BAIC BluePark: Price War Squeezes Profits, Up to 2.7 Billion Yuan Loss Expected in the First Half

![]() 07/22 2024

07/22 2024

![]() 526

526

Since 2020, BAIC BluePark (600733.SH), the "first stock of new energy vehicles," has continued to fall into a loss situation. In the first half of this year, BAIC BluePark failed once again to turn around its losses. According to its 2024 semi-annual performance forecast, BAIC BluePark expects a maximum loss of 2.7 billion yuan in net profit attributable to shareholders for the first half of the year, setting a new record for the highest loss in the same period since its backdoor listing in 2018. In addition to the increasingly intense price war squeezing profit margins, BAIC BluePark's high cost expenditures have also eroded profits.

Stockstar notes that BAIC BluePark's total sales in the first half of the year declined by 20% year-on-year. Despite being the first to go public, its sales were surpassed by later entrants. Its main sales force, the high-end brand ARCFOX, performed below expectations after its listing and struggled to expand its sales volume. Even though ARCFOX's sales increased significantly year-on-year in the first half, it failed to reverse the overall decline.

With sluggish sales and continuous losses, BAIC BluePark seeks a way out through its cooperation with Huawei. In early August, the Enjoyer S9 is set to be launched and delivered. For BAIC BluePark, how to win this turnaround battle is crucial.

01

Record Loss in the Same Period

High Selling Expenses

Data shows that in September 2018, BAIC BJEV backdoor-listed on the A-share market through ST Qianfeng and was renamed BAIC BluePark, becoming the country's "first stock of new energy vehicles," with the Beijing SASAC as its actual controller. BAIC BluePark's subsidiary, BAIC BJEV, was founded in 2009 and is China's first independently operated enterprise to obtain a new energy vehicle production license.

According to BAIC BluePark's performance forecast, the company expects a net profit loss of 2.4 billion to 2.7 billion yuan for the first half of this year, with a net profit loss after deducting non-recurring items of 2.45 billion to 2.75 billion yuan in the same period.

BAIC BluePark attributes the expected loss to two reasons: the increasingly fierce competition in the new energy vehicle market and the intensifying price war, which squeeze profit margins; at the same time, the company has continued to invest in technology research and development, brand channel construction, brand image sharpening, and operational efficiency improvement to promote the high-end development of its products, which has had a certain impact on the company's short-term performance.

In the first half of last year, BAIC BluePark's net profit attributable to shareholders was a loss of 1.98 billion yuan, which means that the loss in the first half of this year has expanded year-on-year, setting a new record since its backdoor listing in 2018.

Stockstar notes that in recent years, BAIC BluePark has been deeply mired in losses. Its net profit attributable to shareholders was 73.29 million yuan and 92.01 million yuan in 2018 and 2019, respectively. However, from 2020 to 2023, its net profit attributable to shareholders was consecutively in the red, with losses of 6.482 billion yuan, 5.244 billion yuan, 5.465 billion yuan, and 5.4 billion yuan. Including the expected low loss of 2.4 billion yuan in the first half of this year, BAIC BluePark's cumulative net profit loss attributable to shareholders since its listing has exceeded 24.8 billion yuan.

Against the backdrop of increasingly intense competition in new energy vehicle prices, the key factors for enterprises to profit are scale effects and cost control. However, BAIC BluePark's expenses are not low. In the first quarter of this year, BAIC BluePark's selling expenses, administrative expenses, research and development expenses, and financial expenses totaled approximately 889 million yuan, accounting for 59% of its revenue in the same period. Last year, these four expenses accounted for only 31% of its total revenue.

Among them, the highest expenditure is selling expenses. Financial data shows that from 2020 to 2023, BAIC BluePark's selling expenses increased from 1.008 billion yuan to 1.999 billion yuan. Most of this money was invested in advertising and exhibition fees, with expenditures of 371 million yuan, 736 million yuan, 1.16 billion yuan, and 1.018 billion yuan, respectively, in each period.

In the first quarter of this year, the company's selling expenses were 333 million yuan, which, although slightly down year-on-year, were still at a high level in the same period.

02

Sales Decline by 20% in the First Half

In 2019, BAIC BluePark achieved sales of 150,600 vehicles, maintaining its position as China's top seller of pure electric vehicles for seven consecutive years. However, with the rise of new forces, BAIC BluePark's sales momentum weakened. From 2020 to 2023, its annual sales were 25,900 vehicles, 26,100 vehicles, 50,200 vehicles, and 92,200 vehicles, respectively. Although these figures increased year by year, they were still far behind the 2019 level.

In the first half of this year, BAIC BluePark achieved sales of 28,011 vehicles, a decline of 20.4% from 35,191 vehicles in the same period last year. It is worth mentioning that most new energy vehicle companies achieved sales growth in the same period. BAIC BluePark's half-year sales were less than the monthly sales of Li Auto-W (02015.HK) in June, and NIO-SW (09866.HK), Zeekr, and Leapmotor (09863.HK) also sold more than 20,000 vehicles each in June.

Data shows that BAIC BluePark is currently focusing on building two major brands: ARCFOX and BEIJING. Among them, ARCFOX is positioned as a high-end intelligent new energy vehicle brand and is produced by BluePark Magna, a joint venture between BAIC BluePark and Magna in China; BEIJING is positioned as an economical intelligent new energy vehicle brand.

The first ARCFOX model was launched in October 2020. Although supported by BAIC Group's funding and Magna's design oversight, sales have been disappointing. According to data disclosed by BAIC Group, ARCFOX sold 4,993 vehicles in 2021, 10,000 vehicles in 2022 (a year-on-year increase of 110%), and 30,000 vehicles in 2023 (a year-on-year increase of 138%).

Stockstar notes that BAIC BluePark set an annual sales target of 100,000 vehicles in 2022, including 40,000 vehicles for ARCFOX and 60,000 vehicles for BEIJING. Clearly, it took ARCFOX two years to reach its target.

In the first half of this year, ARCFOX's sales continued to grow, increasing by 110.24% year-on-year to 18,000 vehicles, with monthly sales exceeding 8,000 vehicles in June, a year-on-year increase of 314.77%.

Stockstar understands that ARCFOX signed a cooperation agreement with Huawei as early as 2017. The Alpha S HI version, officially launched in 2022, is the first luxury pure electric sedan jointly developed by ARCFOX and Huawei equipped with Huawei's HI full-stack intelligent vehicle solution. However, due to various reasons such as high prices, sales failed to open up the market.

03

Seeks Survival through Huawei

Despite its sluggish sales and performance, BAIC BluePark has bucked the trend in the secondary market. On July 16, its share price hit a new high since 2023, closing at 10.61 yuan per share (adjusted for dividends). As of the time of writing on July 18, the share price was 10.32 yuan per share, down 1.05%.

Stockstar notes that the market's expectations for BAIC BluePark may stem from the upcoming launch and delivery of the Enjoyer S9 in early August.

It is reported that the Enjoyer S9 is the first model of the Enjoyer brand, led by Huawei in research and development and manufactured by BAIC BJEV. Positioned as an executive business sedan, it is expected to be priced between 450,000 and 550,000 yuan, targeting competitors such as the Mercedes-Benz S-Class, BMW 7 Series, and Audi A8, traditional luxury flagship sedans.

There are three well-known modes of cooperation between Huawei and automakers, and BAIC BluePark's cooperation with Huawei belongs to the Smart Selection mode, where Huawei not only deeply participates in product research and development but also allows products to be sold through Huawei's channels.

In April this year, Huawei successfully transferred the Enjoyer trademark to BAIC BJEV. In this regard, BAIC BluePark officials told the media that the purpose of the trademark transfer is for the Enjoyer S9.

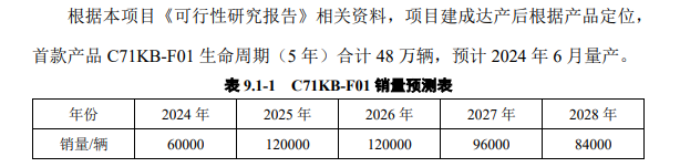

BAIC BluePark has high hopes for the Enjoyer S9 entering Huawei's sales channels. According to the BAIC BJEV official website, the Enjoyer S9 is expected to sell a total of 480,000 vehicles over its life cycle (5 years). The expected sales for 2024 to 2028 are 60,000 vehicles, 120,000 vehicles, 120,000 vehicles, 96,000 vehicles, and 84,000 vehicles, respectively.

BAIC BluePark's high expectations for the Enjoyer S9 may stem from the impressive performance of Seres (601127.SH). According to the performance forecast, Seres expects to achieve operating revenue of 63.9 billion to 66 billion yuan in the first half of this year, up 479% to 498% year-on-year; and a net profit attributable to shareholders of 1.39 billion to 1.7 billion yuan, turning around from a loss last year. It is worth noting that Seres' 2023 revenue was 35.842 billion yuan, indicating that this year's first-half revenue has far exceeded last year's full-year figure.

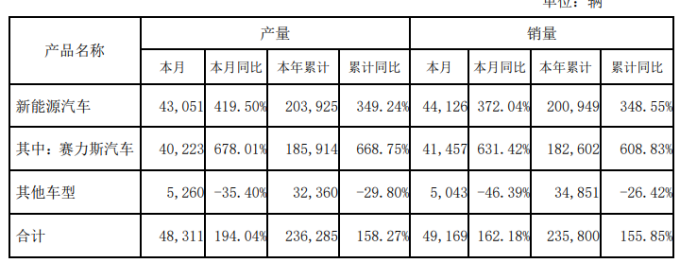

Seres' high growth stems from its cooperation with Huawei on the AITO series. In the first half of this year, Seres sold 200,900 new energy vehicles, an increase of 348.55% year-on-year. Data shows that during the same period, the AITO series delivered a cumulative total of 181,200 new vehicles. Among them, AITO M9 received over 100,000 orders in just half a year after its launch, topping the list of luxury cars priced above 500,000 yuan in terms of deliveries.

In contrast to Seres' popularity, Chery's joint venture with Huawei, Zeekr, has encountered cold sales. Last year, Zeekr S7 struggled with production issues and fell into silence. Even after its relaunch in April this year, sales failed to recover. Deliveries from April to June were 4,546 vehicles, 3,455 vehicles, and 2,995 vehicles, respectively, with sales declining month by month. Can BAIC BluePark replicate Seres' success and reverse its decline with the help of Huawei? Stockstar will continue to monitor this development. (This article was originally published on Stockstar by Lu Wenyan)

- End -