How Much Market Momentum Can Xiaomi's Product Launch Generate in the Secondary Market?

![]() 06/30 2025

06/30 2025

![]() 750

750

By Baker Street Detective

Author: Lu Zhenxi

Can the speculation surrounding Xiaomi truly hold water?

On June 26, 2025, Xiaomi held its People-Car-Home Ecosystem Conference, unveiling the Xiaomi YU7, Xiaomi MIX Flip 2, and Xiaomi AI Glasses. Xiaomi believes these products are "technological marvels tailored for elite consumers, embodying the company's latest strides in the core technology race."

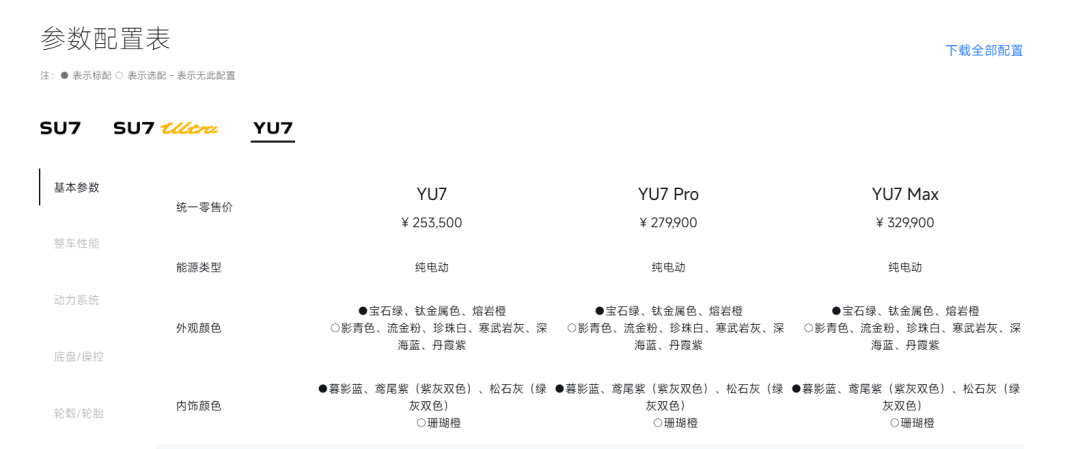

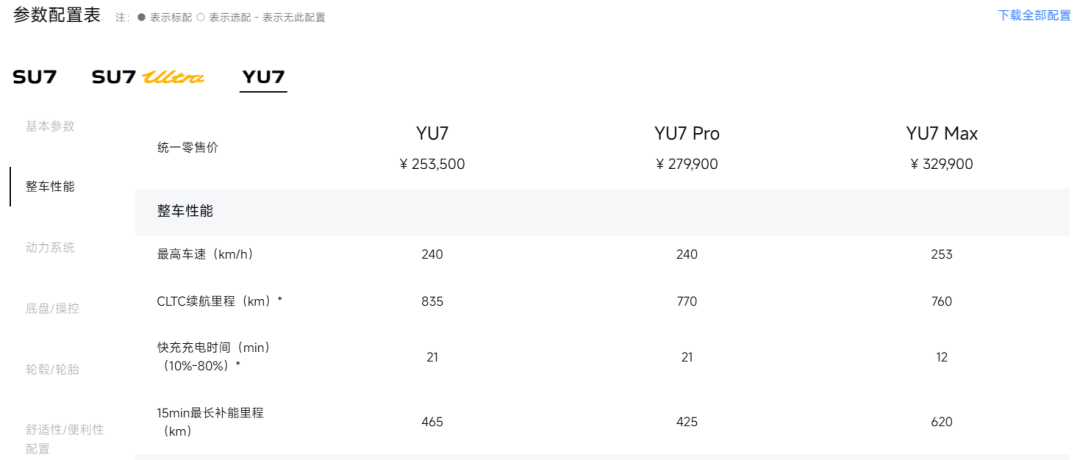

The Xiaomi YU7 is available in three configurations: a standard version priced at RMB 253,500, a Pro version at RMB 279,900, and a Max version at RMB 329,900.

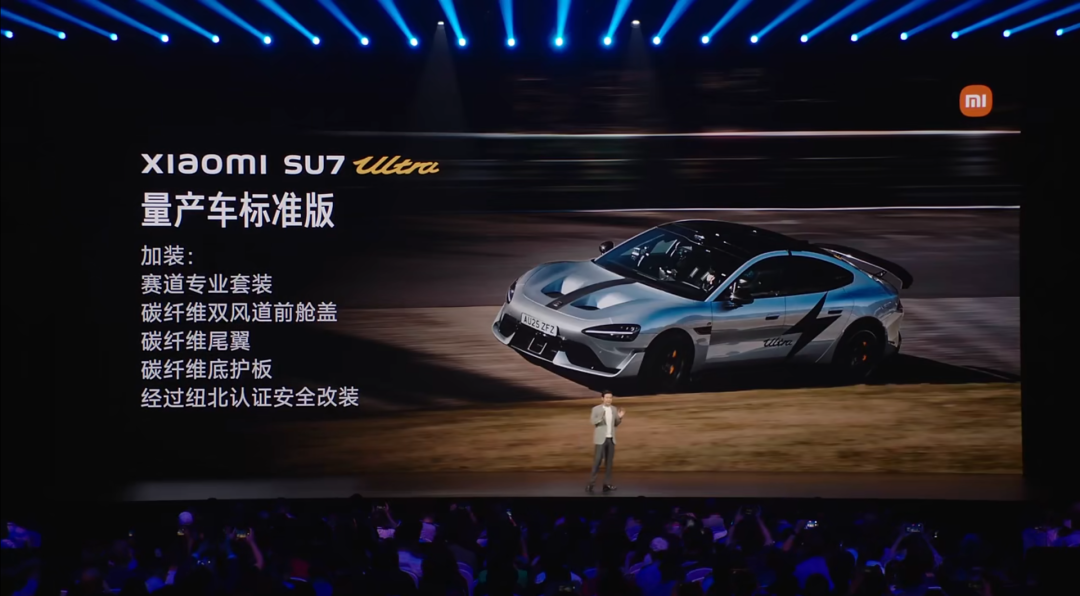

The Xiaomi SU7 Ultra, with an optional racing professional package, is priced at RMB 629,900, while the SU7 Ultra Nürburgring Limited Edition costs RMB 814,900. Additionally, Xiaomi tablets, the Xiaomi 15 Ultra series, and REDMI series products were also showcased.

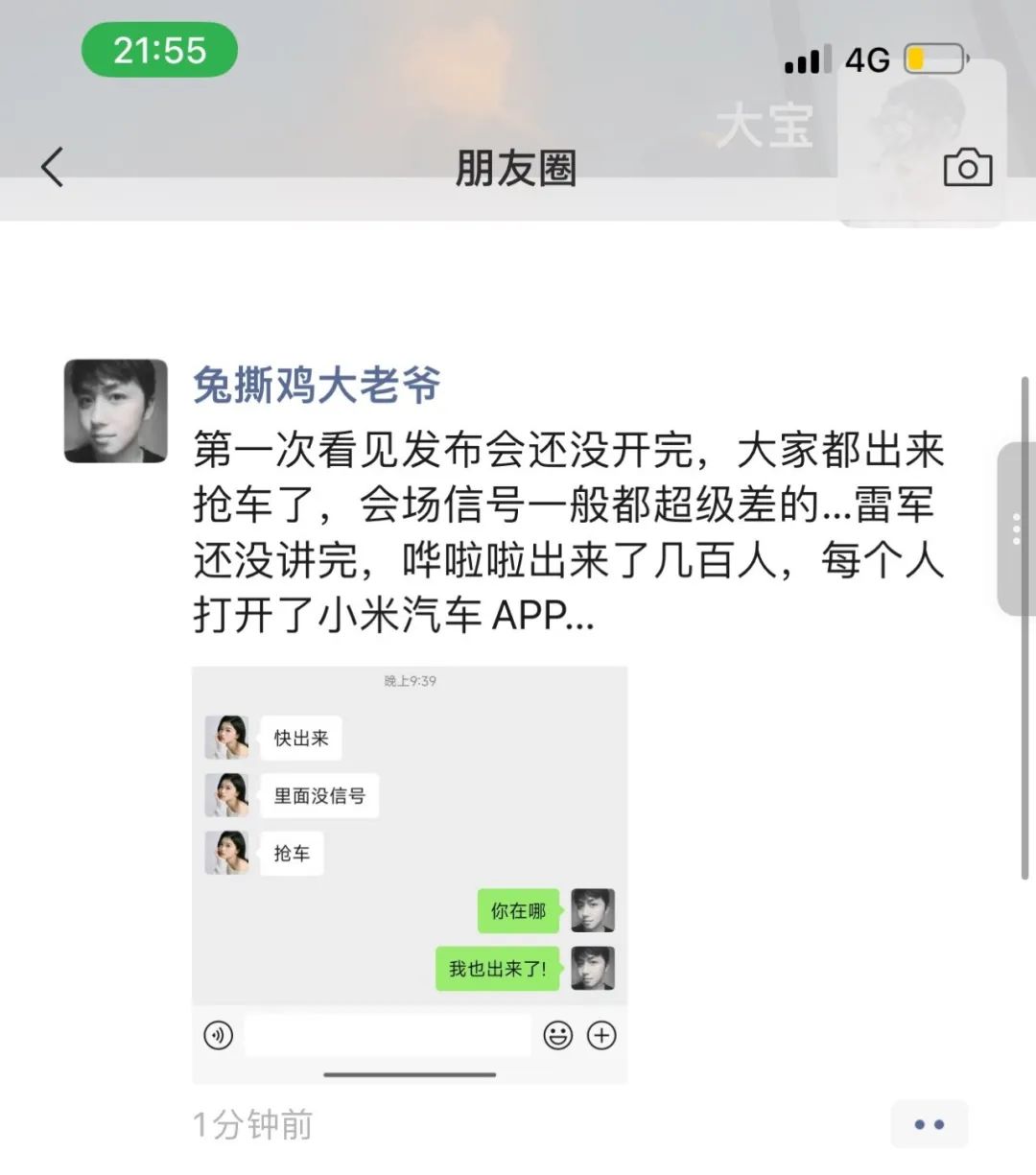

Among the diverse offerings, the Xiaomi YU7 naturally garnered extensive market attention. Reports indicate that before the conference concluded, many attendees rushed to areas with better signal reception to pre-order the YU7.

Image source: Internet

Subsequent pre-order data revealed that 289,000 units were booked within an hour, with over 200,000 units pre-ordered within just three minutes. Domestic new energy vehicle manufacturers welcomed a formidable competitor, while traditional automakers braced for the sales impact of a potential blockbuster model, although their response measures certainly did not involve auditing the accounts of all automakers.

Some experts predict that Xiaomi YU7 could reach 350,000 to 400,000 orders on its first day, with a locked order volume of approximately 70%, equivalent to the cumulative sales of Xiaomi SU7 in the 13 months following its launch (April 2024 to May 2025).

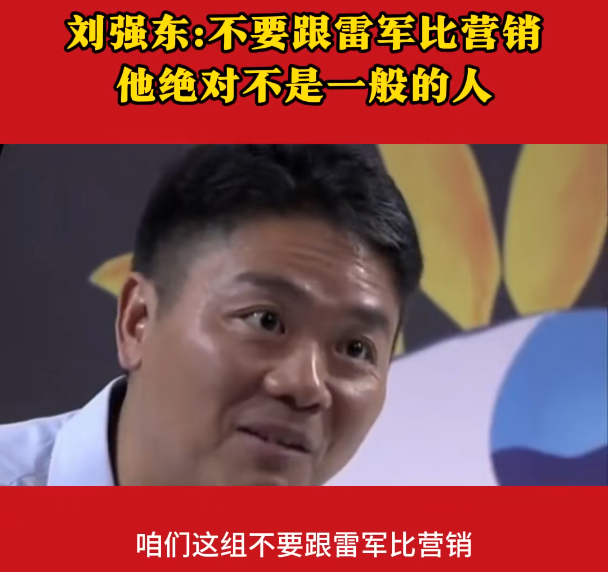

Today, a famous quote from Liu Qiangdong, the founder of JD.com, is circulating on the internet: "Don't compare marketing with Lei Jun; we can't beat him in this area."

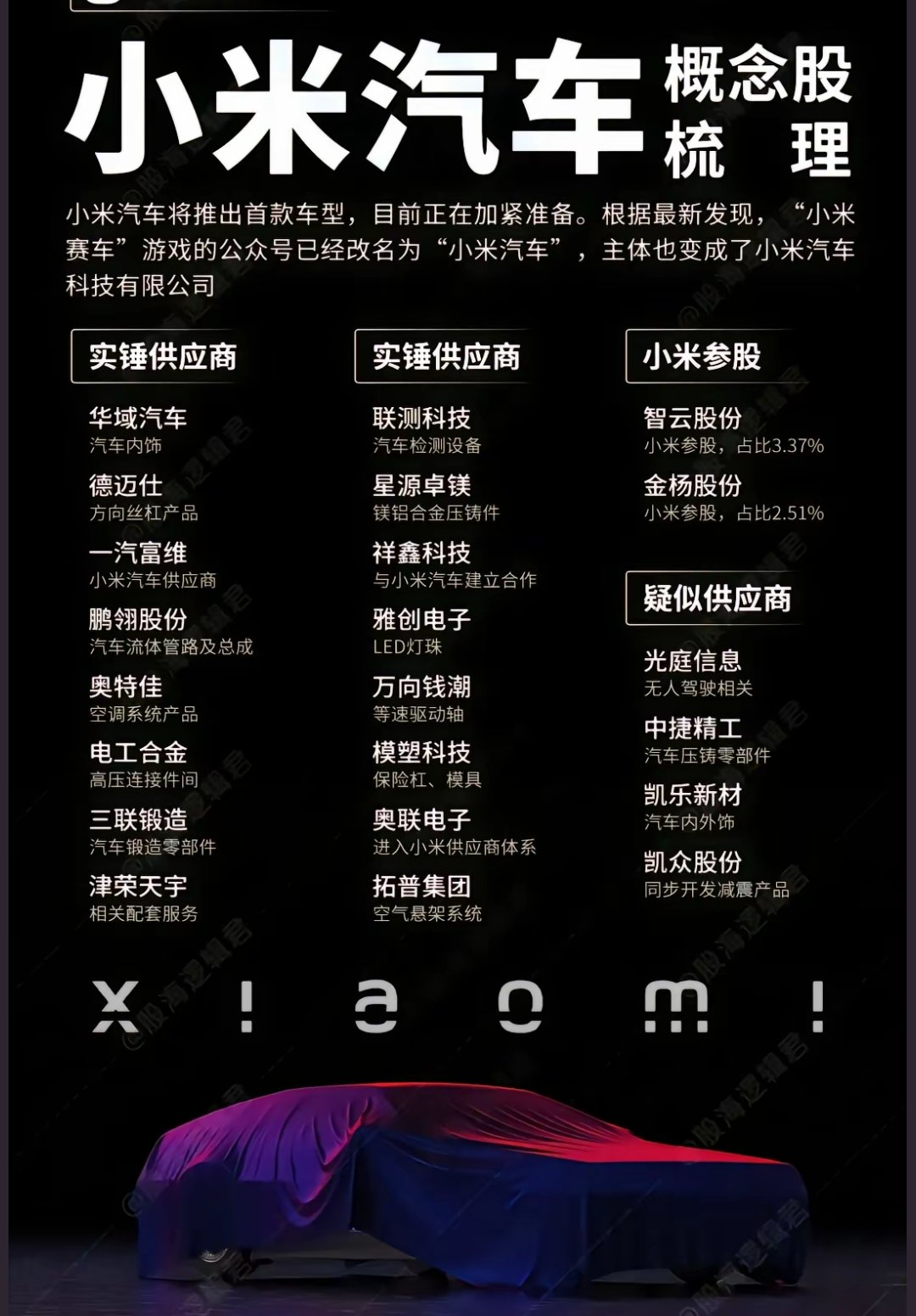

However, in reality, a company that excels solely in marketing is destined to fail in gaining consumer recognition for its products. Xiaomi Automobile's current market success is closely tied to its robust supply chain integration capabilities, involving numerous listed companies. As Xiaomi's share price surges, so do the share prices of related listed companies.

As widely recognized, the secondary market serves as an economic barometer. By examining Xiaomi's share price and the performance of related supply chain enterprises' share prices, the incremental benefits brought to supply chain enterprises by Xiaomi's booming auto sales are directly reflected in the company's share price, exemplified by Xiaomi Automobile concept stock Mouldtech.

Unfortunately, the share prices and performance of Xiaomi supply chain enterprises like Mouldtech depend on the market's recognition of Xiaomi Automobile, which necessitates Xiaomi's continuous launch of market-recognized models. Therefore, behind the massive orders for YU7, more attention should be paid to trends in the new energy vehicle market and Xiaomi Automobile's supply chain situation, especially considering that Xiaomi Automobile SU7 still has pending orders to fulfill.

01

The ultimate form of new energy vehicles may not be purely electric

Since new energy vehicles entered the mainland market, the debate over the merits of plug-in hybrids versus pure electric vehicles has been a focal point. The question of which technical path to prioritize in research and development has also sparked heated market discussions. At one point, some believed that full electrification was the inevitable future of new energy vehicles. However, from the current market perspective, the penetration rate of pure electric vehicles still lags behind that of plug-in hybrid models.

According to data from the China Passenger Car Association, the export growth of new energy vehicles in 2025 has been remarkable, while traditional fuel vehicle exports have declined. Among new energy vehicles, plug-in hybrid models represent a significant growth point for exports. The penetration rate of new energy passenger vehicles has increased, and the market share of independent brands has climbed.

From the perspective of listed company performance, among new energy vehicle manufacturers, those that primarily focus on plug-in hybrids, such as BYD, Li Auto, and Thalys, were the first to turn a profit. BYD, undoubtedly a leader in new energy vehicle sales, has ceased fuel vehicle production, fully embracing the new energy vehicle era.

While Li Auto and Thalys have different development paths, their overall direction is similar, both relying on plug-in hybrid models to achieve profitability. Li Auto was the first among the "NIO, XPeng, and Li Auto" trio to become profitable, while Thalys, having transitioned from manufacturing Xiaokang light pickup trucks, achieved profitability through plug-in hybrid models.

Some argue that plug-in hybrid models are less intelligent compared to pure electric models, and thus, the vigorous development of pure electric models is inevitable. The reasoning is that higher intelligence leads to higher power consumption.

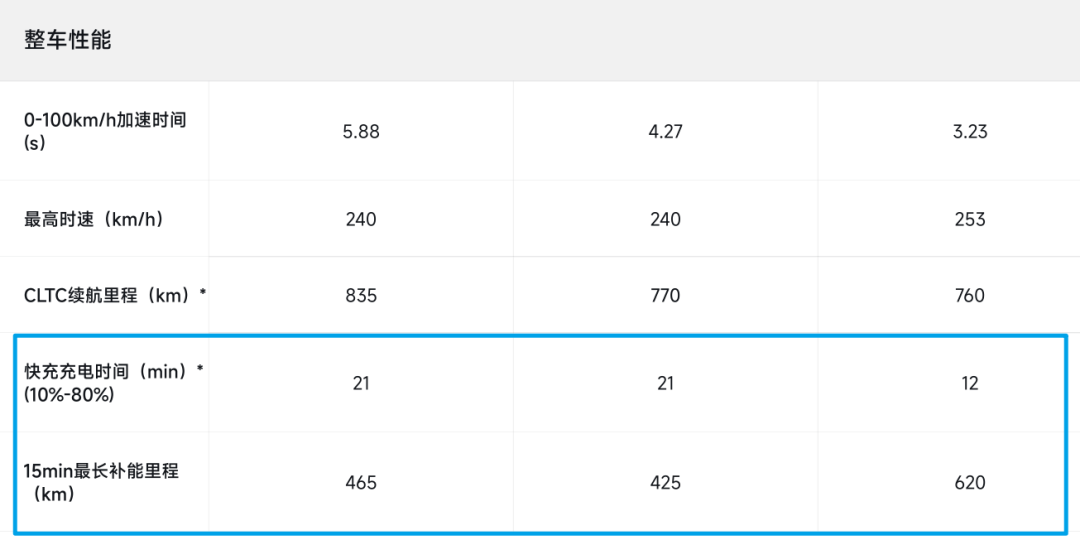

Taking the Xiaomi YU7 series as an example, the YU7, YU7 PRO, and YU7 MAX models are all purely electric-driven, using lithium iron phosphate batteries, lithium iron phosphate batteries, and ternary lithium batteries, respectively. Their CLTC ranges are 835KM, 770KM, and 760KM, respectively. The YU7 with the lowest configuration boasts the longest range, but the YU7 Max has the shortest 10%-80% fast charging time, requiring only 12 minutes, and the highest 15-minute top-up range, reaching 620KM.

This illustrates that smarter pure electric vehicles consume more power, akin to higher-configured vehicles consuming more fuel. In the era of traditional fuel vehicles, automakers increased fuel tank capacity, and modifiers added auxiliary fuel tanks to enhance range. However, in the electric vehicle era, adding a "mobile power source" to new energy vehicles is challenging. Therefore, to enhance the driving experience for consumers and address range anxiety, automakers are vigorously developing high-voltage fast charging technology. There are even rumors that a certain automaker's model can steal electricity from other brands at the same charging station, which sounds implausible.

However, in the view of Liu Ke, Dean of the School of Innovation at Southern University of Science and Technology, the primary issue with pure electric vehicles is that under the current technological landscape, they cannot be fully charged or experience reduced range in northern regions during winter. Even if this problem is resolved, there are limited scenarios where pure electric vehicle owners require a range exceeding 600KM. Most people commute within 150 kilometers. However, due to the significantly lower energy density of lithium batteries compared to fuel, carrying such a large lithium battery for commuting results in energy loss, which is not entirely environmentally friendly.

Moreover, considering global cities such as New York, London, Berlin, Toronto, Moscow, and even Tokyo, which experience cold winters or have areas requiring frequent climbing, pure electric vehicle models are not suitable for all terrains globally. Liu Ke's perspective is supported by the increase in plug-in hybrid model exports in the first half of this year.

Currently, when charging efficiency still lags behind refueling, electric vehicles that can also be refueled remain a consumer favorite. Models like the new AITO M5 and M8, Li Auto L6, Zero Run C16, Qin L DM-i, etc., all offer plug-in hybrid versions. In the medium to long term, pure electric vehicles are still constrained by range anxiety and the convenience of temporary use, and plug-in hybrids will continue to be one of the mainstream technological paths in the market.

Against this backdrop, automakers that solely focus on pure electric vehicles may find themselves at a disadvantage compared to competitors pursuing a dual technological path.

02

How long can plug-in hybrids dominate the market?

Whether from a market or technological perspective, plug-in hybrid models remain the optimal solution for new energy vehicle technology implementation at the current stage. However, in the long run, plug-in hybrids are merely seeking a temporary balance between intelligence and range, which does not guarantee long-term market dominance, especially with battery technology breakthroughs like sodium-ion batteries and solid-state batteries on the horizon.

Focusing on Xiaomi's current models, both the SU7 and YU7 series are produced using outsourced batteries. According to public information, Xiaomi's automotive battery suppliers include BYD's Fudi and CATL.

Taking CATL's sodium-ion batteries as an example, in April this year, CATL unveiled multiple advanced technologies aimed at addressing the issues of low energy density and high cost of sodium batteries, striving to enhance battery performance through advanced technologies.

Firstly, by leveraging self-generating anode technology, the energy density is increased by approximately 50%. A non-expanding anode technology is developed, with nearly zero strain during charging and discharging. High-energy SEI construction technology and low-acid electrolyte technology are utilized to achieve high coulombic efficiency and improve cycle life. The electrolyte system is reconstructed, combined with surface electric field regulation technology and separator fault design, to achieve high safety performance. In terms of environmental protection, thanks to the characteristics of sodium-ion batteries, production carbon emissions are reduced by up to 60% compared to lithium batteries.

Currently, CATL's sodium batteries already have an application basis. In terms of low temperatures, CATL employs a multi-element fast-ion de-intercalation technology for the cathode and uses an exclusive composite anti-freeze electrolyte, allowing the sodium-ion battery to maintain over 90% discharge efficiency in -40℃ environments. At high temperatures, it can still be used at 70℃.

Energy Density: The energy density of sodium-ion batteries has been increased to 175Wh/kg, the highest level in the industry for mass production. Safety: In full-charge state tests, the battery remains smokeless and insensitive under multi-faceted compression, needle penetration, and electric drill penetration, and does not catch fire or explode when sawed off.

Perhaps due to CATL's highly mature battery technology, Xiaomi Automobile has little incentive to push for further battery technology breakthroughs. It shares similarities with traditional fuel vehicle enterprises and transformed new energy vehicle makers like Thalys. The difference lies in Xiaomi sourcing finished components from suppliers like CATL to assemble into its own system, while Thalys obtains complete systems from Huawei, which "assists automakers in building quality vehicles".

Image source: Internet

At this stage, Xiaomi may need to deeply integrate its supply chain to meet timely pre-order deliveries. However, in the long run, Xiaomi may need to collaborate more closely with suppliers or even lead the research and development direction to provide consumers with compelling products. For instance, BYD pioneered the 1000V/10C era, while new forces like NIO, XPeng, and Li Auto have long promoted 800V fast charging but have since stagnated, seemingly content with staying at the 800V standard.

As a latecomer, Xiaomi has not directly adopted the industry's top technology but instead remains at the 800V standard, which is inconsistent with its reputation as a "technology enthusiast". As for Li Auto and Huawei, although one is an automaker and the other a Tier 1 supplier, both started with plug-in hybrid models and do not seem as urgent as other companies focused on pure electric models when expanding into the pure electric path.

In fact, Xiaomi is acutely aware of the importance of ultra-fast charging in marketing and application, evidenced by its emphasis on differences in fast charging time and 15-minute top-up range during model introductions, helping the YU7 MAX surpass the YU7 and YU7 Pro in these data points.

However, the awkward situation arises where, under similar parameters, the price difference between the YU7 Pro and YU7 MAX is about RMB 50,000, while the price difference between the YU7 Pro and YU7 is about RMB 20,000. The YU7 boasts slightly better fast charging time, 15-minute top-up range data, and CLTC range compared to the YU7 Pro, with only a lower 0-100km/h acceleration time, making the YU7 Pro appear less cost-effective.

Beyond the power system, the smart cabin and intelligent driving technologies are also garnering considerable market attention. Due to space constraints, Baker Street Detective will provide further updates in the near future.

© THE END

All materials utilized in this article are sourced from official public domains.

This content does not constitute financial or investment advice.

This article is originally produced by Baker Street Detective. Unauthorized reproduction is prohibited.