The sharp edge of the price war first pierces the dealers

![]() 07/22 2024

07/22 2024

![]() 562

562

Introduction

Why can't this barrier of dealers be pierced on a large scale?

When the editorial department was discussing what the most profound phenomenon in the automotive industry has been over the past six months, many colleagues mentioned the price war. If we compare the price war to a knife, then who should be the first to be hurt by this knife?

The answer might be automotive dealers.

Don't rush to refute this conclusion just yet. A series of recent industry phenomena are gradually answering this question.

BBA has completely withdrawn from the price war, and the dream of owning a luxury car for just over ten thousand yuan is probably shattered. Some joint venture brands have followed suit, and automotive terminal discounts have begun to adjust upwards, with new car prices rising after a long period of decline. Industry analysts believe that while many consumers dislike this behavior, BBA's dealers are truly exhausted from the intense competition.

Before that, Guanghui Auto, the listed dealer group ranked first in total passenger vehicle sales and second in revenue scale, was suspended from trading after 20 consecutive trading days with its share price below 1 yuan per share, embarking on a path to delisting without even being designated as a special treatment stock. Its market value has shrunk to just 6.466 billion yuan, evaporating nearly 100 billion yuan from its peak value. This proves that in the context of intensified competition and worsening industry conditions, capital is no longer optimistic about the automotive dealer model.

Furthermore, the collapse of Senfeng Group, a well-known automotive dealer in Yancheng, along with the collapse of Guangdong Yongao Group earlier in the year, has left over 100 4S stores in financial distress. Owners have gone missing, and many consumers who have paid for cars are unable to take delivery, sparking public concern about the automotive dealer sector.

Multiple hot-button issues all point to one fact: if the price war continues like this, dealers will soon be out of business!

In fact, both the industry and automakers understand that dealers, as middlemen in automotive sales, are a target for many brands to eliminate the "mark-up" business. However, the initial shift from direct sales models to dealer models by many new players has proven the existence and rationality of the dealer ecosystem.

They are not only the most effective sales platforms for automakers to expand their brand and product influence, facing users directly in different regions and markets, but also a buffer zone for automakers to recycle funds and stabilize their sales systems. They are also a barrier against market volatility and industry shocks.

Yet, as automakers pursue sales volume and market share, constantly initiating or following price wars, the question arises: should the dealer barrier be preserved? Opinions are divided among OEMs, dealers, and consumers.

Too difficult! Survive!

"If this price war continues, dealers will collapse, and it will be a Pyrrhic victory for the brands as well." Upon receiving news that BMW was going to ease the pressure on its dealers, Tan Zhen let out a long sigh of relief and told Auto Society that this was undoubtedly the right decision at present.

As a sales director who has been in the luxury car dealer system for nearly a decade, Tan Zhen is well aware that dealers and manufacturers are in the same boat, rising and falling together.

Since BMW announced its withdrawal from the price war, several traditional luxury brands and joint venture automakers have followed suit, adjusting their dealer business policies and reducing dealer inventory targets and performance assessments. Some dealers have said that even if OEMs do not reduce the burden on dealers, they are prepared to abandon their annual targets and forgo incentives, as incentives are insignificant in the face of losses.

Many believe this is a helpless move by these brands facing fierce market competition, but Tan Zhen sees it as a way to ride the tide. After all, in June, the inventory index of luxury brands reached a high of 66.4%, 16.4 percentage points above the critical line, indicating unprecedented pressure.

"It's already the traditional off-season, and further price wars will have limited impact on sales. It's better to take a step back and let dealers catch their breath," said Tan Zhen. Although dealers, as the downstream party to manufacturers, do not expect brand owners to consider their interests, at least it shows that many manufacturers have realized that dealers are facing more difficulties than imagined. For many automotive brands, especially those with a history, they still rely on dealers.

"Ah..." When Auto Society raised the topic of dealer survival in the first half of the year with Yu Ming, his long sigh practically encapsulated the ordeal and situation of dealers over the past six months, a mix of emotions. On the other end of the phone, he had just finished handling sales matters at the store and was preparing to go home, already past 10 pm, which has been the norm for his work in recent months.

As the general manager of a dealership for a leading Chinese automaker in East China, Yu Ming likely has a clearer understanding of the situation than outsiders. "Both sales and profits are declining, and as middlemen, we are very passive," Yu Ming said, adding that the biggest problem is inventory. "Excess inventory ties up funds, and when the capital chain becomes tight, we have to rush to sell vehicles or send them to secondary networks to recoup funds. The longer it drags on, the greater the losses."

Dealers are essentially powerless, facing pressure from manufacturers' performance targets, fierce market competition, and weakening consumer demand.

While dealers in East China may still find some respite in regions with relatively developed economies and less of a decline in automotive consumption, competition in inland areas like Sichuan and Chongqing is even more brutal.

"We've been losing money all along, and not long ago, the group was preparing to close all the stores," said Dai Ke, an insider at a Volkswagen dealership in a city in Sichuan and Chongqing, who told Auto Society that they haven't made a profit in two years and have been surviving on group funding. Sales are weak, and customer sources are scarce. "If it weren't for Volkswagen's brand recognition among consumers here, we might have closed down already," Dai Ke lamented, adding that the full-year harvest depends on the last few months of the year.

Indeed, in fifth-tier cities in the interior, more consumers tend to buy cars around the Spring Festival and prefer to pay in full after a year of earnings. Therefore, the mid-year off-season is the most trying time. As Volkswagen's position weakens amid competition from Chinese automakers, sales pressure falls on every sales consultant.

"I used to earn 10-20,000 yuan a month at the end of the year, but now I only earn 1-2,000 yuan in base salary, and sometimes I even have to pay deductions," Dai Ke said, describing the state of the store. Sales consultants have lost their passion for selling cars due to market and company pressure. "Many cars sit on the lot unsold, exceeding their shelf life. Over 50% of our inventory is long-shelf-life cars, and the interest on these overdue loans is shared by the general manager, sales manager, and sales consultants. Now, sales consultants only sell three to five cars a month, but once the overdue interest is involved, they've essentially worked for nothing that month."

"It's a vicious cycle with no immediate solution," Dai Ke said helplessly.

"I can't see any hope, and I have to say goodbye," Auto Society learned from a conversation with the general manager of a 4S store belonging to a southern group. He has left the automotive distribution industry where he had been deeply rooted for over a decade to embark on his own entrepreneurial journey. He has sold joint venture brands, Chinese brands, and finally, new energy vehicles, but unfortunately, he chose a struggling new force automaker. "Although it's hard to let go, I have no choice. Personally, I believe that the best era for dealers is over."

The above situations are not just isolated cases. Data from the industry speaks volumes about the survival status of dealers. Financial reports from several leading dealer groups show that while revenue has generally increased slightly, net profit declines are staggering. For example, Zhongsheng Group's net profit fell by over 20% year-on-year last year, Yongda Group's net profit fell by over 60%, and Meidong Auto's net profit plummeted by over 70%.

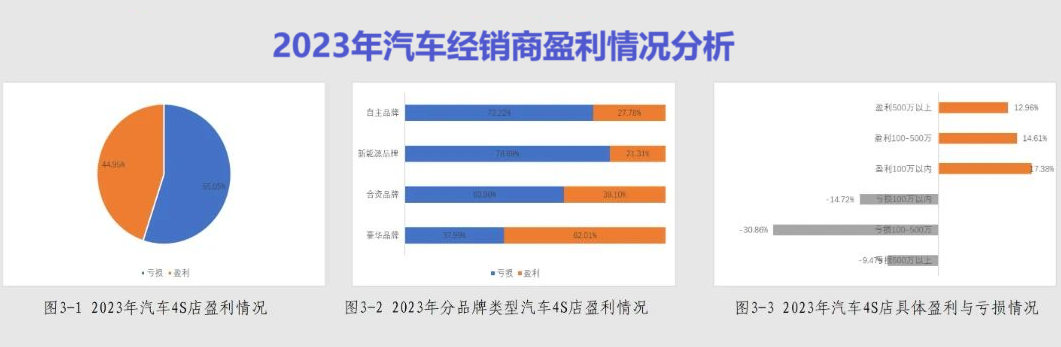

Data from the China Automobile Dealers Association (CADA) on dealer survival conditions in 2023 shows that the national dealer profitability ratio declined from 55% in 2022 to 44% in 2023, and the figure for the first half of this year will only be lower. In particular, for Chinese brands and new energy brands, the profitability ratio of their 4S stores is less than 30%, with over 30% of dealers suffering annual losses in the range of 1-5 million yuan.

There are also some detailed data points, such as over 77% of dealers experiencing price inversions on their main sales models. Out of five main sales models in a store, only one can generate a profit through price differences. The gross margin on new car sales, including rebates, is overall negative, while the gross margin on derivative products is marginally profitable. The overall cost ratio of a single 4S store has reached 17.51%, with operating costs increasing by more than 3 percentage points compared to the previous year...

Who is destroying dealers?

"Customers' excessively high expectations for price drops are the core factor leading to the decline in transactions today," Chen Lu, the head of a leading Chinese dealer in Sichuan and Chongqing, told Auto Society. In the past, Chinese brands rarely offered terminal promotions of 30-40,000 yuan, and even promotions exceeding 20,000 yuan were rare. Now, whether from terminals, social media, or the overall public opinion environment and pressure, the situation is not conducive to dealer survival.

Indeed, under the onslaught of price wars, consumers have their own expectations and psychological price points for automotive products. On the one hand, automakers like BYD have set price anchors at 99,800 and 79,800 yuan, creating a false impression among consumers that mainstream Chinese cars should sell at these prices.

On the other hand, the unrealistic ultra-low prices flooding internet and social media platforms have disrupted the normal order of automotive sales. Low-price lead generation measures can indeed generate effective sales leads and reservations, but they have also caused many consumers to lose their basic understanding of the original prices of cars, believing that they can buy Mercedes-Benz and BMW for 150,000 yuan and Geely and Great Wall for 50-60,000 yuan, which is taken for granted. Once prices exceed these expectations, transaction volumes will decline significantly.

Chen Lu believes that the establishment of such expectations has a significant impact on automotive consumption, enthusiasm for automotive brands, and terminal consumption. Once established, these expectations are often irreversible. Just as when BMW announced its withdrawal from the price war, it triggered negative public opinion from car owners. No one wants to miss the opportunity to drive a BBA for just over 100,000 yuan, so BMW's withdrawal from the price war naturally led to consumers' doubts and dissatisfaction with the brand.

Regarding the deterioration of dealers' survival conditions, Yu Ming believes that in addition to the decline in market demand, it is also related to automakers' need to expand market share and sales by opening more dealer networks. Automakers demand sales volume and now require more offline touchpoints, making channel capability an important indicator of sales capability.

"But the more channels there are, the less profitable it will be for dealers to sell cars, since the pie is only so big, and the more people there are to share it, the smaller each slice becomes," Yu Ming said. Since the start of the price war, each situation has been different. Brands under pressure to sell more vehicles have pushed more vehicles onto dealers, and once the market cools, terminal prices become more chaotic.

Of course, OEMs are well aware of their relationship with dealers and will not let them collapse, so overall business policies are better than before. However, due to the changing market environment and conditions, business policy adjustments have become more frequent. In the past, they were adjusted once a month and were relatively stable, but now some are even adjusted weekly or with temporary remedial measures to address market challenges.

"More phased and temporary policies are not conducive to long-term market operations, and it is difficult for us to predict the next moves of manufacturers. Relatively speaking, we need to proceed more cautiously," Chen Lu believes. Facing OEMs, dealers are a vulnerable group. Manufacturers can sell cars at a loss, even if it's hundreds of millions of yuan, but most dealers are small and medium-sized enterprises. While their capital flows may be high, reaching hundreds of millions of yuan, a loss of three to four million yuan can quickly impact their capital chains and lead to bankruptcy.

Including many large dealer groups that previously pursued a multi-brand path, their survival conditions have also deteriorated in the face of declining joint venture automakers and eroding luxury car markets. Chen Lu believes that in the future, dealers are best served by joining forces to resist risks. As automotive brand sales concentration increases, the multi-brand path has essentially failed.

Reflecting on dealer satisfaction with OEMs, these scores have also declined over the years. When the market was doing well and dealers were making money in 2016, satisfaction scores could reach over 70 points, but by 2023, this score had fallen to just 56 points, setting a new low. The relationship between OEMs and dealers has deteriorated due to changes in the market environment and structure.

"Establish a fair, transparent, simple, and efficient dealer exit mechanism, and call on regulatory authorities to pay close attention to dealer exit issues," the China Automobile Dealers Chamber of Commerce recently issued such an initiative and call. The chamber believes that existing policies and regulations are insufficient to provide clear and robust entry and exit protections for automotive dealers.

At the same time, most automotive OEMs take a negative stance towards dealer exits, lacking standardized and consistent handling mechanisms for issues such as rebate fulfillment, settlement of outstanding payments, disposal of inventory vehicles and after-sales parts, and protection of customer rights and interests. The exit process is complex and drawn out.

Facing increasingly prominent contradictions in the dealer model, automotive OEMs are also exploring new dealer models. For example, the direct sales model, which has been promoted by new forces in the past, is now being combined with traditional dealership models by more automakers driven by new energy vehicles.

On the one hand, vehicles are ordered, eliminating the pressure on funds caused by inventory, and the manufacturer's endorsement also eliminates consumers' concerns about dealer runaways. On the other hand, dealers generate profits from delivery and service, focusing on the long term. Although they may not earn as much profit from vehicle sales as they would from wholesale sales, they can operate safely in a fluctuating market environment, ensuring a steady stream of income.

Regarding after-sales service, Tuhu and Tmall are also infiltrating the traditional 4S store sector. Recently, Dongfeng Nissan, a subsidiary of Dongfeng Southern Group, directly supplied original parts for all its models to Tuhu Auto Service, and FAW-Volkswagen's engine factory original parts landed on the Tuhu Auto Service platform, indicating that OEMs expect to activate traditional 4S store models and competition with new models and expand diversified service systems.