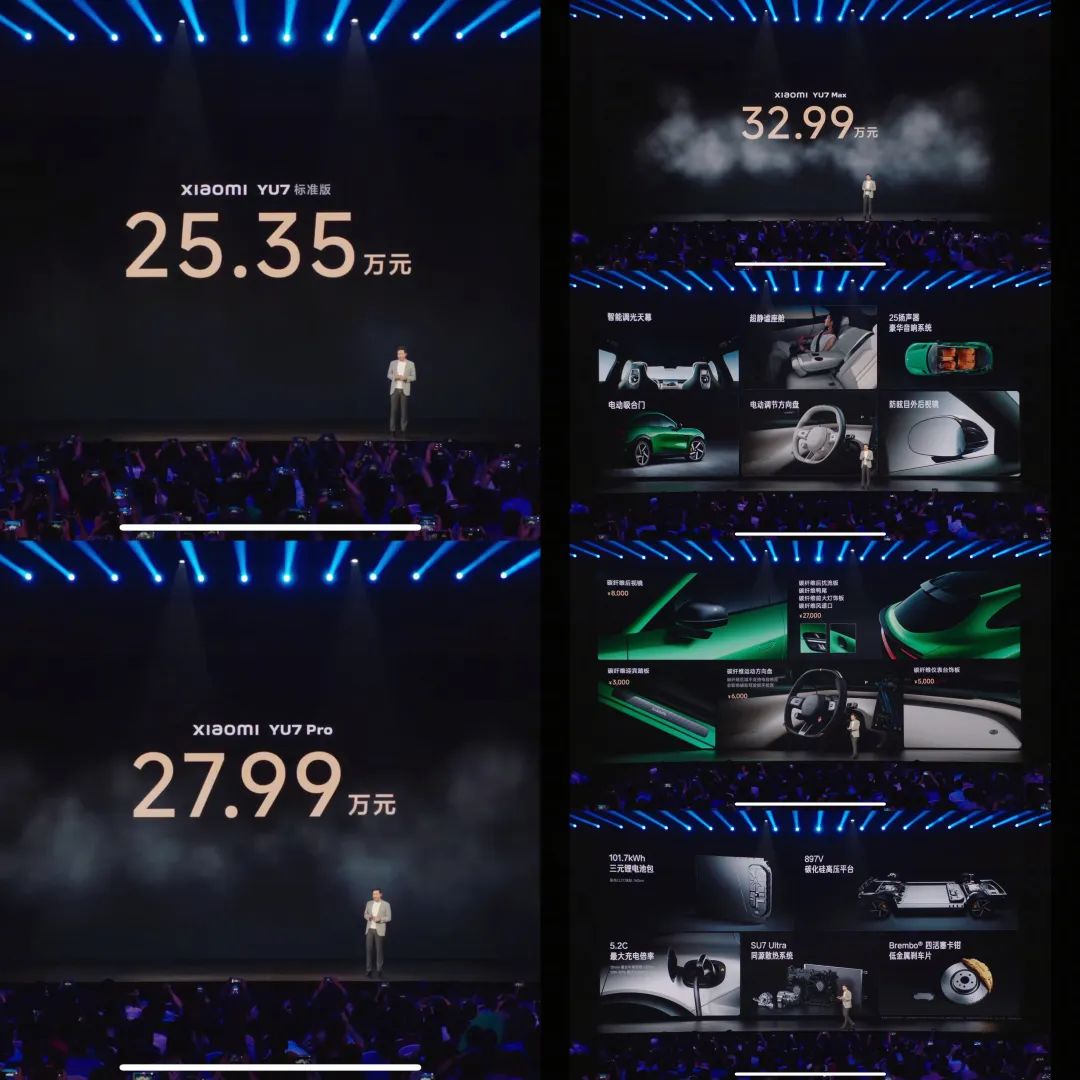

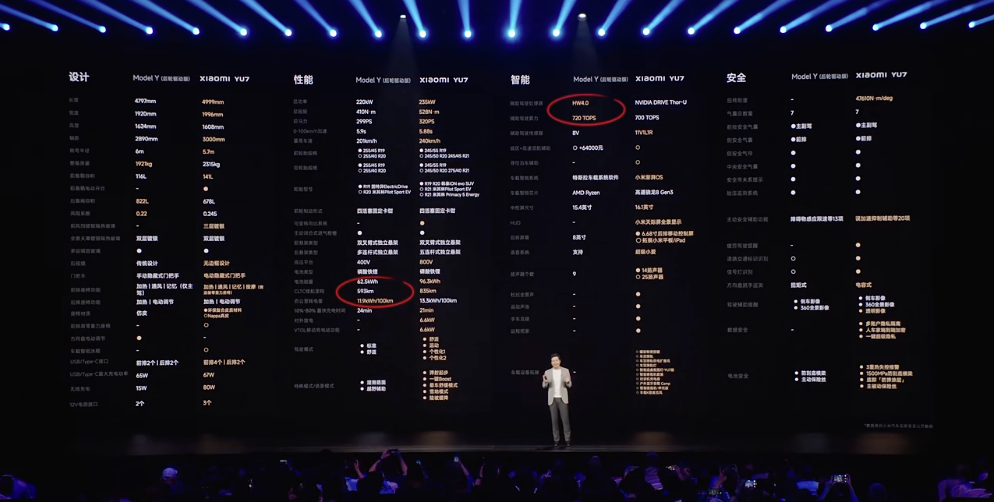

Contrary to expectations that YU7 would be a youth-oriented version of SU7, Xiaomi surprised with a bold move: a more robust style, aggressive specifications, and a higher starting price of 253,500 yuan, with the MAX version priced at 329,900 yuan. This directly surpasses SU7's price range of 215,900 to 299,900 yuan, squarely targeting Tesla's Model Y.

This isn't Redmi; it's Xiaomi Automobile's next strategic step towards higher ground.

Departing from SU7's sleek coupe design, YU7 adopts a more mainstream large five-seat SUV format, with dimensions and aesthetics closely resembling Model Y. As Xiaomi Automobile's first mid-to-high-end smart SUV targeting family users, YU7 plays a pivotal role in transitioning from SU7 to a full-fledged family-oriented lineup. It caters to family users while offering robust configurations and comprehensive ecological integration.

YU7's positioning offers at least four clear strategic advantages:

1. **Avoiding Price Wars and Seizing the Mid-to-High-End SUV Gap**: The 150,000-200,000 yuan pure electric market is saturated with models like BYD Qin PLUS, Xpeng MONA, and Letao L60. Entering this market would only plunge Xiaomi into a homogeneous competition. Instead, the 200,000-300,000 yuan range, while premium, is less saturated. By targeting Model Y, YU7 aims to seize high-end but unsaturated market opportunities.

2. **Building a High-End Technology Label**: SU7 laid the groundwork for technological perception with its advanced configurations and intelligence. Lowering YU7's price would degrade the brand's image. By standardizing lidar, air springs, and HyperOS ecosystem collaboration across the line, YU7 reinforces the perception that "Xiaomi Automobile = high-tech integration capabilities".

3. **Serving as the Hub for the Human-Car-Home Ecosystem**: While SU7 targets tech enthusiasts and early adopters, YU7 is tailored for family users, offering more space, comfort, and a seamless interaction logic that aligns with Xiaomi's smart home strategy. Unlike SU7's focus on sensory experience, YU7 emphasizes ecological collaboration.

4. **Complementing Product Categories and Avoiding Internal Competition**: SU7 emphasizes coupe performance, while YU7 focuses on family SUVs, with distinct positioning and target audiences. Similar to the Model 3 and Model Y combination, SU7 and YU7 complement each other, expanding coverage without competing for users through varying configurations.

From lidar to sensory hardware, storage space, and intelligent assistance, YU7 effectively translates SU7's high-end capabilities into an SUV architecture.

In essence, SU7 is a trailblazer, while YU7 sets the tone.

YU7's objectives are clear: internally, it complements SU7's shortcomings in family use rather than replacing it. Externally, it challenges the ceiling of the 250,000 yuan mainstream SUV market, aiming to replicate SU7's success in a larger segment.

YU7's competition isn't with Qin PLUS or Zero Run C10; it's directly with Model Y, Wenjie M5, and Xpeng G6, capturing buyers hesitant between Model Y and Wenjie M5.

Despite maintaining its price, YU7 adheres to Xiaomi's strategy of material stacking, loop closure, collaboration, and software prioritization.

Margins? Not this time. Instead, YU7 offers a deep integration of Xiaomi's ecosystem, with HyperOS seamlessly interacting with phones and home devices, enhanced AI assistant capabilities, and standard high-level intelligent driving preparation conditions activatable via OTA.

Xiaomi now aims to elevate industry standards through product experience and usage ecology, rather than winning through low prices.

SU7 is Xiaomi's dream car, catering to young tech enthusiasts and early adopters. YU7, however, is designed for mainstream family car buyers.

This requires stable and reliable delivery, after-sales support, and an extensive offline network.

Xiaomi is promoting direct-sales flagship stores alongside third-party authorized 2S delivery cooperation models. The former showcases the brand and delivery experience, while the latter ensures standardized sales and after-sales services. While Huawei's Wenjie has proven selling cars in mobile phone stores feasible, Xiaomi still needs to enhance brand recognition through its vehicles.

So, can YU7 break the perception that "Xiaomi = cheap"?

From its specifications, YU7 undeniably targets the high-end market.

With dimensions of 4999×1996×1600mm and a wheelbase of 3000mm, it offers single-motor rear-wheel drive and dual-motor four-wheel drive. The top-of-the-line version boasts a combined power of 508kW, accelerating from 0-100km/h in just 3.23 seconds and reaching a top speed of 253km/h.

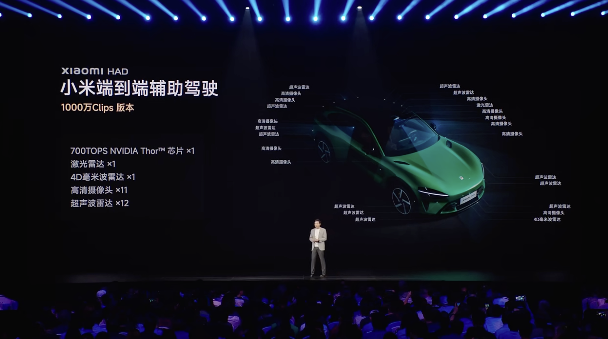

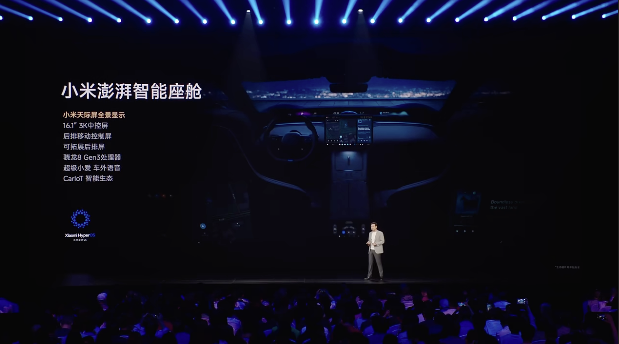

Battery options include 96.3kWh and 101.7kWh capacities, providing a maximum CLTC range of 835 kilometers. All models come standard with lidar, 4D millimeter-wave radar, 11 cameras, and NVIDIA Thor chips, with intelligent driving computing power reaching 700TOPS, laying the hardware foundation for advanced assisted driving.

In terms of comfort, YU7 features an intelligent chassis, 135° electric adjustable seats, HUD with panoramic projection, electric leg rests, dual zero-gravity seats, closed dual-chamber air springs, an intelligent dimming sunroof, and an in-car refrigerator. It offers up to 9 exterior colors and 4 official interior color options, with wheel hubs supporting up to 21-inch forged versions and various carbon fiber exterior components available as options.

From hardware to experience, YU7 doesn't compete on price; it comprehensively explores and challenges the high-end intelligent SUV market above the 300,000 yuan range.

However, Xiaomi has yet to truly establish itself in the high-end market.

From mobile phones to cars, targeting the high-end market has been a slogan Lei Jun has repeatedly chanted but failed to break through the brand ceiling. The public still perceives Xiaomi as cost-effective, targeting young tech enthusiasts and digital geeks.

The trust crisis with SU7 remains unresolved, and for YU7 to succeed in the high-end market, it must overcome the hurdle of user trust, convincing family users that Xiaomi can produce safe, reliable, and high-quality SUVs at 300,000 yuan.

This tests not only the product but also Xiaomi's brand potential, service network, delivery capabilities, OTA rhythm, and system stability.

Crucially, YU7 also represents Xiaomi Automobile's second phase – transitioning from dream-building to revenue generation.

It must answer three core questions: Does Xiaomi possess the engineering capabilities for platform reuse and product expansion? Does it have the organizational capacity for large-scale delivery and service networks? Can it evolve from a single hit model into a consistently growing automaker?

YU7's success will directly determine Xiaomi Automobile's rhythm in 2025-2026.

If YU7 triumphs, it will mark Xiaomi's true high-end turning point, firmly establishing itself in the market above 250,000 yuan through products, not just rhetoric.

However, if it fails, Xiaomi's aspirations to reach higher ground may once again be stymied by the perception that it understands technology but lacks high-end credibility.

YU7 is Lei Jun's next bet, not a volume leader but a crucial piece in Xiaomi's ecological puzzle. It doesn't stir fanatical emotions but encapsulates Lei Jun's future strategic vision.

YU7 isn't just another Xiaomi car; it's a complete manifestation of Xiaomi's automotive philosophy.

If SU7 was a dazzling debut, YU7 represents product normalization – and the ability to turn normalcy into an advantage is Xiaomi's true ace in the hole.