The automaker most adept at making money from foreigners is finally going public

![]() 03/07 2025

03/07 2025

![]() 518

518

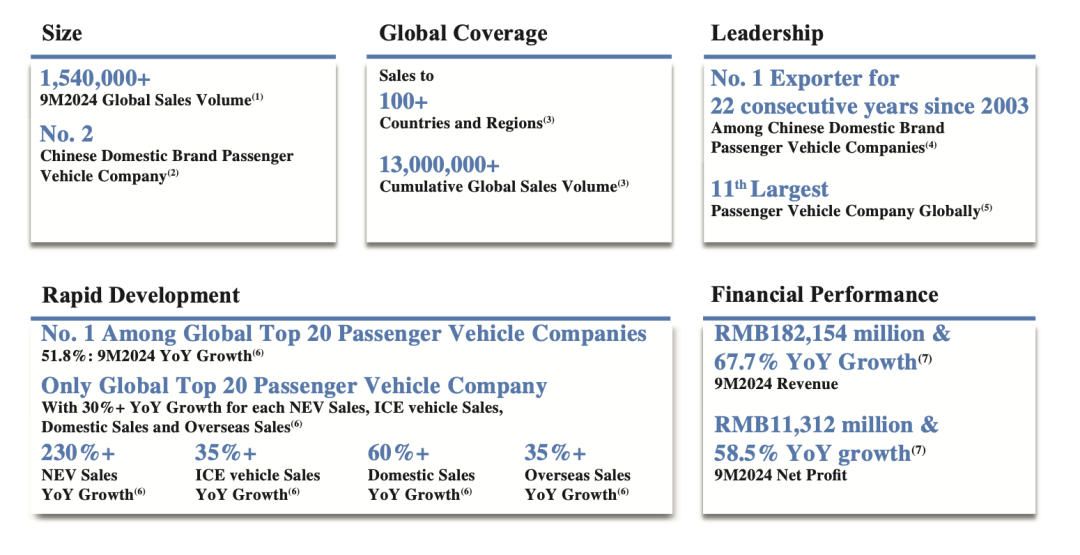

The second largest independent passenger vehicle manufacturer

Author | Liu Yajie

Editor | Qin Zhangyong

“Chery should have gone public a decade ago!”

This remark by Yin Tongyue, chairman of Chery Holding, reveals his reluctance and the longest capital marathon in the history of China's auto industry—from first initiating an IPO plan in 2004 to officially submitting its prospectus to the Hong Kong Stock Exchange in 2025, a total of 21 years have passed.

During this period, it grew from a "small grass house" with debts in Wuhu to become the second-largest independent brand passenger vehicle company in China. On the road to IPO, due to issues such as equity disputes, policy changes, and industry transformation, it has repeatedly missed opportunities in the capital market.

Now, when this "only large Chinese automaker that has not gone public" finally reveals its assets, we are surprised to find that Chery has been quietly making a fortune.

01 Sales of over 1 million vehicles for three consecutive years

Although Chery keeps a low profile, it has not earned any less money over the years.

According to the prospectus, Chery's revenue reached 92.618 billion yuan, 163.205 billion yuan, and 182.154 billion yuan in the first nine months of 2022 to 2024, respectively.

This also means that in the first three quarters of 2024, except for BYD with revenue exceeding 500 billion yuan, the revenues of Geely, Great Wall Motors, and Changan were all lower than those of Chery.

Behind becoming the "second-largest independent brand" is Chery's rising sales.

In 2022, Chery sold over 1 million vehicles for the first time, with annual sales reaching 1.23 million. In 2023, this figure increased to 1.88 million. In 2024, Chery sold 2.6039 million vehicles, an increase of 38.4% over the previous year, setting a new record.

In January of this year, sales performance continued the previous growth trend, with a total sales volume of 224,300 vehicles, an increase of 10.3% compared to the same period last year, marking the sixth consecutive month with monthly sales exceeding 200,000 vehicles. Among these sales figures, Chery Automobile contributed approximately 221,800 vehicles, with a year-on-year growth rate of 11%. The new energy vehicle sector also performed well, with sales of approximately 57,000 vehicles, a year-on-year increase of 172.1%.

The increase in total sales largely came from overseas, and many people do not know that Chery is the top exporter among independent brands in China.

In 2024, Chery Automobile achieved exports of approximately 1.145 million vehicles, an increase of 21.4% compared to the previous year, setting a new record for Chinese automaker exports.

What does 1.145 million vehicles mean? This represents 19.5% of China's total annual vehicle exports (5.86 million). In other words, out of every five vehicles exported from China, one is a Chery.

Currently, Chery Automobile's business has expanded to over 110 countries and regions worldwide, with a cumulative global user base of 15.72 million, including 4.5 million users in overseas markets. In markets such as Europe, South America, the Middle East, and North Africa, Chery Automobile's sales rank first among Chinese independent brands.

Looking at the performance of the Chery Automobile brand alone (excluding its sub-brands such as Jettour and EXEED), it exported 880,000 vehicles independently in 2024, a figure that exceeded the combined exports of the second-placed SAIC MG (460,000 vehicles) and third-placed BYD (410,000 vehicles).

In the first nine months of 2024, Chery Automobile's revenue in overseas markets increased to 80.2 billion yuan, accounting for almost half of the group's total revenue.

The reason for such profitability is that the same vehicle is priced much higher overseas than domestically.

Especially in major markets such as Russia, Brazil, and the Middle East, Chery's prices are generally more than 50% higher than those in China. For example, the Tiggo 8 sells for 120,000 yuan in China but can reach 180,000 yuan when exported to Russia and even soar to 240,000 yuan in the Middle East market.

For the Middle East's "rich" market, the high-end EXEED Starway sells for over 300,000 yuan.

However, due to the relatively low average profit per vehicle, Chery's net profit is still slightly inferior to other OEMs.

In the first three quarters of 2024, Chery's net profit reached 11.3 billion yuan, lower than BYD's 26.2 billion yuan and Geely's 13 billion yuan; its gross margin was 14.8%, also lower compared to BYD's 21.89%, Great Wall Motors' 20.76%, Changan's 15.69%, and Geely's 15.2%.

02 Fuel vehicles still the main source of profit

Chery Automobile stated in its prospectus that although it has been actively developing new energy vehicles and achieved a significant sales increase of 231.7% in the first nine months of 2024 compared to the same period in 2023, it cannot guarantee that it will keep up with the changes in the rapidly developing automotive market.

This is indeed the case. As the second-largest independent brand automaker in China, Chery's business is mainly supported by fuel vehicles.

In the first three quarters of 2024, Chery Automobile achieved revenue of 136.203 billion yuan through sales of fuel vehicles, which is 4.7 times the revenue from new energy vehicle sales during the same period. Looking back at the same periods from 2022 to 2024, Chery's fuel vehicle models generated revenues of 70.258 billion yuan, 143.316 billion yuan, and 136.203 billion yuan, respectively, accounting for 75.9%, 87.8%, and 74.8% of total revenue.

Even in overseas markets, fuel vehicles remain the primary source of revenue. According to Frost & Sullivan data, during the nine months ending September 30, 2024, the Tiggo 8 ranked first and third in terms of sales in the global and Chinese fuel vehicle markets, respectively, as well as among Chinese independent brand passenger vehicle companies.

In contrast, from 2022 to the third quarter of 2024, Chery's revenue in the new energy vehicle sector was 12.253 billion yuan, 7.912 billion yuan, and 29.104 billion yuan, respectively. Among them, revenue in 2023 decreased by 35.4% compared to the previous year.

In fact, Chery made an early layout in the new energy sector. Yin Tongyue once admitted that Chery launched a new energy vehicle as early as 2009, but due to attempting to explore multiple lines of technology including pure electric, hybrid, and hydrogen energy, aiming to occupy the low-end market with the QQ Ice Cream product, and attempting to compete in the mid-range market with the Ant series, it missed opportunities by failing to please everyone. This was criticized as "starting early but arriving late."

Before 2023, Chery's new energy sales performance was unsatisfactory. With the slogan "New Energy, No Holds Barred" in 2023, Chery began to accelerate its transformation.

Currently, Chery owns five major brands: Chery, Jettour, EXEED, iCAR, and iFLYTEK AUTO. In 2024, sales of the Chery brand reached 1.6113 million vehicles, an increase of 31.1% year-on-year; sales of the EXEED brand were 140,900 vehicles, an increase of 12.3% year-on-year.

The iFLYTEK AUTO R7, jointly launched by Chery and Huawei, delivered over 15,000 vehicles in December 2024, making it the top-selling model in China's pure electric mid-to-large SUV market in January this year.

Although there has been progress, compared to BYD, AITO, Xiaomi, etc., Chery Automobile still needs to make breakthroughs.

Besides electrification, intelligence is also an area where Chery Automobile urgently needs improvement.

Judging from the current industry status, the intelligence of the automotive circle has reached a new level, with BYD, Changan, and Geely taking the lead in achieving full-scale intelligent driving.

Although Chery's self-developed Lion Smart Cockpit and DaZhuo Intelligent Driving systems have been put into operation, compared to Huawei's ADS 3.0 and XPeng's XNGP, they seem to be slightly lacking in terms of functional comprehensiveness and price advantage. While leading automakers are rolling out L3, DaZhuo plans to achieve two-stage end-to-end highway NOA in 2025 and urban NOA in 2026.

If Chery Automobile wants to stand out in the Chinese market, it must increase efforts in brand building and R&D investment.

03 21-year IPO marathon

Today, Chery's journey to going public has lasted 21 years.

This automaker from Anhui can be considered the most tragic IPO contender in China's auto industry. As early as 2004, Chery Automobile attempted to go public through a backdoor listing, but due to equity issues with SAIC Motor, it had to abandon this plan.

In the second half of 2008, Chery submitted an IPO application to the China Securities Regulatory Commission. However, due to the outbreak of the global financial crisis, this plan was forced to be interrupted.

Subsequently, in the next year, Chery prepared to re-initiate the IPO application, but the plan was again suspended due to non-compliance of the application materials.

In 2016, Chery's subsidiary Chery New Energy attempted a backdoor listing through Conch New Materials, a building materials listed company, but due to not obtaining a new energy vehicle production license, Conch New Materials announced the abandonment of the acquisition in July of the same year.

In 2019, Chery Automobile and Chery Holding began a "mixed-ownership reform," with Qingdao Wudaokou New Energy Automobile Industry Fund Enterprise (Limited Partnership) investing a total of 14.45 billion yuan, directly holding 46.77% equity in Chery Holding and a combined direct and indirect holding of 33.71% equity in Chery Automobile.

In 2022, Luxshare Precision Industry Co., Ltd., the controlling shareholder of A-share listed company Luxshare, invested 10.054 billion yuan to acquire partial equity in Chery Holding, Chery Automobile, and Chery New Energy from Qingdao Wudaokou, thus becoming a new strategic investor in Chery. In the same year, Chery announced that its mixed-ownership reform had been fully completed.

It is worth noting that after four failed IPO attempts, Chery adopted a textbook strategy—"Heaven and Earth Shift"—successfully restructuring and packaging its major assets such as Southeast Motor and new energy through 32 months of continuous capital operations.

By January 2025, Chery Holding had completed its restructuring and no longer held any shares in Chery Automobile. The original shareholders of Chery Holding directly transformed into new shareholders of Chery Automobile based on their respective shareholding ratios in Chery Holding.

In early February 2025, at the 2025 Annual Cadre Conference of Chery Group and its joint-stock company, Yin Tongyue announced: "Promoting high-quality listing of the company will be our top priority." Subsequently, within just half a month, Chery Automobile successfully submitted its IPO application.

Judging from the current situation, the probability of success is high. Because Chery has cleaned up its debt and equity relations before the IPO, its financial situation is relatively stable. Moreover, against the backdrop of a sharp decline in profits for traditional automakers and only a few new forces achieving profitability, Chery's size gives it a significant advantage.

Market analysis shows that Chery Automobile's valuation is expected to exceed 14 billion USD, equivalent to approximately 100 billion yuan. This indicates that Chery Automobile has the potential to become the largest automaker IPO in the Hong Kong stock market in recent years.

Chery Automobile plans to launch over 60 new vehicles in 2025. If the IPO is successful, it will obtain the necessary funds and R&D support.

Chery Automobile's prospectus shows that as of the end of 2022, 2023, and the third quarter of 2024, its asset-liability ratios were 93%, 92%, and 89%, respectively, significantly higher than those of BYD, SAIC, and Geely.

As of January 31, 2025, Chery Automobile's trade payables and notes have increased to 105.198 billion yuan. Obviously, this Hong Kong listing is of great significance for Chery Automobile to reduce financial pressure.

If this IPO is successful, Chery will definitely increase its investment in R&D. An insider said that Chery frequently mentions BYD as a comparison during meetings.

This will be another new storm for the automotive circle.