Wake up! The price war simply won't stop

![]() 07/22 2024

07/22 2024

![]() 652

652

Introduction

"You can choose to withdraw, but that also means implicitly admitting defeat."

"You keep overspending, but we've decided not to follow suit!"

The biggest news in China's auto market in recent days has undoubtedly been the announcements by BBA (BMW, Benz, Audi) that they will comprehensively withdraw from the "price war" and no longer "exchange price for volume".

As for the underlying purpose, it is to alleviate the operational pressure on their dealerships to a certain extent and attempt to re-establish their luxury brand image through this move. The opening sentence of the article is more like a hidden subtext in their hearts.

Taking advantage of the situation, we learned from their sales personnel that some models of BBA that previously offered significant discounts have indeed slowly begun to increase their prices, adopting a posture of "ending the internal competition and returning to rationality".

More subtly, there are rumors online that in addition to BBA, joint venture brands including Volkswagen, Toyota, Honda, and Volvo will also adjust their car purchase policies from this month, reducing incentives and no longer further participating in the "price war".

Precisely based on this background, a voice is becoming increasingly fierce in China's auto market: "They've considered clearly and decided not to play this deadly game with you anymore, leaving only domestic brands to fight each other. It's clear who is more rational and who is more obsessed."

In their eyes, the "price war" has been going on for more than a year, causing countless casualties and widespread lamentations. With joint venture brands showing strong resistance, it may be gradually coming to an end.

However, attempting to refute the above viewpoint: "Perhaps it's overthinking. Choosing to withdraw can only implicitly prove that joint venture brands are starting to sacrifice market share to ensure profits, rather than ending up with no increase in revenue and a significant decline in sales. As for whether the price war will continue, how it will be fought, and when it will end, the initiative is no longer in their hands."

It's not alarmist; the bloody facts are right there.

In contrast, as the tide of electric vehicle transformation floods into every corner of China's auto market, as mentioned in today's article title: Wake up! The price war simply won't stop.

Why is there a price war?

To start this section, let's share a set of data.

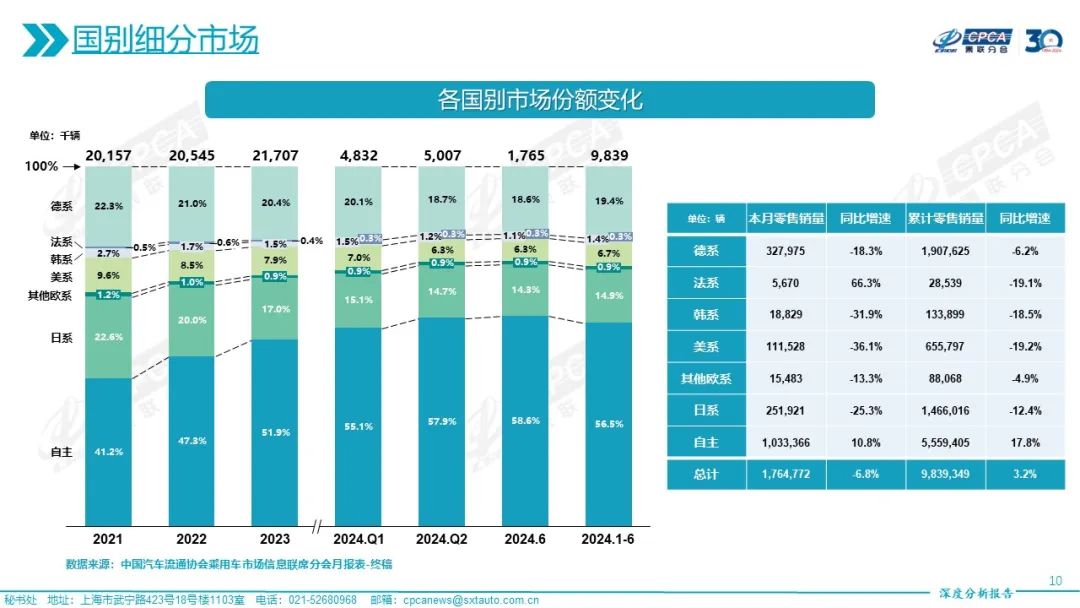

According to the June sales statistics released by the China Passenger Car Association (CPCA), retail sales of domestic brand passenger vehicles reached 1.03 million units, an increase of 10% year-on-year and 5% month-on-month. Domestic brand passenger vehicles accounted for 58.5% of the domestic retail market share, an increase of 9.3 percentage points year-on-year.

Correspondingly, among joint venture brands, German passenger vehicles accounted for 18.6% of retail sales, a decrease of 2.6 percentage points year-on-year; Japanese passenger vehicles accounted for 14.3%, a decrease of 3.5 percentage points; and American passenger vehicles accounted for 6.3%, a decrease of 2.9 percentage points. Not to mention Korean and French brands, which are already on the brink...

Obviously, who is aggressively seizing power and who is rapidly losing ground speaks for itself. And the reason for this outcome, the "price war" is undoubtedly to blame.

So, the new question arises: Why is there a price war?

On the surface, the reason is somewhat clichéd. Due to the continuous price reductions by BYD and Tesla from last year to this year.

More specifically, these two "big bosses" in their respective niche markets have officially reduced the prices of their most important main sales models to a terrifying price range, even at the cost of gross margins to secure abundant orders.

The remaining pursuers, facing the initiative of the leaders, can only either actively or passively "exchange price for volume," or they won't even have a chance to stay at the table.

Almost no one, whether domestic or joint venture brands, has escaped unscathed.

Looking deeper, the reason for the "price war," or why BYD and Tesla would actively start the conflict, is that China's auto market is in a new era of order alternation and rule reshaping. To thoroughly grasp the initiative and discourse power, they must lead the charge with all they have.

Continuing with June as an example, according to relevant statistics from the CPCA, retail sales of new energy vehicles have reached 856,000 units, an increase of 28.6% year-on-year and 6.4% month-on-month. From January to June this year, retail sales of new energy vehicles reached 4.111 million units, an increase of 33.1% year-on-year.

It can be said that the "rise" in sales is evident.

Correspondingly, the retail penetration rate of new energy vehicles in June continued to hit a record high of 48.4%, an increase of 13.5 percentage points from the same period last year, and is increasingly approaching the inflection point of 50%.

As the second half of the year begins, if this critical data does indeed cross the 50% threshold, then traditional gasoline vehicles will become the true "minority".

Moreover, it is foreseeable that after crossing the 50% threshold, the pace of new energy vehicles' expansion will not stop, and will even move forward with even greater strides, with the ultimate goal of converting all traditional gasoline vehicles.

In this process, the "price war" is the most brutal yet inescapable vehicle.

Reading up to here, some readers may question: "The more intense the price war, the less healthy China's auto market will become, and every automaker will have a hard time."

In rebuttal, I want to say: "We all understand the logic, but when the surging tide of reshaping the industrial landscape comes crashing down, it's not about being healthy or not. Right now, it's all about who has more resources, who has a thicker wallet, and who has stronger execution capabilities to withstand the wave after wave of price war consumption."

In short, China's auto market will inevitably become a winner-takes-all scenario.

In this process, for any brand, whether joint venture or domestic, to become the one that remains, it must excel in every dimension, maximize system efficiency, abandon all unrealistic fantasies, and treat every battle as a – decisive battle.

What is the essence of the price war?

"The current era is one of fast fish eating slow fish, not big fish eating small fish. If automakers don't surge ahead in the next 3-5 years, they won't have a chance. And in the next 3-5 years, the overall auto market or different segments will continue to engage in price wars."

This statement should be familiar to everyone. And the protagonist who uttered it is none other than Wang Chuanfu, the "helmsman" of BYD.

Looking back at the first half of the year, this brand, which has long claimed to be the "global leader in new energy vehicles," sold 1.607 million units, making it the undisputed "sales champion" of China's auto market, both from a brand and automaker perspective.

In the midst of the "price war," BYD has indeed benefited greatly.

But precisely because of this, it has almost become the "public enemy." Criticisms from all directions are directed at it. The demands are simple: "Stop excessive competition and stop lowering prices further."

But do you think BYD will compromise?

"Only through sufficient competition in China's auto industry can we force the industry to engage in technological races, continuously providing the market with better products and services, thereby extending Chinese brands globally and showcasing them to the world. The more competitive China's auto industry becomes, the stronger and better it will be!"

Perhaps, the speech delivered by Li Yunfei, General Manager of BYD Brand and PR, at the 2024 China Automotive Forum, combined with Wang Chuanfu's opening remarks, can serve as an answer.

From my personal perspective, I objectively believe: "The price war has always been fought and participated in based on one's own capabilities. As long as there is money to be made or profits to be gained within the corresponding system, there is no reason to stop voluntarily."

At present, the withdrawal of joint venture brands can be seen as their implicit admission of defeat.

After all, if they continue to engage in endless internal competition, they will inevitably suffer even greater backlash. But as mentioned earlier, choosing to step aside can preserve a bit of profit and dignity, but the corresponding cost is to arduously defend their positions and face even fiercer attacks from domestic brands.

The market share of joint venture brands will continue to be fiercely contested.

Writing up to here, let's move on to the next topic: What is the essence of the price war? In fact, it's not difficult to understand – it's the reshaping of the entire Chinese auto market's pricing system.

Looking back at the era of traditional gasoline vehicles, joint venture brands undoubtedly firmly held the definition rights for all popular products. So, for example, there were ingrained price ranges for A-segment sedans, B-segment SUVs, C-segment executive sedans, D-segment full-size SUVs, and so on.

At that time, all domestic brands could do was abide by these prices with a touch of humility. Even when some attempted to challenge and break the authority, they often returned empty-handed.

But in today's era of new energy vehicles, everything has changed dramatically, and the plot has completely reversed.

This time, we firmly hold the definition rights for all popular products. Therefore, the pricing system set by joint venture brands is already a thing of the past.

Who says A-segment sedans should sell for 150,000 yuan? Who says B-segment SUVs should sell for 250,000 yuan? Who says C-segment executive sedans should sell for 400,000 yuan? Who says D-segment full-size SUVs should sell for 1 million yuan?

Domestic brands instantly take on a domineering attitude: "I don't care what you think, I think what I think."

Recently, a conversation left a deep impression. In a discussion with a media teacher, they expressed great confusion: "The all-new Camry shouldn't sell for 140,000 yuan. That's Toyota! How could it have sunk to such a level?"

In response to their question, I directly replied: "The all-new Camry should sell for 140,000 yuan. Go take a look at how fierce domestic plug-in hybrids and pure electric sedans are. Toyota can continue to hold onto its high horse, but it must bear the consequences."

Similar viewpoints apply to all joint venture brands.

In the past, they were truly earning money comfortably lying down. Now, with the wave of electric vehicle transformation, domestic brands are undoubtedly using lower prices, better experiences, and more functions to hit them hard and fast, making them quickly taste the hardships of life.

At this moment, the landscape is still far from settled, and there is no definitive outcome regarding how domestic and joint venture brands will coexist in China's auto market.

So, you ask, "How will the price war stop?"

As this article gradually draws to a close, it's worth noting that in an article published at the end of last year titled "Without a Price War, There's No Chance of Survival," I predicted that this brutal battle would become even more merciless and unsparing.

The pricing system of every segment will be completely overturned and broken, and "catfish" will frantically stir up the red oceans. Both joint venture and domestic brands will have to shed their skin. Temporarily forgoing profits and fully pursuing market share is the universally recognized survival rule.

After 182 days of bitter struggle, every word is being fulfilled.