Who is Snapping Up Xiaomi YU 7?

![]() 06/30 2025

06/30 2025

![]() 681

681

On the evening of June 27, Xiaomi YU7 officially hit the market, generating a staggering 289,000 orders within an hour and securing over 240,000 non-refundable deposits within just 18 hours (locking an order entails a non-refundable deposit while the customer awaits official production). It's remarkable that Xiaomi sold as many cars in a single night as other automakers manage in a year.

Many may wonder, who exactly is purchasing these Xiaomi YU 7s?

1. The True Customer Base of YU 7

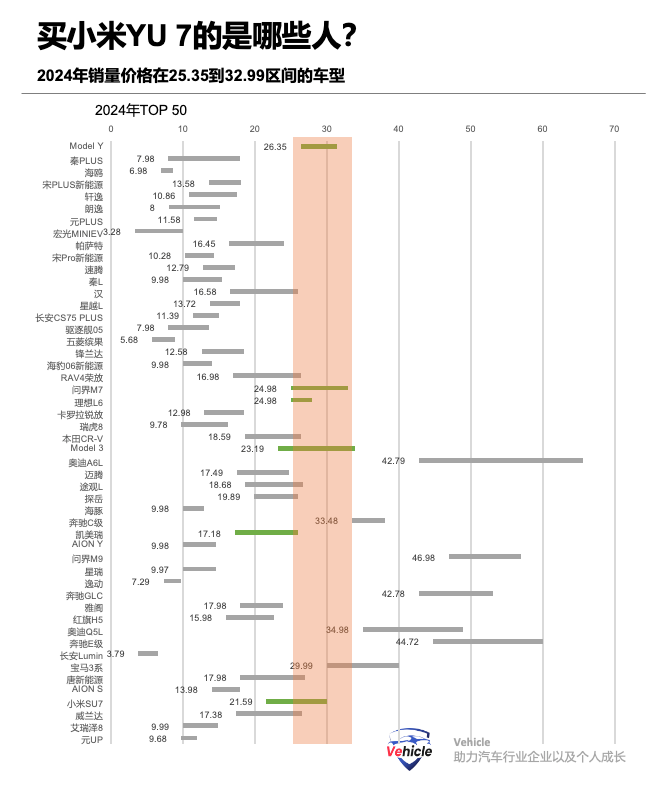

Customers choose based on their budget. The YU 7 is priced between 253,500 and 329,900 yuan.

SUVs that sold more than 50,000 units annually in this price range in 2024 include Tesla Model Y, Li Auto L6/L7/L8, BMW X3, BMW X1, NIO ES6, Lantu Dreamer, Toyota Crown Land Cruiser, and Mercedes-Benz GLB. Together, they sold approximately 1.4 million units.

In the sedan segment, top-selling models within this price range in 2024 were:

Tesla Model 3, BMW 3 Series, Mercedes-Benz C-Class, Audi A4L, and Xiaomi's own SU 7. These models collectively sold around 700,000 units.

Therefore, referencing 2024 data, there are approximately 2 million potential customers who can afford this price range and may be interested in similar models, making them potential YU 7 buyers:

Customers who originally planned to purchase SUVs like Tesla Model Y,

Owners of luxury fuel SUVs transitioning to electric vehicles,

Sedan users switching to SUVs.

2. Xiaomi SU7 Order Transfer Users

During the Xiaomi YU 7 launch event, Lei Jun announced that users with locked orders for Xiaomi SU7/Xiaomi SU7 Ultra could switch to Xiaomi YU7 from 10 PM that night until 24:00 on June 29.

According to information from April this year, the cumulative locked orders for SU7 were 183,800 units. By now, this number should exceed 200,000 units, with many of these users estimated to have switched to the SUV YU 7.

3. Profit-seeking Resellers

'Snatching up cars is nothing short of a miracle in the automotive industry.'

While other carmakers offer discounts for promotions, Xiaomi is different. "Xiaomi's past trend of mobile phone snatching," "The current trendy toy Labubu," and "The Xingye Taikoo Hui in downtown Shanghai packed with people for LV's 'Louis' event" serve as examples. Xiaomi SU7 has already witnessed its first wave of snatching, with order deliveries scheduled until the end of the year. There's no reason why Xiaomi's second SUV model iteration shouldn't follow suit.

'The first wave of YU7 snatchers can capture immense traffic. Many self-media bloggers use it for videos and live streams, and some even resell it at a higher price, creating a secondary market,' explained a car blogger to the reporter. 'Judging from the current popularity, there's no need to worry about not being able to resell it.'

While social media is filled with consumers complaining about not being able to snatch a ready-to-go car, second-hand trading platforms like Xianyu are flooded with YU7 orders being transferred at a premium, with the highest resale price reaching 20,000 yuan.

Therefore, there are undoubtedly many reseller orders among Xiaomi YU7 orders, but these will undoubtedly convert into valid orders.

4. Delivery Becomes Xiaomi's Most Urgent Task

Based on current orders, Xiaomi YU7's estimated delivery times for users are:

Fastest delivery of Xiaomi YU7 Pro within 53-56 weeks after order locking, fastest delivery of Xiaomi YU7 Max within 48-51 weeks after order locking, and fastest delivery within 33-36 weeks after order locking.

It's rumored that Xiaomi has increased its 2025 delivery target from 300,000 to 350,000 units, encompassing SU7, SU7 Ultra, and the first SUV model YU7 to be launched in the middle of the year. To meet this demand, the second phase of the Beijing factory is scheduled to commence production within the year with an annual capacity of 150,000 units, focusing on supporting the mass production of new models.

On June 19, media reports revealed that Xiaomi successfully acquired an industrial land parcel of approximately 485,100 square meters in Yizhuang New City, Beijing, for nearly 640 million yuan, with a lease term of 50 years. According to data from the Beijing Municipal Commission of Planning and Natural Resources, the land parcel was won by Xiaomi Jingxi Technology, a subsidiary of Xiaomi. Industry speculation suggests that this land may be used to build Xiaomi's third factory in Beijing, further expanding its electric vehicle production capacity.

External analysis believes that Xiaomi's automotive factory layout may not be limited to Beijing, and in the future, it may also establish super factories in Shanghai and Wuhan to further boost production capacity. Xiaomi's current layout in Yizhuang, Beijing, could pave the way for the third phase of its electric vehicle production plan.

Some compare Xiaomi YU 7 orders to Tesla's Cybertruck orders from the past, but the comparison is misguided. Lei Jun only manufactures industrial products with mature supply chains and technologies, and given China's manufacturing environment, achieving this production volume is feasible.

So, who exactly is snapping up these Xiaomi YU 7s?