Battery prices keep falling, will many pure electric vehicles be eliminated?

![]() 07/22 2024

07/22 2024

![]() 619

619

If the price war continues, the first to go will not be automakers or the supply chain, but a large number of battery suppliers.

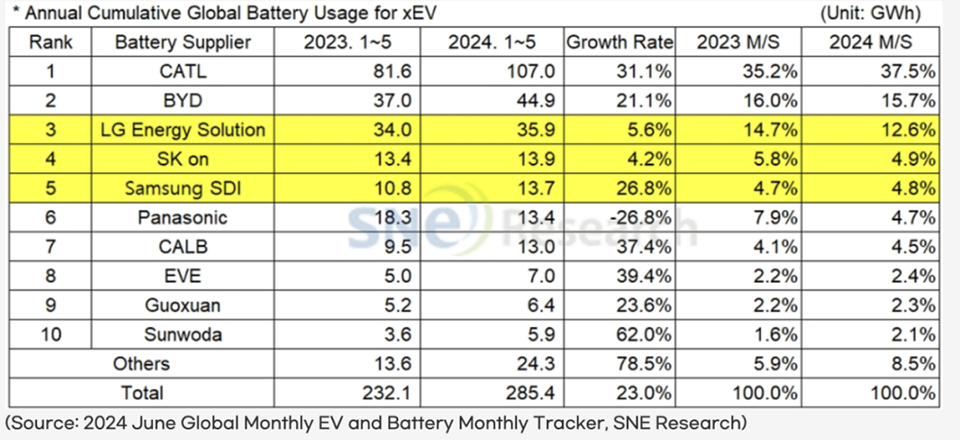

"We're at the end of our rope," said Lee Suk-hee, CEO of SK, in a recent internal letter. It's hard to imagine that the second-largest battery manufacturer in South Korea and the fourth-largest globally, behind CATL, BYD Fudi, and LG Chem, would say something like this. In 2023, its annual sales were 12.9 trillion Korean won, an increase of about 70% from the previous year, setting an all-time high.

"How does that song go again? Oh yes, it's not that I don't understand, it's just that the world is changing fast." As a key member of the sales department at a top 5 Chinese battery supplier, Lin Yang's company anticipated significant market changes for power batteries, but reality has been far more brutal than expected.

Raw material prices for batteries have plummeted, and battery prices are expected to continue falling, while sales growth for pure electric vehicles has slowed rapidly.

Batteries are difficult to make, and electric cars are difficult to sell. Two heavy blows have landed on battery manufacturers. The first is that raw material prices for power batteries are approaching cost levels (i.e., mining them results in losses). According to research reports from COFCO Futures/Guosen Futures, since July, the downward trend has continued, with the SMM battery-grade lithium carbonate index falling to 86,164 yuan/ton, a weekly decline of 3.7%. The consensus at the 2024 China Lithium Industry Conference is that lithium carbonate supply exceeds demand, and there is no significant willingness to reduce production. The second blow is that while battery production exceeds demand, pure electric vehicle sales are slowing, further straining inventory and putting pressure on the capital chain.

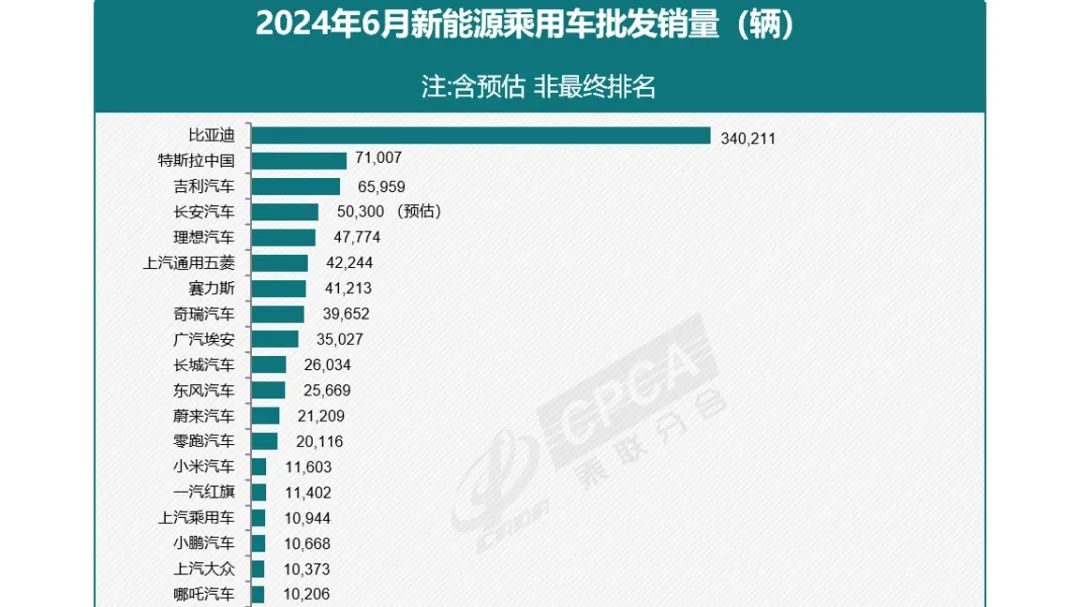

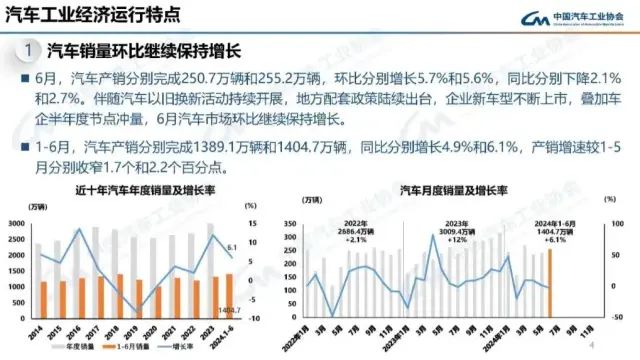

In terms of terminal sales, 829,000 new energy passenger vehicles were sold in June, a year-on-year increase of 28%, maintaining high growth. However, this growth relied on plug-in hybrids (including extended-range vehicles), while pure electric vehicles lagged behind. Among June's new energy sales, pure electric vehicles accounted for 54%, a 10% decrease from the previous year, with a sales growth rate of 6%, while plug-in hybrids grew by 57% and extended-range vehicles by 144%.

Pure electric and pure gasoline vehicles have suddenly become like brothers in distress.

The slowdown in pure electric vehicle sales is naturally closely related to the 18-month price war. As an industry phenomenon, all models on the market ended up with price cuts. Simple official price reductions or 4S store discounts amounted to nothing because everyone was doing it. Guanghui Automobile, China's largest 4S store group, is now facing delisting, with over 1.2 billion yuan in frozen orders. This is because a large number of new cars are being stored in 4S stores, and Guanghui needs to cut prices to sell them.

As a result, the industry's solution has become introducing new models with lower cost technologies. Therefore, more and more plug-in hybrids and extended-range vehicles are using large batteries, which solve the range anxiety of pure electric vehicles while also achieving most of the mainstream functions of the pure electric industry and solving the problem of being more popular than fuel vehicles.

In short, the total sales of the automobile market are only 100%. With the rise of extended-range and plug-in hybrids, pure electric and pure gasoline vehicles are becoming new brothers in distress. Today, there are no more than five automakers that can confidently talk about pure electric vehicles at press conferences with straight backs.

These are BYD, Tesla, ZEEKR, NIO, and Xiaomi. This list does not include Huawei, which leads in the luxury vehicle market above 400,000 yuan. The Wenjie M9, which disrupted this market, has less than 10% pure electric sales and 90% extended-range sales. Today, more and more automakers in the industry are following the trend of homogenization. For example, automakers that have focused on pure electric vehicles in the ride-hailing market have recently announced to the media that plug-in hybrid technologies will be introduced on new vehicles by 2025 at the latest.

On July 19, at a media briefing after ZEEKR 009's listing in Hong Kong, An Conghui, when asked about whether ZEEKR would produce extended-range or plug-in hybrids, smiled and replied, "It's simple for ZEEKR. We don't rule it out, but for now, we're definitely focused on pure electric."

Sales figures validate the conclusion of no more than five automakers. Among the 19 new energy automakers with sales exceeding 10,000 units, only Tesla, NIO, Xiaomi, GAC AION, and Xpeng are currently focused solely on pure electric vehicles from a brand perspective. Among them, we must also exclude some automakers that have experienced sales declines and are currently on a downward trajectory, such as Xpeng and SGMW.

Both of them have achieved remarkable results in the past. SGMW became famous for the Hongguang MINIEV, with sales of 554,000 units in 2022 and halved to 237,000 units in 2023. In 2024, monthly sales have continued to decline. The same is true for Xpeng. Due to SKU issues with the Xpeng G9, sales suffered. Production ramp-up issues with the Xpeng G6 led to a large number of order cancellations. The Xpeng X9, which was supposed to disrupt the MPV market, now sells less than 3,000 units per month.

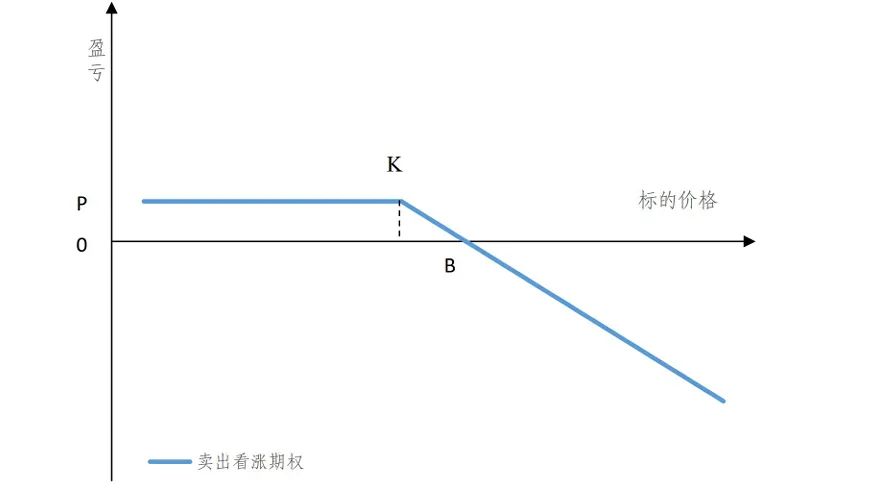

A clear conclusion is that as price wars become ineffective and pause, and as extended-range and plug-in hybrids take away market share, combined with the latest drop in raw material prices for power batteries approaching cost levels and severe inventory overhang, many companies are preparing to cut prices and cash out. As pure electric and plug-in hybrid (extended-range) vehicles experience proportional price drops due to falling battery prices, the trend of slower growth for pure electric vehicles will not fundamentally change when suppressed by plug-in hybrids.

Without a deep moat, can anyone survive?

Whenever the market reaches an impasse, it's also a time for change. Massive changes will lead to a shakeout, with most models eliminated and a few standing firm, eventually forming a new cycle of learning and imitation.

Which cars will struggle to survive in the future? The answer is not hard to guess: those without a moat. Today, the automotive industry is talking about corporate moats, which simply translate to "unique features that automakers possess, cannot be imitated or replicated by others, and are recognized by consumers."

A typical example is Huawei, whose capabilities in digital intelligent driving are indeed as Yu Chengdong said, "those four words." So far, Xiaopeng has lost to Huawei in the AEB competition, and Baidu, with the most experience, has also lost. However, as Huawei has truly transformed into a supplier, more and more automakers are cooperating deeply with it, and the exclusivity of this advantage will gradually diminish.

Another example is BYD's cost reduction capabilities (last year's Champion Edition and this year's Glory Edition, which maintained profits and enhanced competitiveness after significant upgrades) and technological prowess (rumored second-generation Blade Battery, latest fifth-generation DM, etc.), enabling it to advance in pure electric, plug-in hybrid, and extended-range vehicles simultaneously.

Companies with such capabilities also include NIO, ZEEKR, and Xiaomi, which possess unique characteristics that cannot be replicated by others. NIO excels in its technological system and business model, ZEEKR in its R&D capabilities and vehicle manufacturing logic, and Xiaomi in its digital R&D and integration capabilities.

Despite much controversy, as Li Bin began frequent live streams in 2024, answering sensitive questions and apologizing for previous jokes about fuel vehicles, NIO's sales have stabilized at a new high without explicitly participating in price wars, indicating a shift in market perception.

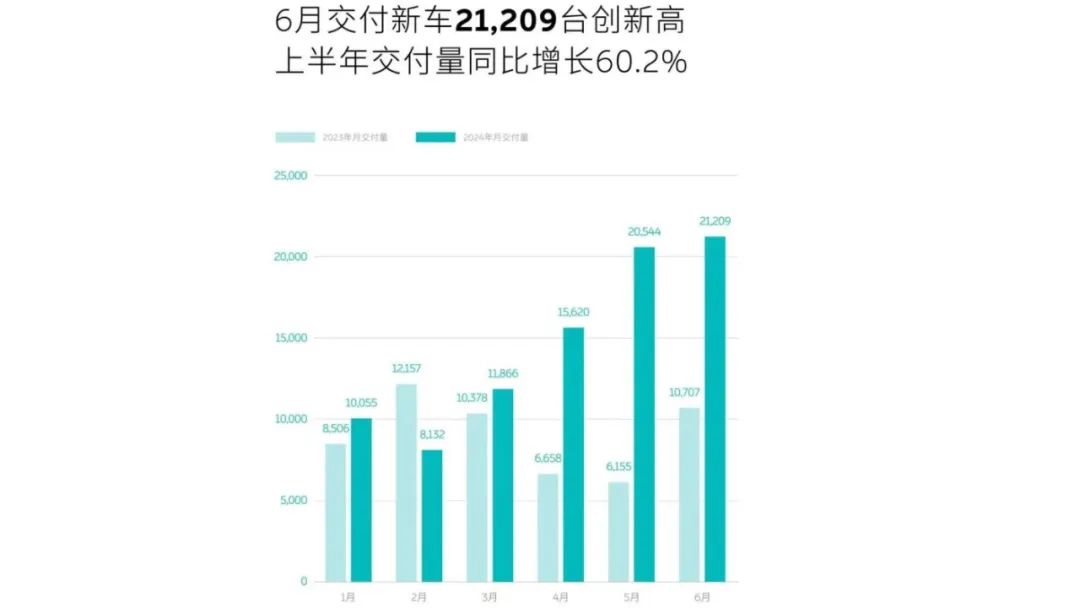

Starting in May this year, NIO has achieved monthly sales of over 20,000 units for two consecutive months. The upcoming Ledao L60 has a high number of potential customers and store visits. The main reason is that many people expect it to enter the sub-160,000 yuan price range after the BAAS model, and it's the only pure electric vehicle that can drive long distances continuously on highways due to battery swapping, which is an emergency feature.

Apart from its business model, NIO's technological R&D system has silenced many critics this year. For example, at the upcoming second NIO NIO IN Tech Day, smartphones will be further iterated. In other words, from a market perspective, only Huawei, Xiaomi, Geely, and NIO have deployed complete ecosystems, which are clearly moats for consumers.

Moreover, Ledao has several upcoming surprises. In the latest Ministry of Industry and Information Technology filings, it only declared a 60kWh battery pack with a range slightly higher than the Tesla Model Y, with a maximum CLTC range of 555 km for the single-motor version. The 90kWh battery pack is expected to be released later, pushing the range above 800 km or even higher.

ZEEKR's moat lies in its powerful R&D and integration capabilities. From the latest ZEEKR 009, it significantly upgrades its configuration while lowering its price. An Conghui responded, "The number of SEA architectures has increased significantly, and their generalization capabilities have improved. With the decline in raw material prices for batteries, we passed on the savings to customers."

Just looking at the ZEEKR 009, it boasts that despite being an MPV, it offers comfort and convenience that can replace and complement the functionality of large SUVs. With a 0-100 km/h acceleration time of 3.9 seconds, an 800V system across the range, 5C batteries, CCD suspension, dual 8295 chips, one-piece die-casting, Magic Body Control suspension, and an 11.5-minute charge from 10% to 80%, very few automakers can replicate this combination. So different manufacturing models, system capabilities, and R&D capabilities have shaped ZEEKR.

In addition to the ZEEKR 009, the ZEEKR 7X is likely to replicate the price and range advantages of the ZEEKR 007, starting at around 200,000 yuan with a range exceeding 700 km.

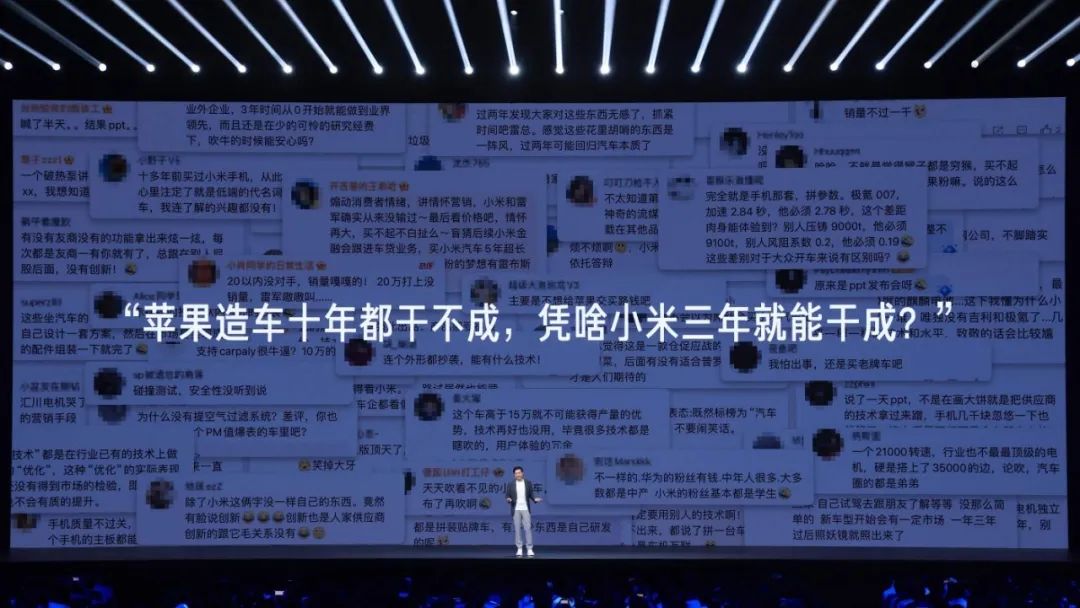

On the same night as ZEEKR's launch event on July 19, Xiaomi held its own event with Lei Jun. Like Huawei fans, Xiaomi fans are fiercely loyal, and there are currently no rivals in the automotive industry. While Xiaomi and Lei Jun have received mixed reviews online, the crowds at Xiaomi SU7 dealerships across the country demonstrate the strong personal charm of Lei Jun and the influence of the Xiaomi brand, which is rare in the industry. Moreover, Xiaomi's core advantage in the automotive field lies in its deep integration of the supply chain, similar to BYD.

Lei Jun has invested heavily in Mi Chain. In his latest speech, he detailed that after conducting research, he found that building a car requires at least $10 billion. The Xiaomi board agreed to support the car manufacturing initiative on the condition that Lei Jun himself would lead the project. When Xiaomi decided to venture into car manufacturing, several venture capital firms offered Xiaomi Auto a valuation of $10 billion. However, Lei Jun rejected external investment, deciding that Xiaomi would fully fund the project on its own.

Therefore, just before the launch of Xiaomi SU7, some internal executives shared their personal views with us, suggesting that if Xiaomi's supply chain could grow for a few more years, its costs might even challenge BYD's supply chain system.

Final Thoughts

So, who will eventually be eliminated? First, companies that fail to achieve excellence—in terms of price, configuration, technology, or business model—and instead just follow the trends set by popular models. Wuling's success and rapid decline is a typical example. The launch of the Hongguang MINI EV achieved an extreme in pricing, but as major players like Geely, Changan, and Chery quickly caught up, Wuling found it challenging to continue progressing, leading to a decline in sales.

In fact, Tesla is currently facing a similar issue. Initially, it achieved excellence, including the Iron Man IP and fully autonomous driving with FSD. However, as more and more car manufacturers catch up, Tesla's model updates have been less effective. This urgency led to the recent updated version of the Model Y and the accelerated plan for a more affordable car.

Moreover, with the continued decline in lithium carbonate prices and battery costs, more pure electric vehicles without strong branding will be overtaken by plug-in hybrids and range-extended vehicles.