Empowerer Huawei | The New Decade of Automotive Industry

![]() 07/22 2024

07/22 2024

![]() 592

592

Author | Yang Lu

Editor | Li Guozheng

Produced by | Bangning Studio (gbngzs)

"Far ahead of the pack" and "leaving no grass unturned wherever it goes"... How can the story of the new automotive industry bypass Huawei? Every utterance from Huawei's executives becomes a hot topic debated by the industry for days.

On the evening of July 15, 2024, Yu Chengdong, Executive Director of Huawei, Chairman of the Terminal BG, and Chairman of the Intelligent Vehicle Solutions BU, discussed the progress of Huawei's automotive business during a live stream with Dong Yuhui, responding to the recent transfer of the "Wenjie" trademark and revealing that the fourth iteration of HarmonyOS Intelligent Drive is named "Zunjie".

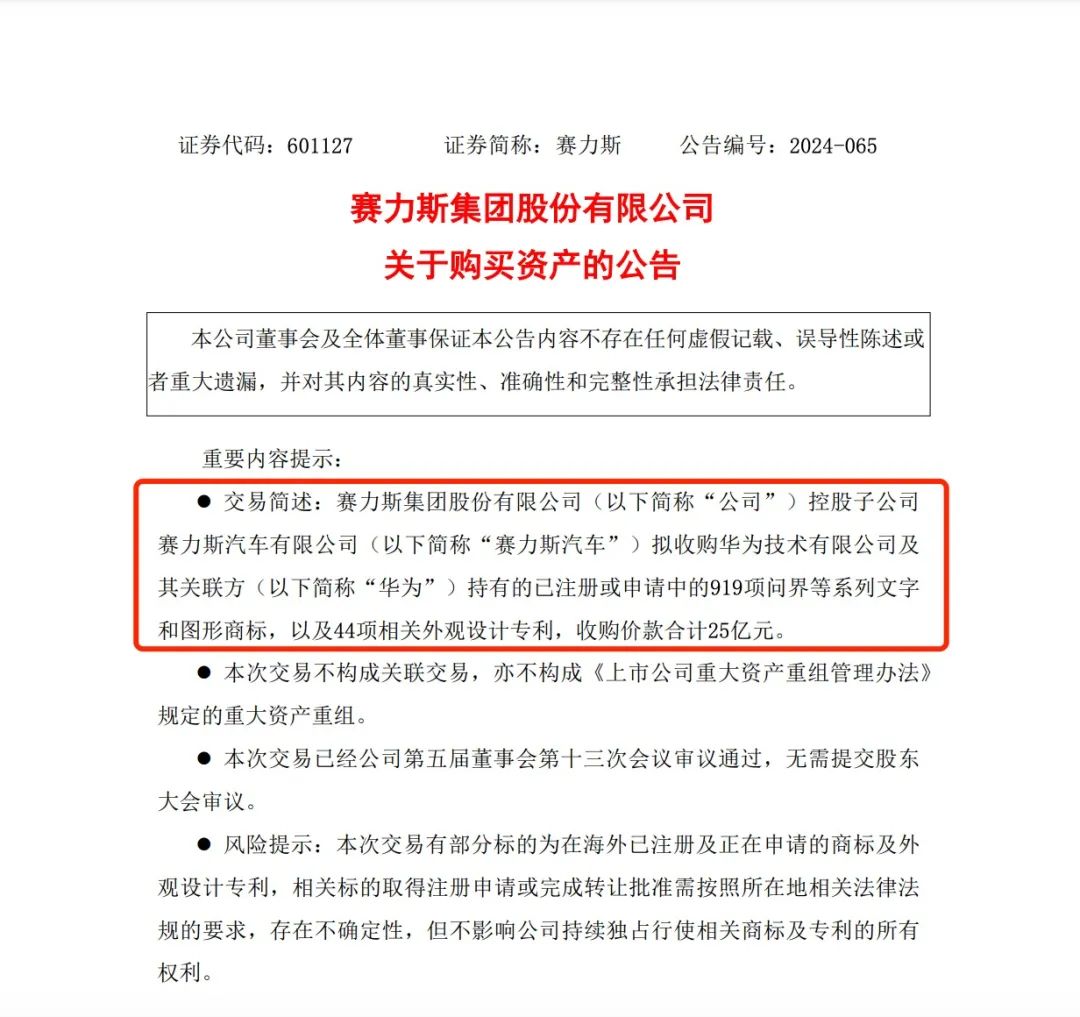

Since Huawei transferred the "Wenjie" trademark to Seres for 2.5 billion yuan on July 2, some insiders believe that Huawei and Seres' channels will gradually separate. However, for now, Seres' sales channels are still managed by Huawei.

Some users are concerned that brand and service quality will suffer after the trademark transfer. "I bought a Wenjie mainly because of Huawei's empowerment, only to find out that the Wenjie logo was sold," complained a car owner who just bought a Wenjie M9 a month ago. In fact, the trademark transfer has no immediate impact on consumer experience.

Huawei's "Wenjie" trademark, with a market value of 10.233 billion yuan, was sold to Seres for a mere 2.5 billion yuan. Yu Chengdong explained, "Due to national regulations, the brand owner and manufacturer must be the same, so the brand must be owned by the manufacturer. That's why we transferred all four 'Jie' brands to the automakers."

He added, "Even the name AITO has been transferred. It's very difficult to register a four-letter name starting with AI globally, and it's an excellent name. Our team worked hard to establish it, but we gave it to the automaker at a low price, and they made a huge profit."

However, Yu Chengdong emphasized that Huawei's role is to empower others, adhering to an altruistic spirit. "Ren Zhengfei requires us to always create value for customers," he said.

This transfer of the "Four Jie" trademarks once again underscores Huawei's stance of not manufacturing cars.

Since entering the automotive business, Huawei has made three significant adjustments, all firmly adhering to its "no car manufacturing" strategy.

First, in May 2019, Huawei established the Intelligent Vehicle Solutions BU (Car BU), marking its official entry into the smart car sector as a component supplier.

Second, in November 2023, Huawei planned to establish a new company to integrate the core technologies and resources of its Intelligent Vehicle Solutions BU, with Changan Automobile and related parties investing 40% of the company's equity.

Third, by transferring trademarks such as "Wenjie" and "Zhijie," Huawei no longer owns any complete vehicle brands.

After five years in the automotive sector, Huawei spent three years building the Wenjie brand, reaching a peak in the new energy automotive industry. Although it gained momentum quickly, the process was full of twists and turns, and Huawei's story with automakers continues to evolve.

Trial Run

To sell cars well for automakers, Huawei first blazed a trail with Seres.

Huawei's automotive business is divided into three models: component mode, HI (Huawei Inside) mode, and Smart Selection mode (later upgraded to HarmonyOS Intelligent Drive).

The Smart Selection mode is Huawei's successful case in the automotive sector, best represented by Wenjie, which Huawei and Seres jointly explored. Their partnership began with the Smart Selection SF5 in 2019, followed by the launch of the AITO Wenjie brand and the delivery of the first Wenjie M5 in 2021. Since then, Huawei has entered the mainstream electric vehicle race, and Seres has been reborn.

After officially announcing their partnership in 2021, Huawei called on dealers to upgrade their mobile phone stores to car stores, bringing Wenjie models into Huawei's showrooms. That's when Yu Chengdong boldly stated, "We aim to sell 300,000 vehicles in a year."

At the time, this goal seemed like a fairy tale, as the annual sales of "NIO, Xpeng, and Li Auto" hadn't even exceeded 100,000 vehicles. But it served as a clarion call, announcing, "Huawei is here."

Under Yu Chengdong's comprehensive leadership, the Smart Selection mode created a sample of Huawei's automotive business, rapidly gaining market recognition and boosting sales. There was a minor controversy regarding the use of "Huawei Wenjie."

In March 2023, AITO Automobile used "HUAWEI Wenjie" for the first time in promotional posters on multiple social platforms, replacing the previous "AITO Wenjie." Screenshots from online chat groups circulated, indicating that AITO's branding would shift from "Huawei's deep empowerment" to "Huawei's comprehensive leadership."

This was Yu Chengdong's closest brush with car manufacturing, but it was firmly nipped in the bud by Huawei's founder, Ren Zhengfei. Ren signed an internal resolution, deciding to continue implementing the 2020 EMT document resolution, once again emphasizing that "Huawei does not manufacture cars" and cannot use terms like "Huawei Wenjie" or "HUAWEI AITO."

Xu Zhijun, Huawei's rotating chairman, reiterated, "Currently, some departments, individuals, or partners are abusing the Huawei brand. This matter is already under investigation. After 30 years, Huawei's brand cannot be abused."

With the road blocked for promoting Wenjie under the Huawei brand, Smart Selection vehicles had to seek other methods.

In July 2023, both parties decided to establish the "AITO Wenjie Sales and Service Joint Working Group," which will be fully responsible for end-to-end closed-loop management of marketing, sales, delivery, service, channels, and other businesses.

Previously, Huawei-led shopping mall experience centers were responsible for sales, customer attraction, store visits, and orders, mainly through Huawei's directly operated and franchised stores. Seres-recruited user centers were primarily responsible for product delivery and after-sales services. This division between the front and back ends could easily lead to fragmentation, affecting user experience.

After several adjustments, AITO Wenjie's channels gradually stabilized. It wasn't until 2024 that Wenjie was expected to achieve Yu Chengdong's initial target of 300,000 vehicles. In June this year, Wenjie's sales exceeded 40,000 units, with first-half sales reaching 183,000 units, a 122% completion rate. However, three years later, Wenjie has raised its annual sales target to 600,000 vehicles.

Expansion

"Many automakers want to cooperate with Huawei, and now there's no room for more cars," a Huawei experience store employee in Chaoyang District, Beijing, told Bangning Studio.

Huawei and Seres spent three years proving the efficiency of the Smart Selection mode. From 2022 to the first half of 2024, Wenjie's sales were 75,000, 94,000, and 183,000 units, respectively. Yu Chengdong once said that Huawei accomplished in one year what others took three to five years to do.

Adhering to the principle of "not manufacturing cars but helping automakers sell well," Huawei's Smart Selection mode won't be limited to Seres alone.

On July 8 this year, Huawei and BAIC unveiled the Xiangjie S9 in stores, with Yu Chengdong personally standing by to explain. On that day, BAIC BluePark's share price rose by 5.6%. The car will be launched in August this year, and since its exhibition at the April Beijing Auto Show, Huawei has mentioned Xiangjie on multiple public occasions and continuously released vehicle information.

Xiangjie is the third brand launched by HarmonyOS Intelligent Drive and Huawei's second collaboration with BAIC. Their initial cooperation model was the HI mode, with the ARCFOX Alpha S HI version being Huawei's first HI model car. However, sales were not ideal, leading to Huawei's Smart Selection cooperation with BAIC.

To date, Huawei has collaborated with Seres, Chery, BAIC, and JAC to create four "Jie" brands, indicating that no other automakers will be introduced for now.

In June this year, Yu Chengdong stated at a forum, "Many major automakers are seeking cooperation with HarmonyOS Intelligent Drive for Smart Selection vehicles, but Huawei lacks resources and can only support four automakers, with whom we currently collaborate."

To expedite sales channels, Huawei is vigorously establishing HarmonyOS Intelligent Drive authorized user centers. According to plans, Huawei will establish 800 HarmonyOS Intelligent Drive stores in 2024, reaching 1,000 by 2025.

Currently, Huawei's car sales channels can be roughly divided into three types: flagship stores fully operated by Huawei, smart living pavilions or authorized experience stores transitioning from dealer-led to self-operated, and HarmonyOS Intelligent Drive authorized user centers.

A sales consultant at a Huawei store revealed that previously, some Huawei stores were operated by dealers, who often secretly offered freebies, leading to inconsistent service experiences across stores. Although the value of these gifts might not be high, they impacted customer experience. Starting at the beginning of the year, the stores were reorganized, and now all staff are Huawei employees.

Furthermore, the salesperson said not all Huawei experience stores have cars available promptly, with priority given to stores with better locations, foot traffic, and overall conditions.

In terms of delivery, only AITO Wenjie has a separate delivery center staffed by Seres employees, selling only AITO brand models. Other models like Zhijie and Xiangjie will continue to have their delivery and after-sales services handled at HarmonyOS Intelligent Drive user centers.

After Huawei transferred the "Wenjie" trademark, some media reported that the depth of cooperation between Huawei and Seres would not change, but their revenue-sharing model would evolve, with new cooperation agreements to be signed.

It is reported that under the Smart Selection mode, the profit-sharing ratio between Huawei and automakers like Seres is approximately 1:9 (excluding hardware and software procurement costs). Taking the 560,000-yuan Wenjie M9 as an example, Huawei earns roughly 56,000 yuan per vehicle sold, with 80% (about 44,800 yuan) going to Huawei's channel distribution costs and 20% (about 11,200 yuan) as technology licensing fees.

If automakers build their sales channels, the profit-sharing ratio also tilts towards them. Currently, Zhijie S7 has been delivered for only three months, and Xiangjie S9 hasn't been launched yet. There's no definitive news on whether these two brands will establish their sales channels. However, some media reported that Chery is setting up a new Zhijie sales company.

Some believe that Huawei's Smart Selection mode is not a stable business model but rather one established based on Huawei's dominant position, with subsequent roles likely to be adjusted at any time. In short, this is a game led by Huawei.

Investment

The automotive business is Huawei's second growth curve, initially focused on "making good cars for automakers."

When Huawei established its Car BU, it was the first year it was listed on the US Entity List for export controls.

That year, Huawei's overseas consumer business revenue was impacted by at least US$10 billion.

That year, China's new energy automotive market transitioned from the introductory phase to the growth phase, with production and sales exceeding 1.2 million vehicles.

Amid internal and external challenges, Huawei marshaled the company's resources to enter the automotive business, establishing the Car BU under the leadership of Wang Jun. The aim was to extend Huawei's 30+ years of ICT technology accumulation and advantages into the smart automotive industry.

Since its inception, Huawei has invested heavily in this business unit. In Huawei's 2021 campus recruitment, almost all of the hundreds of positions went to the Car BU, which rapidly expanded to 2,000 employees. In 2020, Huawei invested approximately US$500 million, exceeding US$1 billion in 2021 and reaching a cumulative US$3 billion by 2022, with a research and development team of 7,000 people.

The Car BU established Huawei's Tier 1 status. Under its leadership, the HI mode pioneered cooperation with BAIC's ARCFOX brand, with the full-stack intelligent driving system first integrated into the ARCFOX Alpha S. Wang Jun once mentioned that the HI mode was not an end goal but a means to sell more components.

However, the HI mode's first battle was unsuccessful. The monthly sales of the first cooperation model, the ARCFOX Alpha S HI version, were only a hundred units. As a result, Huawei's HI mode struggled with both revenue and brand recognition.