Tesla's sales volume no longer matters.

![]() 01/30 2026

01/30 2026

![]() 365

365

“We are making long-term plans for an epic future.”

Author I Xue Xingxing

Editor I Jiang Jiao

Cover I Tesla

For Tesla, the electric vehicle company with the highest market capitalization in history and imitated and revered by countless automakers worldwide, delivery volume no longer matters. More paradoxically, the worse the sales, the more confident the market seems to be in the company.

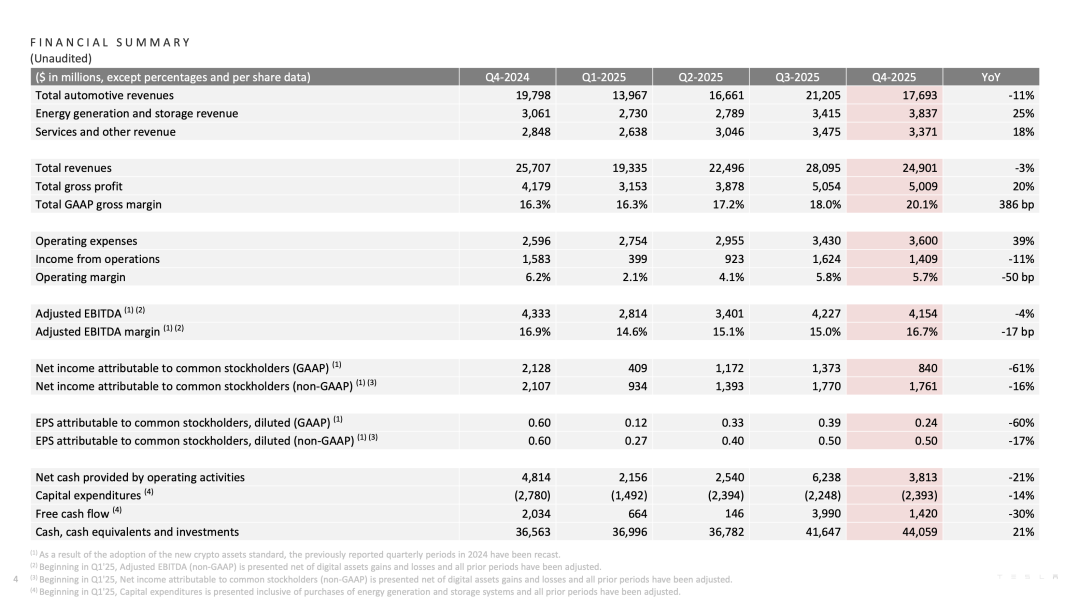

Early this morning (January 29), Tesla released its financial results for the fourth quarter and the full year of 2025. The financial results showed that Tesla's revenue for the quarter was $24.9 billion, down 3% year-on-year, and its revenue for the full year was $94.8 billion, also down 3% year-on-year. This marks the first annual revenue decline since Tesla's inception.

While revenue declined, Tesla's net profit fell even more sharply. Tesla's GAAP net profit for the quarter was $840 million, a significant 61% decrease year-on-year, partly due to the volatility in Bitcoin prices at the end of last year. Looking at the non-GAAP figures, Tesla's net profit for the quarter was $1.76 billion, down 16% year-on-year, and for the full year, it was $5.86 billion, down 26% year-on-year, with the decline still significantly higher than that of revenue.

Tesla's Q4 2025 financial results

More critically, Tesla's core revenue source, the automotive business, continued to shrink. For the quarter, Tesla's automotive business revenue plummeted 11% year-on-year to $17.69 billion. The full-year automotive business revenue was $69.5 billion, with the decline widening to 10% from the 6.5% decrease last year, marking two consecutive years of contraction.

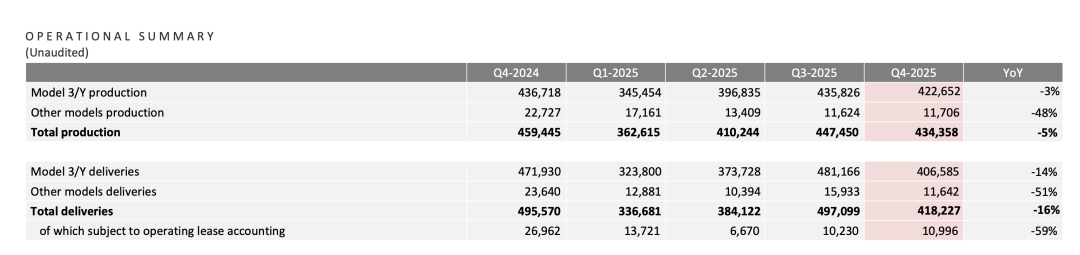

Previously released delivery figures from Tesla showed that deliveries for the quarter were 418,000 units, down 16% year-on-year. Full-year deliveries were 1.636 million units, down 9% year-on-year, also marking two consecutive years of decline.

Tesla's quarterly automotive production and delivery volumes

Despite these lackluster financial results, the capital market's preference for Tesla remained undiminished. This morning, when the US stock market closed, Tesla's stock price only dipped slightly by 0.1% to $430.46, still within a historically high range. When Musk expressed his optimistic vision for the future of AI and autonomous driving during the earnings call, Tesla's stock price even rose by 4% at one point.

During the fourth quarter of last year, when sales continued to decline, Tesla's stock price once surged to $491.5, with its market capitalization reaching $1.63 trillion, a record high. Over the past year, while the stock prices of the seven major US tech companies have generally risen, Tesla is the only company whose revenue and profit have both declined, yet its stock price remains high.

Since 2019, Musk has been gradually downplaying Tesla's identity as an automotive company, tirelessly conveying to the market that Tesla should not be measured by the standards of an automotive company. Now, the outside world seems to have finally been convinced by Musk's viewpoint, even though the vast majority of Tesla's profits and revenue still come from selling cars.

Some Wall Street analysts say that Tesla does not resemble a publicly traded company with stable revenue and profits at all, but rather a startup company with high risks and high returns.

After releasing a set of financial results showing the first annual revenue decline, Tesla also announced its largest-ever capital expenditure plan, with annual investments reaching up to $20 billion. Most of these investments will be concentrated in AI, autonomous driving, and robotics businesses.

“We are making long-term plans for an epic future,” Musk said during the earnings call.

A Tumultuous 2025

Throughout 2025, Tesla hardly released a quarterly financial report that satisfied the market. In the first quarter of last year, Tesla's deliveries were only 337,000 units, down 13.5% year-on-year, with the decline even exceeding the market's most pessimistic expectations, marking the lowest quarterly level since the second quarter of 2022.

The situation did not significantly improve in the second quarter of last year, with quarterly deliveries continuing to decline by 13% year-on-year to 384,000 units, and revenue plummeting by 12% year-on-year, marking the largest single-quarter decline in a decade.

By the third quarter, Tesla seemed to finally emerge from the trough, with quarterly revenue increasing by 11.6% year-on-year, the only quarter of positive revenue growth in the past year. Deliveries reached a new quarterly high, increasing by 5.8% year-on-year to 497,000 units.

However, the growth trend did not continue until the end of the year. The fourth quarter has traditionally been a peak sales season for Tesla, but deliveries for the quarter were only 418,000 units, down 16% year-on-year, not only lower than the previous quarter but also far below market expectations for a rebound during the peak season.

Tesla's full-year deliveries ultimately settled at 1.636 million units, down 9% year-on-year, marking two consecutive years of decline. Tesla can no longer be called the world's largest electric vehicle manufacturer, as BYD sold 2.26 million electric vehicles last year, surpassing Tesla for the first time.

During last night's earnings call, Musk hardly mentioned any topics related to delivery volumes, and there were no questions related to the decline in sales throughout the entire call. Tesla's CFO, Vaibhav Taneja, briefly discussed the sales figures at the beginning, describing the quarterly sales as “interesting.”

He said that the surge in sales in the US market in the third quarter led to an early depletion of demand at the end of the year. However, at the same time, Tesla achieved record-high deliveries in small markets such as Malaysia, Norway, and Poland, with continued strength in the Asia-Pacific, Middle East, and Africa regions. Tesla had more backorders at the end of the year than in the same period in previous years.

In any case, from the perspective of Tesla's management, people's enthusiasm for Tesla cars remains high, and Tesla's sales are still robust. Taneja also emphasized that the latest version of FSD has not yet been launched in regions outside the US market, implying that there is still significant room for growth in Tesla's sales.

However, from the perspective of consumers, Tesla's most notable change this year may be that it is becoming increasingly affordable. Tesla's affordable Model 3 has already been launched in markets such as the US, UK, Middle East, and parts of Asia, with the price in the South Korean market after subsidies even as low as RMB 174,000. In the fiercely competitive Chinese market, Tesla further increased its incentives from 5-year interest-free financing last year to “7-year ultra-low-interest” financing at the beginning of this year, leading consumers to sigh with emotion that buying a car is now comparable to taking out a mortgage to buy a house.

The continuous decline in deliveries led to a simultaneous decline in Tesla's full-year revenue and profit. In 2025, Tesla's full-year revenue declined for the first time, and its full-year GAAP net profit plummeted by 46%.

The Vast Future of Autonomous Driving

Musk seems indifferent to the sales of existing models, as he has lost interest in traditional cars. During the earnings call, Musk announced the discontinuation of the Model S and Model X, saying, “It's time for the Model S and Model X to make a graceful exit.”

The Model S/X are Tesla's luxury electric vehicle models, with starting prices as high as $100,000. They were once key products that opened the door to the electric vehicle market for Tesla, but for Tesla now, these high-priced, low-sales luxury models are no longer the future.

Tesla Model X

In Musk's view, autonomous driving is the future of Tesla cars. He said that all vehicles manufactured by Tesla in the future will be autonomous vehicles. (The ultra-luxury electric supercar Roadster is the only exception. The Roadster was Tesla's first model to achieve mass production and delivery. The second-generation version was released in 2017, with the earliest plan for mass production in 2020, but it has not been delivered yet.)

Tesla's next model to enter mass production will be the CyberCab, which is completely designed for autonomous driving. This vehicle has no steering wheel or pedals and only allows two passengers. It will rely entirely on autonomous driving, with Musk saying, “This car will either drive itself or not move at all.” After multiple delays, Musk has set the latest goal for mass production in April this year. According to him, the production volume of this model will exceed the combined total of all other Tesla models.

Lars Moravy, Tesla's Vice President of Vehicle Engineering, added that the CyberCab will bring Tesla's FSD into a broader market. “In this new autonomous driving market, you must start to view Tesla as a provider of 'Transportation as a Service (TaaS),' rather than just focusing on traditional car sales,” Musk said, adding that all vehicles manufactured by Tesla in the future will be autonomous vehicles.

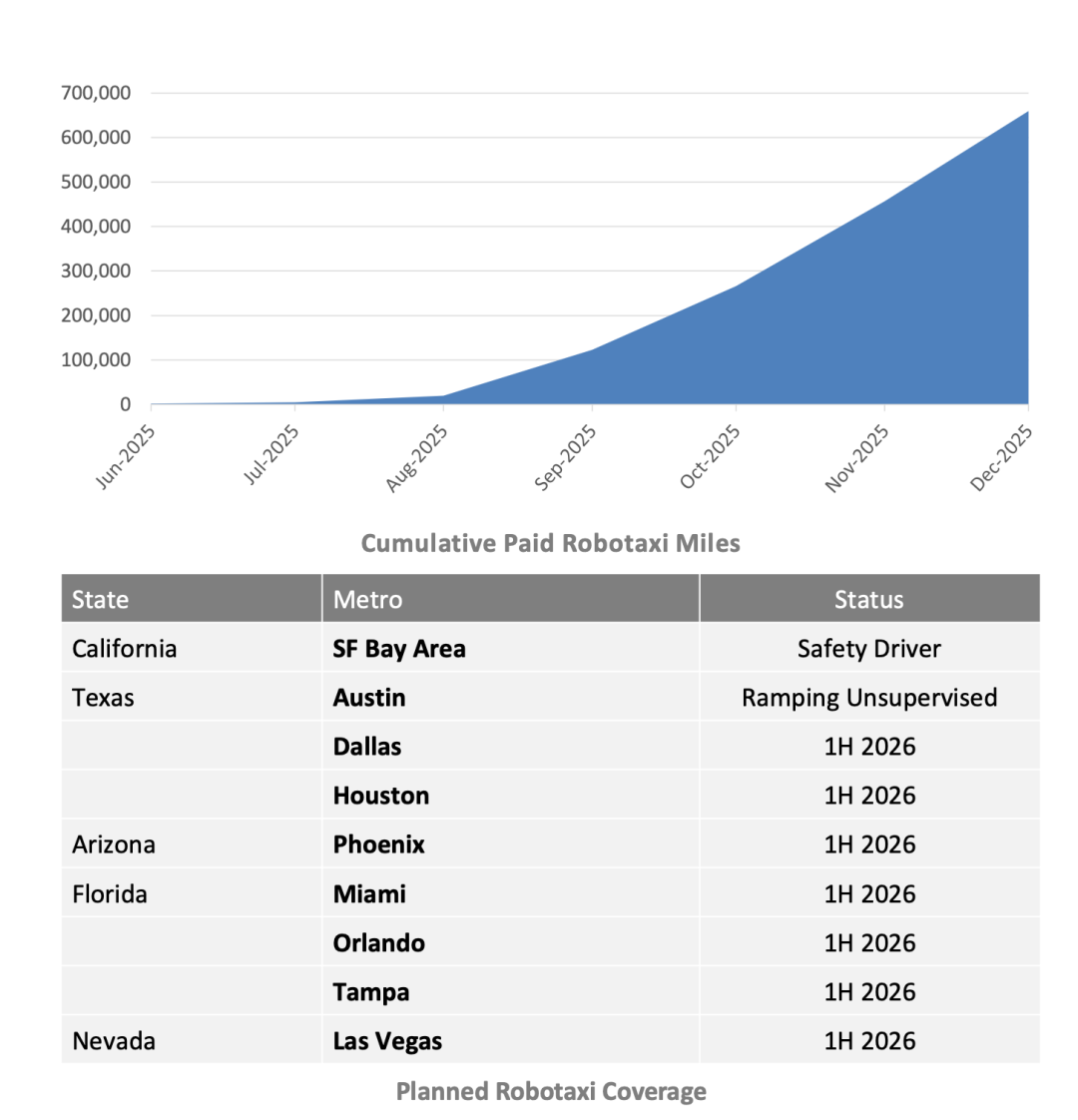

Last year, Tesla's autonomous driving fleet was already operating in Austin and attempted to operate a fully driverless service for the first time at the end of the year, without the need for a safety operator in the vehicle. Tesla plans to expand its autonomous driving fleet to more regions in the first half of this year, including Dallas, Houston, Phoenix, Miami, and others. Musk revealed during the earnings call that the current size of Tesla's autonomous driving fleet is “far more than 500 vehicles.”

Tesla's autonomous driving fleet's cumulative operating mileage and city expansion plans

Currently, the access standards for autonomous driving fleets vary across US states. Musk said that, subject to regulatory approval, Tesla expects to expand its autonomous driving services to regions covering about half of the US population by the end of the year. If the approval process does not proceed as expected, they will only proceed gradually by city and state.

In Musk's grand vision for autonomous driving, all Tesla car owners in the future will have the option to rent out their cars to the autonomous driving fleet at any time to earn money for the owners, “just like Airbnb.”

At the beginning of this year, Tesla announced that it would cancel the one-time buyout service for FSD starting from February 14 this year, and future car owners would need to subscribe on a monthly basis, paying $99 per month. Previously, the buyout price for FSD in North America was $8,000, and in China, it was RMB 64,000.

Tesla disclosed the global number of paid users for FSD for the first time this quarter, with nearly 1.1 million paid users worldwide, accounting for about 12% of the company's cumulative car sales, with nearly 70% being buyout users.

AI, Robotics, and Chips

Similar to most tech companies aiming for the future of AI, Tesla is also about to enter a year of significant capital expenditures. Their capital expenditures this year will reach an unprecedented $20 billion, double what Wall Street had previously expected. Musk said, “This is a well-considered decision because we are making long-term plans for an epic future.”

The $20 billion in capital expenditures will be primarily used for battery factories, humanoid robots Optimus, AI infrastructure, and autonomous driving fleets. Tesla's CFO, Taneja, said that they will build six new factories this year, including a lithium refinery, an LFP battery factory, a CyberCab factory, a Semi factory, a new Mega energy storage factory, and an Optimus factory.

Tesla plans to release the third generation of the Optimus robot this year. After the discontinuation of the Model S/X, the existing production lines will be transformed for Optimus production, with Musk setting a goal of producing 1 million Optimus robots annually. Musk said that the third-generation Optimus robot will be released within a few months. It has been delayed for several years.

Optimus Robot

Last year, domestic robots gained widespread attention after appearing on the Spring Festival Gala, with startups such as Unitree Robotics and Zhi Yuan Robotics emerging. Many domestic automakers have also started to enter the robotics sector, with XPENG Motors showcasing its first humanoid robot, IRON, last year, and Li Auto increasing its investment in humanoid robot research and development at the beginning of this year.

Musk believes that the biggest competition in the humanoid robot field will definitely come from China. “China is very good at AI and manufacturing and is definitely Tesla's strongest competitor. I always think that people outside of China underestimate China,” he said. However, he also emphasized that Tesla's Optimus will be much more powerful than any Chinese robot currently under development.

“There are three major challenges in humanoid robots: first, creating a mechanical hand with the same degree of freedom and flexibility as a human hand; second, real-world AI; and finally, mass production. Tesla is the only company that simultaneously possesses these three elements,” Musk said.

However, the announced $20 billion is far from being Tesla's final investment scale. They are also planning to build solar factories and their own wafer foundries. Leaving aside the long-delayed solar factories, Tesla's latest announcement of the super wafer foundry, TeraFab, is closely related to its AI strategy. Tesla's Optimus, autonomous driving, and even its automotive business all rely on chip support.

Musk believes that the bottleneck limiting Tesla's growth in the next three to four years will only be chips, “I am currently investing more in chips than in any other aspect of Tesla.”

“If we don't build TeraFab, Tesla will inevitably be constrained by external chip production capacity in the future,” Musk said. Currently, Tesla's core chips for autonomous driving and AI are still mainly supplied by external suppliers such as TSMC and Samsung.

In his view, with the rapid expansion of computing power demand, relying solely on the existing capacity planning of semiconductor manufacturers makes it difficult to support Tesla's long-term needs for AI training and inference. "This is a matter of life and death for Tesla, because without AI chips, Optimus would be a completely useless shell."

To this end, they have to plan to build their own wafer fab, "an ultra-large chip factory integrating logic chips, memory chips, and packaging processes." Tesla's TeraFab wafer fab requires a massive investment, with an initial planned monthly production capacity of 100,000 wafers and a long-term plan to reach a monthly production capacity of up to 1 million wafers, all of which will be used by Tesla itself and will not be sold externally.

Analysts are particularly concerned about where Tesla will raise such a large amount of capital. Taneja emphasized that Tesla has over US$44 billion in cash and investment balances on its books, and they will prioritize using their own cash. In addition, they are also considering financing through bank loans using their autonomous driving fleet as collateral. However, there is no clear plan yet for infrastructure construction.

Shortly before the announcement of the fourth-quarter 2025 financial results, Tesla also announced a US$2 billion investment in Musk's xAI. Currently, xAI's Grok large model has been launched in Tesla vehicles. During the financial results conference call, Musk explained that Tesla's investment in xAI was in response to shareholder requests. In addition, he believes that Grok can also help improve the operational efficiency of the autonomous driving fleet and enhance Tesla's factory management.

No matter how you look at it, electric vehicles seem insufficient to encompass the future of Tesla as envisioned by Musk. For a long time, Tesla's core vision has been to "accelerate the world's transition to sustainable energy." Now, Musk has changed this goal to "building a world of extraordinary abundance."

© Copyright by Shangshan. All rights reserved. Reproduction without authorization is prohibited.