The first half of new energy vehicles: an average of one premium model per month, pushing the limits to the extreme

![]() 07/23 2024

07/23 2024

![]() 576

576

These five models are the most significant!

Half of 2024 has passed, and the new energy vehicle market has been incredibly vibrant during this period, with numerous groundbreaking new products being launched.

Xpeng X9 was launched on New Year's Day, followed by Li Auto's MEGA on March 1st. These two new models marked the beginning of new-energy brands expanding their product lines, indicating that some brands have firmly established themselves in their original segments and are seeking a second growth curve;

Since the Spring Festival, BYD has relied on multiple "Glory Edition" models to launch its offensive, culminating in the launch of the groundbreaking new Qin L DM-i on May 28th, hoping to revolutionize the market landscape of A-segment vehicles;

Xiaomi SU7 was officially launched on March 28th, dominating the automotive news cycle for weeks after its release, earning the title of "King of Popularity," and its sales performance was also impressive, delivering over 10,000 units per month for two consecutive months, making it the "dark horse" of the year.

……

They are the focus of attention, but also just the tip of the iceberg. Looking back at the first half of 2024, one "blockbuster" after another has reshaped the entire market order to a certain extent, and the competitive landscape in multiple segments has also changed accordingly. Standing at this juncture, reviewing the significance of these key products that emerged in the first half of the year can help us better understand the market competition in the second half. Generally speaking, the pace of competition will continue to be driven by "blockbusters."

And we have come to realize, somewhat belatedly, that we may have witnessed the birth of multiple "classics" in 2024 so far.

BYD Qin L: Igniting the endurance debate for hybrid vehicles

It was expected that the Qin PLUS DM-i Glory Edition and the Destroyer 05 Glory Edition, which kicked off the price war in the automotive market after the Spring Festival holiday, would be enough to make other family sedans pale in comparison. Little did we expect that the Qin L, launched at the end of May, would be the real "trump card."

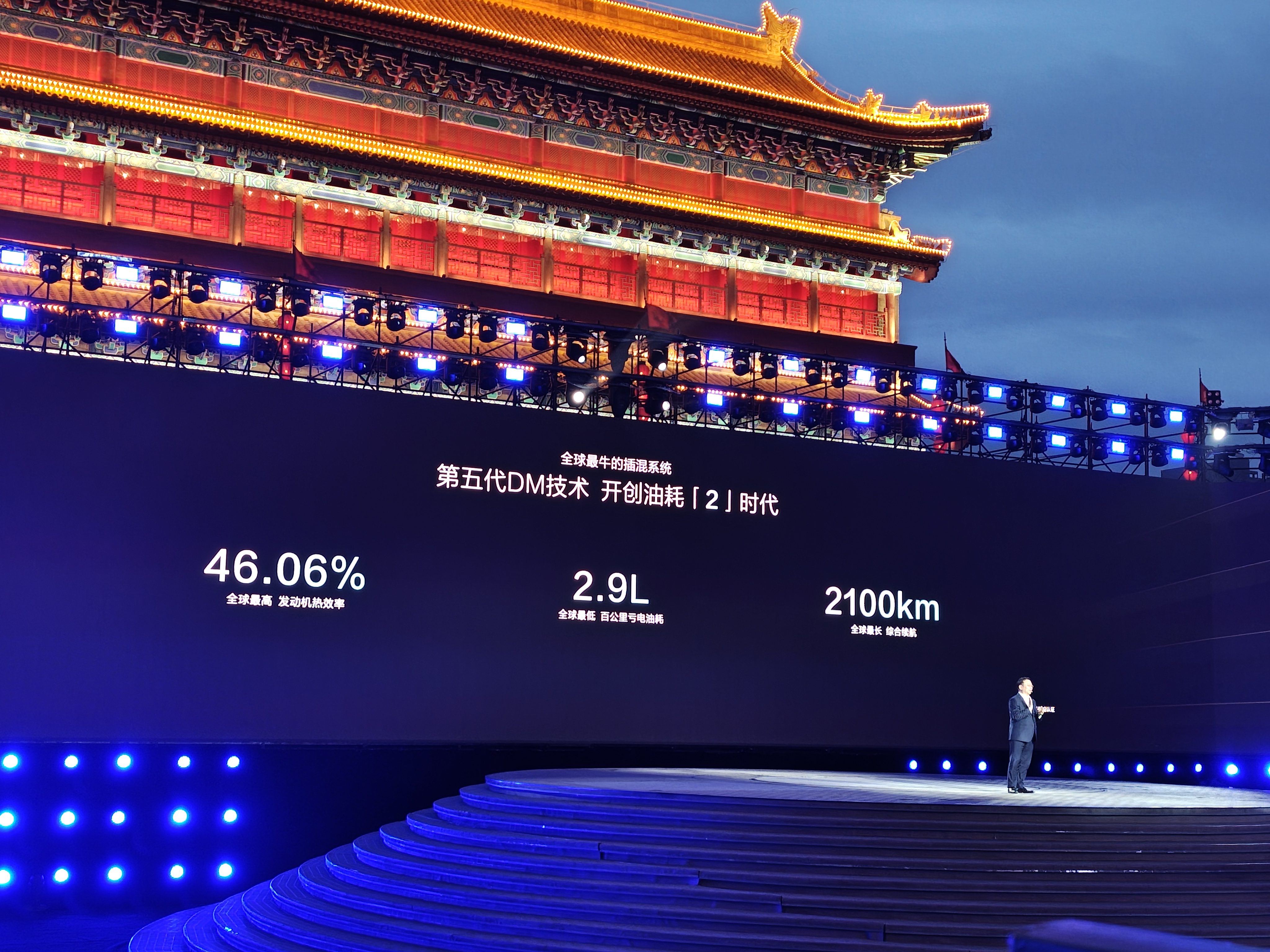

To be honest, the Qin PLUS DM-i, equipped with the fourth-generation DM technology, has a fuel consumption of 3.8L per 100km when the battery is depleted and a comprehensive driving range of 1200km, which many users already consider the "ceiling" of fuel efficiency for family sedans. The fifth-generation DM technology directly achieves a thermal efficiency of 46.04% for the engine, a fuel consumption of 2.9L per 100km when the battery is depleted, and a comprehensive driving range of 2100km, coupled with a starting price of RMB 99,800, directly propelling the Qin L into the spotlight. According to official data, Qin L sold 20,100 units in June, accounting for nearly 30% of the total sales of the Qin family.

In fact, Qin L is not the first product to claim a comprehensive driving range of over 2000km. Before Qin L's launch, Dongfeng Aeolus L7, Chery Fengyun A8 Voyager Edition, etc., all stated that they could achieve a comprehensive driving range of over 2000km, but only Qin L's 2000+km endurance capacity has sparked widespread discussion, undoubtedly due to BYD's influence in the new energy market.

I participated in BYD Qin L's energy-saving race and was indeed impressed by its energy consumption performance: driving 100km in the morning rush hour in downtown Guangzhou, experiencing two long periods of congestion, Qin L still achieved a comprehensive fuel consumption of 2.48L per 100km. Although I couldn't directly experience Qin L's 2000+km comprehensive endurance, such energy consumption performance is clearly within the affordable range for most family users.

For the brand, as the first product to adopt the fifth-generation DM technology, the popularity of BYD Qin L has laid a solid foundation for the comprehensive application of the fifth-generation DM technology in the future. According to the plan, new models such as Song L DM-i, Song PLUS DM-i, and HiPhi 05 will be launched this year. With the market recognition of Qin L and Seal 06, new models equipped with the fifth-generation DM technology are expected to be more easily accepted by mainstream audiences. For other automakers, if they want to seize market share from BYD, relying solely on price competition may soon become unfeasible, and they must also engage in a real battle in the technological field.

Xpeng X9: An unintended benchmark for pure electric MPVs

Xpeng X9 is the first new model to be launched this year and the first MPV from the new-energy camp. In China, the reasons for MPV buyers to purchase are quite simple: either for family use or for business travel. As such, they attach great importance to the safety and market reputation of the product, with preferred models being new vehicles like the Denza D9 and Buick GL8. In contrast, new-energy brands have not yet had a best-selling precedent in the MPV market, and MPVs launched by new-energy brands are difficult to gain user recognition.

Moreover, due to the insufficient charging infrastructure, high-end pure electric MPVs like the Zeekr 009, Denza D9 EV, and NIO Dream Home EV have not received much positive feedback in the market. As soon as Xpeng X9 was first exposed, I was already concerned about its prospects. Moreover, Xpeng's performance in the first half of 2023 was not optimistic. Although the launch of the Xpeng G6 and the new Xpeng G9 reversed the downturn, Xpeng still needed a more volume-driven product to stabilize sales.

Regarding the pure electric powertrain and charging capabilities that consumers care about, Xpeng X9 focuses on showcasing solid driving range, with a maximum driving range of 720km, a fuel consumption of 16.2kWh per 100km, and the ability to add 300km of range in just 10 minutes of charging, which has indeed changed many consumers' perceptions of pure electric MPVs. In addition, the inclusion of standard features such as rear-wheel steering, "refrigerator, TV, big sofa," the XOS Tianji intelligent cockpit system, and the intelligent dual-chamber air suspension makes Xpeng X9 more competitive in the 400,000-yuan MPV market.

In terms of sales, Xpeng X9 became the sales champion in the pure electric MPV market in the first half of the year with a cumulative sales volume of 13,143 units, ranking first in the "pure electric MPV market above 300,000 yuan" list every month.

In terms of performance, Xpeng X9 certainly does not yet have the strength to compete with models like the Denza D9 and Buick GL8, but the fact that Xpeng X9 has achieved such results indicates that its product strength is not an issue, and the main obstacle to its development is the charging infrastructure. However, with the launch of new models like the Li Auto MEGA, Zeekr 009 Guanghui, and LEVC L380, as well as the unveiling of the Zeekr MIX and Volkswagen ID.BUZZ, it proves that some automakers still believe in the development potential of the high-end pure electric MPV market, so the future of this segment is worth looking forward to.

It is worth mentioning that the Li Auto MEGA originally had a good chance to become a must-mention typical product in the first half of the year, but in the end, we believe that Xpeng X9 deserves more discussion. The reason is simple: when a product only excels in early public opinion but falters in later sales, I consider it an "unsuccessful" product.

To discuss this objectively, sales figures speak for themselves, and Xpeng X9 is currently the "correct answer" for pure electric MPVs.

Xiaomi SU7: A disruptor in the pure electric sedan market

In terms of sales, BYD is undoubtedly more popular, but in terms of brand heat, Xiaomi Automobile is not far behind. With the "three-year agreement" now fulfilled, Xiaomi Automobile has launched the pure electric sedan Xiaomi SU7, which received an impressive 88,898 orders within 24 hours of its launch. Such a performance is indeed hard to imagine for a new-energy brand.

Before the launch of Xiaomi SU7, the best-selling pure electric sedan in the over-200,000-yuan segment was the Tesla Model 3, with monthly sales exceeding 10,000 units. The only models that could barely compete were the BYD Han and Zeekr 001. After the launch of Xiaomi SU7, its monthly sales quickly reached the 10,000-unit level, selling 14,296 units in June, while the Model 3 sold 18,151 units in the same month. Although Xiaomi SU7 has not yet dethroned the Model 3, it has already captured a significant share of the Model 3's market.

Why has Xiaomi SU7 been able to quickly attract such high sales? In my opinion, it is partly due to Lei Jun's personal charisma. Lei Jun mentioned in his annual speech on July 19th that many "Mi Fans" placed orders without even test-driving the car. The other reason is its strong product competitiveness.

Thanks to the powerful OS system that integrates the car, home, and user, Xiaomi SU7 offers a stronger and more comprehensive intelligent experience compared to competitors like the Model 3 and Zeekr 001. It not only achieves deep interconnection between mobile phones and the infotainment system but also enhances voice recognition and control capabilities with the addition of the XiaoAI large model. For users who already have a "Xiaomi ecosystem," Xiaomi SU7 can maximize the functionality of Xiaomi's connected devices.

In terms of hardware, Xiaomi SU7 is a pure electric sedan that prioritizes driving pleasure. Performance and handling are essential, with a 0-100km/h acceleration time of 2.78 seconds and a top speed of 265km/h. The chassis also incorporates a full-stack self-developed control algorithm, resulting in better shock absorption and braking performance. For range, the entry-level Xiaomi SU7 offers a CLTC pure electric driving range of over 700km, which is also impressive in the over-200,000-yuan pure electric sedan market.

As for its true product significance, I believe that Xiaomi SU7 has awakened new energy consumers' interest in "performance" and "sportiness," a result that should surprise many people. I expected Xiaomi SU7 to be the best ambassador for "intelligence," but given the current development progress, Xiaomi SU7 may only lead in the cockpit area, with average performance in other areas like autonomous parking and intelligent driving.

Regardless, the arrival of Xiaomi SU7 has injected more vitality into the industry and attracted many consumers who were previously not interested in new energy vehicles. For this alone, Xiaomi SU7 deserves credit.

Leapmotor C10: Pushing the limits to the extreme

Before the launch of Xiaomi SU7, there was a new-energy brand in China known as the "Xiaomi of the automotive industry" that was quietly rising, namely Leapmotor. Like Xiaomi in the tech sector, while other new-energy brands were striving to establish their high-end brand positioning, Leapmotor unapologetically showcased its "high cost-performance" products. The Leapmotor C10, launched in early March, was the first new energy SUV from the new-energy camp this year, and subsequent new-energy SUVs like the Li Auto L6 and Nezha L have also followed suit with high cost-performance offerings.

The Leapmotor C10 is priced between RMB 128,800 and RMB 168,800, offering both extended-range and pure electric powertrains. In terms of hardware, the Leapmotor C10 is positioned as a mid-size SUV with a high "usable space ratio" of 66.8%, and it comes equipped with features like the "big bed mode" and comfortable seats. The more notable aspect is its intelligent configuration. In terms of range, which users pay close attention to, the extended-range version of the Leapmotor C10 offers a pure electric driving range of 210km, making it well-suited for family use scenarios: on the one hand, it eliminates range anxiety for long-distance travel, and on the other hand, it reduces charging costs for short- and medium-distance trips.

Based on the advantages of the LEAP 3.0 platform, the 8295 chip in the Leapmotor C10 fully unleashes its computing power, driving not only the infotainment system but also basic assisted driving functions and audio systems. More importantly, the Leapmotor C10 utilizes the NVIDIA Orin-X chip and lidar specifically for intelligent driving, enabling NAP in both highway and urban environments.

SUVs in the RMB 130,000 price range are not uncommon, but few offer the spaciousness of a near-mid-size SUV and advanced intelligent features like the Leapmotor C10. Admittedly, Leapmotor's influence in the domestic market is far less than that of traditional independent brands and the "NIO-Xpeng-Li" trio, but with its sincere cost-performance "killer app," Leapmotor has successfully entered the first tier of new-energy brand sales, with monthly sales in June second only to Li Auto.

However, in the long run, "involution" is always a temporary measure. Whenever there's a slight breather, car manufacturers should allocate some effort to honing their core competencies. The reason for this is that the reputation of Leapmotor's products still has room for improvement. We often see users criticizing Leapmotor's products on platforms like Car Quality Network. Little Tong is certainly aware that "affordability" comes with its own trade-offs, but Leapmotor should also keep an eye on the "poetry and the distant lands."

Deep Blue G318: More Possibilities for Off-Roading

When Deep Blue Auto released the Deep Blue G318, Little Tong's first reaction was surprise. After all, Deep Blue Auto has always relied on the Deep Blue S7 and Deep Blue SL03, two new energy models oriented towards household use, to establish its market presence. Would a sudden entry into the off-road vehicle market be recognized by the market?

Upon further investigation, it was discovered that the main reason supporting Deep Blue's launch of an off-road vehicle is their Deep Blue Super Range Extender 2.0 technology. The Deep Blue G318 is the first new energy product to feature this technology. Technically speaking, its electric drive, range extender, and battery have all been comprehensively upgraded. Entering the 2.0 era, the official statement claims that 1 liter of fuel can generate 3.63 kWh of electricity. This fuel-to-electricity conversion efficiency is the highest among mass-produced vehicles globally, translating to one tank of fuel generating 218 kWh of electricity. Additionally, the electric drive system's integration and power density are higher, and the thermal efficiency of the new Blue Whale engine reaches a top-notch 44.28%.

Thanks to this strong power generation capability, the Deep Blue G318 can excel in outdoor experiences—supporting 6kW external discharging, 12kW stationary parking power generation, and 3.3kW internal discharging power. This is a level that other off-road models have yet to match.

Notably, during the launch event for the Deep Blue G318, the company directly compared the "Deep Blue G318 = Li Auto L7 + Leopard 5" to convey that the Deep Blue G318 combines the functions of a city SUV and an off-road vehicle, without any fear of offending these two competitors.

In terms of urban driving capability, the Deep Blue G318 stands out in its low energy consumption. Data shows that the pure electric range for the two-wheel-drive and four-wheel-drive versions is 190 km and 184 km, respectively. This means that short to medium distance trips can be almost entirely electric. Even in low-battery scenarios, the fuel consumption for the two-wheel-drive and four-wheel-drive versions is 6.1L/100 km and 6.7L/100 km, respectively. In contrast, traditional hardcore off-road vehicles have urban fuel consumption of at least 10L/100 km.

Regarding the off-road capabilities required for rugged terrains, the Deep Blue G318 is equipped with the ET All-Terrain System, offering multiple modes to adapt to various environments. While many off-road vehicles can do this, what’s particularly challenging to achieve in a vehicle priced around 200,000 RMB is including the R-EPS steering system and configurations like air suspension, CDC, and active magic carpet systems.

Most consumers likely do not need a pure off-road vehicle. Their primary usage scenarios are concentrated in urban or suburban areas, and a vehicle with moderate off-road capabilities would already meet their needs. On top of that, the Deep Blue G318 also offers good fuel efficiency.

Leveraging new energy technology and the manufacturing system advantages of Chang'an Automobile Group, the market response to the Deep Blue G318 has been very enthusiastic. According to official data, the Deep Blue G318 received 14,126 orders within 120 hours of its launch. Deliveries are planned to begin in mid-August. Comparing it to similar models like the Jetour Traveler and Haval Big Dog, which have monthly sales of around 6,000 units, the initial popularity of the Deep Blue G318 demonstrates strong market acceptance. Future releases will include other "boxy" SUVs like the Jetour Shanhai T1 and the iCAR V23. With its robust capabilities, it will be interesting to see how long Deep Blue Auto can maintain its momentum in the off-road vehicle market.

Fiercer Competition, Harsher Reshuffling

In addition to the five new energy products mentioned earlier, the first half of the year saw the launch of several other significant models. These include the Chery Fengyun A8, which directly competes with the Qin PLUS DM-i, the premium domestic sports car Yangwang U9 priced over a million RMB, the Kia EV5 720 Long-Range Version with a pure electric range exceeding 700 km priced under 200,000 RMB, and the range-extended model Lantu FREE 318, which pushes pure electric range to 318 km.

Relatively speaking, the new cars appearing in the first half of 2024 feature a richer array of characteristics. To put it more simply, they are "capable of capturing consumer interest." Whether through innovative design or advanced technology, car manufacturers have various strategies to attract consumers. In any case, the first half of 2024 is not lacking in "star products."

Looking at these new cars, many are aimed at mainstream market segments, focusing on low energy consumption and high configurations. These cars provide a solid foundation for brand profitability. Notably, niche products like the pure electric MPV XPeng X9 and the rugged off-road SUV Deep Blue G318 have also gained recognition.

This indicates that even though niche markets carry certain risks, as long as car manufacturers innovate in technology and products without losing sight of consumer needs, consumers will gradually accept these niche new energy vehicles. Moreover, these niche products becoming hits suggest that the new energy vehicle market is moving towards diversification, which is beneficial for both consumers and the overall market development.

According to the product plans of various car manufacturers, the competition in the car market will only intensify in the second half of the year compared to the first half. First, for emerging brands, HarmonyOS Autopilot's first pure electric coupe SUV, the Zhijie R7, and the executive sedan, the Xiangjie S9, will be launched in the second half. Although these two products are not as mainstream as the Wenjie M7, they are likely to gain significant attention in their initial launch phase due to Huawei's brand influence.

NIO's sub-brand, Ledo, will officially launch the Ledo L60 in September. This pure electric mid-size SUV, positioned against the Model Y, has the battery-swapping advantage that the Model Y lacks. Can the Ledo L60 leverage this advantage to "dethrone" the Model Y?

XPeng's MONA M03 will be launched in August. Will its price range of around 100,000 RMB and intelligent driving advantages boost XPeng's sales?

Looking at traditional brands, groups like BYD, Geely, GAC, and Changan also have significant products to release. Besides continuing to enrich the Ocean and Dynasty series, BYD will launch the large SUV Leopard 8 and the mid-size pure electric SUV Leopard 3.

Under Geely, models like the Galaxy E5, Lynk & Co Z10, Zeekr MIX, and Ji Yue 07 have been revealed, all of which will be released in the second half.

Aion's second-generation AION V is confirmed to be launched on July 23. Changan Automobile Group's Avatr 11, Avatr 12, and Avatr 07 will be equipped with the latest Huawei QianKun 3.0 system, further enhancing their intelligent driving capabilities.

These new cars primarily cover mainstream new energy market segments. Given the influence and capabilities of these brands, the pricing and configurations of these new products may redefine consumers' expectations. Even a strong player like BYD might feel the competitive pressure from so many new releases.

Analyzing market development patterns, such intense competition often signals an impending major market reshuffle. The dense scheduling of product launches in the second half of 2024 includes some products from mid-to-lower-tier car manufacturers making a final effort. If they fail to succeed with these new releases, they may be completely eliminated.

From my perspective, the development of new energy vehicles has reached the ceiling of current technological levels on multiple fronts. Battery technology cannot break through in the short term, and the potential for further advancements in intelligence has been exhausted. Upon closer inspection, many current new energy vehicles are highly homogenized, leaving car manufacturers to seek differentiation through design.

In other words, the market growth driven by technological advancements has nearly disappeared. What awaits the extensive car manufacturers is a brutal elimination race.

Even executives like Yu Chengdong believe that the market will eventually consolidate until only a few car manufacturers remain. While such a future may still be some distance away, we should be prepared: the reshuffling may have already begun.