Which Three Types of People Have Been Overwhelmed by Xiaomi YU7?

![]() 06/30 2025

06/30 2025

![]() 757

757

The myth of Moutai may have faded, but Xiaomi's second car has picked up the baton.

Despite the widespread expectation that Xiaomi's new car would be a hit, the data it achieved was still astonishingly exaggerated. Tesla Model 3 held the previous global car sales record with 115,000 orders in 24 hours and 325,000 reservations one week after its release in 2016. This led to production delays, forcing Musk to adopt unconventional methods like tent-style manufacturing and having Tesla executives sleep next to the production line.

Now, Xiaomi YU7 has surpassed those numbers, recording over 200,000 confirmed orders within 3 minutes and over 289,000 within 1 hour, with 240,000 locked orders after 18 hours of sales. This data is roughly three times that of Xiaomi SU7's release. Compared to 2024 sales figures of various automakers, Xiaomi YU7's current order number for a single model is on par with NIO's 293,700 and close to Tesla Model 3's 360,000, as well as BYD Yuan PLUS and Qin PLUS DM-i's over 300,000.

Whenever a phenomenon like this occurs, a new round of debate and controversy inevitably follows. This includes online discussions, apologies from automaker executives, and confusion among automakers and the media. Many people are left overwhelmed, and many things become casualties of this excitement.

Three groups are particularly affected: automakers, their R&D and engineering teams, and some consumers.

The astronomical order numbers have disrupted the original supply and demand relationship and market competition status.

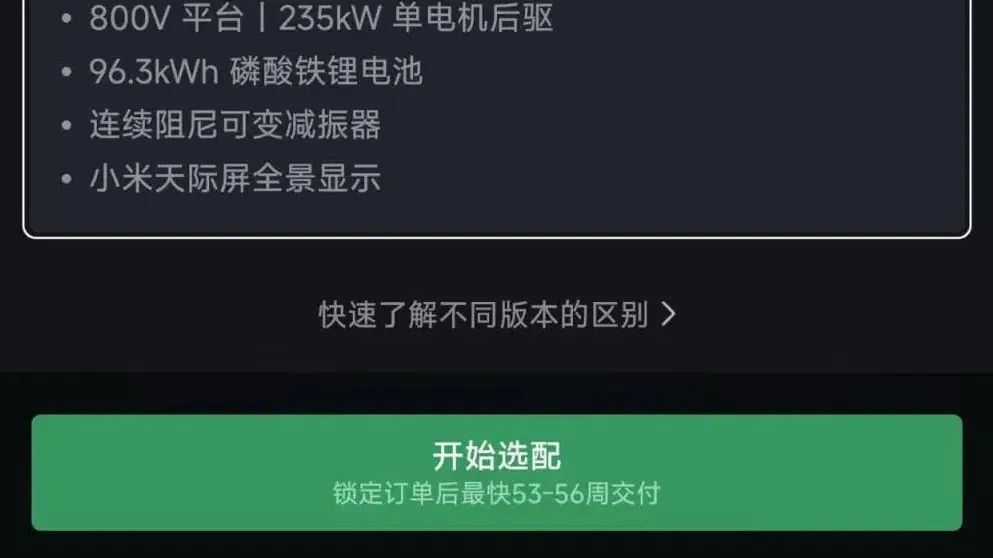

According to the latest Xiaomi APP display, the shortest delivery period for the three versions of Xiaomi YU7 is 33 weeks, or 0.63 years. As of June 28, the standard version had an estimated delivery period of 53-56 weeks, the Pro version 48-51 weeks, and the Max version 33-36 weeks.

The first weekend after the June 28 launch will further affect the delivery cycle. According to current sales channel information, after a large number of test drives and order placements over the weekend, there will be another surge in orders. As of June 9, 2025, the number of Xiaomi Automobile stores in China has exceeded 300. On the first day of the weekend, sales consultants in Beijing indicated that each store could average over 30 new orders, meaning Xiaomi YU7's confirmed orders will soon exceed 300,000.

According to Xiaomi, the production capacity gap is evident. Xiaomi Automobile's current production capacity mainly relies on the Phase I factory in Yizhuang, Beijing, with the Phase II factory expected to commence production in July or August. The Phase I factory has a rated annual production capacity of 150,000 units, with a rated monthly capacity of 12,500 units. Through double-shift production and production line optimization, the monthly capacity can be increased to 24,000 units, with an annual capacity of 300,000 units. The planned annual production capacity of the Phase II factory is 150,000 units. Considering the ramp-up speed of the Phase I factory that previously produced the SU7, the estimated production volume for this year is 60,000 units.

It is clear that many people will not receive their cars until 2026.

Three groups have been overwhelmed: the sales teams of other automakers, the R&D and engineering teams of other automakers, and some consumers.

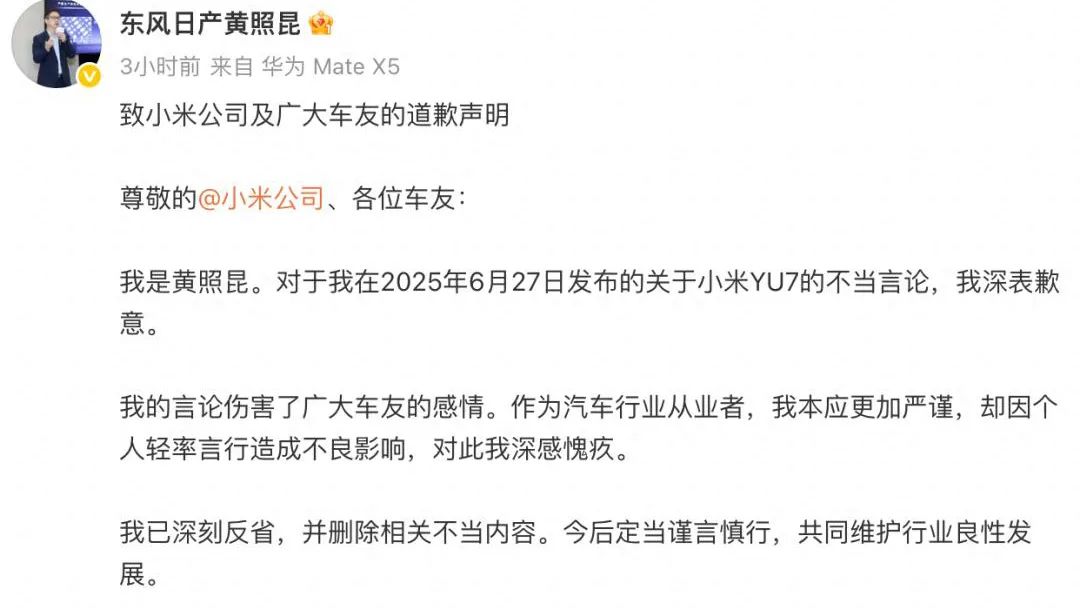

The sales teams of other automakers can be exemplified by the deletion and apology of a Dongfeng Nissan executive. Facing the explosion of orders for Xiaomi YU7, they stated that the delivery period would be over a year, testing the loyalty of brand fans. This sentiment is shared by many sales teams of other automakers, but they have not spoken up. The automotive market is not experiencing rapid growth, and the industry consensus has long been that it is "shifting from an incremental market to a stock market." Therefore, Xiaomi YU7, to a certain extent, has drained the consumption potential of other automakers in the 250,000-300,000 yuan price range.

However, there is another view within the industry that the sales explosion of Xiaomi YU7 is a good thing, as it demystifies Tesla Model Y and changes the perception of domestic cars. Coupled with the current ultra-long delivery period, it makes more people consider purchasing other domestic SUVs. Examples include the upcoming Xpeng G7 and Li Auto i6, which will follow Xiaomi YU7 to the market, as well as currently available similar models like the AITO Asker R7, NIO ES6, and Zeekr 7X. However, judging from the market response, such claims do not seem to hold up.

The group purchasing Xiaomi YU7 currently has several typical characteristics: they know it may take a long time to receive the car but still want to try it; they appreciate its appearance; and buying Xiaomi YU7 is not just about transportation, but also about purchasing into Xiaomi's ecosystem. According to the latest third-party survey data, Xiaomi's current average transaction price is 266,000 yuan, surpassing Audi's 265,000 yuan. They are not short of money, do not prioritize extreme cost-effectiveness, and are relatively young. These key characteristics make it difficult for them to settle for alternatives.

After changing the supply and demand relationship, Xiaomi's official restrictions on order transfers and other operations, such as requiring "three certificates in one," are still insufficient to prevent many people from taking their own actions to get their hands on Xiaomi YU7 earlier. For the sales teams of other automakers, only a very small number of models have a clear advantage against Xiaomi YU7, such as the deeply home-oriented Li Auto i6 or the battery-swappable NIO ES6.

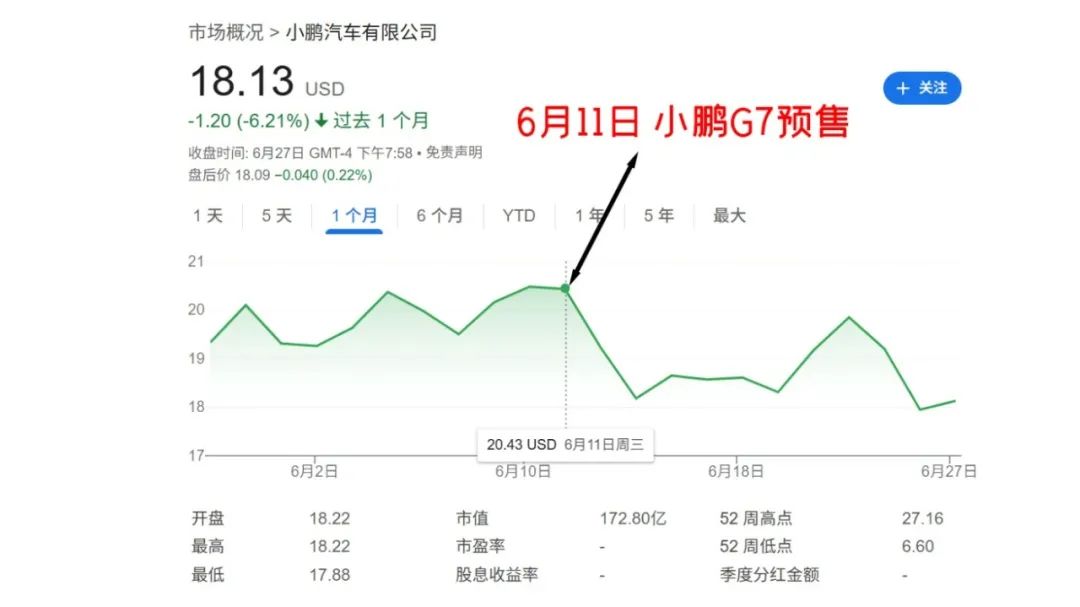

More models may become casualties, such as the Xpeng G7, which is not particularly favored by the market. Its pre-sale was a crucial turning point: before pre-sale, its share price rose smoothly, but after pre-sale, it plummeted sharply. The attitude of the capital market towards it is consistent with consumers' perception of it.

"Car-savvy" enthusiasts are also being overwhelmed

In addition to the enormous pressure on the sales teams of other automakers, the second group being overwhelmed are the R&D and engineering teams, or product definition teams, of other automakers. The third group are those whose perceptions have been shaped by the automotive price war in the past three years, especially car enthusiasts.

The second type of overwhelm involves a hot topic that emerged after the explosion of orders for Xiaomi YU7: if Lei Jun's personal appeal is set aside, can its product strength really compete? According to sales channel information, the current best-selling model of Xiaomi YU7 is the mid-range Pro version, priced at 279,900 yuan with a CLTC range of 770 kilometers.

For example, it compares closely with the technical platform of the Zeekr 7X, which clearly has the ability to compete.

The advantages of the Zeekr 7X include a maximum power of 475kW, higher than Xiaomi YU7's 365kW; a 0-100km/h acceleration time of 3.8 seconds, better than Xiaomi's 4.27 seconds; an 8-year/200,000-km warranty for the battery, electric drive, and electronic control system, superior to Xiaomi's 8-year/160,000-km warranty; and a ternary lithium battery, superior to Xiaomi's lithium iron phosphate battery.

However, from a sales figure perspective, in the market above 200,000 yuan, the battle of parameters is not the key to victory. More elements such as emotional value and user trust must be considered.

If carefully analyzed, this is what overwhelms the "car-savvy crowd": the product performance of Xiaomi YU7 does not exhibit as large a difference advantage as that of AITO Asker M9 facing BMW X5 and Mercedes-Benz GLE. The competitors Xiaomi YU7 faces in the 250,000-300,000 yuan market are also experts with unique secrets in the fierce market competition.

Therefore, car enthusiasts tend to use previous automotive consumption analysis patterns for deduction, but facts have proven that the majority of groups still recognize Lei Jun's model.

In addition, with the supply and demand relationship being disrupted, the service attitude of sales consultants in Xiaomi's stores has also been perceived by many as having "an innate sense of pride, although not as bad as the price-gouging of the Highlander or Lexus ES a few years ago."

In fact, what causes the above three types of overwhelm is not only Lei Jun's marketing or Xiaomi's human-car-home model, but also the dimensional attack of the technology circle on the automotive circle.

In the past automotive market, whenever a new car was released with explosive orders, similar automakers would dissect and analyze it. However, with the entry of Huawei and Xiaomi, even though many automakers have analyzed and imitated, it has been difficult to quickly replicate their success. The biggest difference is not technology.

The strategy of the technology circle is brand + traffic, and Lei Jun has further endowed it with the logic of live streaming sales and financial management. As a result, automotive consumption is not just about buying a Xiaomi car, but also about buying into its ecosystem. Each order is not just about the length of the delivery period, but becomes an opportunity for everyone to make money.

Brand + traffic is easy to understand. Huawei and Xiaomi have both achieved success in the field of technology and digital products. The sales volume and user reputation of their mobile phones and tablets have directly translated into widespread user awareness. For instance, even elementary school students know about Xiaomi Automobile, bringing a huge traffic entrance.

Secondly, in event-level marketing, Xiaomi and Huawei are far ahead of automotive companies. For example, Xiaomi set a Chinese record at the Nürburgring Nordschleife, and Huawei brought global first-in-class application recognition in intelligent driving assistance and autonomous driving.

And for Xiaomi YU7, it simultaneously introduced the financial logic of Moutai wealth management and LABUBU.

Moutai's logic is that because it is easy to store and its price continues to rise, most of its annual production is consumed, while a small portion is converted into investment products to be sold when the price rises further. The current orders for Xiaomi YU7 follow the same logic. Early orders that allow faster vehicle delivery can be easily cashed in, while mid-term orders also increase in value as the new car gains popularity.

The same logic applies to the LABUBU model. It first breaks through the circle to attract as wide a range of people as possible, and then its value continues to rise amidst market speculation. Ultimately and most importantly, with the establishment of the blogger ecosystem, it has continuous topics and traffic, becoming a free atmosphere group.

This is the most impressive aspect of Xiaomi's car venture. With Lei Jun's super IP and the integration of various strategies, as long as the product can achieve 90 points, it can achieve an effect exceeding 100 points.

Written at the end

Essentially, Xiaomi has tapped the value of orders to new heights. For example, pending delivery orders for Xiaomi SU7 can be directly converted to Xiaomi YU7, profoundly breaking the long-standing rules of the automotive industry. In the eyes of automakers, the original model is more stable and provides more protection for the enterprise. It does not have to cause production and other issues due to such large variables.

However