Dongfeng and Changan Mulling Over Reorganization?

![]() 02/27 2025

02/27 2025

![]() 677

677

Restructuring Central Enterprises

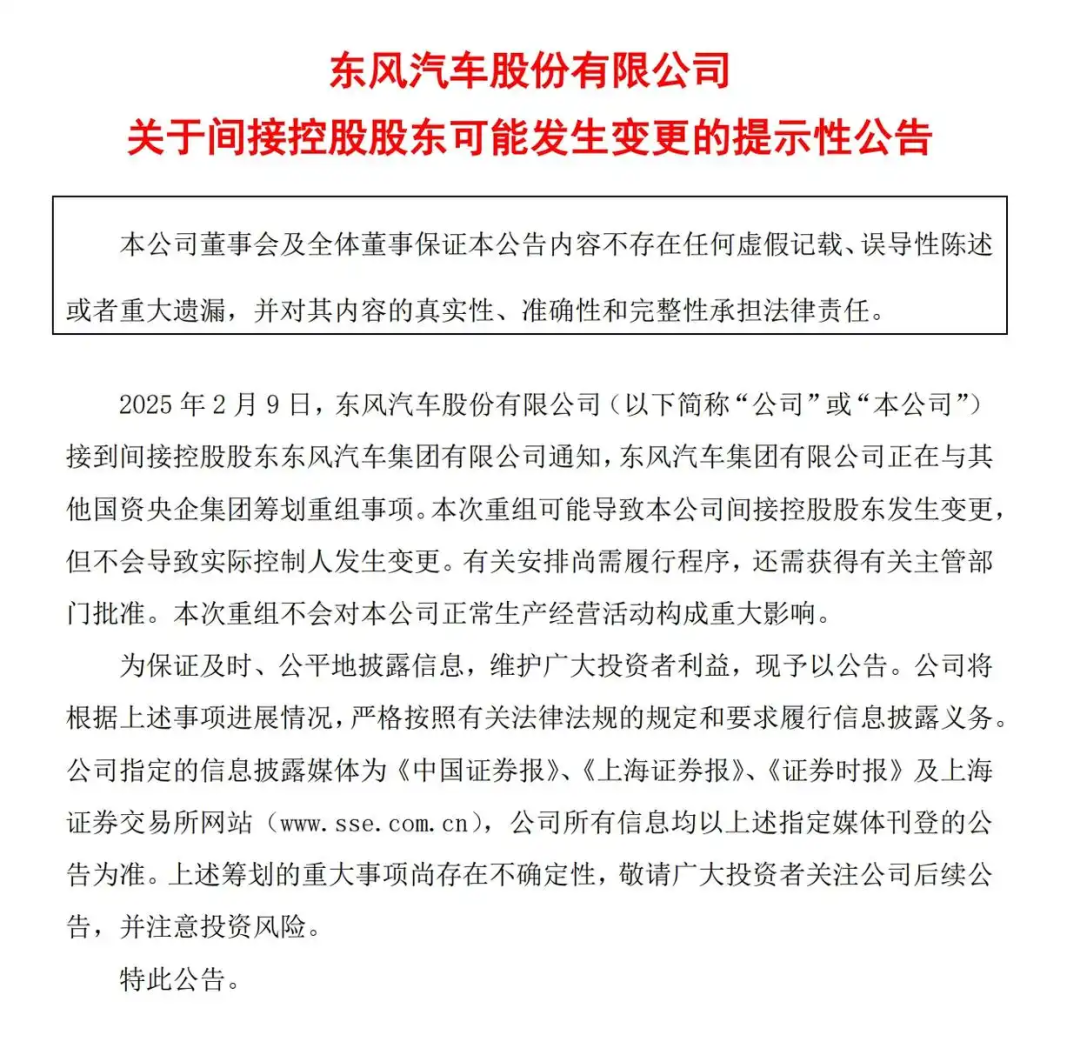

Recently, several listed companies from Dongfeng and CSGC (China South Industries Group Corporation) have disclosed that their indirect controlling shareholders/controlling shareholders might undergo changes. The announcements indicate that Dongfeng Motor Group Co., Ltd. (hereinafter referred to as "Dongfeng Motor") and China South Industries Group Co., Ltd. (hereinafter referred to as "CSGC") are contemplating restructuring with other state-owned enterprises, although the announcements emphasize that this will not lead to a change in actual controllers.

Image source: Dongfeng Motor

Although the announcements did not explicitly mention each other as the target of the restructuring, the coinciding timing and content have led the industry to believe that there is a certain degree of interconnection between the two companies.

On February 17, CSGC underwent a leadership change with Zhou Zhiping, Director, General Manager, and Deputy Secretary of the Party Committee of Dongfeng Motor, assuming the roles of Director, General Manager, and Deputy Secretary of the Party Leadership Group of CSGC. This personnel change, occurring during a pivotal period of restructuring turbulence, has once again sparked new speculation regarding the reorganization of the two automakers.

Previously, rumors circulated that Dongfeng Motor and Changan Automobile's automotive businesses would merge into a brand-new automotive group, with Zhou Zhiping serving as the general manager of the "new company" post-restructuring. However, as of now, neither Dongfeng Motor nor Changan Automobile has released any definitive information.

Since 2024, SASAC (State-owned Assets Supervision and Administration Commission of the State Council) has repeatedly emphasized that central enterprises need to enhance their core competitiveness through "strategic reorganization + professional integration," particularly in the field of new energy, where accelerated breakthroughs are essential.

Based on this, the recent restructuring news from Dongfeng Motor and Changan Automobile has garnered significant attention. The industry anticipates that the actual realization of the restructuring of the two companies will result in the formation of China's largest automobile group. Public data shows that Changan Automobile achieved total sales of 2.68 million vehicles in 2024, while Dongfeng Group sold 2.48 million vehicles, bringing their combined sales to 5.16 million vehicles, making them the overnight sales champion of Chinese automobiles.

National Team Assembly

This is not the first time that news of the restructuring of Dongfeng Motor and Changan Automobile has surfaced. As early as 2015, during the large-scale restructuring of central enterprises, the exchange of leaders between Dongfeng Group and FAW Group was seen as a prelude to a merger. At that time, Zhu Yanfeng took over Dongfeng Motor, while Xu Ping was transferred to FAW Group. In 2017, another personnel change occurred, with Xu Liuping, the former general manager of CSGC, appointed as the new chairman of FAW Group. Simultaneously, Xu Ping was transferred to CSGC to serve as chairman. Subsequently, Liu Weidong, the deputy general manager of Dongfeng Motor, was transferred to CSGC, and Lei Ping, the vice president of Dongfeng Motor Corporation Limited, moved to FAW to serve as deputy general manager. You Zheng, the head of FAW Group's product planning and project department, was transferred to Dongfeng Motor Group to serve as deputy general manager.

From 2017 to 2018, FAW, Dongfeng, and Changan, three central enterprises in the automotive industry, signed a strategic cooperation framework agreement and jointly launched T3 Mobility. In 2024, China FAW intended to invest and hold a controlling stake in Lishen Qingdao, a subsidiary of China Chengtong, with CSGC and Dongfeng Group participating simultaneously to jointly build a leading state-owned battery enterprise and promote the high-quality development of the new energy vehicle business of central enterprises. For a long time, rumors of a merger among the three automotive central enterprises have persisted. As the new energy market enters a more competitive second half, automotive companies generally adopt a focusing strategy to impact the global market with a more efficient posture. The restructuring of Dongfeng Motor and Changan Automobile seems reasonable. Some believe that Dongfeng Motor and Changan Automobile, both belonging to the central enterprise camp, can maximize the efficiency of state capital by eliminating internal friction through restructuring.

Image source: Dongfeng Motor

In March 2024, Zhang Yuzhuo, the Director of SASAC, publicly stated during the first "Ministers' Channel" centralized interview activity of the Second Session of the 14th National People's Congress that the development of state-owned new energy vehicle enterprises was not fast enough, "not as good as Tesla, not as good as BYD," and therefore policies would be adjusted to conduct separate assessments of the new energy vehicles of the three central enterprises.

Almost simultaneously, Gou Ping, the Deputy Director of SASAC, also pointed out at the China Electric Vehicle Hundred People Forum (2024) that it is necessary to face up to the gaps and deficiencies in the development of central enterprises in the new energy vehicle industry, increase resource investment, accelerate the pace of transformation, implement a strategic emerging industry investment doubling action plan, and comprehensively utilize equity investment, fund investment, and other methods to encourage and support central enterprises to carry out high-quality investments and mergers and acquisitions, as well as professional integration, to accelerate the mastery of core industrial resources and key technologies.

The 14th Five-Year Plan emphasizes that the automotive industry needs to increase concentration and promote the restructuring of central enterprises to build an internationally competitive "national automotive team." To this end, enterprises should achieve resource complementarity and reduce internal friction through mergers, responding to the state's call to strengthen, optimize, and expand state capital.

Looking back at over 130 years of automotive industry development, the industrial development paths of developed countries led by Europe and the United States have undergone multiple splits and mergers, ultimately moving towards group development, thereby integrating superior assets and continuously forming core competitiveness: for example, Germany ultimately formed three major groups of Volkswagen, BMW, and Mercedes-Benz; the United States formed three major groups of General Motors, Ford, and Chrysler. The new "group" in China's automotive industry may also be about to begin.

Advancement of Chinese Brands

In recent years, Chinese automobile brands have risen sharply. Data from the Passenger Car Association shows that global automobile sales from January to December 2024 were 90.6 million vehicles, an increase of 2% year-on-year. The market share of Chinese brands continues to increase, from 33.8% in 2023 to 34.7% in 2024. Among them, China's auto market share in December 2024 was 41%, reaching a historical high for the global share. Globally, the Chinese automobile market recovered strongly in 2024, with Chinese automakers such as BYD, Chery Automobile, Geely Automobile, and Changan Automobile showing the most prominent rebound effects, bringing about significant changes in the global automaker share. BYD and Geely Automobile even entered the top ten global automakers. In the Chinese local market, the market share of Chinese brands has once again broken through a high level. In January of this year, the domestic retail share of Chinese brands was 61%, an increase of 5.9 percentage points year-on-year. BYD, Geely, Chery, and Changan continue to occupy the top positions, with their sales share rising from 38% in the previous year to 46% in January 2025, further improving concentration.

Image source: Avatar

However, despite the breakthroughs in the growth of independent brands under Changan Automobile and Dongfeng Motor, there is still a significant gap compared to private enterprises such as BYD and Geely Automobile, which is also regarded as one of the factors actively promoting the restructuring of central enterprises. In recent years, competition between traditional automakers and new force brands has intensified, and the survival of the fittest has continued to accelerate. Zhu Huarong, Chairman of Changan Automobile, has repeatedly stated in public that 80% of Chinese fuel vehicle brands will "close, stop, merge, or transfer" in the next 3-5 years. In fact, in addition to Chinese automakers, Japanese automakers have also begun to choose to "huddle together for warmth." The previously high-profile merger of Honda Motor and Nissan Motor was known in the industry as a giant merger case to "defend against Chinese automakers."

However, due to the breakdown of negotiations, the merger has been terminated. But it is undeniable that under the new competitive landscape, mergers have become one of the effective means to "become bigger and stronger." Guotai Junan Research believes that the reform of automotive central enterprises has both subjective and objective conditions. At the subjective level, the economic proportion of the automotive industry has surpassed real estate to become a pillar industry. Since 2023, the continuous decline in sales of central and state-owned automakers has significantly dragged down the local economy, and their motivation for active change is strong. At the objective level, central and state-owned automakers have obvious advantages in automobile technology reserves, cash reserves, and production capacity, creating objective conditions for strengthening external cooperation.

This article is originally written by China News Auto. Welcome to share it with your friends. If media need to reprint it, please indicate the author and source before the text. It is forbidden to use any content of this article to produce video or audio scripts. Violators will bear legal responsibility.