Top 10 new energy vehicle sales for the latest week (7.15-7.21)

![]() 07/24 2024

07/24 2024

![]() 609

609

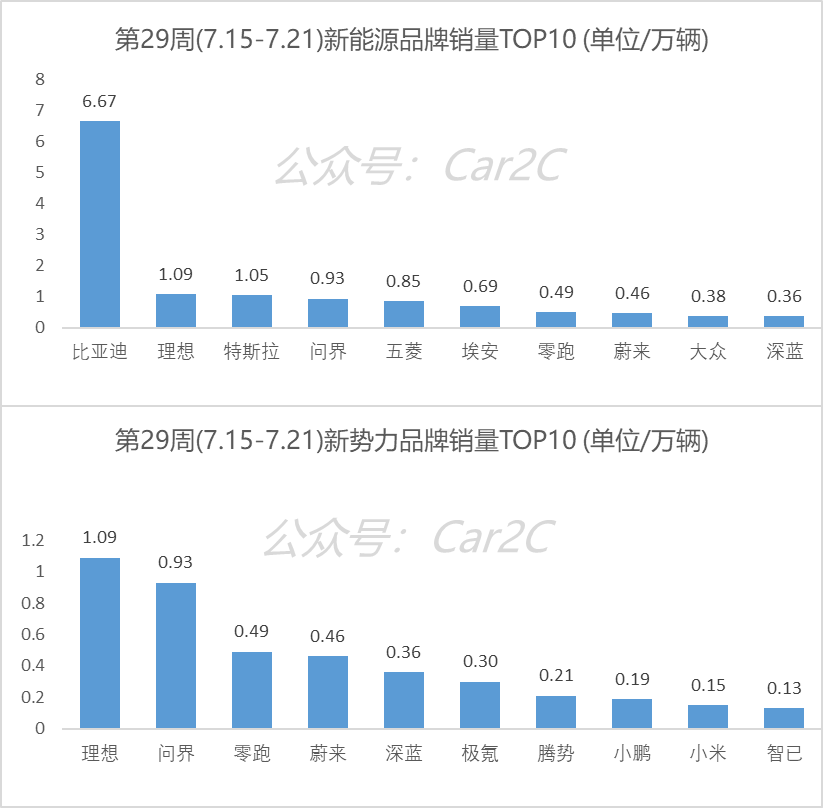

Weekly sales of new energy vehicles for the 29th week of 2024, with the top 5 automakers' positions basically stabilizing. BYD ranks first with sales reaching 66,700 this week, and the new Wangchao L series cars are still in the ramp-up phase;

Lixiang ranks second with sales of 10,900. On the one hand, the increase in L6 sales has lowered the average vehicle price level, but the delivery speed seems to have started to decline. By offering a limited-time RMB 10,000 discount on car purchases and introducing self-developed intelligent driving systems, Lixiang aims to stimulate terminal order volumes;

Tesla ranks third with weekly sales of 10,500, roughly the same as in the past. However, its brand and autonomous driving halo are facing a gradual weakening situation, but it still has a first-mover advantage compared to other foreign brands;

Wenjie ranks fourth with sales of 9,300, basically stable. Subsequent growth will mainly come from new models like Xiangjie and Zunjie series. Huawei has sold the brand ownership to automakers and will start expanding its intelligent driving market share and data coverage through three BU models, such as launching ADS SE models with Shenlan under the HI mode, ultimately enhancing the overall performance of the intelligent driving system;

The specific top 10 insured sales numbers for each brand are shown in the figure below: (Unit/10,000 vehicles)

Terminal order situation: 1. Lixiang has accumulated 30,000 confirmed orders in July, with 12,000 last week. Customers began to rush sales in the late July, with the proportion of high-end intelligent driving exceeding 55%. The weekly sales policy of 1.99% low-interest loans has had a significant stimulating effect. 2. Hongmeng Intelligent Driving has accumulated 16,000 to 16,500 confirmed orders in July, with 6,500 last week. The number of store visits has slightly recovered, with no changes in benefits policies, and the focus remains on channel integration. Note that the proportion of M9 is still increasing, accounting for 50~55% in the third week of July and 45% cumulatively this month. 3. NIO has accumulated 14,500 to 15,000 confirmed orders in July, with 5,300~5,700 last week. As benefits policies continue to decline, stores are pushing for a slight increase in orders. 4. Zero-Run has accumulated 21,000 confirmed orders in July, with 7,300 last week. Cumulative orders for C16 have exceeded 10,000, and deliveries this month are expected to exceed 20,000. 5. Xiaomi has accumulated 9,300~9,500 confirmed orders in July, with 3,200~3,400 last week. The delivery cycle is too long, and the situation remains the same as last week, with new orders coming from the expansion of new channels. 6. BYD has accumulated 215,000~220,000 confirmed orders in July, with 75,000~80,000 last week. Sales continue to rise slightly, with accelerated terminal production and delivery of Qin L and Haibao 06. Song L DMi has started entering stores, and customers are showing strong wait-and-see sentiment.

7. BMW has withdrawn from the price war, and frontline sales have declined by 20%~25% after raising prices in July.