When automakers start to fight back against internal competition

![]() 07/22 2024

07/22 2024

![]() 691

691

Lead

While some domestic automakers are deeply engaged in internal competition, a portion of them have begun to reject it. Endless internal competition has not only significantly reduced automakers' profits but also impacted employees' incomes and investment in R&D. Healthy competition can promote the steady development of the entire industry, but extreme internal competition forces automakers to do everything possible to reduce costs. For users, this is not necessarily good news.

Produced by | Heyan Yueche Studio

Written by | Zhang Chi

Edited by | He Zi

2964 words in total

4 minutes to read

Recently, a car blogger posted that BMW will adopt a strategy of reducing production to maintain prices starting in July. This is in stark contrast to the 50% discounts offered by BMW for the I3 model in some 4S stores not long ago. Undoubtedly, facing the internally competitive domestic auto market, BMW has chosen to sacrifice some sales to ensure profit margins and the brand image behind it. In addition to BMW, foreign brands such as Mercedes-Benz, Audi, Volvo, Cadillac, Volkswagen, Honda, Guangfeng, and Buick are rumored to have already or will soon reduce terminal discounts. Beyond foreign brands, NIO is also rumored to be reducing its discounts. This wave of counter-trend price increases initiated by BMW shows signs of intensifying.

According to BMW's published data, global deliveries reached 1.0965 million vehicles in the first half of 2024, an increase of 2.3% year-on-year. Electric vehicle sales increased by a remarkable 34.1% year-on-year. However, unlike its steady progress in the global market, BMW's domestic sales declined by 4.2% to 375,900 vehicles in the first half of the year. Even BMW's heavily invested new-generation electric vehicles are not guaranteed to succeed in the domestic market.

△BMW's stark contrast between overseas and domestic markets

Profit vs. Sales: Which is More Important?

For running a business, profit is paramount. Even if investors allow initial losses, allowing the company to burn some money, it is ultimately aimed at making money in the long run. From a broader perspective, only with profits can employment issues be continuously resolved, taxes paid to the government, and foreign exchange earned through exports.

From the perspective of foreign automakers, continuing to participate in the internal competition of the Chinese auto market is no longer a profitable business.

On the one hand, continuous price reductions have depleted single-vehicle gross margins. More critically, price reductions have significantly harmed brand images. A BMW I3 priced at 180,000 yuan is unimaginable in the era of fuel vehicles, let alone electric vehicles with higher costs. For dealers, significant discounts are often unavoidable. Many dealers now rely on loans to purchase vehicles from manufacturers, meaning that every extra day of inventory accumulation adds to the interest burden. Selling vehicles at a discount may result in some losses, but it reduces interest expenses and earns more rewards by meeting manufacturers' sales targets. Overall, discounts can reduce some losses and offer greater benefits.

△Some BMW dealers offered 50% discounts on the I3

Next, if BMW continues to adhere to the business policy set at the beginning of the year and continues to pressure dealers with inventory, dealers will inevitably further increase terminal discounts. For BMW, short-term sales are important, but brand image is a more long-term interest. If domestic consumers firmly believe that foreign brands are inferior to Li Xiang and Wenjie in the new energy vehicle sector, BMW may have no foothold in the domestic market in the future.

△BMW adjusts strategy to reduce dealers' burdens

On the other hand, most multinational automakers have performed well post-pandemic. Strong demand in European and American markets has brought considerable sales and profits, allowing these automakers to subsidize the Chinese market with sufficient resources. In contrast, many domestic automakers are deeply engaged in internal competition, with unclear momentum in the short term, both technically and price-wise. This cost-blind internal competition will eventually exhaust most automakers, and some with weaker systems may not survive more than two or three years. When domestic automakers can no longer afford price wars, BMW can launch counterattacks, likely achieving better results.

Great Wall Motors' Net Profit Soars

On July 10, Great Wall Motors released its first-half performance forecast, estimating a net profit attributable to shareholders of the parent company of 6.5 billion to 7.3 billion yuan for the first half of 2024, an increase of approximately 5.139 billion to 5.939 billion yuan year-on-year, up 377.49% to 436.26%.

Among domestic traditional automakers, Great Wall Motors is not often heard engaging in price wars, and its electric vehicle strategy is hardly successful. Today, apart from Wei Jianjun's occasional live streams generating some online buzz, it's difficult to see Great Wall Motors in the headlines. Yet, this automaker, relying primarily on the Ora brand in the domestic electric vehicle market and with the once-legendary Haval H6 no longer in its glory days, has achieved remarkable net profits.

△The legendary Haval H6 is no longer in its prime

From a broader perspective, within the domestic market, only Tesla seems to be genuinely reaping substantial rewards from pure electric vehicles. Domestic automakers like BYD, Li Xiang, and AITO Wenjie likely derive most of their profits from hybrid models. It's not uncommon for electric vehicle manufacturers to incur more losses as they produce more, a common issue facing the entire industry. For Great Wall Motors, rather than continuing to invest heavily in developing a full range of electric vehicles, it might be wiser to allocate limited resources to areas with greater returns. Moreover, Great Wall's strengths lie in pickup trucks and rugged off-road SUVs, which are not naturally suited for pure electric technology.

△Great Wall Motors relies heavily on the Ora brand in the electric vehicle sector

In time, when battery technology advances enough to truly alleviate range anxiety or charging infrastructure becomes more comprehensive, a larger-scale transition to pure electric vehicles may be a better option. For now, relying on fuel/hybrid vehicles to accumulate more funds for exploring forward-looking technologies or continuously iterating existing electric vehicles, adopting a small-step, fast-pace strategy to continuously improve may be wiser. Great Wall Motors is also one of the few domestic automakers consistently investing and positioning itself in the fuel cell market. It's not impossible that fuel cell vehicles may once again receive policy favor and capital pursuit in the future.

△Great Wall Motors has also positioned itself in the fuel cell market, which can periodically "go crazy" with capital

What's Invisible is Often More Important

On the surface, competition among automakers has driven down domestic car prices and increased cost-effectiveness. But deep down, has this competition truly elevated overall vehicle quality? We see significant improvements in interior luxury, intelligent driving, and vehicle networking in new-generation models, but how many car owners truly care about the invisible aspects? According to internet thinking, if car owners don't care and it's not a user pain point, why invest heavily in enhancing these areas?

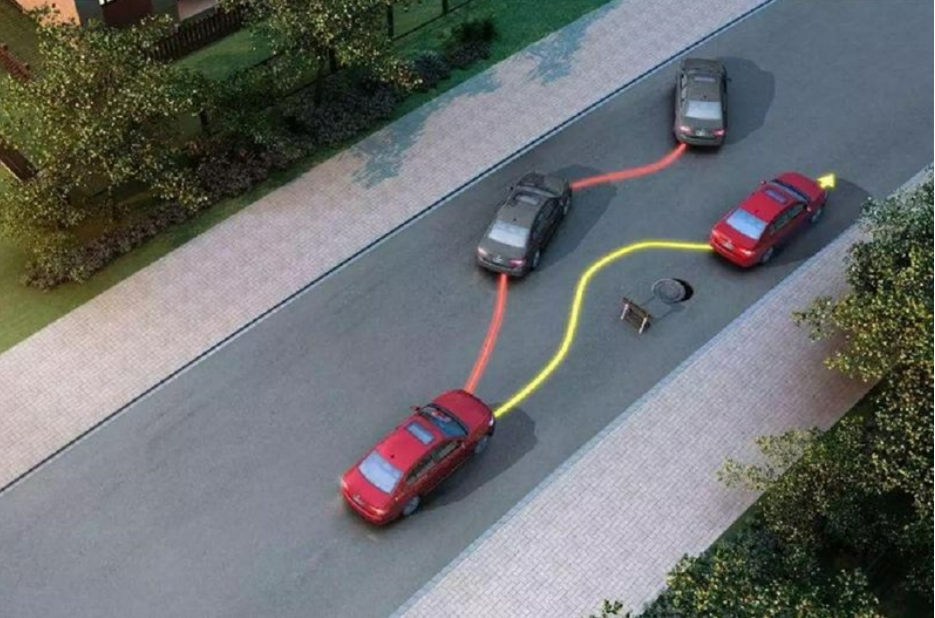

△Invisible chassis handling performance is crucial for high-speed driving safety

Specifically, chassis handling cannot be solved with air springs alone. Scenarios like extreme cornering in the elk test, which seem rarely used, could lead to vehicle instability on highways when avoiding large trucks ahead. Intelligent driving cannot be judged solely by the number of functions; sometimes, even basic AEB functions may not work. Furthermore, vehicle NVH (Noise, Vibration, Harshness) is a significant challenge for automakers. Although electric vehicles eliminate the loudest and most vibratory source—the engine—making NVH less difficult, many automakers boast about the sound-insulating materials used in their products. However, NVH is a systematic project; if sound-insulating materials alone could solve all problems, it wouldn't be considered a discipline. Proper modal isolation to avoid resonance is the fundamental solution to NVH issues, which also takes time. Reliability issues require rounds of Mule Car testing and functional/durability validation. Some manufacturers may skip certain steps to save time, which outsiders can rarely know unless they're insiders.

△Vehicle NVH is also a crucial aspect of overall vehicle quality

These issues may not be apparent during car purchases but will undoubtedly surface during usage. For users, ignorance is not a problem, but comparison is. After personal experience and comparing multiple models, they will realize that the invisible aspects are far more practical than flashy visible features. After all, a car is primarily a means of transportation. If car manufacturing becomes like phone manufacturing, problems will inevitably arise.

Commentary

BMW, Great Wall Motors, and other automakers' strategies to protect profits will likely impact short-term sales. However, for large automakers, both short-term sales and long-term corporate strategies must be considered. To some extent, implementing and achieving long-term strategies may be more crucial. The competition in smart electric vehicles is also a marathon, and this marathon may have just passed one-third. It remains to be seen who will emerge victorious.

(This article is originally written by Heyan Yueche and may not be reprinted without authorization)