Not Afraid of Price Wars, BBA Collectively Raises Prices

![]() 07/22 2024

07/22 2024

![]() 615

615

Author | Lu Shiming

Editor | Da Feng

After BMW announced a price increase, a "defensive battle" for joint venture automakers officially began.Recent media reports have stated that sales at a BMW 4S store in Beijing's Chaoyang District indicated that prices for all models have risen, and several Beijing dealers also confirmed that BMW has begun to retract discounts from dealerships (4S stores) starting this week, with varying degrees of price increases across different models and configurations.Leading the way, Audi and Mercedes-Benz have followed suit.A Mercedes-Benz 4S store sales consultant stated that "prices will definitely rise next," and although Mercedes-Benz will not issue a formal notice like its competitors, prices will increase at any time, albeit not by a significant margin. Notably, the prices of Audi's main models such as the Q5L, A6L, and A4L have also seen minor adjustments upwards, with potential for further increases in the future.Since entering China three to four decades ago, BBA (BMW, Audi, and Mercedes-Benz) has long dominated the Chinese premium automobile market, leveraging their overseas brand advantages. For decades, they have firmly controlled the discourse in the Chinese premium automobile market, reaping substantial profits from the Chinese automobile market.However, the new era of automotive industry has arrived, and under the general trend of electrification and intelligence, the development of China's automotive industry has surpassed global expectations. The current collective price increase by BBA marks an important sign of a comprehensive withdrawal from price wars and is a testament to the rise of China's automotive industry.Price Cuts Do Not Equal Significant Sales GrowthIn terms of the intensity of competition in the automotive market, no country or region globally can match China's level of intensity.Over the past few years, major automakers have adopted price reduction strategies to compete for market share. Especially with the continuous rise of new-energy automakers, the "price war" in the luxury automobile market has intensified.As representative automakers of premium vehicles in the past, BMW, Mercedes-Benz, and Audi have actively participated in price wars over the past one to two years to defend their market dominance. Brands have significantly reduced prices, with many star models being sold at "bargain prices."Especially in the electric vehicle sector, media reports at the end of June this year stated that the BMW i3, one of BMW's models with the highest discounts, has seen its bare car price halved from the guidance price of 353,900 yuan, with the insured price after purchase dropping from around 250,000 yuan last year to below 200,000 yuan.

Image: BMW I3

On the Mercedes-Benz side, in Beijing, electric models such as the Mercedes-Benz EQS and Mercedes-Benz EQA have seen maximum discounts of up to 50%. Among them, the EQB has seen a discount of 48%, while models such as the Mercedes-Benz EQE, Mercedes-Benz EQE SUV, and Mercedes-Benz EQS SUV have all seen discounts exceeding 40%.Turning to gasoline-powered vehicles, before announcing the price increase, the starting price of the BMW 5 Series gasoline-powered vehicles dropped to around 310,000 yuan, equivalent to a 30% discount; certain Mercedes-Benz C-Class models offered price discounts exceeding 130,000 yuan; the Audi Q5L model started at 330,000 yuan, with a price reduction exceeding 120,000 yuan...Luxury brands actively participate in discounts to maintain market share. Despite significant price reductions, brand sales have not increased accordingly.In the second quarter of 2024, BMW's sales data showed that its global sales were 618,800 units, a year-on-year decrease of 1.3%; in the Chinese market, BMW sold 188,500 units, a year-on-year decrease of 4.7%.A similar situation occurred with Mercedes-Benz, which delivered over 352,600 units in China in the first half of 2024, a year-on-year decrease of 5.8% compared to the 374,600 units delivered in the first half of 2023. Additionally, Mercedes-Benz's electric vehicle sales remained sluggish, with 51,000 units sold in the second quarter of 2024, a year-on-year decrease of 23%.As for Audi, its cumulative sales for the first half of the year were 292,000 units, a year-on-year decline of 0.61% compared to the 294,000 units sold in the same period last year.

In fact, even Porsche has struggled with "price wars," with its high-end electric vehicle Taycan seeing monthly sales of only over 100 units despite maximum terminal discounts of up to 440,000 yuan. In the first quarter of this year, Porsche's total revenue was 9 billion euros, a year-on-year decrease of 10.8%; sales in the Chinese market during the same period declined by nearly 25%, to just 16,340 units.Significant price cuts failing to translate into sales increases have left BBA questioning themselves. Based on considerations of dealerships, profits, brand value, and other aspects, BBA has been forced to withdraw from price wars.Raising Prices to Protect Profits and Brand ValueUnder the traditional 4S store sales model, terminal discounts for automobiles are generally divided into two parts: one is the promotional subsidies provided by automakers, and the other is additional discounts offered by dealers to meet sales targets.When market conditions are good, dealers generally do not offer too many discounts. However, amid increasingly fierce price wars, dealers have to offer additional discounts to boost sales in order to meet factory targets, so most dealers may be operating at a loss when selling new cars.As price wars continue, dealer losses continue to intensify, and if automakers do not take measures, they may risk repeating the "rebellion" of Porsche dealers. Previously, after reports of authorized dealers collectively "rebelling," Porsche promptly appeased and addressed the situation, issuing a joint statement.

Source: Porsche ChinaWith BMW's current price increase, appeasing dealers is undoubtedly the top priority. By increasing ex-factory prices, it can help dealers alleviate operational pressures to a certain extent and maintain a stable sales network.BMW insiders have also responded that BMW will alleviate store operational pressures by reducing sales volumes starting in July, aiming to help dealers cope with short-term market challenges and ease business pressures.In addition to considering dealers, profits are also of utmost importance.After participating in price wars for two years, the cost of BBA's price-for-volume strategy has become apparent. For BMW, last year's net profit declined by over 30%, and its EBIT margin for the automotive business was 9.8%, lower than market expectations.With BBA withdrawing from price wars, an overall decline in sales is inevitable, but profits may not necessarily continue to decline. From a product perspective, if the decrease in sales volume is less than the increase in unit prices or the decrease in unit costs, profits will rise.Stabilizing sales channels and ensuring current profits are the "immediate" reasons for BBA's price increase, but in the long run, the price increase is more about protecting their brand value.

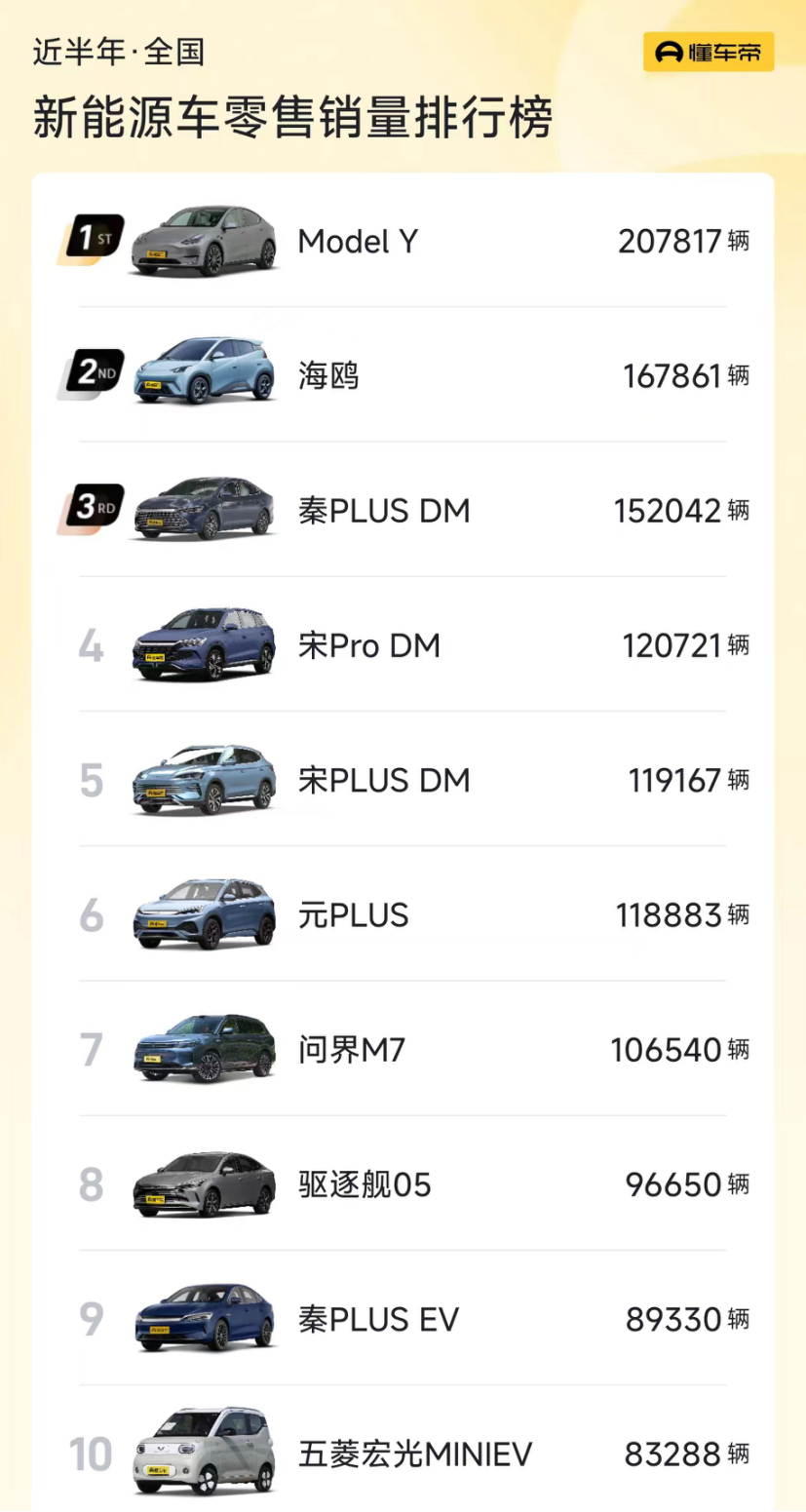

Gaining market share through large-scale price cuts can stimulate sales growth in the short term, but in the long run, this approach damages brand value and product positioning. Through these years of price cuts, BBA has significantly devalued its brand, to the point where there are even sayings like "if you don't work hard, you can only drive BBA."If price cuts continue until the luxury positioning no longer exists, there will be no market position left at all. By raising prices while the brand value has not yet been completely destroyed, attracting high-end users back may allow BBA to continue enjoying a few more years of prosperity. But this is a risky bet on the appeal of BBA's luxury positioning.One view is that once the public has developed a perception of low prices for a company, its brand value cannot be restored.The Glory of Joint Venture Vehicles Is Rapidly FadingIn fact, it's not just BBA. Second-tier luxury brands such as Jaguar Land Rover, Cadillac, Lincoln, Lexus, and Volvo, as well as joint venture automakers like Volkswagen, Toyota, and Honda, have all decided to adjust their terminal policies from July, reducing terminal discounts or refraining from further price cuts.According to reports by Red Star Capital Bureau, some joint venture automaker dealers stated that they had not received formal price adjustment notices from brand owners but would adjust dynamically based on market conditions, holding a positive attitude towards "reducing volume and stabilizing prices."From this perspective, this is not a unique phenomenon in the luxury automobile market but a "collective action" by joint venture automakers as a whole. However, the outcome of this "group hug" is not optimistic.The automotive market is either about price competition or technological competition. Failing to compete means either insufficient innovation capabilities, technical strength, or cost control abilities; without any of these, the only option left is to pack up and leave.The reason joint venture automakers have been able to charge a premium for so many years is based on their technological foundation. However, relying on the brand value accumulated during the gasoline-powered era to increase premiums in today's highly competitive market is akin to "using a sword from a previous dynasty to behead officials of the current dynasty."Currently, domestic automobile brands are gaining momentum rapidly and have firmly established themselves in the A-to-C segment. Especially in the new energy sector, they have completely "penetrated" joint venture brands.At BYD's 2023 financial report investor communication meeting, BYD Chairman Wang Chuanfu believed that the new energy industry has entered a knockout stage, with 2024 to 2026 being decisive years for scale, cost, and technology. The accelerated launch of new energy products by Chinese automakers will erode the market share of joint venture brands, and over the next 3 to 5 years, the share of joint venture brands will drop from 40% to 10%, with 30% of this decline representing growth opportunities for Chinese brands.

Source: Autohome

Currently, signs of a collapse among joint venture brands in China are emerging. For example, Korean cars have completely failed, and the sales of the three major Japanese automakers have declined significantly in China. Compared to the collapse of Japanese automakers in China, German brand sales, while still stable, are growing at a much slower pace.

With the fact that China's automotive industry has "stood up," the mindset of Chinese consumers has also undergone significant changes.

It is undeniable that there is still a segment of consumers, especially those born in the 1970s and 1980s, who place greater emphasis on brand reputation, believing that traditional brands have a long history, rich technological heritage, and more mature manufacturing processes, making them more stable and reliable choices. However, the proportion of consumers holding this sentiment is gradually declining.As for the larger young demographic, they are no longer willing to pay exorbitant premiums for no value, instead favoring intelligent configurations and turning to domestic independent brands, with significantly increased trust and recognition in domestic automobiles.

Times change, and the glory of joint venture vehicles is rapidly fading, while Chinese automobiles are walking on a path of continuous improvement and prosperity.